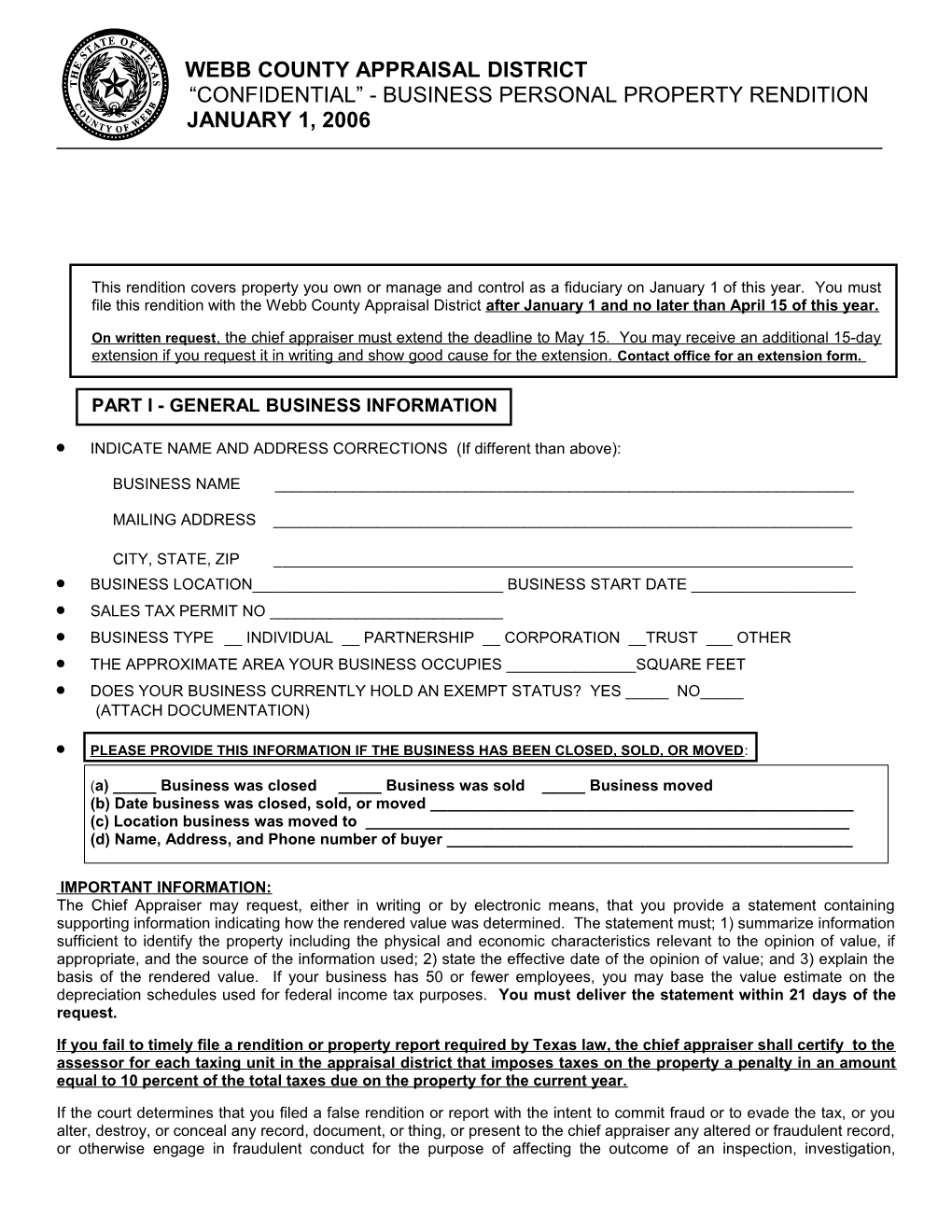

WEBB COUNTY APPRAISAL DISTRICT USI “CONFIDENTIAL” - BUSINESS PERSONAL PROPERTY RENDITION JANUARY 1, 2006

This rendition covers property you own or manage and control as a fiduciary on January 1 of this year. You must file this rendition with the Webb County Appraisal District after January 1 and no later than April 15 of this year.

On written request , the chief appraiser must extend the deadline to May 15. You may receive an additional 15-day extension if you request it in writing and show good cause for the extension. Contact office for an extension form.

PART I - GENERAL BUSINESS INFORMATION

INDICATE NAME AND ADDRESS CORRECTIONS (If different than above):

BUSINESS NAME ______

MAILING ADDRESS ______

CITY, STATE, ZIP ______ BUSINESS LOCATION______BUSINESS START DATE ______ SALES TAX PERMIT NO ______ BUSINESS TYPE __ INDIVIDUAL __ PARTNERSHIP __ CORPORATION __TRUST ___ OTHER THE APPROXIMATE AREA YOUR BUSINESS OCCUPIES ______SQUARE FEET DOES YOUR BUSINESS CURRENTLY HOLD AN EXEMPT STATUS? YES _____ NO_____ (ATTACH DOCUMENTATION)

PLEASE PROVIDE THIS INFORMATION IF THE BUSINESS HAS BEEN CLOSED, SOLD, OR MOVED:

(a) _____ Business was closed _____ Business was sold _____ Business moved (b) Date business was closed, sold, or moved ______(c) Location business was moved to ______(d) Name, Address, and Phone number of buyer ______

IMPORTANT INFORMATION: The Chief Appraiser may request, either in writing or by electronic means, that you provide a statement containing supporting information indicating how the rendered value was determined. The statement must; 1) summarize information sufficient to identify the property including the physical and economic characteristics relevant to the opinion of value, if appropriate, and the source of the information used; 2) state the effective date of the opinion of value; and 3) explain the basis of the rendered value. If your business has 50 or fewer employees, you may base the value estimate on the depreciation schedules used for federal income tax purposes. You must deliver the statement within 21 days of the request.

If you fail to timely file a rendition or property report required by Texas law, the chief appraiser shall certify to the assessor for each taxing unit in the appraisal district that imposes taxes on the property a penalty in an amount equal to 10 percent of the total taxes due on the property for the current year.

If the court determines that you filed a false rendition or report with the intent to commit fraud or to evade the tax, or you alter, destroy, or conceal any record, document, or thing, or present to the chief appraiser any altered or fraudulent record, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an inspection, investigation, determination, or other proceeding before the appraisal district, the chief appraiser must impose an additional penalty equal to 50 percent of the total taxes due on the property for the current year.

PART 2 - GENERAL DESCRIPTION OF BUSINESS ASSETS

1. Describe the general types of assets you own (inventory, merchandise, parts, tools, machinery, supplies, office equipment, office furniture, office fixtures, vehicles, aircraft, trucks, trailers, etc.):

______

2. Give location of assets if different from location listed in Part 1 or if you have a secondary location.

______

3. CHECK THE TOTAL MARKET VALUE OF YOUR PROPERTY.

Under $20,000 $20,000 or more

Your estimate of market value should be based on the value of all tangible personal property owned by your business on January 1,

Note: Whether you checked “under $20,000” or “$20,000 or more”, complete all parts of the form when applicable.

PART 3 - INVENTORY, RAW MATERIALS, AND SUPPLIES

IMPORTANT: Check whether figures below are based on

Original cost Replacement cost Cost (your cost) or market whichever is lower

FIFO LIFO (if LIFO, add LIFO reserve below Other (explain) ______

If you checked LIFO, What is LIFO reserve? ______

DESCRIPTION OF PROPERTY ORIGINAL COST

COST OF INVENTORY AS OF JANUARY 1 ______

Raw Materials ______

Goods in Process of Manufacture ______

Finished goods ______

Consigned goods ______

Supplies (used in manufacturing) ______

SUPPLIES (USED IN BUSINESS) ______

PART 3A - PROPERTY UNDER BAILMENT, LEASE, CONSIGNMENT OR OTHER ARRANGEMENT

List the name and address of each property owner of taxable property that is in your possession or under your management on JANUARY 1 by bailment, lease, consignment or other arrangement. If necessary, attach additional sheets.

Owner’s Name and Address Description Value of consignment

______

______

PART 4 - FURNITURE & FIXTURES, MACHINERY, EQUIPMENT AND OTHER FIXED ASSETS

List all items of furniture, fixture, machinery and equipment regardless of whether purchased new or used, original cost, and the year of acquisition. List items received as gifts in the same manner.

If you provided an amount in the “good faith estimate of market value”, you need not to complete “ Original Cost” and/or “Year acquired”. * IF NECESSARY, ATTACH ADDITIONAL SHEETS AND/OR A COMPUTER-GENERATED ASSET LISTING.

Property Description Quantity Year Original Good Faith Life Expectancy by type/category Purchased Cost Estimate of Market Value

PART 5 - LEASED OR RENTED BUSINESS PERSONAL PROPERTY

List below the name and address of any business property assets that are leased, loaned, consigned, or rented to you at your location or other taxable property at another location which you own and are responsible for rendering. If necessary, attach additional sheets.

NAME & ADDRESS LOCATION DESCRIPTION

______

______

______

PART 6 - VEHICLES, TRUCKS, TRAILERS, BUSES

List vehicles licensed under the name of the business and/or used in the production of income. Vehicles disposed after January 1st are taxable for the year and must be listed below. If necessary, attach additional sheets. Year Make/Model License/VIN no Property owner’s value estimate Original cost (optional) PART 6A - SPECIAL EQUIPMENT MOUNTED ON VEHICLES

List and describe below any special equipment attached to vehicles and trailers listed on part 6.

Year Make/Model License/VIN no Property owner’s value estimate Original cost (optional)

PART 7 - SIGNATURE AND AFFIRMATION

Are you the business property owner or an employee of the business or an employee of the affiliated entity of the business property owner? YES NO This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your knowledge and belief. If you checked “YES” above, sign and date on the first signature line below. No notarization is required. Printed name ______Title ______Owner/Agent Signature ______Date ______Telephone ______Fax ______If you checked “NO” above, you must complete the following: I swear that the information provided on this form is true and correct to the best of my knowledge and belief. Printed name ______Title ______Owner/Agent Signature ______Date ______

Notary Statement: SUBSCRIBED AND SWORN TO BEFORE ME this the ______day of ______, 20 ____. ______Notary Public, State of Texas

Return to: Webb County Appraisal District Attn: Business Personal Property Department 3302 Clark Blvd. Laredo, Texas 78043-3346 Phone: (956) 718-4091 Fax: (956) 718-4052

Section 22.26 of the Property Tax Code states: (a) The rendition statement or property report required or authorized by this chapter must be signed by an individual who is required to file the statement or report. (b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has been designated in writing by the board of directors or by an authorized officer to sign on behalf of the corporation must sign the statement or report. IF YOU MAKE A FALSE STATEMENT ON THIS FORM, YOU COULD BE FOUND GUILTY OF A CLASS A MISDEMEANOR OR A STATE JAIL FELONY UNDER SECTION 37.10, TEXAS PENAL CODE Webb CAD adaptation of State Property Tax Board Form 50-144