Prof. Thomas J. Chemmanur MF807 Corporate Finance

Problem Set - IV

Introduction to Risk, Return, and The Opportunity Cost of Capital

1. You can find monthly adjusted prices for most or all of the companies in Table 8.3 on Standard & Poor’s Market Insight Web site (www.mhhe. com/edumarketinsight) or on finance.yahoo.com. Download the prices for three of these companies to an Excel spreadsheet. Calculate each company’s variance and standard deviation of the monthly returns. The Excel functions are VAR and STDEV. Convert the standard deviations from monthly to annual units by multiplying by the square root of 12. How has the stand-alone risk of these stocks changed, compared with the figures reported in Table 8.3?

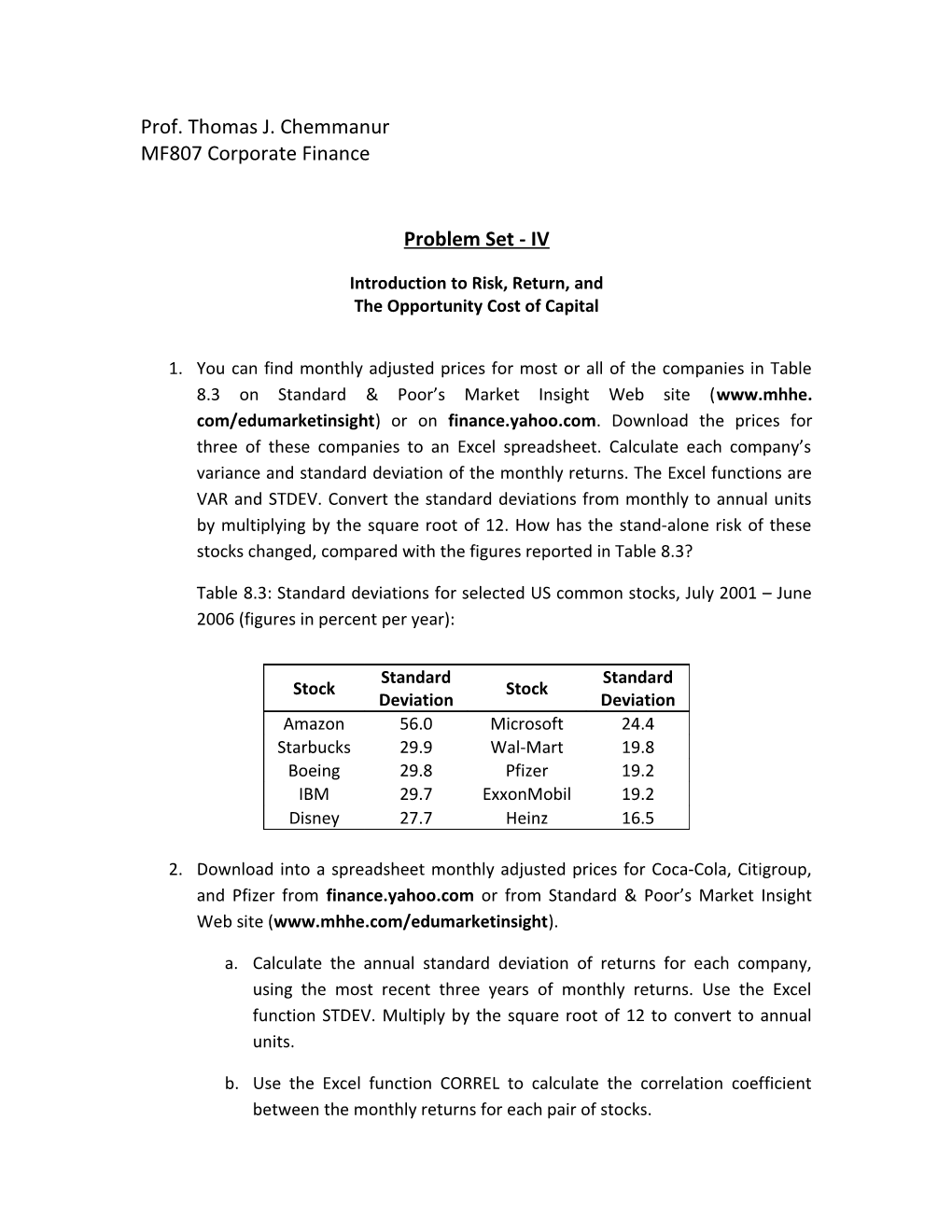

Table 8.3: Standard deviations for selected US common stocks, July 2001 – June 2006 (figures in percent per year):

Standard Standard Stock Stock Deviation Deviation Amazon 56.0 Microsoft 24.4 Starbucks 29.9 Wal-Mart 19.8 Boeing 29.8 Pfizer 19.2 IBM 29.7 ExxonMobil 19.2 Disney 27.7 Heinz 16.5

2. Download into a spreadsheet monthly adjusted prices for Coca-Cola, Citigroup, and Pfizer from finance.yahoo.com or from Standard & Poor’s Market Insight Web site (www.mhhe.com/edumarketinsight).

a. Calculate the annual standard deviation of returns for each company, using the most recent three years of monthly returns. Use the Excel function STDEV. Multiply by the square root of 12 to convert to annual units.

b. Use the Excel function CORREL to calculate the correlation coefficient between the monthly returns for each pair of stocks. c. Calculate the standard deviation of returns for a portfolio with equal investments in each of the three stocks.

3. Most of the companies in Table 8.5 are covered either in finance.yahoo.com or in the Standard & Poor’s Market Insight Web site (www.mhhe.com/edumarketinsight). For those that are covered, you can easily calculate beta. Download the “Monthly Adjusted Prices” spreadsheet, and note the columns for returns on the stock and the S&P 500 index. Beta is calculated by the Excel function SLOPE, where the “y” range refers to the company’s return (the dependent variable) and the “x” range refers to the market returns (the independent variable). Calculate the betas. How have they changed from the betas reported in Table 8.5?

Table 8.5: Betas for selected US common stocks, July 2001 – June 2006

Stock Beta Stock Beta Amazon 2.20 Starbucks .69 IBM 1.59 ExxonMobil .65 Disney 1.26 Wal-Mart .57 Microsoft 1.13 Pfizer .55 Boeing 1.09 Heinz .36

4. There are few, if any, real companies with negative betas. But suppose you found one with β=-.25.

a. How would you expect this stocks rate of return to change if the overall market rose by an extra 5%? What if the market fell by an extra 5%?

b. You have $1 million invested in a well-diversified portfolio of stocks. Now you receive an additional $20,000 bequest. Which of the following actions will yield the safest overall portfolio return?

1) Invest $20,000 in Treasury bills (which have β=0).

2) Invest $20,000 in stocks with β=1.

3) Invest $20,000 in the stock with β=-.25.

Explain your answer. 5. You can form a portfolio of two assets, A and B, whose returns have the following characteristics:

Stock Expected Return Standard Deviation Correlation A 10% 20% .5 B 15% 40%

If you demand an expected return of 12%, what are the portfolio weights? What is the portfolios standard deviation?

Risk and Return

1. Here are returns and standard deviations for four investments.

Return Standard Deviation Treasury Bills 6% 0% Stock P 10% 14% Stock Q 14.5% 28% Stock R 21.0% 26%

Calculate the standard deviations of the following portfolios.

a. 50% in Treasury bills, 50% in stock P.

b. 50% each in Q and R, assuming the shares have

i. perfect positive correlation

ii. perfect negative correlation

iii. no correlation

c. Plot a figure to illustrate how expected return (Y-axis) and standard deviation (X-axis) change as you hold different combination of Q and R, assuming a correlation coefficient of .5. d. Stock Q has a lower return than R but a higher standard deviation. Does that mean that Q’s price is too high or that R’s price is too low?

2. For each of the following pairs of investments, state which would always be preferred by a rational investor (assuming that these are the only investments available to the investor):

a. Portfolio A r=18% σ=20% Portfolio B r=14% σ=20%

b. Portfolio C r=15% σ=18% Portfolio D r=13% σ=8%

c. Portfolio E r=14% σ=16% Portfolio F r=14% σ=10%

3. True or false? Explain or qualify as necessary.

a. Investors demand higher expected rates of return on stocks with more variable rates of return.

b. The CAPM predicts that a security with a beta of 0 will offer a zero expected return.

c. An investor who puts $10,000 in Treasury bills and $20,000 in the market portfolio will have a beta of 2.0.

d. Investors demand higher expected rates of return from stocks with returns that are highly exposed to macroeconomic risk.

e. Investors demand higher expected rates of return from stocks with returns that are very sensitive to fluctuations in the stock market.

4. Ebenezer Scrooge has invested 60% of his money in share A and the remainder in share B. He assesses their prospects as follows:

A B Expected return (%) 15 20 Standard deviation (%) 20 22 Correlation between returns .5

a. What are the expected return and standard deviation of returns on his portfolio?

b. How would your answer change if the correlation coefficient was 0 or -.5?

c. Is Mr. Scrooge’s portfolio better or worse than one invested entirely in share A, or is it not possible to say?

5. Percival Hygiene has $10 million invested in long-term corporate bonds. This bond portfolio’s expected annual rate of return is 9%, and the annual standard deviation is 10%.

Amanda Reckonwith, Percival’s financial adviser, recommends that Percival consider investing in an index fund that closely tracks the Standard and Poor’s 500 Index. The index has an expected return of 14%, and its standard deviation is 16%.

a. Suppose Percival puts all his money in a combination of the index fund and Treasury bills. Can he thereby improve his expected rate of return without changing the risk of his portfolio? The Treasury bill yield is 6%.

b. Could Percival do even better by investing equal amounts in the corporate bond portfolio and the index fund? The correlation between the bond portfolio and the index fund is +.1.

6. Some true or false questions about the APT:

a. The APT factors cannot reflect diversifiable risks.

b. The market rate of return cannot be an APT factor.

c. There is no theory that specifically identifies the APT factors. d. The APT model could be true but not very useful, for example, if the relevant factors change unpredictably.

7. Consider the following simplified APT model:

Factor Expected Risk Premium Market 6.4% Interest rate -.6 Yield spread 5.1

Calculate the expected return for the following stocks. Assume rf =5%.

Factor Risk Exposures Market Interest Rate Yield Spread Stock (b1) (b2) (b3) P 1.0 -2.0 -.2 P2 1.2 0 .3 P3 .3 .5 1.0

8. Look again at Question 7. Consider a portfolio with equal investments in stocks P, P2 and P3.

a. What are the factor risk exposures for the portfolio?

b. What is the portfolio’s expected return?

9. The following table shows the sensitivity of four stocks to the three Fama-French factors in the five years to June 2006. Estimate the expected return on each stock assuming that the interest rate is 5%, the expected risk premium on the market is 7.6%, the expected risk premium on the size factor is 3.7%, and the expected risk premium on the book-to-market factor is 5.2%. (These were the realized premia from 1926 2006.)

Factor Sensitivities Factor Coca-Cola Ford Pfizer Microsoft Market .36 2.00 .58 .89 Size* -.23 -.03 -.47 -.07 Book-to-market+ .38 1.10 -.15 -1.17 *Return on small-firm stocks less return on large-firm stocks.

+Return on high book-to-market-ratio stocks less return on low high book-to-market-ratio stocks.

Note: Students are not responsible for Question 6, 7, 8 and 9 since related concepts are not covered in the course.

Efficient Markets and Behavioral Finance

1. How would you respond to the following comments?

a. Efficient market, my eye! I know lots of investors who do crazy things.

b. Efficient market? Balderdash! I know at least a dozen people who have made a bundle in the stock market.

c. The trouble with the efficient-market theory is that it ignores investor’s psychology.

d. Despite all the limitations, the best guide to a company’s value is its written-down book value. It is much more stable than market value, which depends on temporary fashions.

2. Respond to the following comments:

a. The random-walk theory, with its implication that investing in stocks is like playing roulette, is a powerful indictment of our capital markets.

b. If everyone believes you can make money by charting stock prices, then price changes won’t be random.

c. The random-walk theory implies that events are random, but many events are not random. If it rains today, there’s a fair bet that it will rain again tomorrow. 3. Which of the following observations appear to indicate market inefficiency? Explain whether the observation appears to contradict the weak, semistrong, or strong form of the efficient-market hypothesis.

a. Tax-exempt municipal bonds offer lower pretax returns than taxable government bonds.

b. Managers make superior returns on their purchases of their company’s stock.

c. There is a positive relationship between the return on the market in one quarter and the change in aggregate profits in the next quarter.

d. There is disputed evidence that stocks that have appreciated unusually in the recent past continue to do so in the future.

e. The stock of an acquired firm tends to appreciate in the period before the merger announcement.

f. Stocks of companies with unexpectedly high earnings appear to offer high returns for several months after the earnings announcement.

g. Very risky stocks on average give higher returns than safe stocks.

4. What does the efficient-market hypothesis have to say about these two statements?

a. I notice that short-term interest rates are about 1% below long- term rates. We should borrow short-term.

b. I notice that interest rates in Japan are lower than rates in the United States. We would do better to borrow Japanese yen rather than U.S. dollars.