SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

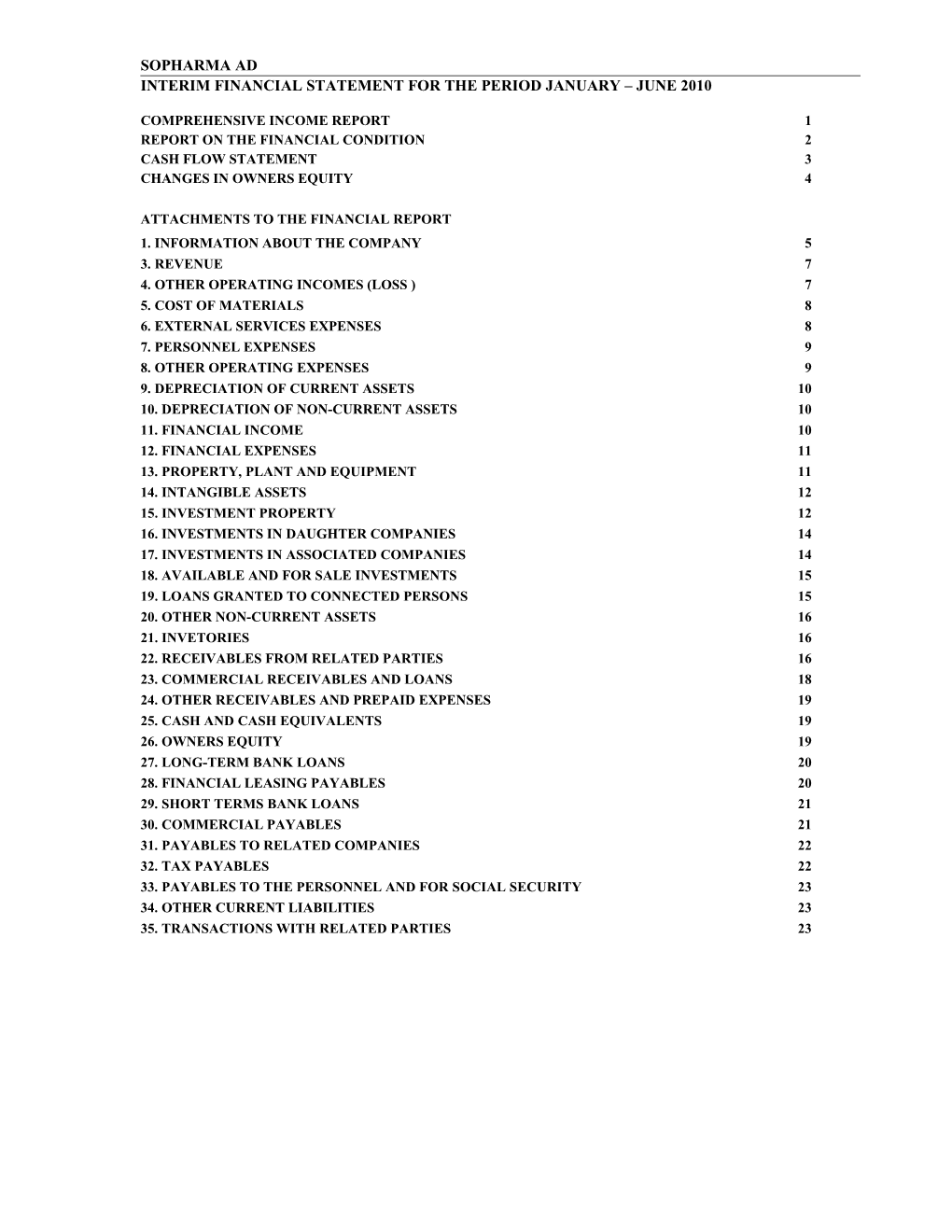

COMPREHENSIVE INCOME REPORT 1 REPORT ON THE FINANCIAL CONDITION 2 CASH FLOW STATEMENT 3 CHANGES IN OWNERS EQUITY 4

ATTACHMENTS TO THE FINANCIAL REPORT 1. INFORMATION ABOUT THE COMPANY 5 3. REVENUE 7 4. OTHER OPERATING INCOMES (LOSS ) 7 5. COST OF MATERIALS 8 6. EXTERNAL SERVICES EXPENSES 8 7. PERSONNEL EXPENSES 9 8. OTHER OPERATING EXPENSES 9 9. DEPRECIATION OF CURRENT ASSETS 10 10. DEPRECIATION OF NON-CURRENT ASSETS 10 11. FINANCIAL INCOME 10 12. FINANCIAL EXPENSES 11 13. PROPERTY, PLANT AND EQUIPMENT 11 14. INTANGIBLE ASSETS 12 15. INVESTMENT PROPERTY 12 16. INVESTMENTS IN DAUGHTER COMPANIES 14 17. INVESTMENTS IN ASSOCIATED COMPANIES 14 18. AVAILABLE AND FOR SALE INVESTMENTS 15 19. LOANS GRANTED TO CONNECTED PERSONS 15 20. OTHER NON-CURRENT ASSETS 16 21. INVETORIES 16 22. RECEIVABLES FROM RELATED PARTIES 16 23. COMMERCIAL RECEIVABLES AND LOANS 18 24. OTHER RECEIVABLES AND PREPAID EXPENSES 19 25. CASH AND CASH EQUIVALENTS 19 26. OWNERS EQUITY 19 27. LONG-TERM BANK LOANS 20 28. FINANCIAL LEASING PAYABLES 20 29. SHORT TERMS BANK LOANS 21 30. COMMERCIAL PAYABLES 21 31. PAYABLES TO RELATED COMPANIES 22 32. TAX PAYABLES 22 33. PAYABLES TO THE PERSONNEL AND FOR SOCIAL SECURITY 23 34. OTHER CURRENT LIABILITIES 23 35. TRANSACTIONS WITH RELATED PARTIES 23 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

1. INFORMATION ABOUT THE COMPANY SOPHARMA AD is a company registered in Bulgaria with headquarters at 16, Iliensko shoes str., Sofia. The court registration of the company is dated November 15, 1991 with decision №1/1991 of the Sofia City Court.

1.1. Ownership and management SOPHARMA AD is a public company according to the provisions of the Law on Public Offering of Securities. As at June 30, 2009 the structure of the capital of the company is as follows:

% Donev Investments Holding AD 24.75 Telekomplekt AD 20.42 Financial Consultancy Company 16.85 Gramercy Emerging Markets Fund 12.89 Other legal persons 21.76 Physical persons 3.33

SOPHARMA AD has a one-tier management system with five members of the Board of directors as follows: Ognian Donev, PhD Chairman Vesela Stoeva Member Ognian Palaveev Member Alexander Todorov Member Andrey Breshkov Member

Дружеството се представлява и управлява от изпълнителния директор д.и.н. Огнян Донев. The Company is represented and managed by its Executive Director Ognian Donev, D.Sc. For the first six months of this year the average number of employees of the company is 1,747 (2009: 1,773).

1.2. Scope of activities The scope of activities of the company includes the following operations and transactions: Production and trade with medicinal substances and medicinal forms;

5 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Research and development and engineer-and-introduction activities in the area of medicinal substances.

2. MAYOR ISSUES OF THE COMPANY ACCOUNTING POLICY

2.1. Basis for financial statements preparation The current interim financial statement is prepared according to the International Accounting Standard 34 “Interim Financial Reporting” and is not certified by a registered auditor. When preparing the interim financial statements follow the accounting policies applied in preparation of annual financial statements for 2008. Financial statements are prepared on historical cost basis except for property, plant and equipment, investment properties and financial instruments available for sale are measured at revalued / fair value. The company leads its accounting records in the Bulgarian Lev (BGN), which accepts as its reporting currency for the presentation. Data in the report and its annexes are presented in thousands of BGN, unless otherwise specifically stated.

2.2. Comparative data The company gives comparative data in this financial statement for the preceding year. When necessary comparative data is reclassified (and recalculated) to achieve comparability of data with the current year.

2. 3 . Currency of accounting The functional and accounting currency of the Company is the Bulgarian Lev (BGN). Since 01.07.1997 it has been fixed to the German mark BGN 1:DEM 1 following an act of the BNB, and with the introduction of EURO as an official currency of the European union, the rate has been BGN 1.95583:EUR 1. Upon initial recognition, a foreign currency transaction is entered in the functional currency, the sum in foreign currency being calculated according to the exchange rate as at the moment of transaction or operation. Cash assets and liabilities denominated in foreign currency are reported in their BGN equivalent according to the exchange rate published by BNB on the last working day of the relevant month. As at December 31st they are reported as BGN equivalent according to the closing exchange rate of BNB. The exchange rate differences in the settlement of transactions in foreign currency or the accounting of foreign currency transactions according to exchange rates different from the rates under

6 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010 which they have been acknowledged, are included in the income statement at the time of their origination and are treated as "other incomes/loss from the activities" and are entered as a net value.

3. REVENUE Main revenues from sale of production of the company include: 2010 2009 BGN '000 BGN '000

Export 69 804 50 716 Domestic sales 31 888 31 895 Total 101 692 82 611

4. OTHER OPERATING INCOMES (LOSS )

2010 2009 BGN '000 BGN '000

Sale of materials 6 968 7 101 Reported value of materials (6 875) (6 937) Profit from sale of materials 93 164 Income from sale of long-term assets 48 19 Long-term assets value in BS (72) (88) Profit from sale of long-term assets (24) (69) Income from sale of goods 733 612 Cost of goods sold (455) (346) Profit from sale of goods 278 266 Income from services rendered 1 192 1 320 Income from financing 26 67

Profit/(loss) from revaluating investment properties to fair value 0 0 Net loss from exchange rate differences resulting from commercial receivables and payables and current accounts 9 100 Written-off payables 0 0 Assets surplus 0 0 Redemptions 4 4 Court cases won 14 0 Interest on current accounts 32 3 Other income 1 23 Total 1 625 1 878

5. COST OF MATERIALS

7 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

2010 2009 BGN '000 BGN '000

Main materials 19 667 18 299 Spare parts and technical materials 1 669 572 Heat 1 434 1 654 Electricity 926 883 Fuel and lubricants 479 390 Water 433 340 Safety 313 231 Rejects 1 4 R&D materials 0 10 Depreciation of materials (Attachment № 10) 0 0 Total 24 922 22 383

6. EXTERNAL SERVICES EXPENSES 2010 2009 BGN '000 BGN '000

Production 16 367 12 156 Advertisement 3 817 2 633 Commissions 1 826 372 Transportation 1 204 1 308 Logistics on the domestic market 630 700 Insurance 610 535 Consultancy services 575 1 089 State and regulatory fees 555 395 Meintenance of buildings and equipments 447 730 Logistics for the export markets 436 467 Civil contracts 432 413 Local taxes and fees 418 460 Security 367 397 Communication 266 290 Rent 256 285 Subscription fees 253 178 Services on registration of medicines 226 498

8 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Translation of documents 223 266 Medicinal services 210 142 Income tax 196 150 Service fees 174 132 Taxes for servicing current accounts in banks 105 101 Car repairs 101 93 License fees 74 329 Courier services 72 71 Clinical trials 32 18 Decomposition of rejected medicines 30 34 Other 0 0 Total 29 902 24 242

7. PERSONNEL EXPENSES 2010 2009 BGN '000 BGN '000

Remuneration 10 757 10 087 Social insurance 2 044 2 034 Social benefits and payments 515 427 Total 13 316 12 548

8. OTHER OPERATING EXPENSES 2010 2009 BGN '000 BGN '000

Business lunches, dinners, presents etc. 763 518 Rejects of finished and unfinished goods 271 0 Business trips 210 161 Written-off receivables 181 0 Grants 157 108 Unrecognized VAT credit 54 25 Accrued/recovered depreciation of receivables (Attachment 49 0 № 9) Payments to the budget 38 103

9 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Training 27 33 Rejects of plantations 13 0 Other 11 0 Court cases 0 91 Rejects of finished and unfinished goods 0 0 (Attachment № 9) Written off and missing long-term assets 0 0 Total 1 774 1 039

9. DEPRECIATION OF CURRENT ASSETS

2010 2009 BGN '000 BGN '000

Depreciation of receivables 49 0 Restored depreciation of receivables Net change of receivables depreciation (Attachment №8) 49 0 Depreciation of finished goods (Attachment № 8) Depreciation of materials (Attachment № 5) Depreciation of unfinished goods (Attachment № 8) Total 49 0

10. DEPRECIATION OF NON-CURRENT ASSETS 2010 2009 BGN '000 BGN '000

Depreciation of investments in daughter companies 229 Depreciation of investments in associated companies 0 229

11. FINANCIAL INCOME 2010 2009 BGN'000 BGN'000

Interest on loans granted 1 404 865 Net profit from exchange rate differences on loans 418 0 Operations with investments 157 16 Income from private equity 116 2 806 Total 2 095 3 687

10 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

12. FINANCIAL EXPENSES

Financial expenses include: 2010 2009 BGN'000 BGN'000

Interest expenses 2 903 3 270 Net loss from exchange rate differences on loans 188 Bank fees on loans and guarantees 210 93 Investment operations expenses 7 18 Total 3 120 3 569

13. PROPERTY, PLANT AND EQUIPMENT

Total Land Machines and In process of and Other building acquisition equipment s

2010 2009 2010 2009 2010 2009 2010 2009 2010 2009 BGN BGN BGN BGN BGN BGN BGN BGN ‘000 ‘000 BGN ‘000 ‘000 ‘000 ‘000 BGN ‘000 ‘000 ‘000 ‘000 Book value Balance on January 1 68 015 65 092 78 383 74 683 16 613 16 838 3 251 14 043 166 262 170 656 Acquired 45 389 757 881 337 604 88 1 788 1 227 3 662

Transfer to property, plant 3 and equipments 213 2 534 335 108 58 35 (606) (5 677) - 0 Transfer to investment property (6 903) - (6 903) Effect from fair value revaluation - 0 (2 (1 (8 Written-off (48) 89) 11) 64) - (159) (1 153) Balance on June/December 30/31 68 273 68 015 79 427 78 383 16 897 16 613 2 733 3 251 167 330 166 262

Accrued amortization Balance on January 1 1 640 0 43 605 38 897 7 718 6 388 0 0 52 963 45 285

Annual amortization 870 1 640 2 525 4 980 805 1 641 4 200 8 261 (2 ( (3 ( Written-off amortization (19) 72) 54) 11) - - (73) 583)

Depreciation - - -

Effect from revaluations to fair value - - - -

Balance on June 30 2 510 1 640 46 111 43 605 8 469 7 718 - - 57 090 52 963

Balance on June 30 65 763 66 375 33 316 34 778 8 428 8 895 2 733 3 251 110 240 113 299

Balance on January 1 66 375 65 092 34 778 35 786 8 895 10 450 3 251 14 043 113 299 125 371

11 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

As at 30.06.2010 long-term assets of the company include: land 25,766 thousand BGN (31.12.2009 : 25,711 thousand BGN) and buildings with book value of 39,997 thousand BGN (31.12.2008 : 40,664 thousand BGN).

14. INTANGIBLE ASSETS Rights on Total In process of intellectual Software acquisition property

2010 2009 2010 2009 2010 2009 2010 2009 BGN BGN BGN BGN BGN Book value BGN ‘000 ‘000 BGN ‘000 ‘000 BGN ‘000 ‘000 ‘000 ‘000 Balance at January 1 745 245 1 038 1 033 777 2 068 2 560 2 560 Acquired 23 150 3 5 38 622 64 777 Transfer 55 350 (55) (350) - -

Transfer to investment property (1 563) - (1 563) Written-off - - Balance at 30/31 June/December 823 745 1 041 1 038 760 777 2 624 1 774

Accrued amortization Balance at January 1 223 175 653 553 0 0 876 876

Accrued amortization for the year 70 48 48 100 148

Written-off amortization - - Balance at 30/31 June/December 293 223 701 653 0 0 994 876

Balance at 30/31 June/December 530 522 340 385 760 777 1 630 1 684

Balance on January 1 522 70 385 480 777 2 068 1 684 2 618

Intellectual property rights include mainly R&D products.

15. INVESTMENT PROPERTY 30.06.2010 31.12.2009 BGN '000 BGN '000

Balance on January 1 18 552 10 368 Transferred from property, machine and equipment - 6 903 Transfer from intangible assets - 1 563 Acquired - 31 Qritten-off - (18)

12 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Fair value adjustment as at December 31 accounted for in the income statement - (295) Transferred to property, machine and equipment - -

Fair value adjustment accounted for in owners equity - - Balance on June 30/31 December 18 552 18 552

Investment properties are special parts from buildings available for long-term renting to daughter companies.

13 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

16. INVESTMENTS IN DAUGHTER COMPANIES

Book value of investments in daughter companies is as follows:

Participatio Participatio n n 30.06.2010 31.12.2009 BGN '000 % BGN '000 %

Sopharma Trading AD Bulgaria 32 424 90.11 32 948 91.56 Bulgarian rose-Sevtopolis AD Bulgaria 8 731 50.00 8 729 49.99 Briz OOD Latvia 6 262 51.00 6 262 51.00 Vitamina AD Ukraine 6 187 99.56 6 187 99.56 Ivanchich and sons Serbia 5 958 51.00 5 738 51.00 Biopharm engineering AD Bulgaria 4 766 69.43 4 766 69.43 Momina krepost AD Bulgaria 4 082 50.00 4 072 49.66 Pharmalogistica AD Bulgaria 1 911 76.54 1 911 76.54 Sopharma buildings REIT Bulgaria 1 093 40.87 1 090 40.74 Electroncommerce EOOD Bulgaria 384 100.00 384 100.00 Sopharma Zdrovit Poland 124 50.01 124 50.01 Extab Corpation USA 108 80.00 108 80.00 Sopharma Poland OOD Poland 10 60.00 10 60.00 Rostbalkanpharm AD Russia 4 51.00 4 51.00 Sopharma USA USA 0 100.00 - 100.00 72 044 72 333

17. INVESTMENTS IN ASSOCIATED COMPANIES

Participatio Participation 30.06.2010 n 31.12.2009 BGN '000 % BGN '000 %

Sopharma Logistics AD /Fintexco AD/ Bulgaria 1 876 29.13 1 849 28.44 1 876 1 849

14 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

18. AVAILABLE AND FOR SALE INVESTMENTS

30.06.2010 Participation 31.12.2009 Participation BGN '000 % BGN '000 %

Doverie United Holding AD 15 423 14.08 15 339 13.87 Medika AD 2 455 9.27 1 932 6.43 Unipharm AD 2 322 6.42 1 885 5.34 Sopharma properties REIT 469 1.25 650 1.73 Maritzatex AD 435 6.73 423 6.28 Olainpharm AD - Latvia 142 0.77 142 0.77 Ecobulpack AD 7 1.48 7 1.48 Unicredit Bulbank AD 3 0.001 3 0.001 Total 21 256 20 381

19. LOANS GRANTED TO CONNECTED PERSONS

30.06.2010 31.12.2009 BGN '000 BGN '000

Daughter companies 9 482 7 791 Companies shareholders with substantial influence 2 993 3 048 12 475 10 839

Conditions:

Currency Contractua Due date Interest 30.06.2010 31.12.2009 l amount % BGN'00 BGN'00 '000 0 BGN'000 0 BGN'000 Incl. Incl. interest interest To daughter companies 3 000 01.03.201 5 839 1 058 4 799 706 USD 2 9.80% 1 000 25.01.201 1 966 372 1 616 252 USD 2 9.80% 3 000 01.04.201 1 677 243 1 376 148 USD 2 9.80% To companies shareholders with substantial influence

15 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

1 500 26.01.201 EUR 1 5.50% 0 0 3 048 114 1 500 10.02.201 2 993 59 - - EUR 2 5.50% 12 475 1 732 10 839 1 220 20. OTHER NON-CURRENT ASSETS

As at June 30, 2010 a loan has been granted to a syndicate organizaiton under the following conditions: 30.06.2010 31.12.2009 BGN '000 BGN '000

Contractual amount: 25 thousand BGN 25 thousand BGN Interest rate: 8.08% 8.08% Due date: 01.06.2012 01.06.2012 Guarantee: None None

Purpose: Working capital Working capital Balance as at June/December 30/31 10 thousand BGN 12 thousand BGN Including long-term part 6 thousand BGN 7 thousand BGN Short-term part 4 thousand BGN 5 thousand BGN

The short-term part is granted as a commercial loan 4 thousand BGN(31.12.2009 : 5 thousand BGN).

21. INVETORIES 30.06.2010 31.12.2009 BGN '000 BGN '000

Materials 20 291 17 995 Finished goods 18 395 21 558 Mid products 5 140 4 421 Unfinished goods 4 406 3 132 Goods 171 196 Total 48 403 47 302

22. RECEIVABLES FROM RELATED PARTIES

30.06.2010 31.12.2009 BGN '000 BGN '000

Receivables from daughter companies 55 843 54 721 Depreciation of uncollectable receivables (641) (641)

16 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

55 202 54 080 Receivables from companies under joint control 15 653 11 911 Depreciation of uncollectable receivables (1 681) (1 632) 13 972 10 279

Receivables from companies under joint control through key management personnel/ shareholder 9 067 7 235 Receivables from a company owner with substantial influence 7 940 5 166 Total 86 181 76 760

Commercial loans are in the following categories:

30.06.2010 31.12.2009 BGN '000 BGN '000

Receivables for sales of products and materials 58 206 57 402 Commercial loans 27 266 19 138 Advance payments 709 220 Total 86 181 76 760

Commercial loans by type of companies are as follows:

30.06.2010 31.12.2009 BGN '000 BGN '000

Companies under joint control 11 925 7 554 Depreciation of commercial loans (1 447) (1 399) 10 478 6 155

Companies shareholders with substantial influence 7 721 4 944 Receivables from companies under joint control control through key management personnel/ shareholder 9 067 8 039 Daughter companies - - Total 27 266 19 138

17 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Commercial loans are as follows: Currency Contractual Due date Interest 30.06.2010 31.12.2009 amount % '000 BGN'000 BGN'000 BGN'000 BGN'000 в т.ч. в т.ч. лихва лихва To daughter companies

To companies with substantial influence

EUR 1 500 26.01.2011 5.50% 3 000 66 - - EUR 1 125 13.10.2010 5.50% 2 254 54 2 539 339 BGN 1 896 31.07.2010 8.08% 1 467 57 1 410 - EUR 500 9.09.2010 5.50% 1 000 22 995 17 Companies under joint control BGN 1 213 31.12.2010 8.08% - - - - BGN 170 31.12.2010 8.08% 173 3 - - BGN 473 31.12.2010 8.08% - - 525 27 BGN 2 661 31.12.2010 8.08% 2 739 78 1 856 26 EUR 1 581 01.04.2011 5.50% 3 150 57 0 0 BGN 3 993 31.12.2010 8.08% 4 065 72 3 774 53 BGN 350 21.06.2011 8.08% 351 1 - - Receivables from companies under joint control control through key management personnel/ shareholder BGN 7 836 31.12.2010 8.30% 8 091 255 7 235 46 BGN 800 31.12.2010 8.08% 914 114 804 104 BGN 130 31.12.2010 8.08% 62 1 - - 27 266 780 19 138 612

23. COMMERCIAL RECEIVABLES AND LOANS 30.06.2010 31.12.2009 BGN '000 BGN '000

Receivables from clients 38 923 32 328 Depreciation of uncollectable receivables (588) (585) 38 335 31 743 Commercial loans 1 185 1 961 Advance payments 1 026 884

18 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Total 40 546 34 588

Commercial loans amounting to 1,185 thousand BGN (31.12.2009: 1,961 thousand BGN) are made: • Company engaged in the acquisition of real estate, wholesale and retail of goods and commodities - 1,180 thousand BGN (31.12.2009: 1,956 thousand BGN). The loan is secured by mortgages on real estate. Agreed annual rate - 8.80%.

• sindicate organization - 4 thousand BGN (31.12.2009: 5 thousand BGN). The loan is secured. Agreed annual rate - 8.08%.

24. OTHER RECEIVABLES AND PREPAID EXPENSES

30.06.2010 31.12.2009 BGN '000 BGN '000

Taxes to be refunded 2 391 1 820 Court cases won 415 420 Devaluation of court cases receivables (415) (418) 0 2 Receivables from investment transactions 275 275 Devaluation of receivables from investment transactions (275) (275) - - Prepaid expenses 219 571 Receivables on deposit guarantees 318 134 At disposal of investments intermediaries 137 71 Other 296 116 Total 3 361 2 714

Taxes to be repaid include: 30.06.2010 31.12.2009 BGN '000 BGN '000

Profit tax - - Accise 1 969 1 727 VAT 366 - Tax at the source 56 93 Total 2 391 1 820

25. CASH AND CASH EQUIVALENTS 30.06.2010 31.12.2009 BGN '000 BGN '000

Cash in bank accounts 9 835 4 393

19 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Cash on hand 519 530 Blocked cash 9 900 5 Total 20 254 4 928 26. Owners equity

Owners equity 30/06/2010 to registered share capital amounted to Sopharma 132,000 thousand BGN, divided into 132,000,000 shares with a nominal value of a dollar per share.

Statutory reserves amounting to 17,787 thousand BGN (31.12.2009 d: 14,428 thousand BGN) are formed of profit-sharing and include full amounts for the reserve fund.

Revaluation reserve - property, plant and equipment amounted to 23,107 thousand BGN (31.12.2009: 23,107 thousand BGN) is formed by the positive difference between the carrying value of property, plant, equipment and their fair values at the dates of the revaluation. The effect of deferred taxes on revaluation reserve is directly reflected in this reserve.

Reserve for financial assets available for sale at 30.06.2010 is negative amounting to 4,372 thousand BGN (31.12.2009: negative EUR 4,288 thousand BGN) and is formed by the effects of ex post evaluation of investments available for sale and at fair value.

27. LONG-TERM BANK LOANS

30.06.201 31.12.200 0 9 Currenc Contracted Maturity Long-term Short-term Total Long-term Short-term Total y credit part part part part amount

BGN'00 BGN'00 '000 BGN'000 BGN'000 0 BGN'000 BGN'000 0

Credit lines USD. 13 000 30.09.2012 1 996 4 128 6 124 10 743 6 145 16 888 EUR 5 000 31.03.2011 0 9 779 9 779 9 721 40 9 761 USD. 4 000 30.09.2012 4 077 2 298 6 375 3 639 1 819 5 458 EUR 1 000 20.09.2011 167 671 838 503 672 1 175 BGN 18 000 15.12.2010 0 17 950 17 950 0 18 030 18 030 EUR 5 000 10.11.2010 0 0 0 0 9 770 9 770 EUR 3 788 24.03.2010 0 0 0 0 7 406 7 406 EUR 3 000 25.08.2010 0 5 868 5 868 0 5 875 5 875 EUR 2 500 31.03.2011 0 3 822 3 822 0 0 0

Investment loans EUR 7 000 25.08.2010 0 391 391 0 1 558 1 558 EUR 3 788 24.03.2010 0 0 0 0 768 768

20 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

6 240 44 907 51 147 24 606 52 083 76 689

28. FINANCIAL LEASING PAYABLES The financial leasing payables included in the balance as at June 30 are under contracts for purchasing of automobiles. They are listed net of future interest and are as follows:

Term 30.06.2010 31.12.2009 BGN '000 BGN '000

Up to one year 168 148 Over one year 355 326 Total 523 474

Minimum leasing payments on the financial leasing are due as follows:

Term 30.06.2010 31.12.2009 BGN '000 BGN '000

Up to one year 302 259 Over one year 535 497 837 756 Future financial expense (314) (282)

Future financial expense 523 474

The down payments owed in the next 12 months are included in “other current liabilities”.

29. SHORT TERMS BANK LOANS Amount 30.06.2009 31.12.2009 Currency Due date '000 BGN'000 BGN'000 Bank loans EUR 12 000 29.09.2010 23 470 23 780 EUR 12 000 08.12.2010 23 098 23 410 EUR 5 000 29.09.2010 5 861 5 864 EUR 5 000 05.01.2011 9 768 - EUR 12 000 14.01.2011 24 301 - Total 86 498 53 054

21 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

30. COMMERCIAL PAYABLES

Commercial payables are as follows: 30.06.2010 31.12.2009 BGN '000 BGN '000

To suppliers 8 555 8 430 Advances received 129 159 Total 8 684 8 589

31. PAYABLES TO RELATED COMPANIES

30.06.2010 31.12.2009 BGN '000 BGN '000

To daughter companies 1 831 3 134 To companies under joint control 1 262 89

To companies shareholders with substantial influence 833 73 Company under joint control through key management personnel/shareholder - - Total 3 926 3 296

Payables to related companies by types are as follows:

30.06.2010 31.12.2009 BGN '000 BGN '000

Payables for investments in daughter companies 0 3 008 Services supplied 3 926 288 Payables for commercial loans - - Total 3 926 3 296

32. TAX PAYABLES

30.06.2010 31.12.2009 BGN '000 BGN '000

Corporate tax 610 2 059

22 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Income tax for physical persons 155 139 VAT 0 17 Tax at the source 4 15 Interest for late payments - - Total 769 2 230

33. PAYABLES TO THE PERSONNEL AND FOR SOCIAL SECURITY

30.06.2010 31.12.2009 BGN '000 BGN '000

To the personnel 1 057 1 227 For social security 420 450 Total 1 477 1 677

34. OTHER CURRENT LIABILITIES 30.06.2010 31.12.2009 BGN '000 BGN '000

Payables for financial leasing 168 148 Court cases 143 148 Payables for dividends 137 138 Deductions from remuneration 71 61 EU financing - 5 Payables resulting from purchase of shares - - Guarantees and deposits 0 1 Others 9 7 Total 528 508

35. TRANSACTIONS WITH RELATED PARTIES

Related parties Type of the relation Period

Company shareholder with substantial 2008 и 2009 Telekomplekt AD influence Company shareholder with substantial 2008 и 2009 Donev Investments AD influence Financial Consultancy Company Company shareholder with substantial От 27.08.2008 и 2009 EOOD influence

23 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Company shareholder with substantial до 05.08.2008 Telso AD influence Company under joint control От 06.08.2008 и 2009 Sopharma Trading AD Daughter company 2008 и 2009 Pharmalogistics AD Daughter company 2008 и 2009 Bulgarian Rose Sevtopolis AD Daughter company 2008 и 2009 Sopharma Poland Daughter company 2008 и 2009 Sopharma Zdrovit Daughter company 2008 и 2009 Rostbalkanpharm Daughter company 2008 и 2009 Sopharma USA Daughter company 2008 и 2009 Electroncommerce AD Daughter company 2008 и 2009 Biopharmengineering AD Daughter company 2008 и 2009 Vitamina AD Daughter company От 18.01.2008 и 2009 г Ivanchich and sons AD Daughter company От 10.04.2008 и 2009 г Sopharma buildings REIT Daughter company От 04.08.2008 и 2009 г Momina krepost AD Daughter company 2008 и 2009 Extab Corporation Daughter company От 01.08.2009 Briz OOD Daughter company От 01.12.2009 SFARM Investments Limited Daughter company От 08.04.2008 до 30.09.2009 г Company under joint control От 01.10.2009 г Mineralcommerce AD Daughter company 2008 и до 30.09.2009 Company under joint control От 01.10.2009 Sopharma Logistics AD Associated company 2008 и 2009 Pharmachim Holding AD Company under joint control 2008 и 2009 NIFHI AD Company under joint control 2008 и 2009 Unipharm AD Company under joint control 2008 и 2009 Kaliman RT AD Company under joint control 2008 и 2009 Seiba Pharmacies and drug stores Company under joint control 2008 и 2009 Sopharma Trading 2006 AD Company under joint control 2008 и 2009 Sofiiski apteki AD Company under joint control 2008 и 2009 SCS Franchising AD /Sanita Company under joint control 2008 и 2009 Franchising AD / Sopharma properties REIT Company under joint control 2008 и 2009 Sofia Inform AD Company under joint control 2008 и 2009 Sofprint group AD Company under joint control 2008 и 2009 Sofconsult group AD Company under joint control 2008 и 2009 Elpharma AD Company under joint control 2008 и 2009 Company under joint control through 2008 и 2009 key management personnel/shareholder Doverie obedinen holding group

24 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

Supplies from related parties: 01 - 06.2010 2009 BGN ‘000 BGN ‘000 Materials supplied from: Companies under joint control 4 488 7 503 Daughter companies 1 704 2 022 Companies owners with substantial influence 60 339 6 252 9 864 Services supplied by: Daughter companies 7 162 13 155 Companies under joint control 4 383 7 244 Companies owners with substantial influence 1 195 2 712 12 740 23 111

Long-term assets supplied by: Companies owners with substantial influence 75 169 Daughter companies 0 110 Companies under joint control 5 31 80 310 Supplies for LT Assets acquired from: Companies owners with substantial influence 0 789 Daughter companies - - 0 789

Total 19 072 34 074

Sales to related parties 01 - 06.2010 2009 BGN ‘000 BGN ‘000 Finished goods: Daughter companies 35 897 68 302 Companies under joint control 318 1 535 36 215 69 837 Services: Daughter companies 647 1 401 Companies under joint control 244 591 Companies owners with substantial influence 25 50 916 2 042 Other sales: Daughter companies 3 947 7 581 Companies under joint control 3 339 6 027 Companies owners with substantial influence 30 115

25 SOPHARMA AD INTERIM FINANCIAL STATEMENT FOR THE PERIOD JANUARY – JUNE 2010

7 316 13 723

Total 44 447 85 602

The conditions under which the transactions have been carried out do not differ from market conditions for this type of transactions.

26