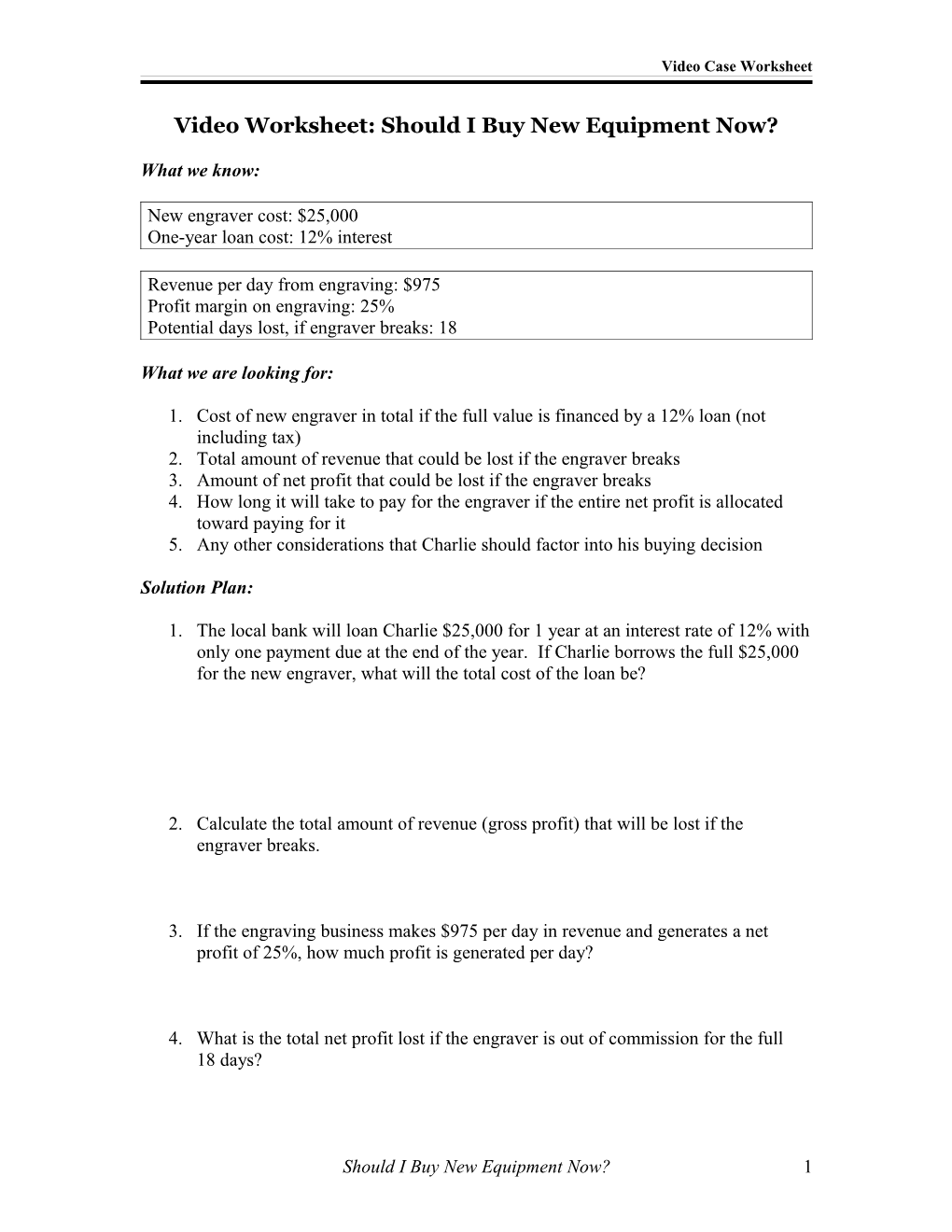

Video Case Worksheet

Video Worksheet: Should I Buy New Equipment Now?

What we know:

New engraver cost: $25,000 One-year loan cost: 12% interest

Revenue per day from engraving: $975 Profit margin on engraving: 25% Potential days lost, if engraver breaks: 18

What we are looking for:

1. Cost of new engraver in total if the full value is financed by a 12% loan (not including tax) 2. Total amount of revenue that could be lost if the engraver breaks 3. Amount of net profit that could be lost if the engraver breaks 4. How long it will take to pay for the engraver if the entire net profit is allocated toward paying for it 5. Any other considerations that Charlie should factor into his buying decision

Solution Plan:

1. The local bank will loan Charlie $25,000 for 1 year at an interest rate of 12% with only one payment due at the end of the year. If Charlie borrows the full $25,000 for the new engraver, what will the total cost of the loan be?

2. Calculate the total amount of revenue (gross profit) that will be lost if the engraver breaks.

3. If the engraving business makes $975 per day in revenue and generates a net profit of 25%, how much profit is generated per day?

4. What is the total net profit lost if the engraver is out of commission for the full 18 days?

Should I Buy New Equipment Now? 1 Video Case Worksheet

5. If the engraver is kept busy 269 full days per year, how much revenue (gross profit) will be generated?

6. If the engraver is kept busy 269 full days per year, how much net profit will be generated?

7. Given a 25% profit margin and $975 per day in revenue, how many days would it take for the new engraver to earn back the total cost of purchase, if the entire net profit were allocated to pay for the unit? Round your answer to the next full day.

8. What other factors should Charlie consider in order to make a good business decision?

9. Should Charlie buy the new engraver? Why?

2 Video Case Worksheets