Clarifications and Suggested Adjustments from the DAC Donors to the Circular Number 3 from the President’s Office of 23 August 1999 on the Subsistence Allowance (per Diem) Rates for Official Travels Within Tanzania

1. Introduction

In consideration of increased cost of living, as well as changes in the policy, trend and levels of Salaries of Civil Servants, the Government decided to make amendments on per diem rates for duty (official) travel within the Country. A new circular issued by Government of Tanzania has been effective since 1st September 1999.

In response to these amendments, Bilateral and Multilateral Institutions in Tanzania (DAC Group) seek clarifications on some issues, and would like to suggest adjustments to the rules and regulations regarding Daily Subsistence Allowance Rates (DSA rates) for official travel within the country as they pertain to donor funded projects/programmes.

2. Policy for Government Officials who are programme/project staff - including direct employed staff, attached staff and national advisers

ENTITLEMENT A person is entitled to a refund of travel costs, i.e. transport and subsistence allowances when: a) travelling on duty b) travelling to attend seminars, conferences, in-service training, courses, etc. where such activities are funded by any of the DAC donors.

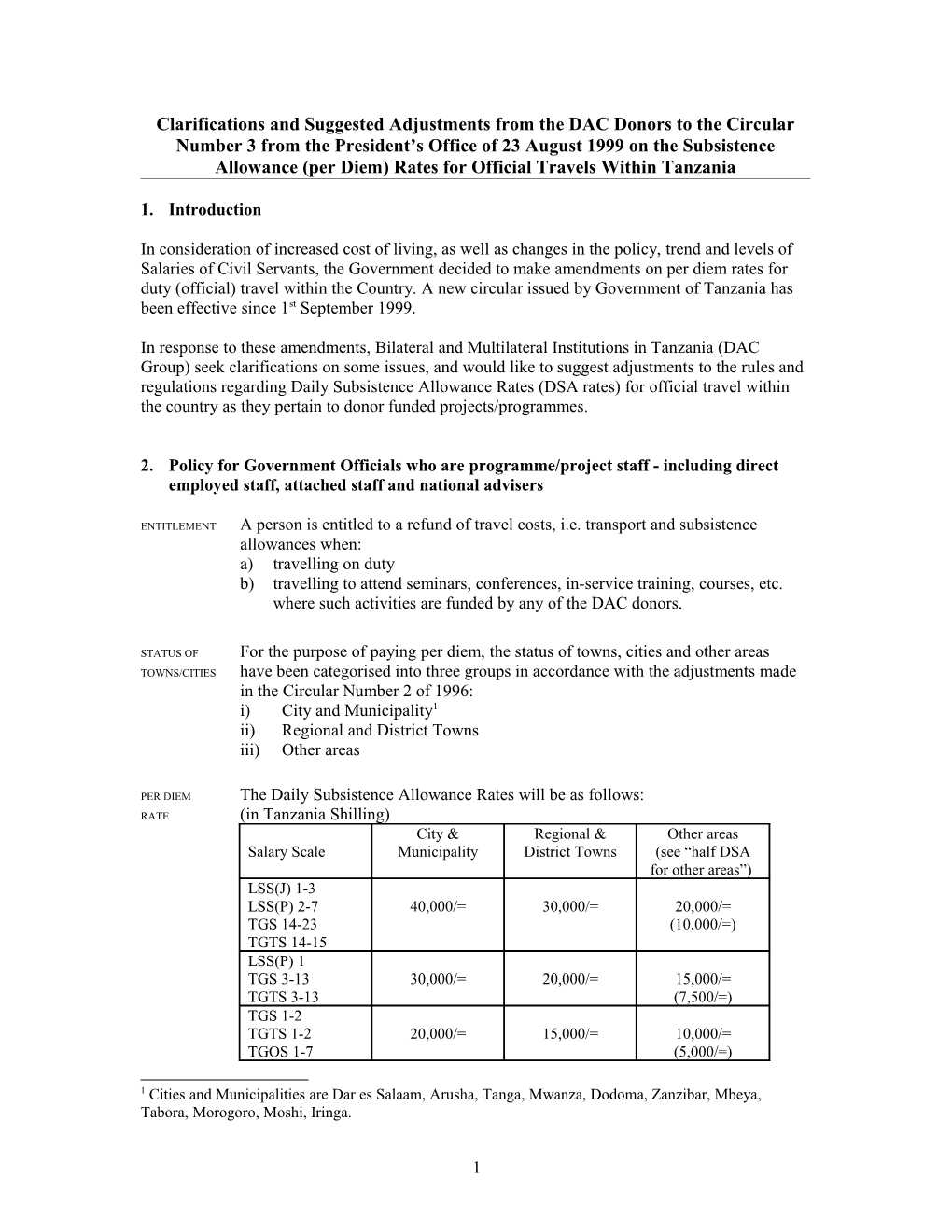

STATUS OF For the purpose of paying per diem, the status of towns, cities and other areas TOWNS/CITIES have been categorised into three groups in accordance with the adjustments made in the Circular Number 2 of 1996: i) City and Municipality1 ii) Regional and District Towns iii) Other areas

PER DIEM The Daily Subsistence Allowance Rates will be as follows: RATE (in Tanzania Shilling) City & Regional & Other areas Salary Scale Municipality District Towns (see “half DSA for other areas”) LSS(J) 1-3 LSS(P) 2-7 40,000/= 30,000/= 20,000/= TGS 14-23 (10,000/=) TGTS 14-15 LSS(P) 1 TGS 3-13 30,000/= 20,000/= 15,000/= TGTS 3-13 (7,500/=) TGS 1-2 TGTS 1-2 20,000/= 15,000/= 10,000/= TGOS 1-7 (5,000/=)

1 Cities and Municipalities are Dar es Salaam, Arusha, Tanga, Mwanza, Dodoma, Zanzibar, Mbeya, Tabora, Morogoro, Moshi, Iringa.

1 TRANSPORT Mode of transport will normally be by programme/ project vehicle. Where COSTS circumstances necessitate it, and programme/project management deems it feasible, transport can also be by public transport (e.g. bus, train or airplane). In such cases, cost of transport will be reimbursed according to actual cost of a ticket (economy class for travel by air) and upon presentation of receipt. At the end of the travel, the used tickets must be attached to the travel report.

NUMBER A person on duty travel is entitled to receive a subsistence allowance in respect of OF DSA every night for which s(he) is away from her/his duty station. It is the responsibility of the individual staff member to ensure that the duty travel is planned and organised in such a way that the most economical use is made of transport and travelling allocations, and that unnecessary expenses are not incurred by the programme/project.

EXPENSIVE If a person is compelled to stay in a hotel which is more expensive than his/her HOTEL subsistence allowance, (s)he will be required to obtain permission from the Permanent Secretary of Civil Service Department and/or the Project/Programme Authority to allow him/her to stay at such a hotel. The person will be paid full board or (s)he will be paid for bed and breakfast plus fifty percent of the subsistence allowance.

FULL BOARD If a person on duty travel is provided with full board and lodging, an amount equal to 20% of the appropriate subsistence allowance per day will be paid to cover for incidental elements of expenses such as laundry, tips, transport to/from airports, railway station, bus station, other "town run", etc.

REDUCED DSA If a person on duty travel is provided with free meals and/or free accommodation, the subsistence allowance shall be reduced with a percentage as follows: lodging 40% breakfast 10% lunch 15% dinner 15% The balance of twenty percent (20%) is for “out of pocket” incidentials.

HALF DSA For community based programmes/projects and for any other donor-funded FOR “OTHER activities (e.g. conduction of surveys) which involve a lot of travelling in rural AREAS” areas, a Subsistence Allowance of only fifty- percent (50%) of the normal rate for “Other Areas” can be applied. Government and the project/programme authority can decide to apply this special rate after consultation.

NON A person going on duty travel and not spending a night away from her/his duty RESIDENTIAL station but is away over 20km from his duty station and absent for eight hours or DUTY TRAVEL more in anyone day will be eligible to be reimbursed, on production of a receipted bill, the cost of necessary meals at a reasonable cost. Instead of producing receipted bills a person can claim fifty percent (50%) of the appropriate rate of subsistence allowance for the final destination. If the reduced rate for other areas is normally applied the allowance is based on the reduced rate.

TRANSFER/ In general, transfer/transit allowance is not relevant in relation to donor-funded TRANSIT programmes/projects. Only in special cases, where the programme/project grant ALLOWANCE provides for the reimbursement of travel cost in relation to relocation of a staff member from one place of work to another, transfer/transit allowance can be paid.

2 DSA FOR Fifty percent (50%) of the Officer’s rate (Parent) for the pertinent category shall BABIES apply for suckling babies.

TRAVEL For subsistence allowance, no receipted bills shall be required. For accountability REPORT purposes a travel report must be completed. The travel report shall be counter- signed by project management or a person authorised by project management to approve duty travels. The travel report must be completed and handed over to the programme/project management latest fourteen days after completion of the duty travel.

TRAVEL A person going on duty travel can be paid a reasonable advance to cover for costs. ADVANCE Travel advances must be accounted for at the time of completing the travel report and latest fourteen days after completion of the travel. Such an advance will not exceed the estimated DSA for the proposed duty travel. If the officer returns earlier than planned, the subsistence allowance for the nights, which were not spent away from the duty station, must either be returned or will be deducted from the allowance of the next travel depending on the type of contract.

3. Policy for Counsellors, Members of Steering Committees, Participants in Working Groups, and other persons not employed by or permanently attached to the project/ programme, etc.

SITTING Sitting Allowance for participation in meetings and workshops is not paid. ALLOWANCE

FULL ONE DAY For a full one day meeting/workshop (6 hours or more) a provision for lunch can MEETING/ be made, either in the form of a flat rate payment of 20% of the relevant DSA rate WORKSHOP to each participant (excluding members of staff) to cover for the cost of a lunch or by providing a free meal. Where a flat rate payment for lunch has been made, meals cannot be served during the meeting. In the case a free meal is provided, the flat rate is not applicable. Minor refreshments such as coffee, tea, and water can be served during the meeting.

OVER-NIGHT Persons who have to travel in order to participate in a meeting, and where the STAY travel distance is of a length that prohibits the person from travelling to and from the meeting place the same day as the meeting is held, can be refunded travel cost and is entitled to subsistence allowances.

PER DIEM Subsistence allowances are paid at the same rates and in accordance with the RATE same rules as applicable to project/programme staff on duty travel (section 2).

TRAVEL Travel costs are reimbursed according to actual costs. The maximum amount COSTS which can be reimbursed to any person is an amount corresponding to the cost of travel by public transport to and from the meeting place. In special circumstances, a kilometre allowance for transport in own car can be paid corresponding to the number of kilometres from her/his constituency or home to the meeting place and return, at a rate of 12.4 US Cents per kilometre.

3