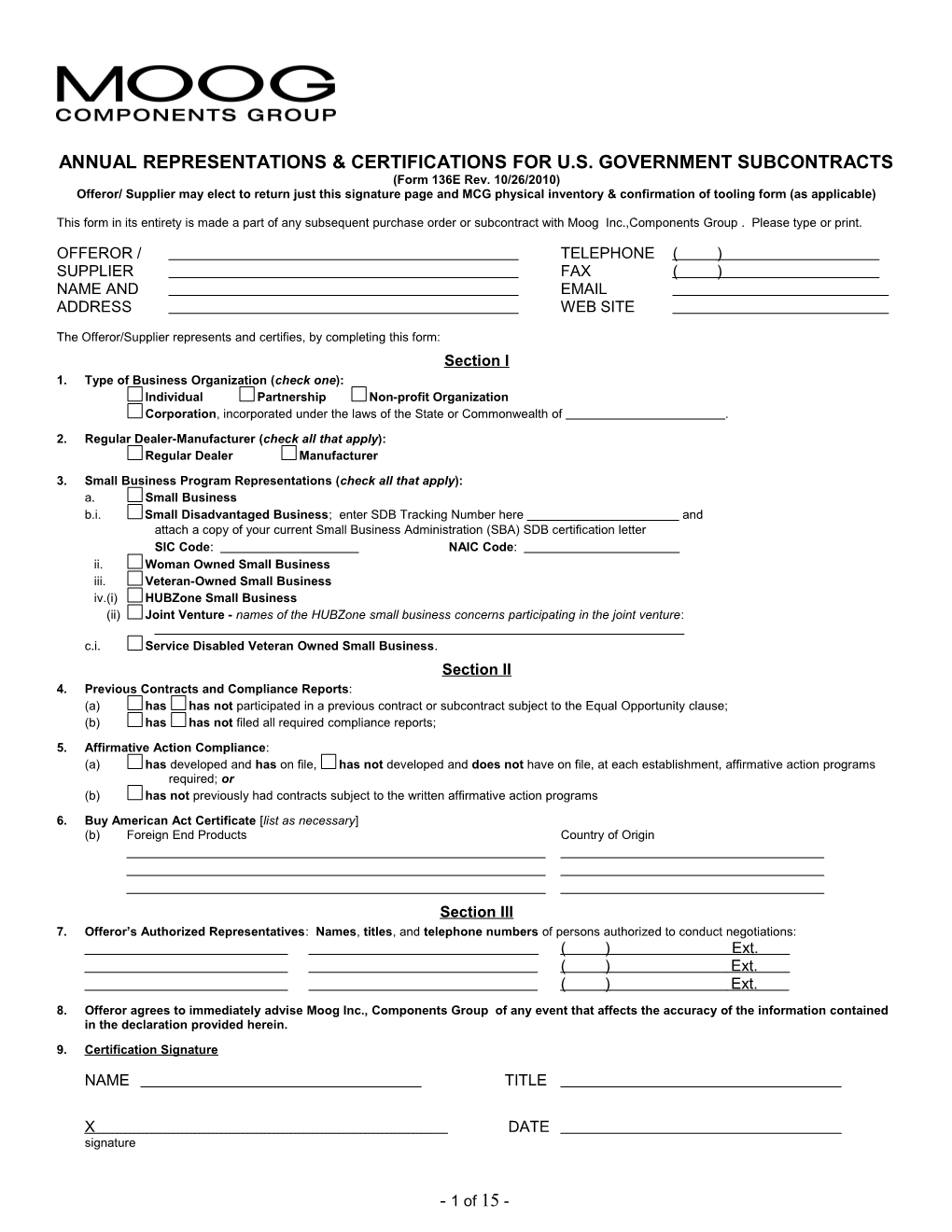

ANNUAL REPRESENTATIONS & CERTIFICATIONS FOR U.S. GOVERNMENT SUBCONTRACTS (Form 136E Rev. 10/26/2010) Offeror/ Supplier may elect to return just this signature page and MCG physical inventory & confirmation of tooling form (as applicable)

This form in its entirety is made a part of any subsequent purchase order or subcontract with Moog Inc.,Components Group . Please type or print.

OFFEROR / TELEPHONE ( ) SUPPLIER FAX ( ) NAME AND EMAIL ADDRESS WEB SITE

The Offeror/Supplier represents and certifies, by completing this form: Section I 1. Type of Business Organization (check one): Individual Partnership Non-profit Organization Corporation, incorporated under the laws of the State or Commonwealth of . 2. Regular Dealer-Manufacturer (check all that apply): Regular Dealer Manufacturer 3. Small Business Program Representations (check all that apply): a. Small Business b.i. Small Disadvantaged Business; enter SDB Tracking Number here and attach a copy of your current Small Business Administration (SBA) SDB certification letter SIC Code: NAIC Code: ii. Woman Owned Small Business iii. Veteran-Owned Small Business iv.(i) HUBZone Small Business (ii) Joint Venture - names of the HUBZone small business concerns participating in the joint venture:

c.i. Service Disabled Veteran Owned Small Business. Section II 4. Previous Contracts and Compliance Reports: (a) has has not participated in a previous contract or subcontract subject to the Equal Opportunity clause; (b) has has not filed all required compliance reports; 5. Affirmative Action Compliance: (a) has developed and has on file, has not developed and does not have on file, at each establishment, affirmative action programs required; or (b) has not previously had contracts subject to the written affirmative action programs 6. Buy American Act Certificate [list as necessary] (b) Foreign End Products Country of Origin

Section III 7. Offeror’s Authorized Representatives: Names, titles, and telephone numbers of persons authorized to conduct negotiations: ( ) Ext. ( ) Ext. ( ) Ext.

8. Offeror agrees to immediately advise Moog Inc., Components Group of any event that affects the accuracy of the information contained in the declaration provided herein.

9. Certification Signature

NAME TITLE

X DATE signature

- 1 of 15 - REPRESENTATIONS & CERTIFICATIONS FOR U.S. GOVERNMENT SUBCONTRACTS (Form 136E Rev. 10/26/2010)

This form is made a part of any subsequent purchase order or subcontract with Moog Inc., Components Group .

OFFEROR / DATE SUPPLIER TELEPHONE ( ) NAME AND FAX ( ) ADDRESS EMAIL

CFR web site: http://www.gpoaccess.gov/cfr/index.html DFARS web sites: http://farsite.hill.af.mil/VFDFARA.HTM & http://www.acq.osd.mil/dp/dars/dfars.html FAR web sites: http://farsite.hill.af.mil/VFFARa.htm & http://www.arnet.gov/far/ HUBZone locator: http://map.sba.gov/hubzone/init.asp#address Public Law web site: http://www.gpoaccess.gov/plaws/index.html U.S. Code web site: http://uscode.house.gov/

Applicability: Annual Dollar Amount up to and including $10,000 Sections I apply annually & to offers Annual Dollar Amount exceeding $10,000 Sections I, & II apply annually & to offers Individual Offers exceeding $150,000 Sections IV & VI apply to individual offer Individual Offers exceeding $650,000 Sections VII apply to individual offer Applies to all orders Sections III & V & VIII apply annually & to all Offers

Submit Sections I, II, & III as applicable annually. Submit Sections IV, V, & VI as applicable with each offer.

The Offeror/Supplier represents and certifies, by completing this form:

SECTION I (submit annually; applies to all Annual Dollar Amounts and all offers)

1. Type of Business Organization: Offeror operates as an individual, a partnership, a non-profit organization, a corporation, incorporated under the laws of the State or Commonwealth of .

2. Regular Dealer-Manufacturer: The Offeror represents as a part of this offer that the Offeror is, or is not , a regular dealer in; or is, or is not, a manufacturer of, the supplies offered.

2(A) Certification of Non-Segregated Facilities: Regardles of size or number of employees, supplier does not and will not maintain or provide for its employees any segregated facilities and IS IN COMPLIANCE WITH FAR 52.222.21. YES NO

3. Small Business Program Representations:

a. The Offeror represents as part of its offer that it is, is not a small business concern.

“Small Business Concern”, as used in this provision, means a concern, including its affiliates, that is independently owned and operated, not dominant in the field of operation in which it is bidding on Government Contracts, and qualified as a small business under the criteria in 13 CFR Part 121.

b. Complete the following only if the Offeror represented itself as a small business concern under 3a above

i. The Offeror represents, for general statistical purposes that it is*, is not, a small disadvantaged business. * Enter SDB Tracking Number here AND attach a copy of your current Small Business Administration (SBA) SDB certification letter.

- 2 of 15 - STANDARD INDUSTRIAL CLASSIFICATION (SIC) CODE OR NORTH AMERICAN INDUSTRIAL CLASSIFICATION (NAIC) CODE (FAR 19.102)

Enter the 4-digit SIC Code or 6-digit NAIC Code that most closely represents the product, commodity or service that your firm is likely to sell to Moog Inc.,Components Group in the calendar year covered by these representations.

SIC Code: NAIC Code:

The SIC Code Table can be found at FAR 19.102. SIC and NAIC Code listings are also available at your public library and through the Internet at: http://www.sba.gov/regulations/siccodes/.

“Small Disadvantaged Business Concern”, as used in this provision, means a small business concern that (1) is at least 51 percent unconditionally owned by one or more individuals who are both socially and economically disadvantaged, or a publicly owned business having at least 51 percent of its stock unconditionally owned by one or more socially and economically disadvantaged individuals, and (2) has its management and daily business controlled by one or more such individuals. This term also means a small business concern that is at least 51 percent unconditional owned by one or more of these entities, which has its management and daily business controlled by members of an economically disadvantaged Indian tribe or Native Hawaiian Organization, and which meets the requirements of 13 CFR Part 124.

ii. The Offeror represents, as part of its offer, that it is, is not a Woman Owned Small Business Concern.

"Women-Owned Business Concern", as used in this provision, means a small business concern that is at least 51 percent owned by one or more women or, in the case of any publicly owned business, at least 51 percent of the stock of which is owned by one or more women; and (2) whose management and daily business operations are controlled by one or more women.

iii. The Offeror represents, as part of its offer that it is, is not a veteran-owned Small Business Concern.

“Veteran-Owned Small Business Concern” means a small business concern – (1) not less than 51 percent of which is owned by one or more veterans (as defined at 38 U.S.C. 101(2)) or, in the case of any publicly owned business, not less than 51 percent of the stock is owned by one or more veterans and (2) the management of the daily business operations of which are controlled by one or more veterans.

iv. The Offeror represents, as part of its offer that –

(i) It is, is not a HUBZone small business concern listed, on the date of this representation, on the List of Qualified HUBZone Small Business Concerns maintained by the Small Business Administration, and no material change in ownership and control, principal office of ownership, or HUBZone employee percentage has occurred since it was certified by the Small Business Administration in accordance with 13 CFR Part 126; and

(ii) It is, is not a joint venture that complies with the requirements of 13 CFR part 126, and the representation in paragraph (b) (4) (I) of this provision is accurate for the HUBZone small business concern or concerns that are participating in the joint venture. [The Offeror shall enter the name or names of the HUBZone small business concern or concerns that are participating in the joint venture: .] Each HUBZone small business concern participating in the joint venture shall submit a separate signed copy of the HUBZone representation. c. Complete the following only if the Offeror represented itself, as a veteran owned small business concern under b, iii above:

i. The Offeror represents, as part of its offer, that it is, is not a service disabled veteran owned small business.

“Service disabled veteran owned small business means a small business concern –

- 3 of 15 - (1) Not less than 51 percent of which is owned by one or more service disabled veterans, or, in the case of any publicly owned business, not less than 51 percent of the stock is owned by one or more services disabled veterans and

(2) The management of the daily business operations of which are controlled by one or more services disabled veterans or, in the case of a veteran with permanent and severe disability, the spouse, or permanent caregiver of such veteran.

ii. Service disabled veteran means a veteran, as defined in 38 U.S.C. 101(2), with a disability that is service connected, as defined in 38 U.S.C. 101(16).

NOTICE OF PENALTY

Under 15 U.S.C. 645(d), any person who misrepresents a firm’s status as a small, HUBZone small, small disadvantaged or woman owned small business concern in order to obtain a contract to be awarded under the preference programs established pursuant to sections 8(a), 8(d), 9, or 15 of the Small Business Act or any other provision of Federal law that specially references section 8 (d) for a definition of program eligibility, shall:

(i) Be punished by imposition of fine, imprisonment, or both.

(ii) Be subject to administrative remedies, including suspension and debarment; and

(iii) Be ineligible for participation in programs conducted under the authority of the Act.

- 4 of 15 - SECTION II (submit annually; applies to Annual Dollar Amount and offers exceeding $10,000)

4. Previous Contracts and Compliance Reports (FAR 52.222-22) (FEB 1999):

The Offeror represents that --

(a) It has, has not participated in a previous contract or subcontract subject to the Equal Opportunity clause of this solicitation;

(b) It has, has not, filed all required compliance reports; and

(c) Representations indicating submission of required compliance reports, signed by proposed subcontractors, will be obtained before subcontract awards.

5. Affirmative Action Compliance (FAR 52.222-25) (APR 1984)::

The Offeror represents that --

(a) It has developed and has on file, has not developed and does not have on file, at each establishment, affirmative action programs required by the rules and regulations of the Secretary of Labor (41 CFR 60-1 and 60- 2); or

(b) It has not previously had contracts subject to the written affirmative action programs requirement of the rules and regulations of the Secretary of Labor.

6. Buy American Act Certificate (FAR 52.225-2) (FEB 2009):

(a) The Offeror certifies that each end product, except those listed in paragraph (b) of this provision, is a domestic end product and that the Offeror has considered components of unknown origin to have been mined, produced, or manufactured outside the United States. The Offeror shall list as foreign end products those end products manufactured in the United States that do not qualify as domestic end products. The terms "component," "domestic end product," "end product," "foreign end product," and "United States" are defined in the clause entitled "Buy American Act-Supplies" (FAR 52.225-1).

(b) Foreign End Products Country of Origin

[List as necessary]

(c) The Government will evaluate offers in accordance with the policies and procedures of Part 25 of the Federal Acquisition Regulation.

- 5 of 15 - SECTION III (submit annually; applies to all Annual Dollar Amounts and all offers)

7. Offeror’s Authorized Representatives: The Offeror will include a list of names, titles, and telephone numbers of persons authorized to conduct negotiations for this solicitation.

( ) Ext.

( ) Ext.

( ) Ext.

8. Offeror agrees to immediately advise Moog Inc. Components Group of any event that affects the accuracy of the information contained in the declaration provided herein.

9. Certification Signature

Offeror’s Signature:

X

Please type or print:

Name Telephone ( ) Ext.

Title Fax ( )

Company email

Date Web Site

- 6 of 15 - SECTION IV (applies to and submit with all offers exceeding $150,000)

10. 52.209-5 -- Certification Regarding Responsibility Matters (Apr 2010)

(a) (1) The Offeror certifies, to the best of its knowledge and belief, that --

(i) The Offeror and/or any of its Principals --

(A) Are [_] are not [_] presently debarred, suspended, proposed for debarment, or declared ineligible for the award of contracts by any Federal agency;

(B) Have [_] have not [_], within a three-year period preceding this offer, been convicted of or had a civil judgment rendered against them for: commission of fraud or a criminal offense in connection with obtaining, attempting to obtain, or performing a public (Federal, State, or local) contract or subcontract; violation of Federal or State antitrust statutes relating to the submission of offers; or commission of embezzlement, theft, forgery, bribery, falsification or destruction of records, making false statements, tax evasion, violating Federal criminal tax laws, or receiving stolen property (if offeror checks “have”, the offeror shall also see 52.209-7, if included in this solicitation); and

(C) Are [_] are not [_] presently indicted for, or otherwise criminally or civilly charged by a governmental entity with, commission of any of the offenses enumerated in paragraph (a) (1)(i)(B) of this provision; and

(D) Have [_], have not [_], within a three-year period preceding this offer, been notified of any delinquent Federal taxes in an amount that exceeds $3,000 for which the liability remains unsatisfied.

(1) Federal taxes are considered delinquent if both of the following criteria apply:

(i) The tax liability is finally determined. The liability is finally determined if it has been assessed. A liability is not finally determined if there is a pending administrative or judicial challenge. In the case of a judicial challenge to the liability, the liability is not finally determined until all judicial appeal rights have been exhausted.

(ii) The taxpayer is delinquent in making payment. A taxpayer is delinquent if the taxpayer has failed to pay the tax liability when full payment was due and required. A taxpayer is not delinquent in cases where enforced collection action is precluded.

(2) Examples.

(i) The taxpayer has received a statutory notice of deficiency, under I.R.C. §6212, which entitles the taxpayer to seek Tax Court review of a proposed tax deficiency. This is not a delinquent tax because it is not a final tax liability. Should the taxpayer seek Tax Court review, this will not be a final tax liability until the taxpayer has exercised all judicial appeal rights.

(ii) The IRS has filed a notice of Federal tax lien with respect to an assessed tax liability, and the taxpayer has been issued a notice under I.R.C. §6320 entitling the taxpayer to request a hearing with the IRS Office of Appeals contesting the lien filing, and to further appeal to the Tax Court if the IRS determines to sustain the lien filing. In the course of the hearing, the taxpayer is entitled to contest the underlying tax liability because the taxpayer has had no prior opportunity to contest the liability.

- 7 of 15 - This is not a delinquent tax because it is not a final tax liability. Should the taxpayer seek tax court review, this will not be a final tax liability until the taxpayer has exercised all judicial appeal rights.

(iii) The taxpayer has entered into an installment agreement pursuant to I.R.C. §6159. The taxpayer is making timely payments and is in full compliance with the agreement terms. The taxpayer is not delinquent because the taxpayer is not currently required to make full payment.

(iv) The taxpayer has filed for bankruptcy protection. The taxpayer is not delinquent because enforced collection action is stayed under 11 U.S.C. 362 (the Bankruptcy Code).

(ii) The Offeror has [[_] has not [_], within a three-year period preceding this offer, had one or more contracts terminated for default by any Federal agency.

(2) “Principal,” for the purposes of this certification, means an officer; director; owner; partner; or a person having primary management or supervisory responsibilities within a business entity (e.g., general manager; plant manager; head of a division or business segment; and similar positions).

This Certification Concerns a Matter Within the Jurisdiction of an Agency of the United States and the Making of a False, Fictitious, or Fraudulent Certification May Render the Maker Subject to Prosecution Under Section 1001, Title 18, United States Code.

(b) The Offeror shall provide immediate written notice to the Contracting Officer if, at any time prior to contract award, the Offeror learns that its certification was erroneous when submitted or has become erroneous by reason of changed circumstances.

(c) A certification that any of the items in paragraph (a) of this provision exists will not necessarily result in withholding of an award under this solicitation. However, the certification will be considered in connection with a determination of the Offeror’s responsibility. Failure of the Offeror to furnish a certification or provide such additional information as requested by the Contracting Officer may render the Offeror nonresponsible.

(d) Nothing contained in the foregoing shall be construed to require establishment of a system of records in order to render, in good faith, the certification required by paragraph (a) of this provision. The knowledge and information of an Offeror is not required to exceed that which is normally possessed by a prudent person in the ordinary course of business dealings.

(e) The certification in paragraph (a) of this provision is a material representation of fact upon which reliance was placed when making award. If it is later determined that the Offeror knowingly rendered an erroneous certification, in addition to other remedies available to the Government, the Contracting Officer may terminate the contract resulting from this solicitation for default.

- 8 of 15 - SECTION V (submit annually; applies to all Annual Dollar Amounts and all offers)

11. Certificate of Independent Price Determination (FAR 52.203-2) (Apr 1985):

(a) The Offeror certifies that --

(1) The prices in this offer have been arrived at independently, without, for the purpose of restricting competition, any consultation, communication, or agreement with any other offeror or competitor relating to --

(i) Those prices; (ii) The intention to submit an offer; or (iii) The methods or factors used to calculate the prices offered.

(2) The prices in this offer have not been and will not be knowingly disclosed by the Offeror, directly or indirectly, to any other offeror or competitor before bid opening (in the case of a sealed bid solicitation) or subcontract award in (in the case of a negotiated solicitation) unless otherwise required by law; and

(3) No attempt has been made or will be made by the Offeror to induce any other concern to submit an offer for the purpose of restricting competition.

(b) Each signature on the offer is considered to be a certification by the signatory that the signatory --

(1) Is the person in the Offeror's organization responsible for determining the prices being offered in this bid or proposal, and that the signatory has not participated and will not participate in any action contrary to subparagraphs (a)(1) through (a)(3) of this provision; or

(2) (i) Has been authorized, in writing, to act as agent for the following principals in certifying that those principals have not participated, and will not participate in any action contrary to subparagraphs (a)(1) through (a)(3) of this provision [insert full name of person(s) in the Offeror's organization responsible for determining prices offered in this bid or proposal, and the title of his or her position in the Offeror's organization];

(ii) As an authorized agent, does certify that the principals named in subdivision (b)(2)(i) of this provision have not participated, and will not participate, in any action contrary to subparagraphs (a)(1) through (1) (3) of this provision; and

(iii) As an agent, has not personally participated, and will not participate, in any action contrary to subparagraphs (a)(1) through (a)(3) of this provision.

(c) If the Offeror deletes or modifies subparagraph (a)(2) of this provision, the Offeror must furnish with its offer a signed statement setting forth in detail the circumstances of the disclosure.

SECTION VI (Individual Offers exceeding $150,000)

12. 52.203-11 -- Certification and Disclosure Regarding Payments to Influence Certain Federal Transactions.

Certification and Disclosure Regarding Payments to Influence Certain Federal Transactions (Sep 2007)

(a) Definitions. As used in this provision—“Lobbying contact” has the meaning provided at 2 U.S.C. 1602(8). The terms “agency,” “influencing or attempting to influence,” “officer or employee of an agency,” “person,” “reasonable compensation,” and “regularly employed” are defined in the FAR clause of this solicitation entitled “Limitation on Payments to Influence Certain Federal Transactions” (52.203-12).

(b) Prohibition. The prohibition and exceptions contained in the FAR clause of this solicitation entitled “Limitation on Payments to Influence Certain Federal Transactions” (52.203-12) are hereby incorporated by reference it his provision.

(c) Certification. The offeror, by signing its offer, hereby certifies to the best of its knowledge and belief that no Federal appropriated funds have been paid or will be paid to any person for influencing or attempting to influence an officer or

- 9 of 15 - employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress on its behalf in connection with the awarding of this contract.

(d) Disclosure. If any registrants under the Lobbying Disclosure Act of 1995 have made a lobbying contact on behalf of the offeror with respect to this contract, the offeror shall complete and submit, with its offer, OMB Standard Form LLL, Disclosure of Lobbying Activities, to provide the name of the registrants. The offeror need not report regularly employed officers or employees of the offeror to whom payments of reasonable compensation were made.

(e) Penalty. Submission of this certification and disclosure is a prerequisite for making or entering into this contract imposed by 31 U.S.C. 1352. Any person who makes an expenditure prohibited under this provision or who fails to file or amend the disclosure required to be filed or amended by this provision, shall be subject to a civil penalty of not less than $10,000, for each such failure.

- 10 of 15 - SECTION VII (applies to and submit with all offers exceeding $650,000)

13. Small Business Subcontracting Plan (FAR 52.219-9) (OCT 2010) / (DFARS 252.219-7003): (APR 2007)

The apparent successful Offeror, upon request by the Buyer, shall submit a Small Business Subcontracting Plan fully responsive to the requirements of FAR 52.219-9, and DFARS 252.219-7003 for Department of Defense subcontracts, which, upon acceptance by the Buyer, shall be included in and made a material part of any resultant subcontract. The subcontracting plan shall be submitted within the time specified by the Buyer. Failure to submit the subcontracting plan shall make the Offeror ineligible for award of subcontracts over $650,000. This clause does not apply if the Offeror is a small business concern (see above, Section I, 3.a).

14. Cost Accounting Standards Notices and Certification (FAR 52.230-1): (OCT 2008)

Sectio Offeror: Complete each of the following Sections, unless otherwise indicated, and determine the Cost Accounting Standards (CAS) requirements applicable to the request for quotation or proposal (RFQ/RFP) or other item as indicated in Section D, below. MOOG may require and offeror hereby agrees to provide justification to support its responses, below, including but not limited to claimed CAS exemptions. n A: Offeror: If your proposal exceeds the applicable Cost Accounting Standards (CAS) threshold, but you claim a full exemption from all CAS rules and regulations, certify that an exemption applies by checking the appropriate box(es), below:

Sealed bid contracts.

Contracts and subcontracts with small businesses.

Contracts and subcontracts with foreign governments or their agents or instrumentalities.

Contracts and subcontracts in which the price is set by law or regulation.

Firm fixed-priced and fixed-price with economic price adjustment (provided that price adjustment is not based on actual costs incurred) contracts and subcontracts for the acquisition of commercial items.

Contracts or subcontracts of less than $7,500,000, provided that, at the time of award, the business unit of the contractor or subcontractoris not currently performing any CAS-covered contracts or subcontracts valued at $7,500,000 or greater.

Subcontracts under the NATO PHM Ship program to be performed outside the United States by a foreign concern.

Contracts and subcontracts to be executed and performed entirely outside the United States, its territories, and possessions.

Firm-fixed-price contracts or subcontracts awarded on the basis of adequate price competition without submission of cost or pricing data.

If you claim one of the Full Contract Exemptions, above, skip Sections B. and C. and proceed to Section D. Otherwise, continue on to Sections B., C. and D. Section B: Certificate of Partial Contract Exemption from CAS Coverage (Modified Coverage Applies) or Alternative CAS Coverage SECTION B: Certificate of Partial Contract Exemption from CAS Coverage (Modified Coverage Applies) or Alternative CAS COVERAGE. Offeror: If your proposal exceeds the applicable CAS threshold, but you claim a partial exemption from certain CAS rules and regulations or if you claim that alternative CAS coverage applies, certify that an exemption applies by checking the appropriate box(es), below:

Contracts and subcontracts awarded to a foreign concern. (Foreign businesses, other than United Kingdom concerns, are exempt fromFAR 52.230-2 but subject to FAR 52.230-3. Note that pursuant to

- 11 of 15 - 48 CFR 9903.201-1(b)(4), foreign concerns are subject only to the CAS Standards found in 48 CFR 9904.401 and 48 CFR 9904.402. Therefore, the FAR 52.230-3 references to 48 CFR 9904.405 and 48 CFR 9904.406 do not apply to foreign concerns.)

Contracts and subcontracts awarded to a United Kingdom contractor for performance substantially in the United Kingdom, provided that the contractor has filed with the United Kingdom Ministry of Defence, for retention by the Ministry, a completed Disclosure Statement (Form No. CASB-DS-1) which shall dequately describe its cost accounting practices. Whenever that contractor is already required to follow United Kingdom Government Accounting Conventions, the disclosed practices shall be in accord with the equirements of those conventions. (See 48 CFR 9903.201-4(d).) (United Kingdom businesses are exempt from FAR 52.230-2 but subject to FAR 52.230-4.)

Offeror is an educational institution that will not use a Federally Funded Research and Development Center (FFRDC) operated by it toperform the work for this contract. (CAS coverage is pursuant to FAR 52.230-5 rather than FAR 52.230-2.) Section C: CAS Applicability – Parts 1 through 4

SECTION C CAS Applicability – Parts 1 through 4: Offeror: Examine each Part (1-4, below) and provide the requested information. If you are an educational institution, Part 2 does not apply unless the contemplated subcontract will be subject to full CAS coverage pursuant to 48 CFR 9903.201-2(c)(5) or modified CAS coverage pursuant to CFR 9903.201-2(c)(6).

Part 1: Disclosure Statement – Cost Accounting Practices and Certification

Offeror:

(a) Any subcontract in excess of the applicable CAS threshold resulting from this solicitation will be subject to the requirements of the Cost Accounting Standards Board (48 CFR Chapter 99), except for those subcontracts which are exempt as specified in 48 CFR 9903.201-1.

(b) Any proposal you submit, if accepted, that results in a subcontract subject to the requirements of 48 CFR Chapter 99, will require you, as a condition of contracting, to submit a Disclosure Statement as required by 48 CFR 9903.202. When required, the Disclosure Statement must be submitted as a part of your proposal under this solicitation unless you have already submitted a Disclosure Statement disclosing the practices used in connection with the pricing of this proposal. If an applicable Disclosure Statement has already been submitted, you may satisfy the requirement for submission by providing the information requested in (c) of this Part (Part 1), below.

CAUTION: In the absence of specific regulations or agreement, a practice disclosed in a Disclosure Statement shall not, by virtue of such disclosure, be deemed to be a proper, approved, or agreed-to practice for pricing proposals or ccumulating and reporting contract performance cost data.

(c) Check the appropriate box, below:

(1) Certificate of Concurrent Submission of Disclosure Statement.

Offeror hereby certifies that, as a part of the proposal, copies of the Disclosure Statement have been submitted as follows: (a) original and one copy to the cognizant Administrative Contracting Officer (ACO) or Federal agency official authorized to act in that capacity, as applicable, and (b) one copy to the cognizant Federal auditor. Note: Disclosure must be on Form No. CASB DS-1 or CASB DS-2, as applicable. Forms may be obtained from the ACO or Federal official and/or from the loose-leaf version of the FAR.)

Date of Disclosure Statement:

Name of ACO or Federal official where filed:

Address of ACO or Federal official where filed: Offeror further certifies that the practices used in estimating costs in pricing this proposal are consistent with the cost accounting practices disclosed in the Disclosure Statement.

- 12 of 15 - (2) Certificate of Previously Submitted Disclosure Statement.

Offeror hereby certifies that the Disclosure Statement was filed as follows:

Date of Disclosure Statement:

Name of ACO or Federal official where filed:

Address of ACO or Federal official where filed:

Offeror further certifies that the practices used in estimating costs in pricing this proposal are consistent with the cost accounting practices disclosed in the Disclosure Statement.

(3) Certificate of Monetary Exemption.

Offeror hereby certifies that, together with all divisions, subsidiaries, and affiliates under common control, did not receive net awards of negotiated prime contracts and subcontracts subject to CAS totaling $50,000,000 or more in the cost accounting period immediately preceding the period in which this proposal was submitted. Offeror further certifies that if such status changes before an award resulting from this proposal, offeror will advise MOOG immediately.

(4) Certificate of Interim Exemption.

Offeror hereby certifies that: (a) offeror first exceeded the monetary exemption for disclosure, as defined in (c)(3) above, in the cost accounting period immediately preceding the period in which this offer was submitted; and (b) in accordance with 48 CFR 9903.202-1, offeror is not yet required to submit a Disclosure Statement. Offeror further certifies that if an award resulting from this proposal has not been made within 90 days after the end of that period, offeror will immediately submit a revised certificate to the Contracting Officer, in the form specified under (c)(1) or (c) (2) above, as appropriate, to verify submission of a completed Disclosure Statement.

CAUTION: Offerors currently required to disclose because they were awarded a CAS-covered prime contract or subcontract of $50,000,000 or more in the current cost accounting period may not claim this exemption (exemption (c)(4)). Further, this exemption applies only in connection with proposals submitted before expiration of the 90-day period following the cost accounting period in which the monetary exemption was exceeded.

Part 2: Cost Accounting Standards – Eligibility for Modified Contract Coverage

Offeror: If you are eligible to use the modified provisions of 48 CFR 9903.201-2(b) and elect to do so, indicate by checking the box below. By checking this box, you are claiming that the resultant subcontract is subject to the Disclosure and Consistency of Cost Accounting Practices clause in lieu of the Cost Accounting Standards clause:

Offeror hereby claims an exemption from the Cost Accounting Standards clause under the provisions of 48 CFR 9903.201-2(b) and certifies that offeror is eligible to use the Disclosure and Consistency of Cost Accounting Practices clause because during the cost accounting period immediately preceding the period in which this proposal was submitted, offeror received less than $50,000,000 in awards of CAS-covered prime contracts and subcontracts. Offeror further certifies that if such status changes before an award resulting from this proposal, Offeror will advise MOOG immediately.

CAUTION: Offerors may not claim the above eligibility for modified contract coverage if this proposal is expected to result in the award of a CAS-covered subcontract of $50,000,000 or more; or if, during its current cost accounting period, offeror has been awarded a single CAScovered prime contract or subcontract of $50,000,000 or more.

- 13 of 15 - Part 3: Additional Cost Accounting Standards Applicable to Existing Contracts Offeror: Indicate below whether award of the contemplated subcontract would, in accordance with subparagraph (a) (3) of the Cost Accounting Standards clause, require a change in established cost accounting practices affecting existing contracts and subcontracts: YES NO

Part 4: Proposal Disclosure – Cost Accounting Practices Changes Offeror: Complete this Part only if a CAS exemption is not claimed and the subcontract will be subject to CAS as specified in 48 CFR 9903-201 (see FAR 52.230-7):

Will the contract award result in a required or unilateral change in cost accounting practice, including unilateral changes requested to be desirable changes?

YES NO *If you checked "YES", you must:

(1) Prepare the price proposal in response to the solicitation using the changed practice for the period of performance for which the practice will be used; and (2) Submit a description of the changed cost accounting practice to the Buyer and the Cognizant Federal agency official as pricing support for the proposal. Rized

SECTION VIII (Applies to all orders)

Moog has determined that a survey of suppliers is needed to determine their status with regard to registration under the International Traffic in Arms Regulations (ITAR) (22, CFR Parts 120-130). The following is a brief explanation of the requested information along with the check boxes for your response.

ITAR Registration

The Moog Terms and Conditions of Purchase require compliance with the International Traffic in Arms Regulations. Part 122 of the ITAR requires all manufacturers of defense items and providers of defense services to be registered with the Directorate of Defense Trade Controls (DDTC). Moog is a manufacturer of defense items and as a result the material or service supplied may be contributing to the products covered by this regulation.

Any non-compliance with ITAR requirements is a serious matter and a lack of registration would preclude award of any purchase orders or subcontracts for any defense articles or defense services. Such registration is required for manufacturers even if they do not engage in exporting.

If you wish to obtain further details about registration, they can be found at the U.S. Department of State, Directorate of Defense Trade Controls (DDTC) website located online at http://pmddtc.state.gov/registration.htm.

As part of our augmentation of regulatory compliance documentation, we are asking our suppliers to confirm whether or not they are registered with DDTC.

We represent that:

1. We are in compliance with the requirements of all U.S. export laws, including but not limited to the Arms Export Control Act, the International Traffic in Arms Regulations (ITAR), the Export Administration Regulations (EAR) as implemented through the International Emergency Economic Powers Act.

2. a. We are registered as a manufacturer/broker/exporter under the International Traffic in Arms Regulations;

Our registration expires: Or b. We are not registered as a manufacturer/broker/exporter under the International Traffic in Arms Regulations. We do manufacture Defense Articles. Exemption Claimed: ______We do not manufacture Defense Articles.

- 14 of 15 - 3. We will at least annually verify and update the above representations and, upon request, will provide to Moog Inc. copies of Supplier’s registration letter issued by the U.S. Department of State.

4. We will immediately advise Moog Inc. of any event that affects the accuracy of the information contained in the above representation.

SSSupplier Name: AdAddress:

SSSigned:

TitlTitle: DaDate:

Signature of Offeror

- 15 of 15 -