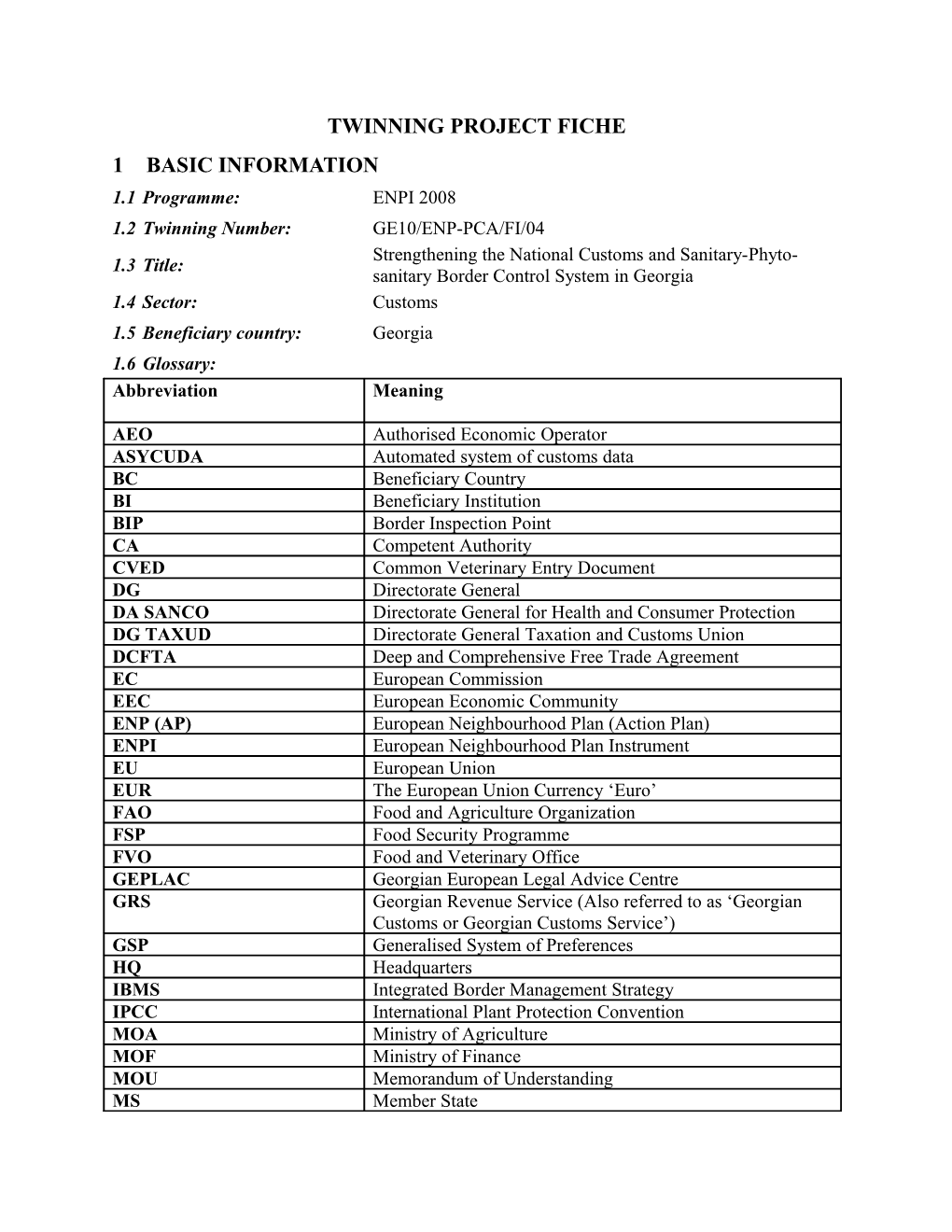

TWINNING PROJECT FICHE 1 BASIC INFORMATION 1.1 Programme: ENPI 2008 1.2 Twinning Number: GE10/ENP-PCA/FI/04 Strengthening the National Customs and Sanitary-Phyto- 1.3 Title: sanitary Border Control System in Georgia 1.4 Sector: Customs 1.5 Beneficiary country: Georgia 1.6 Glossary: Abbreviation Meaning

AEO Authorised Economic Operator ASYCUDA Automated system of customs data BC Beneficiary Country BI Beneficiary Institution BIP Border Inspection Point CA Competent Authority CVED Common Veterinary Entry Document DG Directorate General DA SANCO Directorate General for Health and Consumer Protection DG TAXUD Directorate General Taxation and Customs Union DCFTA Deep and Comprehensive Free Trade Agreement EC European Commission EEC European Economic Community ENP (AP) European Neighbourhood Plan (Action Plan) ENPI European Neighbourhood Plan Instrument EU European Union EUR The European Union Currency ‘Euro’ FAO Food and Agriculture Organization FSP Food Security Programme FVO Food and Veterinary Office GEPLAC Georgian European Legal Advice Centre GRS Georgian Revenue Service (Also referred to as ‘Georgian Customs or Georgian Customs Service’) GSP Generalised System of Preferences HQ Headquarters IBMS Integrated Border Management Strategy IPCC International Plant Protection Convention MOA Ministry of Agriculture MOF Ministry of Finance MOU Memorandum of Understanding MS Member State OIE Office International des Epizooties (world organisation for animal health) OSCE Organization for Security and Cooperation in Europe PAO Programme Administration Office PCA Partnership and Cooperation Agreement PCC Post-Clearance Control PSC Project Steering Committee RASFF Rapid Alert System for Feed and Food RTA Resident Twinning Adviser SAFE Security and Facilitation in a Global Environment SIDA Swedish Government Agency for bi-lateral development cooperation SP Sub-Project SOP Standard Operating Procedures SP’A’ Sub-Project ‘A’ – Customs control procedures SP’B’ Sub-Project ‘B’ – SPS control procedures SPS Sanitary and Phyto-Sanitary STE Short Term Expert TA Technical Assistance TAIEX Technical Assistance Information Exchange Unit TRACES Trade Control and Export System UN United Nations USAID United States Agency for International Development VAT Value Added Tax WCO World Customs Organisation WHO World Health Organisation 2 OBJECTIVES 2.1 Overall Objective(s) This twinning project has two in overall objectives being the development and implementation of modern customs and SPS border controls based on EU best practice. The project has two sub- projects, which follow logically from the twin overall objectives. Sub-project ‘A’ concerns the development of modern customs control procedures and Sub-project ‘B’ concerns the development and implementation of SPS border control procedures.

2.2 Project Purpose(s) Component 1 – Customs The present twinning project, through the strategic planning approach, will contribute to improved administrative capacity and sustainability for Georgian Customs policy, organization and procedures.

Component 2 - SPS The present Twinning project will contribute to strengthening the food safety import control system in Georgia. It will also contribute to the improvement of public health protection by increasing food safety control in Georgia and meeting the EU veterinary standards and the action requirements of the PCA. It is expected that this improvement on compliance with the EU and international food safety standards will enhance general product quality in Georgia and facilitate trade in goods between Georgia and the EU, thereby fulfilling essential objectives of the PCA and the European Neighbourhood Policy Action Plan (ENP-AP).

2.3 Contribution to the Partnership and Co-operation Agreement and the European Neighbourhood Policy Action Plan In relation to the area of customs:

Georgia has been invited to enter into intensified political, security, economic and cultural relations with the EU, enhanced regional and cross border co-operation and shared responsibility in conflict prevention and conflict resolution. The EU-Georgia Action Plan is a first step in this process. It is a political document laying out the strategic objectives of the cooperation between Georgia and the EU and covers a timeframe of five years (2008-2013). Its implementation will help to fulfil the provisions of the EU-Georgia Partnership and Cooperation Agreement, build ties in new areas of cooperation and encourage and support Georgia's objective of further integration into European economic and social structures.

Implementation of the Action Plan will significantly advance the approximation of Georgian legislation, norms and standards to those of the European Union. In this context, it will build solid foundations for further economic integration based on the adoption and implementation of economic and trade-related rules and regulations with the potential to enhance trade, investment and growth. It will furthermore help to devise and implement policies and measures to promote economic growth and social cohesion, to reduce poverty and to protect the environment, thereby contributing to the long-term objective of sustainable development. Georgia and the EU will cooperate closely in implementing the Action Plan.

It is worth noting that, one of the priorities of the ENP Action Plan is to improve customs services.

Priority areas 1 and 2

Specific actions: Adopt (in 2006) and implement a new Customs Code in line with EU and international standards Adopt and implement the necessary implementing provisions to the revised Customs Code in order to simplify and streamline customs procedures and to address the issue of customs ethics in line with EU and international standards Set up a mechanism to ensure regular consultation/information of the trade community on import and export regulations and procedures Strengthen the overall administrative capacity of the customs administration, in particular to increase transparency of customs rules and tariffs, to ensure the correct implementation of customs valuation rules, to implement the principles of risk based customs control and post clearance control ; provide the customs administration with sufficient internal or external laboratory expertise as well as sufficient operational capacity in the IT area Enhance the efficiency of Georgian relevant authorities (Police, State Border Service, Customs) notably through providing modern equipment, adequate infrastructure, facilities and appropriate training in order to increase the security of the Georgian borders and the effectiveness of border crossing checkpoints Adopt and implement a strategy for an integrated system of border management Develop an integrated border management strategy by strengthening co-operation between customs and other agencies working at the border Develop EU-Georgia co-operation with regard to risk-based customs control ensuring safety and security of goods imported, exported or in transit and define standards for certification of operators (exporters and transporters) intervening in commercial exchanges

In the area of sanitary and phytosanitary controls (SPS):

The Component number 2 (SPS) is fully aligned with the ENPI action Plan for Georgia, which states, under its Trade-related issues, market and regulatory reform priority area, an action point on Increase food safety for consumers and facilitate trade through reforms and modernisation of the sanitary and phyto-sanitary services, including, specifically:

- Continue work towards full implementation of the WTO Agreement on the Application of Sanitary and Phyto-sanitary measures and active participation in relevant international bodies (World Organisation for Animal Health (OIE), FAO/WHO/Codex Alimentarius, and IPPC/FAO after adhesion).

- Exchange information on and explore possible areas of convergence with EU rules and practices in the field of sanitary and phyto-sanitary issues (e.g. policy, legislation, strengthening of institutions, implementing practices) In the medium-term, draw up a first list of measures for gradual convergence towards EU general food safety principles and requirements (e.g. regulation 178/2002/EC, Directives 91/496 and 97/78); live animals' identification and animal welfare; animal products, plants products and feed traceability systems; hygiene in food and feed processing). Start approximation of Georgian legislation in these areas.

- Fulfilment of EU requirements on plant health (for plants and plant products (listed in Part B of Annex V to Directive 2000/29/EC)

- Fulfilment of EU requirements on animal health and for the processing of animal products (c.f.: General Guidance for third country authorities on the procedures to be followed when importing live animals and animal products into the European Union, DG SANCO/FVO October 2003.

- Work towards interconnection with the EU Rapid Alert System for Food and Feed (RASFF)

3 DESCRIPTION OF THE TWINNING PROJECT 3.1 Background and justification Policy developments the customs sector The government of Georgia has implemented significant reforms with the aim of customs service modernization and encouraging voluntary compliance. The key initiatives implemented are described below.

In the first quarter of 2009 the new procedures using risk-based cargo selectivity applicable to imports since July 2008 was expanded to exports and customs warehouses as well. As a result of this new risk management system, about 85 percent of shipments are subject to only documentary review (“yellow corridor”), representing a decrease in time for clearance for most shipments by several days. The remaining 15 percent are referred for physical inspection (“red corridor”) based on a combination of risk criteria programmed into the ASYCUDA customs processing software and random selection. Further, Revenue Service looks forward to introducing the “green corridor” and “blue corridor”, available currently only to Gold List participants and which requires no physical or documentary checks, by the end of the year in line with the roll-out of post-clearance control.

From January 2009, changes to the Customs Code came into effect that empowered the Revenue Service to conduct post clearance controls. In the beginning of the year post-clearance audit unit with 7 staff members was established. The post-clearance audit team has been going through various trainings to get equipped with the knowledge and skills required for the post-clearance audit. It is expected to start actual audits not later than by the end of the year. Customs valuation methods are one of the key issues in recent changes to the Customs Code and secondary legislation (December 2008). In 2008 (from April) Georgian customs administration gradually begun proper implementation of customs valuation methods and now absolute majority of goods are cleared according to first method except for those shipments with high risk on valuation. The customs code was amended in section VI (customs valuation) and new addition of valuation methods is more in line with international best practices as it was entirely drafted on basis of GATT and EU customs legislation.

Voluntary disclosure concept was partially introduced. According to the EU practice companies have possibility to amend customs declarations and correct any procedural mistakes without getting penalized, after the goods are cleared (released) and before these mistakes are revealed by customs audit or before customs makes decision about auditing the company. The legislative changes also touched upon the dispute resolution issues. According to the changes came into effect in January 2009, trader is authorized to appeal against violation act even if he signed it. Another innovation of changes (of December 2008) is a possibility to receive binding information about classification and country of origin of goods. From January 1, 2009 new provisions on customs penalties entered into force. According to the changes majority of provisions became clearer and penalties became more proportionate to violations.

The Revenue Service of the Ministry of Finance of Georgia is responsible for implementation and enforcement of Customs legislation and reforms. It has been established since 2008 as a result of amalgamation of three previously separate organizations: Tax Department, Customs Department and the Finance Police. In November 2009, Finance Police was re-established taking investigation and enforcement functions back from the Revenue Service. Recently, the Revenue Service changes status and has established as a Legal Entity of Public Law. It gives the possibility to the agency to levy fees from the taxpayers for providing additional services.

Policy developments in relation to SPS The implementation of the border control component is necessary in the Twinning project for a complex improvement of the residue control system, related to plant and animal health, as part of the Georgia food safety and quarantine control system.

Georgia and the European Union decided to jointly prepare the ground for the start of negotiations on a Deep and Comprehensive Free Trade Agreement. With this purpose, the EU Commission carried out a special fact-finding mission to Georgia in October 2008. As a result, the European Commission presented an assessment of Georgia’s preparedness for the Deep and Comprehensive Free Trade Agreement (DCFTA) with the EU, which includes a number of recommendations related to food safety issues. The food safety area is regarded as a key priority for the proper functioning of a future DCFTA.

In October 2008 the EU carried out a fact-finding mission to Georgia in order to asses Georgia’s preparedness for the possible future DCFTA with the EU. The report concluded that there are serious unresolved SPS issues in Georgia which, if not properly addressed, would lead to the effective exclusion of agriculture and food products from the benefits of an FTA. In particular, (1) the deferral of SPS controls and inspections severely restricts the capacity of Georgian products to be exported to the EU market; (2) animal health is also a matter of great concern. The 2007 outbreak of African swine fever was an example of Georgia's vulnerability regarding animal health safety. In Georgia there is neither legislation nor controls in place for animal identification and traceability, nor obligation for animal holdings or food establishments to be registered, nor monitoring of movement of animals and (3) laboratories. Georgia would need to review the national laboratory network and identify national reference laboratories in the SPS sectors.

The key recommendations done by the fact-finding mission are that Georgia should (i) start implementing the suspended food safety legislation and (ii) prepare a comprehensive strategy of establishment of a solid food safety system.

According to primary legislation of Georgia (Georgian Laws On Veterinary, On Agricultural Quarantine, and Customs Code) Revenue Service of the Ministry of Finance (RS) implements state phyto-sanitary and veterinary border-quarantine controls based on rules defined by the Ministry of Agriculture. This decision was part of the border control related reform, aimed, among others, at introduction of streamlined procedures at the customs and eradication of corrupt practices, significantly undermining trade relations and country’s economic development.

The sphere of competence of the RS is defined as the operational authority, and that of the Ministry of Agriculture as the policy decision-making authority. According to N987-N2-184 joint order, 31.12.2008 of the Minister of Agriculture and Minister of Finance, veterinary or phyto-sanitary officer of the RS has obligation to undertake documentary check, identity check, and physical check as well as laboratory sampling. The spheres of competence, division of power and cooperation practices between National Service of Food Safety, Veterinary and Plant Protection (NS) and RS are defined by this Joint order. From July 1, 2009 the RS started to undertake full identity check and physical check of imported food products with or without laboratory sampling. Full identity check includes visual inspection to ensure that the veterinary or phyto-sanitary certificate(s) or other document(s) provided by the Georgian legislation match with the product itself, as well as for the presence and conformity of the marking which must appear on the animals themselves or on the packaging of products. The procedure also includes thorough examination of transportation means.

Documentary and identity check of imported goods should be undertaken in every case (excluding consignments which have to be controlled according to monitoring plan). If the officer finds any non-compliance in the process of documentary and identity check, he/she should undertake a physical check and laboratory sample-taking procedures additionally. The transportation of goods from Border Inspection Post (BIP) to customs clearance office may take place only if results of physical check and laboratory sample-taking do not reveal any public threat.

Only Documentary check should be implemented at the BIP if consignment is chosen according to the reduced frequency of physical checks monitoring plan for laboratory analysis. In this case the identity check will be implemented in the place of destination by the relevant phyto-sanitary or veterinary officer of Regional Centre of RS, according to the following procedures:

If an officer finds any non-compliance, or suspicion is there in the process of identity check, the officer should implement physical check and laboratory samples taking. Goods may be released into free circulation (import) only if results of physical check and laboratory sample-taking do not reveal any threat.

If an officer does not find any non-compliance, or no suspicion is there in the process of identity check, the officer should implement physical check and laboratory sampling (the same will apply regarding physical check). Goods may be released after laboratory samples taking, without waiting for results of laboratory samples.

According to the Joint Order, RS has obligation to regularly send information to the NS which onsists of data on consignment, serial number of control act and results from checks. Based on this information the monitoring plan should be updated, adjusting the frequency of physical checks and sampling at the BCP. According to the existing monitoring plan, samples should be examined by Laboratory of the Ministry of Agriculture a legal entity of public law. Positive results of tests, undertaken either based on monitoring plan or due to a suspicion, are immediately otified by the RS to the NS. In this case, the NS should re-examine the case, and provide the RS with relevant notification. The RS has obligation to take into account the notification of the NS and either continue, stop or prohibit the clearance process of these goods, accordingly. Cooperation between the NS and RS is not stipulated by the Law. Therefore, obligation of RS to permanently exchange information with the NS will be introduced and defined in the Law.

The SPS components of this twinning project consist of the outstanding issues required to complete the legislative framework and establish modern, EU and international standards- compliant SPS control procedures and documentation

Beneficiary institution and other involved parties The beneficiary institution will be the Revenue Service under the Ministry of Finance – responsible for Customs and SPS border control. The Customs Control Department of the Revenue Service is responsible for customs operations together with seven regional centres (Tbilisi, Batumi, Kutaisi, Rustavi, Poti, Akhaltsikhe, and Telavi). Based on the current changes the Revenue Service is organized as a semi-autonomous agency (“a legal entity of public law”) reporting to the Minister of Finance; basic funding would continue to be provided through the normal government appropriation and budget process. A specific objective of the proposed change is to facilitate the development of more effective HR policies - tax and customs officers abandoned their current civil service status. Officials performing SPS control at the border are contracted by the Revenue Service. A special division for veterinary, sanitary and phyto-sanitary control was created within Customs Control Department (former Customs Control Organisation Division) of Revenue Service in April 2007. This division is in charge of SPS import control at the border, has authority to control and supervise daily work of phytosanitary and veterinary specialists of territorial units of the Revenue Service. The number of staff in the division for veterinary, sanitary and phyto-sanitary control, within the customs control department is 6, (Head of Division, 1 sanitary, 1 phyto- sanitary, 3 veterinary), the number of staff of the BIP inland customs clearance division (the same applies here). The quantity of sanitary specialists of the BIP is 20.

Other parties involved will be:

- Ministry of Agriculture – responsible for policy-making in the field of food safety. In this regard, the issue of co-operation between the Ministry of Finance (GRS) and the Ministry of Agriculture is of prime importance in ensuring a coherent, planned and effective control of SPS at the border.

- The National Service of Food Safety, Veterinary and Plant Protection under the Ministry of Agriculture – exclusively responsible for food safety supervision, monitoring and control. NS includes food safety, veterinary and plant protection departments (see bellow). There are 4 divisions at the city level (29 employees) and 54 divisions at regional level (184 employees) under the NS. In total, the number of employees of the NS equals to 322 persons.

- Ministry of Labour, Health and Social Protection – responsible for setting food safety parameters and norms, baby food, contribution to crisis management.

- Ministry of Finance– responsible for policy-making in the field of customs policies and legislation. In this regard, the issue of co-operation with the Ministry of Finance is of prime importance in ensuring a coherent, planned and effective implementation of activities.

3.2 Linked activities (other international and national initiatives) Other initiatives in the area of customs: Donor Project Main activities EU Georgian European facilitate approximation to European values and Legal Advice Centre integration into European Union markets as from the Partnership and Co-operation Agreement (PCA) commitments, and the European Neighbouring Policy Action Plan (ENP AP) priorities EU Support to Tax o To further strength the Tax Administration to Administration consolidate the legislative reforms, and to approximate the public administration to a European style institution. o To continue to build capacity in the tax administration and inspectorates at central and regional levels to improve the institution performance. o To Increased Public Awareness. Progress the already well ahead introduction of the Tax Payer Services, to better the relation with the public EU PFM 2007-2009 Sector The programme sets policy conditions in 6 areas Policy Support including for the Revenue Service; namely, preparation of Programme service and audit procedure manuals, defining objectives of service and audit, responsibilities and other required provisions.

EU Support to the Revenue The project will provide assistance to the Ministry of Service of the MoF in Finance to assess the administrative and operational the area of Customs capacity of the Revenue Service in the area of Customs policies, systems and procedures. EU PFM 2010-2011 Sector Sector policy condition to be discussed/agreed with the Policy Support government. One of the conditions include bringing Programme customs valuation practice in accordance to WTO standards WB Development Policy Pillar 3 – Improving External Competitiveness. The Operations programme proposed DPO program in the areas of: (i) introduce risk management system at customs (ii) improving customs administration infrastructure (iii) Introduce risk based tax audit system (iv) improving access of Georgian products to European and international markets; (v) reform the statistics system to provide reliable and timely information WB Revenue Modernisation The project will aim to address the main challenges Project focusing on the following areas:

• Organizational management and human resources development • Operations reform - taxpayer segmentation needs to be augmented; • IT modernization.

• Facilities - several office facilities, including those for the LTI need to be upgraded to provide better taxpayer service and facilitate trade. USAID Customs Reform This activity will increase business revenues and Asycuda strengthen the business enabling environment by increasing efficiency in the movement of goods across Georgia. It will increase the operational capacity of the Georgian customs agency through a country-wide expansion of a modern electronic declaration system for import, export, and transit requirements that is compliant with international best practices

Other initiatives linked to the area of SPS: Donor Project Main activities EU Technical Assistance to (1) Draft joint decree between the Ministry of Agriculture the Secondary Customs and the Ministry of Finance Legislation and SPS (2) To prepare two manuals of operating procedures (one Import Controls for Vet controls and one for Phyto-sanitary controls) (Europe (3) To familiarise staff with the new legislation and Aid/122625/C/Ser/GE) procedures through workshops and study visits

EU Support to the (1) Approximation process of Directive 2000/13 improvement of the (consolidated text on food labeling matters). Sanitary and Phyto (2) Approximation process of Directive 2000/29 for plant sanitary system in health and related matters. Georgia (TACIS/ (3) Assistance to the EC Delegation and Georgian 2009 /208-879). Government on SPS issues in the frame of the preparatory process for future negotiations of the free trade agreement. EU/FAO Programme on linking (1) Improvement of the quality of the information. information and (2) Pilot action on animal identification decision-making to (3) Survey on farmers' organizations improve food security 2009-2012 EU Comprehensive To be defined. Project under preparation. It will probably Institutional Building started by the beginning of 2011 Assistance to the National Service for Food Safety EU TAIEX Workshop on On-time training conducted in March, 2010 on SPS border control Management of border inspection points and on the use of management TRACES system SIDA Support to the Milk and (1) Working with local dairy farmers to build collection Dairy Sector and SPS centres which are owned and operated by dairy farmer associations (2) Assisting MoA in creating a country-wide association of milk producers. (3) Providing TA on SPS related issues to the national Service for Food Safety SIDA TA for Alignment (1) To assist the National Service for Food in assessing Needs Assessment of the needs for being able to proceed with the alignment of the national Service for Georgian legislation with the EU SPS Acquis. Food Safety (2) As a result of the mission the MoA and the NSFSVPP shall have a clear picture of the greatest gaps between the SPS legislation of EU and Georgia and how a proposed alignment strategy supported by a possible CIB programme could fill those gaps. IFC Georgia Food Safety (1) Providing advice to companies in upgrading their food Improvement Project systems (2) Improving public and private awareness on food safety issues and solutions (3) Harmonizing Georgian food safety regulations with international best practices. WB Design of a modular (1) a detailed description and design of a modular BIP and BIP and Border Border Crossing Point Crossing Point (BCP); (2) Building projects for two motor transport BIP&BCP (Sadakhlo (border with Armenia), and Tsiteli Khidi (border with Azerbaijani) (3) Recommendations and operational manual on movement of live animals; (4) Design for five small food safety laboratories located at the BIP, including detailed specifications for laboratory equipment. Five food safety laboratories will be purchased and put in operation for the BIPs.1

1 BIP design should be consistent with and support the standard operating procedures and inspection requirements for agricultural products, livestock products and live animals as defined in the EU directives: 1. “Technical requirements for veterinary border inspection posts’’; 2. Commission directive 98/22/ec of 15 April 1998, laying down the minimum conditions for carrying out plant health checks in the community, at inspection posts other than those at the place of destination, of plants, plant products or other objects coming from third countries’’; 3.COMMISSION DECISION of 7 December 2001 drawing up a list of border inspection posts agreed for veterinary checks on animals and animal products from third countries and updating the detailed rules concerning the checks to be carried out by the experts of the Commission 2001/881/EC). 3.3 Results At the completion of this Twinning Project, the following results shall be achieved: Component 1 – Customs

R1. Customs control procedures prior goods releasing: Customs control procedures prior goods releasing is reviewed and modernized according to EU best practices R2. Training strategy: Current training plans are reviewed, updated and implemented R3. Legislation: Review of the approximation of the Georgian Customs legislation is conducted and a guidance booklet is produced R4. Relations with traders, simplification of Customs control procedures: A review and report, involving an effective consultation process between Georgian Customs and respective trade bodies, is produced contributing to developing new simplified customs control procedures R5. Risk Management: Review of current risk management procedures, update the risk management strategic plan and facilitate the process of creation of guidance booklet, risk profiles and risk database based on EU best practice R6. Post Clearance Control and Audit: Review current and develop proper post clearance control procedures; preparation of guidance booklet for post clearance control staff R7. Anti-smuggling prevention and detection equipment: A review current cargo and baggage inspection equipment and guide Georgian customs experts on preparing supply tender for ant-smuggling prevention and detection equipment; training, sharing of expertise in the field of X-ray cargo scanning inspection system. R8. Rules of Origin: Guidance and recommendations are provided to customs officers regarding the transfer of competence of certification on preferential origin to customs officers; recommendations for procedures of issuance of certificate of rules of origin, verification

Component 2 - SPS

R1. Border inspections strategy: A strategy and business plan of Border Inspection Posts lts is drafted, as part of the Integrated Border Management Strategy2

2 Possible preparatory activities towards preparing the Strategy, could be: (1) A report evaluating current and forecasted throughputs, trade patterns and trends of each BIP in Georgia (2) A report describing and documenting requirements of BIPs in terms of facilities, infrastructure (including laboratories), equipment and staffing depending on their intended use, throughput and scope of approval, and (3) A report proposing the future overall BIP structure, location and organisation in Georgia, including location of laboratories. R2. Legal approximation: The EU veterinary and phyto-sanitary border control legislation (see the list of legislative acts to be translated in Annex2) and EU veterinary certificates are translated and approximated into the Georgian legislation3 R3. Pre-Notification: Pre-notification of inbound consignments including pre-notification document and suitable electronic means of submission in line with the CVED, are produced R4. Standard Operating Procedures: A review and report is produced, evaluating the application of SOP’s in conducting and documenting border controls including recording of findings and results thereof in a CVED format. R5. Risk-based National Monitoring Plan: A review and report is produced evaluating the application of a risk-based national monitoring plan for conducting physical checks, including sampling for laboratory test and sent to other department of RS and will be sent to MoA. R6. Border control inter institutional arrangement between RS and relevant FS authorities: A review of the implementation of the Joint Order of the RS and MoA “Approving the Procedure for the Implementation of State Phyto-sanitary Border-quarantine and State Veterinary Border- quarantine Control”. No. 987-No.2-184 of 31 December 2008, and other legal acts which regulate relation between the RS and other FS authorities, are produced, including communication system modalities. R7. Review of Inspection Fees: A review and report establishing the levels and procedures for collecting border inspections fees in the light of EU standards is produced R8. Review of Laboratory Equipment: A review and compilation of a full list of laboratory equipment required for use at BIPs for Veterinary and Phyto Sanitary control, plus identification and guidance on the tender procedures for purchasing equipment is produced R9. TRACES database: A dedicated TRACES-like database linked to the existing Customs database, is designed and developed, with compatible architecture, contents, functions and accessibility rules R10. RASFF database: Access to the RASFF application being developed in the Ministry of Agriculture is developed and implemented; linking all authorities involved in border and internal market controls R11. Training Modules: Training modules detailed are produced and are used to train veterinary and phytosanitary border

3 Including:- (1) A full, clear and EU compliant set of import conditions applicable to live animals, plant and products of animal and plant origin, (2) Systems and procedures for subsequent regular review and updating of the legislation are developed, (3) Communications procedures between different authorities’ regulators and enforcers are developed. (4) Guidelines for Georgian exporters and border inspectors on the new EU rules on food hygiene, official food controls and key questions related to import requirements are developed (5) A guidance booklet with recommendations for Georgian veterinary and phyto sanitary border control procedures is developed and produced. inspectors.

3.4 Activities This list of activities is just tentative. Applicants are requested to elaborate further what concrete activities should be developed for each of the results.

Component 1 – Customs

R1 Customs control procedures prior goods releasing: Elaboration customs control procedures prior goods that: o approximates to that of the EU DG Taxud customs blueprints o includes all relevant ENPI Action Items o includes all projects funded externally or internally o includes a monitoring system R2. Training Strategic Plan4 Activities: Review the currently available training plans, facilities and resources in GRS and prepare a report with recommendations for the future structure of training in GRS. o Produce a training strategic plan for a three year period, taking account of the needs of GRS and its developmental plans, and EU best practice, which includes: a core curriculum, and internal and external training o Produce the following customs training modules:- o Introductory course for new customs officers o Integrity (customs ethics) o Customs legislation and procedures o Strategic planning o Customs Control Procedures, including:- Declaration processing; Customs valuation; Risk management; Post clearance control and audit; Rules of Origin; IPR protection; Customs control for physical examination of goods, containers, transport means, passengers with or without using special detection equipment (excluding X-ray cargo scanning system) o GRS implements the training strategic plan o Produce a training guidance booklet describing the training strategy and plan, including a list of training courses o Create and run ‘train the trainers’ courses R3. Legislation Activities:

4 Includes a ‘Train the trainers’ plan Review the approximation of current Georgian Customs Code and secondary legislation to current EU Customs Code and produce. Discuss and agree results of the review and by applying this remove ambiguities and errors from the texts and provide clear, logical, primary and secondary legislation according to GRS needs and a close approximation to EU customs law. Ensure that Georgian Customs legislation now reflects fully the change in GRS policy from regulatory and command to co-operation GRS ensures amended primary and secondary customs legislation is processed as per standard Georgian procedures Produce a guidance booklet to explain to GRS staff the framework of customs law, including the powers of customs officers R4. Relations with traders - simplification of Customs control procedures Activities:: Review the current means of involving importers and exporters and representative trade bodies in developing new simplified customs control procedures Establish an effective consultation process between Georgian Customs and representative Trade Bodies (in the light of the foregoing review) to obtain and process comment on proposed legislation or new procedures R5. Risk Management Activities: Review:- o risk management provisions , systems and procedures o risks arising from all customs operators activities o the introduction of relevant risk management systems Prepare a risk management strategic plan and risk management procedures based on the foregoing review and EU best practice Prepare a guidance booklet for risk management staff Creation, edition, cancellation of risk profiles and risk database based on EU best practice R6. Post Clearance Control and audit activities: Review the current Post Clearance Control law, control structure and procedure in GRS and propose a structure and procedures based on best EU practice GRS implements the new Post Clearance Control and audit procedures Prepare a guidance booklet to provide information for all PCC staff on how to manage PCC. Sharing of experience to acting customs officer in post clearance control and audit procedures R7. Anti-smuggling prevention and detection equipment strategy Activities Review cargo and baggage inspection equipment currently used in Georgian Customs Produce a report recommending a strategic approach to the purchase, distribution, control and use of inspection and detection equipment and necessary training Provide guidance to GRS experts on preparing a supply tender for anti-smuggling equipment Liaise with GRS risk management specialists to ensure that risk management strategic plan covers the use of anti-smuggling equipment R8. Rules of Origin: Trainings in EU rules of preferential origin for the relevant staff of the customs department (in coordination with activities of the component 2) Development of guidelines on rules of origin for Custom officers of Georgia Development of informational leaflet for Custom officers of Georgia

Component 2 - SPS

This list of activities is just tentative. Applicants are requested to elaborate further what concrete activities should be developed for each of the results.

R1. Border inspections strategy: (a) Establish and evaluate historic, current and forecasted throughputs, trade patterns and trends of each BIP in Georgia; describe and document requirements of each BIP in terms of facilities, infrastructure (including laboratories5), equipment and staffing depending on their intended use, throughput and scope of approval, (b) Propose overall BIP structure, location and organisation in Georgia , (c) Draft a Strategy and Business Plan of Border Inspection Posts as part of the Integrated Border Management Strategy, based on the foregoing, (d) Prioritise and streamline activities towards meeting these requirements within a realistic time frame R2. Legal approximation: Transfer the EU veterinary and phyto-sanitary border control legislation (see the list of legislative acts to be translated in Annex 2) and EU veterinary certificates into the Georgian legislation, including a full, clear and EU compliant set of import conditions applicable to live animals, plant and products of animal and plant origin. Develop systems and procedures for subsequent regular review and updating of the legislation. Develop communications procedures between different authorities’ regulators and enforcers. Develop guidelines for Georgian exporters and border inspectors on the new EU rules on food hygiene, official food controls and key questions related to import requirements. Develop and produce a guidance booklet with recommendations for Georgian veterinary and phyto sanitary border control procedures. R3. Pre-Notification:

5 Laboratories: Laboratory functions and requirements should include sampling and test for e.g. customs tariff classification purposes, as well as SPS Develop and implement pre-notification of inbound consignments including pre-notification document and suitable electronic means of submission in line with the CVED. R4. Standard Operating Procedures: Review and evaluation of SOP’s for conducting and documenting border controls including recording of findings and results thereof in a CVED format. R5. Risk-based National Monitoring Plan: Review and evaluation of implementation of risk-based national monitoring plan6 for conducting physical checks on imported consignments, including sampling for laboratory test R6. Border control inter institutional arrangement between RS and relevant FS authorities: Review and evaluation of the implementation of the Joint Order “Approving the Procedure for the Implementation of State Phyto-sanitary Border-quarantine and State Veterinary Border- quarantine Control”. No. 987-No.2-184 of 31 December 2008, and other legal acts which regulate relation among the RS and other FS authorities, and recommendation for improvement communication system modalities. R7. Review of Inspection Fees: Review to establish the levels and procedures for collecting border inspections fees in the light of EU standards R8. Review of Laboratory Equipment: Review and compile a full list of laboratory equipment7 required for use at BIPs for Veterinary and Phyto Sanitary control R9. TRACES database: Design and develop a dedicated TRACES-like database linked to the existing Customs database, with compatible architecture, contents, functions and accessibility rules R10. RASFF database: Design and develop a RASFF-like application linking all authorities involved in border and internal market controls, including at an extended communication with the EU RASFF data base R11. Training Modules: Train veterinary and phyto-sanitary border inspectors in several supplementary modules 8

6 Liaison with MoA Risk Based Inspection Project is essential 7 Laboratory equipment: see component 1; the opportunity should be taken to identify and list equipment necessary for customs sampling processes, other than for SPS. 8 Including:- Including trainings, inter allia, on: Transposition of the EC/Veterinary Border Control Law into Georgian legislation, including, without limitation: Council Directive 91/496/EEC of 15 July 1991 laying down the principles governing the organisation of veterinary checks on animals entering the Community from third countries and amending Directives 89/662/EEC, 90/425/ EEC and 90/675/EEC (1) Council Directive 97/78/EC of 18 December 1997 laying down the principles governing the organisation of veterinary checks on products entering the Community from third countries Other selected acts, see the relevant list of border control legislation in Annex 2. Veterinary Checks (including documentary checks) at the border, on import and transit goods, including:- Veterinary checks on animals from third countries entering EU/Georgia Veterinary checks on animal products from third countries entering EU/Georgia Veterinary documentation, especially Common Veterinary Entry Document (CVED). Phyto-sanitary checks (including documentary checks) at the border, on import and transit goods, including:- Phyto-sanitary checks on plants from third countries entering EU/Georgia Phyto-sanitary checks on plant products from third countries entering EU/Georgia Phyto-sanitary documentation. Standard Operating Procedures at Border Posts, including:- Requirements for Border Inspection Posts. Practical training at EU Border Inspection Posts for Georgian border veterinarians/phyto-sanitary officers Training at an airport's BIP, a seaport BIP, abroad and/or railway BIP).Training courses for ‘train the trainers’ are created and run for the above modules. 3.5 Means/input from MS Partner Administration In support of GRS own efforts to implement the Twinning project, the principal input of the MS partner(s) will be the staff time. This includes the time of the Project Leader, RTA(s), short and medium term experts and other staff involved in managing and accounting for the project. As project consist of 2 components and envisages to have 2 RTAs, the EU Member States are encouraged to involve in the implementation of the of the project at least 2 relevant public institutions.

All key staff, including the Project Leader, the RTA, and the principal short and medium term experts must provide full CVs, which will be attached to the Twinning Contract. The profile of the other experts should appear in the Twinning work plan.

The Twinning work plan will state exactly how much time will be devoted to each component of the project. The time allocation will be precisely linked to the budget provisions. The different categories of MS staff (officials or assimilated) input is as follows: 3.5.1 Profile and Tasks of the Project Leader (PL)

Qualifications and skills University degree or equivalent experience Fluent English speaker. Command of Georgian and/or Russian would be a strong asset.

General professional experience Minimum of 10 years of professional experience in a senior management position in a customs administration in a Member State (in new Member States a minimum of 3 years experience in aligning customs legislation to the acquis communautaire) Experience in programme and/or project management Experience of working in international or EU programmes

Specific professional experience Must have a broad knowledge of all components of the project and good leadership skills. Sound knowledge of EU legislation and policies in relation to customs control procedures Experience in the management of Twinning contracts will be an advantage

Role and tasks The Project Leader will be a senior civil servant from the MS-partner administration. The Project Leader will direct, co-ordinate and control the overall progress of the project according to the contract requirements. The Project Leader will lead the activities of the project, ensure the achievement of the mandatory results, and will be responsible for the implementation of the activities. The Project Leader will be responsible for the high level monitoring of the project budget. The Project Leader will coordinate, from the Member State(s) side, the Project Steering Committee (PSC) meetings, which will be held in Georgia every three months. The Project Leader is expected to devote a minimum of three working days per month to carry out an on-site mission to Georgia, and to attend the PSC meetings to be held at least once every three months. The Project Leader will liaise with the RTA on a regular basis and with the BC counterpart Project Leader 3.5.2 Profile and Tasks of the RTA The scope of the twinning project requires active, clear project management to ensure that the twinning project achieves the mandatory results and in particular that all the activities are efficiently coordinated. As it is described above, the current twinning fiche covers two different components: customs and phyto-sanitary issues; as it is known, usually these fields are under two different administrations in MSs, therefore with customs and SPS experience. For that reason, it is proposed to introduce two RTAs - one per sub-project: RTA-Customs will be responsible for the Sub-Project A: Development and implementation of customs control procedures RTA – SPS will be responsible for the Sub-Project B – Development and implementation of SPS control procedures.

The RTA – Customs requires a good knowledge of the components of the Twinning project, with particular emphasis on implementation and institutional set up. Comparative knowledge of other MS systems, as well as good management, communication and language skills are an asset.

The profile of the RTA - Customs should be evaluated in conjunction with that of the rest of the team (including the Project Leader) since lack of experience of an RTA - Customs could be compensated for by the quality of the team as a whole.

It is advisable for the work plan to foresee a period of 2 to 4 weeks at the beginning, during which the RTA - Customs is given a chance to acquaint himself with his/her new working environment and sort out his/her practical living arrangements.

Qualifications and skills University degree or equivalent experience Excellent knowledge of and fluency in the English language Good command of Georgian/Russian would be an advantage, PC Computer literacy with significant working knowledge of common software applications such as MS Word, Excel and PowerPoint, Good interpersonal skills - team leader and motivator, co-operative and flexible Strong analytical, problem solving and team-working skills.

General professional experience Minimum of 10 years professional experience in a Member State customs administration in the fields of the twinning project Sound knowledge of EU legislation and policies in relation to customs control procedures Experience of working in international or EU customs projects Sound knowledge of DG Taxud customs blueprints Experience in programme and/or project management Experience in project implementation in ENP or Central and Eastern European countries is desirable Experience of managing staff and budgets Rapidly adaptable to new environments and able to work effectively under pressure

Specific professional experience Minimum of 10 years professional experience in the field of customs legislation and control procedures applied to the control of imports and exports and the enforcement of relevant customs legislation in a MS administration Ability to manage teams of experts and co-ordinate complex and politically sensitive activities. Ability to identify and liaise effectively with international and national institutional stakeholders Experience as RTA or STE in Twinning projects.

Role and tasks The RTA - Customs will be responsible for the day-to-day management and implementation of the Sub-Project A: Development and implementation of customs control procedures The RTA – Customs will coordinate the implementation of activities in compliance with the project work plan and will liaise with the RTA counterpart- Customs in Georgia. The RTA – Customs will be stationed in Georgia for a period of eighteen months, and will be based at the Head Office of the Ministry of Finance Customs (address at section 4 below)

The RTA -Customs Assistant will be recruited and funded by the project.

The RTA- SPS is expected to be responsible for the Sub-Project B – Development and implementation of SPS control procedures.

The RTA - SPS is expected, together with the RTA-Customs, to ensure the achievement of the project objectives detailed in the project fiche. In order to meet these objectives, the expert may propose alternative and/or complementary project activities and/or outputs to those identified in the respective sections, if regarded as necessary and justified.

Qualifications and skills A postgraduate degree level qualification with at least 10 years practical experience in the general organization and management of border inspection services of life animals and fresh plant products PC Computer literacy with significant working knowledge of common software applications such as MS Word, Excel and PowerPoint, She/he should have detailed and practical knowledge of the EU border control of live animals and animal and plant products. Food and Veterinary Office recommendations and other procedures in the fields SPS gained during at least five years of job experience. A background in drafting and implementing strategies, policies and regulation Knowledge of relevant EU veterinary legislative, institutional requirements and best practices related to acquis alignment He/she should also have deep knowledge of the European Commission Food and Veterinary office recommendations as well as OIE standards. Excellent command of English is essential; knowledge of local or Russian language would be an asset.

General professional experience Minimum of 5 years professional experience in a senior management position in a SPS control system in a Member State. Working experience in a EU Member State’s Phyto-sanitary systems, and familiarity with the governing EU legislation and practices Considerable experience in the fields of animal health, food safety, veterinary inspection or quality standards and management for laboratory analysis. He/she should have strong communication skills and previous experience of working in a multi-disciplinary team

Specific professional experience Ability to manage teams of experts and co-ordinate complex and politically sensitive activities. Ability to identify and liaise effectively with international and national institutional stakeholders She/he should proven experience in the EU border control of live animals and animal and plant products. Experience as RTA or STE in Twinning projects will be an advantage Experience in quarantine facilities, procedures, legislations and EU standards regarding quarantine services. • Sound knowledge of international accepted procedures of trade and agreements governing trade, such as SPS and TBT agreements.

Role and tasks

The RTA - SPS will be responsible for the day-to-day management and implementation of the Sub-Project B: Development and implementation of SPS control procedures. The RTA – SPS will coordinate the implementation of activities in compliance with the project work plan and will liaise with the RTA counterpart- SPS in Georgia. The RTA – SPS will be stationed in Georgia for a period of eighteen months, and will be based at the Head Office of the Ministry of Finance Customs (address at section 4 below)

The RTA -SPS Assistant will be recruited and funded by the project. It is proposed to recruit one separate translator/interpreter for the project and funded by the project

Notes: Change of Project Leader or RTAs Should the situation arise where the MS Project Leader or RTA has to be changed, the Twinning Contract and Twinning work plan will be amended according to the procedure outlined under section 6.6 of the Twinning Manual. Such changes request the consultation of the Twinning Steering Committee at Commission Headquarters. Staff Origin The Project Leader, the RTA –Customs and the RTA - SPS must be a Member State national.

3.5.3 Profile and tasks of the MS short-term experts (STE) The project activities are estimated to require the mobilisation of at least seventy short-term experts, the majority with different profiles, from the MS partner administration in order to complement the technical qualifications and skills of the RTA. However some short term experts may have the qualifications, skills and experience to be involved in more than one activity in a component and more than one component of a sub-project.

Sub-project ‘A’ (customs control components) will occupy an estimated 76 short term experts with a total of 428 man days and sub-project ‘B’ (SPS control components) will occupy an estimated 26 short term experts with a total of 250 man days. The total estimated man days for short term experts are 678 for the whole project. In addition study visits are planned for 8 GRS experts with a total of 40 days.

Because of the differing nature of the two sub-projects they can be partly run in parallel since the short term experts working in each sub-project will mostly have entirely different technical expertise.

The experts will principally be seconded from an MS customs administration or a consortium of customs administrations.

The roles, tasks and profiles of the envisaged short term experts are indicated below, according to the relevant sub-project:-

For sub-project ‘A’ (Customs control components) General experience of customs control experts o At least 5 years experience in a member state customs administration o Strong analytical and team working skills o Good inter personal skills o Experience in project implementation in MS countries and/or the countries of central and eastern Europe o Wide knowledge of MS and EU customs legislation and procedures Specific experience of customs control experts o At least 5 years experience in the specific component discipline o At least 5 years practical experience in the specific component discipline o Experience of writing training modules and delivering training

For sub-project ‘B’ (SPS components) General experience of all Short-Term Veterinary Experts are as follows: o University degree in veterinary issues/food safety (except for the law harmonization expert). o Good knowledge of English, o Command of Russian/Georgian is not required, however will be a strong asset. o Good interpersonal and communication skills. o Good training skills. General experience of all Short-Term Phyto sanitary Experts are as follows: o University degree in veterinary issues/food safety (except for the law harmonization expert). o Good knowledge of English, o Command of Russian/Georgian is not required, however will be a strong asset. o Good interpersonal and communication skills. o Experience in the implementation of official control systems applied to food products of plant origin and plants, o Knowledge on the international food standardization framework, role of key international institutions (Codex, OIE, IPPC). o Good training skills. General experience of BIP experts: o Experience in preparing and conducting a training session; expertise, and consultancy on veterinary border control issues. o Preferably 10 years of professional experience as a border veterinarian or officer responsible for border control in the central veterinary administration. o Specific experience in the organisation and operation of inspection services and basic experience/knowledge on the organisation and operation of official laboratories. o Knowledge of the general structure and constituents of the EU food and veterinary laws, including phyto-sanitary legislation and specific requirements of the EU legislation applicable to residue control. o Experience in drafting border control legislation will be an asset. o Strong analytical skills and team-working skills. o Experience in project implementation in MS countries and/or the countries of Central and Eastern Europe would be an asset. Specific experience of BIP experts: Practical skills in border control. Knowledge of the EU veterinary border legislation: Directive 97/78, Directive 91/496 and other acts (see the list of legislation in Annex 2) 4 INSTITUTIONAL FRAMEWORK Institutional structure, organisation and beneficiaries The Beneficiary Institution (BI) will be the Revenue Service (RS) of the Ministry of Finance (MoF) of Georgia, which was established in March 2007 by the merger of the MoF subordinated agencies - Tax Department, Customs Department, and Financial Police.

From April 2008 the Headquarters organisation consists of eight Departments, plus three special structural units, namely Investigative Department, Special Mission Brigade and Audit Department. There are twelve Territorial Units as follows: - Large Tax Inspection, 3 Tax Inspections and 7 Regional Centre (unifying at local level Customs and Tax administrations).

The Ministry of Finance Revenue staff in total is currently 3,340 of which the customs staff amount to 1,050. Of this latter number, 648 staff members are employed in Head Quarters in Tbilisi and 402 in the Regional Customs Offices. Customs is responsible for collecting some 87% of the State Budget funds.

An organisation chart of the Georgian customs structure is included at Annex 4. The Department of the Revenue Service that will be principally involved in the twinning project is the Customs Control Department, which will be responsible for liaison activities and management of the twinning project from the Beneficiary side. Other GRS Departments and Divisions will be involved as well as the Legal Department, the Methodology Department and the Information Processing and Analysing Department. It is not foreseen that the twinning project will lead to any institutional changes other than the probable necessity to set up a Strategic Planning Division. Regional Offices and BIPs will be involved to the extent that trainers may be drawn from there and staff will be trained from there. The status of the new training academy has yet to be finally established.

Twinning Management Structure

The Twinning Contract is an agreement between two parties (i.e. the two administrations of the BC and the MS involved), which together commit themselves to achieving mandatory results. The project must therefore be carried out under the responsibility of two Project Leaders, one from the BC and the other from the MS. Each will be responsible for the activities assigned to his/her administration in the Twinning work plan, with full authority over the human and material resources mobilised to that end. More specifically, the BC Project Leader will be responsible for experts from the BC and the MS Project Leader for all other experts.

A typical instrument for ensuring good co-ordination is a Project Steering Committee. The more actors that are involved (e.g. MS consortia and relevant BC Ministries), the more such a mechanism is likely to be useful and necessary and should be foreseen in the Twinning work plan. The Project Steering Committee is inter alia called upon to examine the interim and final reports.

The signatories of the Twinning Contract will manage both the finances and the logistics required for its organisation and implementation. MS activities are therefore organised and implemented by the Project Leader. Similarly, BC activities will be organised and implemented by the Project Leader from the BC. The Project Leaders will have to work together closely to co- ordinate their activities.

In practical terms, the RTA is likely to play an important role in assisting the Project Leaders in the co-ordination and management of the project - the MS logistical and financial management, co-ordination between MS partners in a consortium, etc.

These tasks and responsibilities require strong project management capacity and a minimum of financial and legal autonomy. Each MS is free to choose the most appropriate co- operation architecture according to the structure of its national administration.

Additional monitoring will take place in the framework of regular operational coordination meetings between:- The BC, the MS and the EU Delegation The BC, the MS and the PAO in coordination with the EU Delegation where applicable For this purpose monthly meetings between the EU Commission Delegation and BC Ministries concerned with the Twinning project and RTAs should be held.

The Project Leader of the MS will be required to submit formal reports and the Project Leader of the BC will be fully involved in this process and will be required to co-sign them.

The proper implementation of Twinning projects may be assessed in the framework of monitoring bodies set up by the respective EU programme, in order to review results and achievements of the project against those set out in the work plan.

Benefits to the respective beneficiary institutions

The perceived benefits for each Institution involved in the twinning are as follows:- Increase in the administrative capacity of GRS Successful move from command to a co-operative approach to the administration of Georgian customs legislation and procedures Approximation of Georgian Customs law to EU customs law Increase in the knowledge and experience of customs staff Increase in the training capacity for customs staff Development and implementation of a national customs strategy Development and implementation of a customs training strategy Development and implementation of a border management strategy (as part of IBMS) Development and implementation of modern customs control procedures Increase in revenue collected through more efficient procedures Increase in facilitation of trade through streamlining and simplification of procedures, based on risk management Increase in the effectiveness, efficiency and economy of border controls through strategic and operational agreements between Institutional stakeholders Decrease in the incidence of smuggling - through improved control activity Improvement in control and monitoring databases and in the declaration processing system Sustainable improvement in GRS administration and procedures is achieved

Impact of developed SPS controls

The Twinning project will have an influence on the allocation of responsibilities and duties, within the competences of:- The Customs Border Control service, which is responsible for the control of imported live animals, plants and products of animal or plant origin, and control of export documents. The Customs Border Control service, which is also responsible for the appropriate sampling for laboratory checks Through the impact of the twinning project, the BC will be informed about the functions of food control institutions, on the duties of the customs SPS service and in conducting veterinary checks in accordance with EU legislation. In addition close co-operation will be in place between the different Ministries and Institutions involved in SPS control.

Impact of developed customs controls and procedures

The twinning project results will impact on the strategic direction of Georgian customs, firstly because of the introduction of a long term strategic planning approach within the organisation and secondly because that approach will be based on the EU customs strategy blueprints.

Closer links with MS customs administrations can be expected as a result of twinning and adoption of MS best practice could lead to changes in the structure of the organisation, its management of resources and an increasing focus on risk. 5 BUDGET The total maximum budget is EUR 1.800.000 . 6 IMPLEMENTATION ARRANGEMENTS 6.1 Implementing agency responsible for tendering, contracting and accounting The Implementing Agency responsible for tendering, contracting and accounting is the European Commission represented by the Delegation of the European Union to Georgia. The person in charge of this project at the Delegation of the European Union to Georgia is:

Mr. Irakli Khmaladze, Project Manager, EU Delegation to Georgia, 38, Nino Chkheidze str. 0102 Tbilisi, Georgia. TEL: +995 32 943763 FAX: +995 32 943768 E-Mail: [email protected] 6.2 Main counterparts in the BC The person in charge of Twinning at the Centre/PAO in Georgia is Mr. Roman Kakulia, Director of the PAO.

Mr. Roman Kakulia PAO Director Office of the State Minister of Georgia on European and Euro-Atlantic Integration #7, Ingorokva Street, Tbilisi 0134, Georgia Office tel/fax: (995 32) 93 14 02 E-Mail: [email protected]

The Project Leader

The Project Leader in the BC will be responsible for the overall management of the twinning project from the beneficiary side.

The BC Project Leader designate is a senior civil servant and decision maker, (a high ranking official) in the BC administration, who is in a position to operate at the appropriate political level. He will have the following role in the implementation of the project:- Responsibility for ensuring the overall steering and coordination with the MS Project Leader and the RTA, ensuring operational dialogue and support at political levels in order to facilitate the implementation of project activities; Responsibility for ensuring the mobilisation of resources and energies within the Ministry of Finance Revenue Service in order to allow appropriate implementation of project activities; and Responsibility for designating the RTA counterpart and Components’ Counterparts in the BC. Responsibility for chairing, from the Georgian side of the project the Steering Committee which will meet at least every three months in Georgia.

The Project Leader's seniority and standing in the BC organisation will ensure his ability to call on technical experts in support of the efficient implementation of the project and the full support at senior levels within the BC.

The Project Leader is not an Adviser; he directs the implementation of the project. There will normally be a trade-off between seniority and the time available for the project. The Project Leader may not be able to devote a significant amount of time due to other obligations.

A minimum has been recommended as 3 days per month with an on-site visit at least every 3 months to participate in the Project Steering Committee.

The BC Project Leader will be: Mr. Giorgi Tskhakaia Head of Revenue Service, Ministry of Finance, Georgia. TEL: +995 32 261001 E-Mail: [email protected]

The RTA Counterpart for Customs component

The RTA counterpart-Customs will have the following role in the implementation of the project: Responsibility for the day-to-day follow-up of project activities in close consultation with the RTA to ensure the effective implementation of the project work plan according to set mandatory results. He will work in close collaboration with the RTA to facilitate the implementation of activities. Responsibility for supervision of the work of the Component Counterparts in the Georgian Revenue Service Responsibility for ensuring the effective delivery of other inputs from the Ministry of finance and other Ministries in Georgia, which are planned to support the implementation of the project.

The contact person in the BC who will be responsible for the day to day management of the twinning project Sub-Project A activities and who will be the RTA counterpart--Customs is:-

Mr Samson Uridia, Deputy Head of Customs Control Department of Revenue Service, Ministry of Finance, Georgia Adress: 16 Gorgasali str. Tbilisi 0114, Georgia TEL: +995 32 261232 Mob:: +995 99 434312 E-Mail: [email protected]

The RTA counterpart for SPS component

The RTA counterpart-SPS is assigned by the Beneficiary institution in order to cooperate with the RTA -SPS in a smooth the Sub-Project B – Development and implementation of SPS control procedures. The RTA counterpart-SPS will have the following role in the implementation of the project:

Responsibility for the day-to-day follow-up of the Sub-Project B activities in close consultation with the RTA, the RTA counterpart and the RTA –SPS to ensure the effective implementation of the project work plan according to set mandatory results. He will work in close collaboration with the RTA - SPS to facilitate the implementation of the Sub-Project B activities. Responsibility for supervision of the work of the Component Counterparts in the Georgian Revenue Service

The contact person in the BC who will be responsible for the day to day management of the twinning project Sub-Project B activities and who will be the RTA counterpart--SPS is:- Ms. Lili Begiashvili Deputy Head of Revenue Service, Ministry of Finance Address: 16 Gorgasali str. Tbilisi 0114, Georgia Tel: +995 32 26 12 64 Mob: +995 99 78 99 88 Email: [email protected]

Other experts (RTA Counterpart, counterparts for key MS experts)

The Beneficiary shall designate project counterparts who will work full time/part-time with the EU experts.

The estimated time to be spent by MS experts in Georgia for each component of the project is shown in the Log Frame Matrix (Activities v Resources) and in the Budget Worksheet Analysis. This provides a starting point for Georgian Customs to identify and match GRS experts to their MS counterparts. Whilst the GRS experts are likely to have to spend much of the programmed time with the MS expert(s), there will of necessity be additional work involved outside that time, in preparation and follow-up activities, including study visits and training.

In the context of training, GRS should identify at an early stage those officers who will receive ‘train the trainers’ training for the training modules to be produced in SPA component 2 and SPB component 11

6.3 Steering Committee Every three months, a Steering Committee will assess the progress of the project, verify the achievements of the outputs and mandatory results and discuss any other which might affect a smooth implementation of the project. The exact composition of the Steering Committee is to be defined in the Twinning Contract. However, the following persons should at least be a member: BC Project Leader, MS Project Leader, BC Counterparts to the RTAs, RTAs, representative of the Twinning Programme Administration Office (PAO), representative of the EC Delegation.

Representatives of other donors and relevant projects may be invited to participate as observers in the Steering Committee meetings. Beyond this coordination mechanism, informal contacts with other projects and donors, for exchange of information on respective work programmes, etc. are encouraged so as to ensure the best synergy. 7 IMPLEMENTATION SCHEDULE (INDICATIVE) 7.1 Launching of the call for proposals Estimated as June 2010 7.2 Indicative start of project activities Estimated as March 2010 7.3 Action’s implementation period 18 months +3 months for the starting up and closure of the project. The total duration of the twinning contract is 21 months, though the RTA works for 18 months. 9. 8 SUSTAINABILITY

In the first instance, the approximation of Georgian legislation to EU legislation is more likely to move towards harmonization (and therefore greater sustainability), in the light of a possible deep and comprehensive free trade area and as a result of alignment with EU and international food safety standards.

A continuing medium term strategic approach to customs activities will provide a sustainable basis for consolidation of administrative and control improvements arising from this twinning project.

Since increasing competitiveness of Georgian food products of animal origin on the international markets is regarded as a major precondition of enhancing the economy it is a realistic assumption that it will receive attention of the highest level decision makers also in the long term.

Even if the probable changes in government may present some risks, the specific commitment of the respective leaders of these particular fields is supposed to counter balance the possible negative effects of some changes.

The level of organisation and principle of food safety control system is reasonably high; hence it is appropriate to support structural changes. Although budgetary problems may somewhat influence sustainability of mandatory results of the project, it is estimated that this risk is acceptable, since food safety is one of the areas where the necessary financing usually can be made available.

The development and implementation of formal agreements on inter Ministry co-operation in border controls and the implementation of the associated Integrated Border Management Strategy will provide sustainable benefits in safeguarding the citizens of Georgia and in meeting the important action points arising from the ENPI (AP). 9 CROSSCUTTING ISSUES

Equal Opportunities Since female employees represent a majority at the different laboratories of food safety the aspect of equal opportunities should receive special emphasis in the project. Hence, equal opportunity principles and practices will be adopted to ensure equitable gender participation in the respective activities of the project.

9 The period for the implementation of the project proper is 18 months which includes preparatory work for the project components and their respective activities, including the work plan and the training of the RTA. These 18 months, however, are increased by another three months for project preparation and closure of the action. The total duration is 21 months, of which are 18 months project implementation. Environment The project will not have negative impact on the environment. However, due to the specific area of the project (food safety) it is advised that the respective environmental authorities are consulted in the beginning of the project to find out any relevant measures to be made. 10 CONDITIONALITY AND SEQUENCING Basic preconditions and assumptions have been developed in the Project Logical Framework. They provide the most important conditionality. Specific, among them is the lasting commitment of the Georgian Government to this project and the continuing, positive and material support of the Revenue Service senior management.

This Twinning Project Fiche has been drafted in close cooperation with the Georgian counterpart, in particular with the Heads of Divisions who will be directly involved in individual components and with the designated RTA counterpart and the BC Project Leader, both senior managers in GRS. All discussions were positive and showed great commitment to the project.

Although these have already been discussed with GRS management, the Beneficiary will be asked at the contracting stage to commit itself to make the contributions stated in this Fiche such as:- Supply of office premises, equipped with computer, telephone, internet access, printer, photocopier to MS in-country staff and visiting experts from the beginning of the project implementation period; Providing suitable venues and equipment for training sessions and seminars that will be held under the project; Ensuring co-ordination between BIs; Ensuring access to all necessary information and documents; Ensuring strong involvement/commitment of BIs staff at all levels; Appropriate co-ordination and transparency of the work of all key players involved will be ensured. ANNEX 1. LOGICAL FRAMEWORK MATRIX Twinning Project Title: Strengthening the National Customs and Sanitary-Phyto-sanitary Border Control System in Georgia Financing Agreement: ENPI 2008 Georgia Total Budget: 1.800.000 EUR