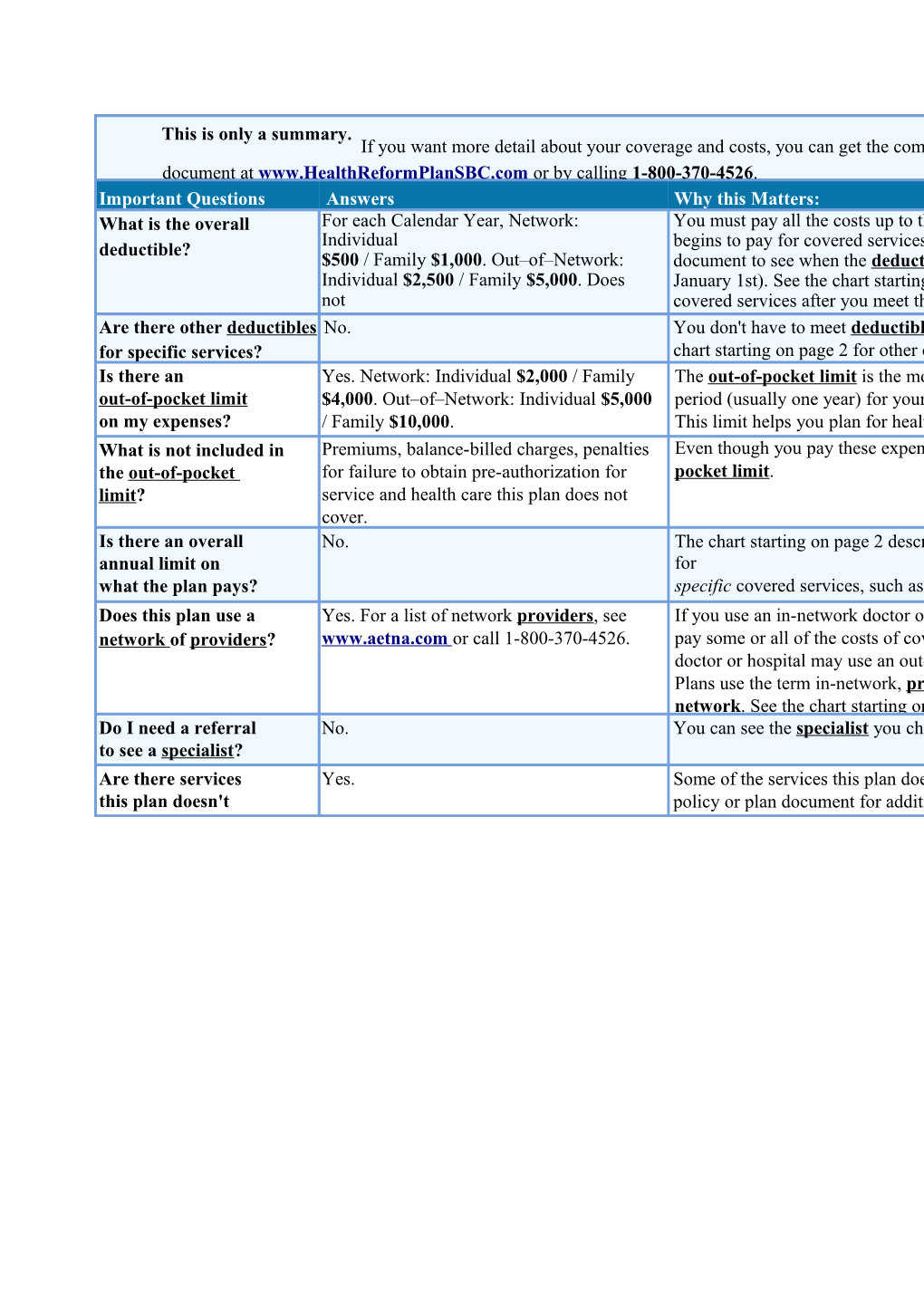

This is only a summary. If you want more detail about your coverage and costs, you can get the complete document at www.HealthReformPlanSBC.com or by calling 1-800-370-4526. Important Questions Answers Why this Matters: What is the overall For each Calendar Year, Network: You must pay all the costs up to the Individual deductible? begins to pay for covered services $500 / Family $1,000. Out–of–Network: document to see when the deductible Individual $2,500 / Family $5,000. Does January 1st). See the chart starting not covered services after you meet the Are there other deductibles applyNo. to office visits, preventive care, and You don't have to meet deductibles for specific services? chart starting on page 2 for other costs Is there an Yes. Network: Individual $2,000 / Family The out-of-pocket limit is the most out-of-pocket limit $4,000. Out–of–Network: Individual $5,000 period (usually one year) for your on my expenses? / Family $10,000. This limit helps you plan for health What is not included in Premiums, balance-billed charges, penalties Even though you pay these expenses, the out-of-pocket for failure to obtain pre-authorization for pocket limit . limit? service and health care this plan does not cover. Is there an overall No. The chart starting on page 2 describes annual limit on for what the plan pays? specific covered services, such as Does this plan use a Yes. For a list of network providers, see If you use an in-network doctor or network of providers? www.aetna.com or call 1-800-370-4526. pay some or all of the costs of covered doctor or hospital may use an out-of-network Plans use the term in-network, preferred network. See the chart starting on Do I need a referral No. You can see the specialist you choose to see a specialist? Are there services Yes. Some of the services this plan doesn't this plan doesn't policy or plan document for additional cover? services. Copayments are fixed dollar amounts (for example, $15) you pay for covered health care, usually when you receive the service. Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, if the plan's allowed amount for an overnight hospital stay is $1,000, your coinsurance payment of 20% would be $200. This may change if you haven't met your deductible. The amount the plan pays for covered services is based on the allowed amount . If an out-of-network provider charges more than the allowed amount, you may have to pay the difference. For example, if an out-of-network hospital charges $1,500 for an overnight stay and the allowed amount is $1,000, you may have to pay the $500 difference. (This is called balance billing .) This plan may encourage you to use network providers by charging you lower deductibles, copayments, and coinsurance amounts.

Your Cost If Your Cost Common Medical Services You May Need You Use a Network If You Use Limitations & Exceptions Event Provider an Out–of–Network Primary care visit to treat an Custom Network PCP 40% coinsuranceProvider Includes Internist, General Physician, injury or illness $0 copay per visit; $20 Family Practitioner or Pediatrician. copay per visit for all others Specialist visit $25 copay per visit 40% coinsurance ––––––––––– None ––––––––––– Other practitioner office visit Chiropractic care: 40% coinsurance $25 copay per visit, Chiropractic maintenance care is not Acupuncture: 20% covered. If you visit a health care coinsurance; after provider's office or clinic $25 copay per visit Preventive care /screening No charge 40% coinsurance, Age and frequency schedules may apply. /immunization except No charge: Routine GYN Exam, & Routine Mammogram, Not covered: Routine Physical Exam & Routine Diagnostic test 10% coinsurance 40%Prostate coinsurance Specific (includes x-ray, blood work, ultrasound) If you have a test Imaging (CT/PET scans, $50 copay per visit $50 copay per visit ––––––––––– None ––––––––––– MRIs) Your Cost If Your Cost Common Medical Services You May Need You Use a Network If You Use Limitations & Exceptions Event Provider an Out–of–Network Generic drugs $10 copay/ $10 copay/Provider Covers up to a 90 day supply (retail prescription for a 30 prescription for a 30 prescription), 90 day supply (mail order day supply (retail or day supply (retail), prescription). Includes performance mail order), $15 copay/ $15 copay/ enhancing medication (6 tablets per 30 prescription for a 90 prescription for a 90 days for retail or 18 tablets per 90 days for day supply (retail or day supply (retail) mail order or retail)*Infertility and If you need drugs to treat mail order) Erectile Dysfunction drugs: $50.00 copay your illness or condition Preferred brand drugs $30 copay/ $30 copay/ for 30 day supply or $75.00 copay for 90 prescription for a 30 prescription for a 30 day supply, contraceptive drugs and devices obtainable from a pharmacy, oral More Information about day supply (retail or day supply (retail), mail order), $45 copay/ $45 copay/ and injectable fertility drugs. No charge prescription drug coverage prescription for a 90 prescription for a 90 for formulary generic FDA-approved is available at day supply (retail or day supply (retail) women's contraceptives www.aetna.com/phar macy- mail order) in-network. Precertification required. insurance/individ uals-families Non-preferred brand drugs $45 copay/ $45 copay/ prescription for a 30 prescription for a 30 day supply (retail or day supply (retail), mail order), $70 copay/ $70 copay/ prescription for a 90 prescription for a 90 day supply (retail or day supply (retail) mail order) Specialty drugs Applicable cost as Not covered ––––––––––– None ––––––––––– noted above for generic or brand drugs. Facility fee (e.g., Preferred Network 40% coinsurance ––––––––––– None ––––––––––– ambulatory surgery center) Facility 10% coinsurance, after If you have outpatient deductible. All others 20% coinsurance, after surgery deductible; Non-free standing hospital: 5% coinsurance, after deductible Your Cost If Your Cost Common Medical Services You May Need You Use a Network If You Use Limitations & Exceptions Event Provider an Out–of–Network Physician/surgeon fees Preferred Network 40% coinsuranceProvider ––––––––––– None ––––––––––– 10% coinsurance, after deductible. All others 20% coinsurance, after deductible. If you need immediate Emergency room services $300 copay per visit $300 copay per visit ––––––––––– None ––––––––––– medical attention Emergency medical 0% coinsurance 0% coinsurance ––––––––––– None ––––––––––– Urgenttransportation care $25 copay per visit 40% coinsurance ––––––––––– None ––––––––––– Facility fee (e.g., hospital Preferred 10% 40% coinsurance Pre-authorization required for out-of- room) coinsurance. All other network care. Facilities 20% If you have a hospital stay coinsurance Physician/surgeon fee Preferred 10% 40% coinsurance ––––––––––– None ––––––––––– coinsurance. All other Facility 20% coinsurance Mental/Behavioral health $25 copay per visit 40% coinsurance ––––––––––– None ––––––––––– outpatient services If you have mental health, Mental/Behavioral health 10% coinsurance 40% coinsurance Pre-authorization required for out-of- behavioral health, or inpatient services network care. substance abuse needs Substance use disorder $25 copay per visit 40% coinsurance ––––––––––– None ––––––––––– outpatient services Substance use disorder 10% coinsurance 40% coinsurance Pre-authorization required for out-of- inpatient services network care. Prenatal and postnatal care No charge 40% coinsurance ––––––––––– None ––––––––––– If you are pregnant Delivery and all inpatient 0% coinsurance 40% coinsurance Includes outpatient postnatal care. services Pre-authorization required for out-of-network care. Your Cost If Your Cost Common Medical Services You May Need You Use a Network If You Use Limitations & Exceptions Event Provider an Out–of–Network Home health care 0% coinsurance 40% coinsuranceProvider Pre-authorization required for out-of- network care. Rehabilitation services $25 copay per visit 40% coinsurance ––––––––––– None ––––––––––– If you need help Habilitation services $25 copay per visit 40% coinsurance Benefit limitations may apply. recovering or have other Skilled nursing care 0% coinsurance 40% coinsurance Coverage is limited to 100 days per special health needs calendar year. Pre-authorization required for Durable medical equipment 0% coinsurance 40% coinsurance –––––––––––out-of-network None care. ––––––––––– Hospice service 0% coinsurance 40% coinsurance Pre-authorization required for out-of- network care. Eye exam No charge 40% coinsurance Coverage is limited to 1 routine eye If your child needs exam per calendar year. dental or eye care Glasses Not covered Not covered Not covered. Dental check-up Not covered Not covered Not covered. Excluded Services & Other Covered Services: (This isn't a complete list. Check your policy or plan document for other excluded services.) Services Your Plan Does NOT Cover Cosmetic surgery Long-term care Private-duty nursing Dental care (Adult & U.S.Non-emergency care when traveling outside the Routine foot care Glasses (Child) Weight loss programs Other Covered Services (This isn't a complete list. Check your policy or plan document for other covered services and your costs for these services.) Acupuncture toHearing a maximum aids - Coverageof $1,400 isper limited 36 months to 1 hearing up to age aid Infertility treatment - Benefit limitations may Bariatric surgery 19. Routine eye care (Adult) - Coverage is limited to Chiropractic care routine eye exam per calendar year. Your Rights to Continue Coverage: If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keep health coverage. Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than the premium you pay while covered under the plan. Other limitations on your rights to continue coverage may also apply. For more information on your rights to continue coverage, contact the plan at 1-800-370-4526. You may also contact your state insurance department, the U.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 or www.dol.gov/ebsa, or the U.S. Department of Health and Human Services at 1-877-267-2323 x61565 or www.cciio.cms.gov. Your Grievance and Appeals Rights: If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. For questions about your rights, this notice or assistance, you can contact us by calling the toll free number on your Medical ID Card. You may also contact the Department of Labor's Employee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. Additionally, a consumer assistance program can help you file an appeal. Contact information is at http://www.aetna.com/individuals-families-health-insurance/rights-resources/complaints-grievances-appeals/index.html Does this Coverage Provide Minimum Essential Coverage? The Affordable Care Act requires most people to have health care coverage that qualifies as "minimum essential coverage". This plan or policy does provide minimum essential coverage. Does this Coverage Provide Minimum Value Standard? The Affordable Care Act establishes a minimum value standard of benefits of a health plan. The minimum value standard is 60% (actuarial value). This health coverage does meet the minimum value standard for the benefits it provides. Language Access Services: Para obtener asistencia en Español, llame al 1-800-370-4526. Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-370- Dinek'ehgo shika at'ohwol ninisingo, kwiijigo1-800-370-4526. holne' 1-800-370-4526. 4526. ------To see examples of how this plan might cover costs for a sample medical situation, see the next page.------About these Having a Managing type 2 diabetes Coverage Examples: baby (routine maintenance of a well-controlled condition) (normal These examples show how this plan might delivery) cover medical care in given situations. Use these examples to see, in general, how much financial protection a sample patient might get if they are covered under different plans. Sample care costs:

Sample care costs:

This is not a cost estimator. Don't use these examples to estimate your actual costs under this plan. The Patient pays: actual care you receive will be different from Patient these examples, and the pays: cost of that care also will be different.

See the next page for important information about these examples. Questions and answers about the Coverage Examples: What are some of the What does a Coverage Can I use Coverage Examples assumptions behind the Coverage Example show? to compare plans? Examples? For each treatment situation, the Coverage Yes. Example helps you see how deductibles, When you look at the Summary of Benefits and Coverage for other Costs don't include premiums. copayments, and coinsurance can add up. plans, you'll find the same Coverage Sample care costs are based on national It also helps you see what expenses might be left up to you to pay because the service Examples. averages supplied by the U.S. When you compare plans, check the "Patient Department of Health and Human or treatment isn't covered or payment is Pays" box in each example. The smaller Services, and aren't specific to a limited. that number, the more coverage the plan particular geographic area or health provides. plan. Does the Coverage Example predict The patient's condition was not my own care needs? an Are there other costs I should excluded or preexisting condition. depending on the care you receive, the prices All services and treatments started No. Treatments shown are just your providers charge, and the and ended in the same coverage examples. The care you would receive for reimbursement your health plan allows. period. this condition could be different, based There are no other medical expenses on your doctor's advice, your age, how for any member covered under this serious your condition is, and many other plan. factors. Out-of-pocket expenses are based only on treating the condition in the example. Does the Coverage Example The patient received all care from predict my future expenses? in-network providers. If the patient had received care from out-of-network No. Coverage Examples are not cost providers, costs would have been estimators. You can't use the examples to higher. estimate costs for an actual condition. They are for comparative purposes only. Your own costs will be different consider when comparing plans? the lower your premium, the more accounts such as health savings accounts you'll pay in (HSAs), flexible spending arrangements out-of-pocket costs, such as copayments, (FSAs) or health reimbursement accounts Yes. An important cost is the deductibles, and coinsurance. You (HRAs) that help you pay out-of-pocket premium you pay. Generally, should also consider contributions to expenses.