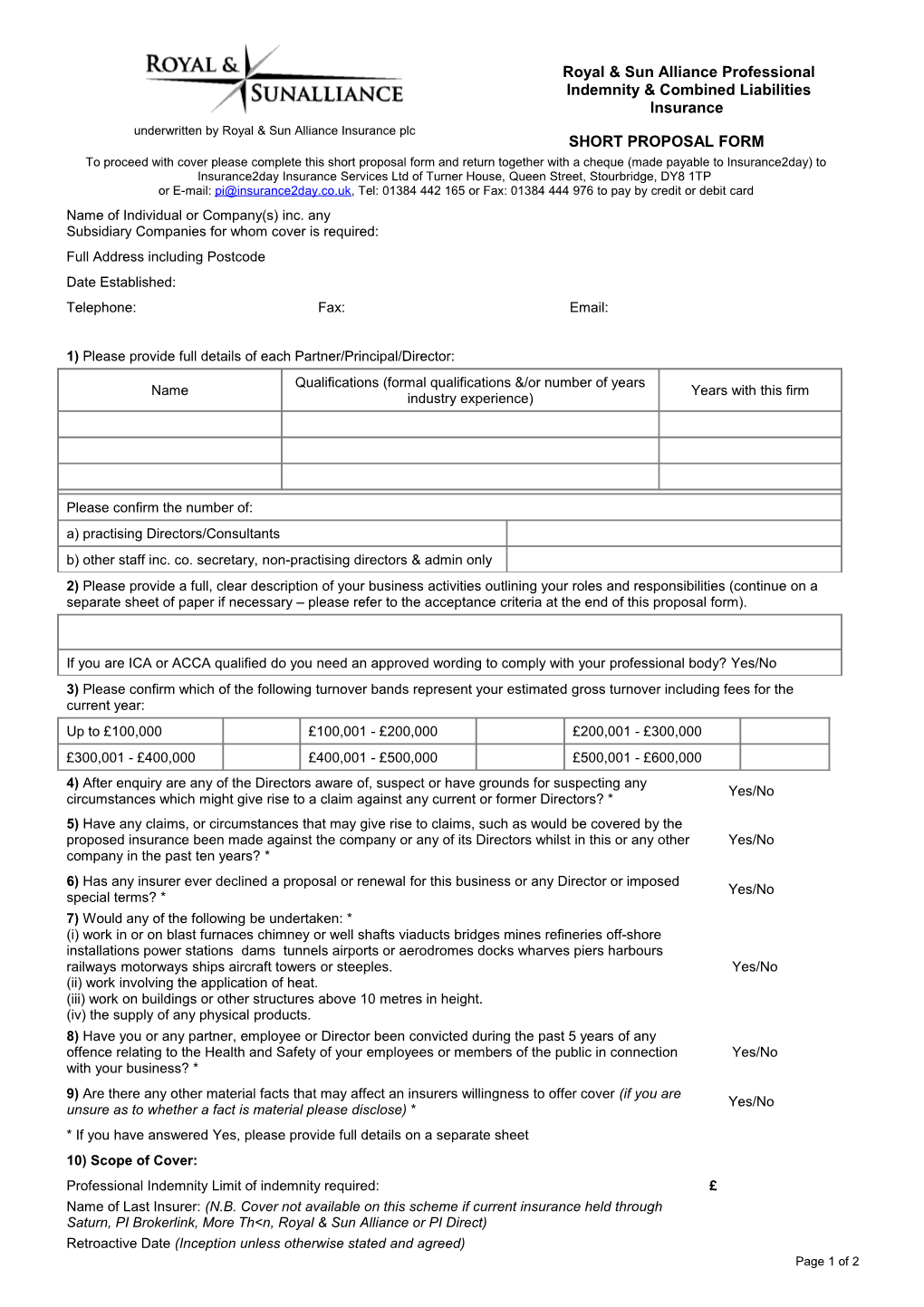

Royal & Sun Alliance Professional Indemnity & Combined Liabilities Insurance underwritten by Royal & Sun Alliance Insurance plc SHORT PROPOSAL FORM To proceed with cover please complete this short proposal form and return together with a cheque (made payable to Insurance2day) to Insurance2day Insurance Services Ltd of Turner House, Queen Street, Stourbridge, DY8 1TP or E-mail: [email protected], Tel: 01384 442 165 or Fax: 01384 444 976 to pay by credit or debit card Name of Individual or Company(s) inc. any Subsidiary Companies for whom cover is required: Full Address including Postcode Date Established: Telephone: Fax: Email:

1) Please provide full details of each Partner/Principal/Director: Qualifications (formal qualifications &/or number of years Name Years with this firm industry experience)

Please confirm the number of: a) practising Directors/Consultants b) other staff inc. co. secretary, non-practising directors & admin only 2) Please provide a full, clear description of your business activities outlining your roles and responsibilities (continue on a separate sheet of paper if necessary – please refer to the acceptance criteria at the end of this proposal form).

If you are ICA or ACCA qualified do you need an approved wording to comply with your professional body? Yes/No 3) Please confirm which of the following turnover bands represent your estimated gross turnover including fees for the current year: Up to £100,000 £100,001 - £200,000 £200,001 - £300,000 £300,001 - £400,000 £400,001 - £500,000 £500,001 - £600,000 4) After enquiry are any of the Directors aware of, suspect or have grounds for suspecting any Yes/No circumstances which might give rise to a claim against any current or former Directors? * 5) Have any claims, or circumstances that may give rise to claims, such as would be covered by the proposed insurance been made against the company or any of its Directors whilst in this or any other Yes/No company in the past ten years? * 6) Has any insurer ever declined a proposal or renewal for this business or any Director or imposed Yes/No special terms? * 7) Would any of the following be undertaken: * (i) work in or on blast furnaces chimney or well shafts viaducts bridges mines refineries off-shore installations power stations dams tunnels airports or aerodromes docks wharves piers harbours railways motorways ships aircraft towers or steeples. Yes/No (ii) work involving the application of heat. (iii) work on buildings or other structures above 10 metres in height. (iv) the supply of any physical products. 8) Have you or any partner, employee or Director been convicted during the past 5 years of any offence relating to the Health and Safety of your employees or members of the public in connection Yes/No with your business? * 9) Are there any other material facts that may affect an insurers willingness to offer cover (if you are Yes/No unsure as to whether a fact is material please disclose) * * If you have answered Yes, please provide full details on a separate sheet 10) Scope of Cover: Professional Indemnity Limit of indemnity required: £ Name of Last Insurer: (N.B. Cover not available on this scheme if current insurance held through

Saturn, PI Brokerlink, More Th Signature of Principal / Partner / Director Name of Signatory Date N.B. The annual premium is a minimum deposit premium – in the event of policy cancellation no return premiums are available. ACCEPTANCE CRITERIA (If you do not comply with all or any of the criteria below please call Insurance2day on 01384 442 165 for details of other products which may be more suited to your requirements) a) Proposer to be aged less than 65, based in the United Kingdom (including Channel Islands, Isle of Man and N. Ireland) with no more than 25% of fees from overseas and no work in USA/CANADA/AUSTRALIA b) Maximum of 3 practising Partners, Directors or Consultants all with relevant industry experience and qualifications c) Gross fees per practising Partner, Director or Consultant in past, current or next year not to exceed £200,000 d) Work for clients where the Proposer has an association or financial interest not to exceed 25% of total fees e) Additional criteria for the IT Industry: (i) Supply of hardware not to exceed 50% of income, (ii) IT Security work not to exceed 25% of income, (iii) Software reselling work not to exceed 50% of income, (iv) No involvement in Live Trading Systems and (v) No Internet Service Provision. Cover excludes claims arising from (i) supply of and/or defective workmanship in the installation, repair or maintenance of computer hardware and/or peripheral equipment and wiring, (ii) web site hosting activities and/or (iii) domain name registration activities f) Additional criteria for Interim Managers: Interim Financial Management not to exceed 25% of income g) Amongst the excluded occupations are (i) Advertising Agencies, (ii) any sub-contract or direct printing, (iii) Health & Safety Consultants, (iv) those acting in the role of a FSA approved Compliance Oversight Office, (v) Automotive Engineers who are not 100% creative design (those who specify stresses, materials, structural strength or major parts including engine parts need to be referred), (vi) Architects and professionals involved in the construction industry including but not limited to project managers and acoustic consultants, (vii) Engineers other than IT engineers and energy/fuel efficiency consultants who specialise in utility bill savings only and (viii) Environmental consultants and waste management consultants. h) Proposer does not require an approved professional indemnity wording e.g. to comply with the minimum institute requirements of The Institute of Chartered Accounts or the Association Of Chartered Certified Accountants PLEASE NOTE 1. It is warranted that all subcontractors have and maintain their own insurance coverage to at least equivalent limits of indemnity 2. Excludes claims arising from (i) supply of and/or defective workmanship in the installation, repair or maintenance of computer hardware and/or peripheral equipment and wiring, (ii) web site hosting activities and/or (iii) domain name registration activities 3. It is warranted that formal sign off procedures are in force for all and any design activities 4. Cover is subject to a Year 2000 exclusion 5. Retroactive Date: Inception - (if you have previously held professional indemnity insurance cover please advise us of the retroactive date so that we can refer to insurers for terms for the retroactive date to be carried forward) 6. The cover will be governed by and construed in accordance with the Laws of England and Wales N.B. No cover is in place until you have received written confirmation. Royal & Sun Alliance Insurance plc are Authorised and Regulated by the Financial Services Authority Page 2 of 2