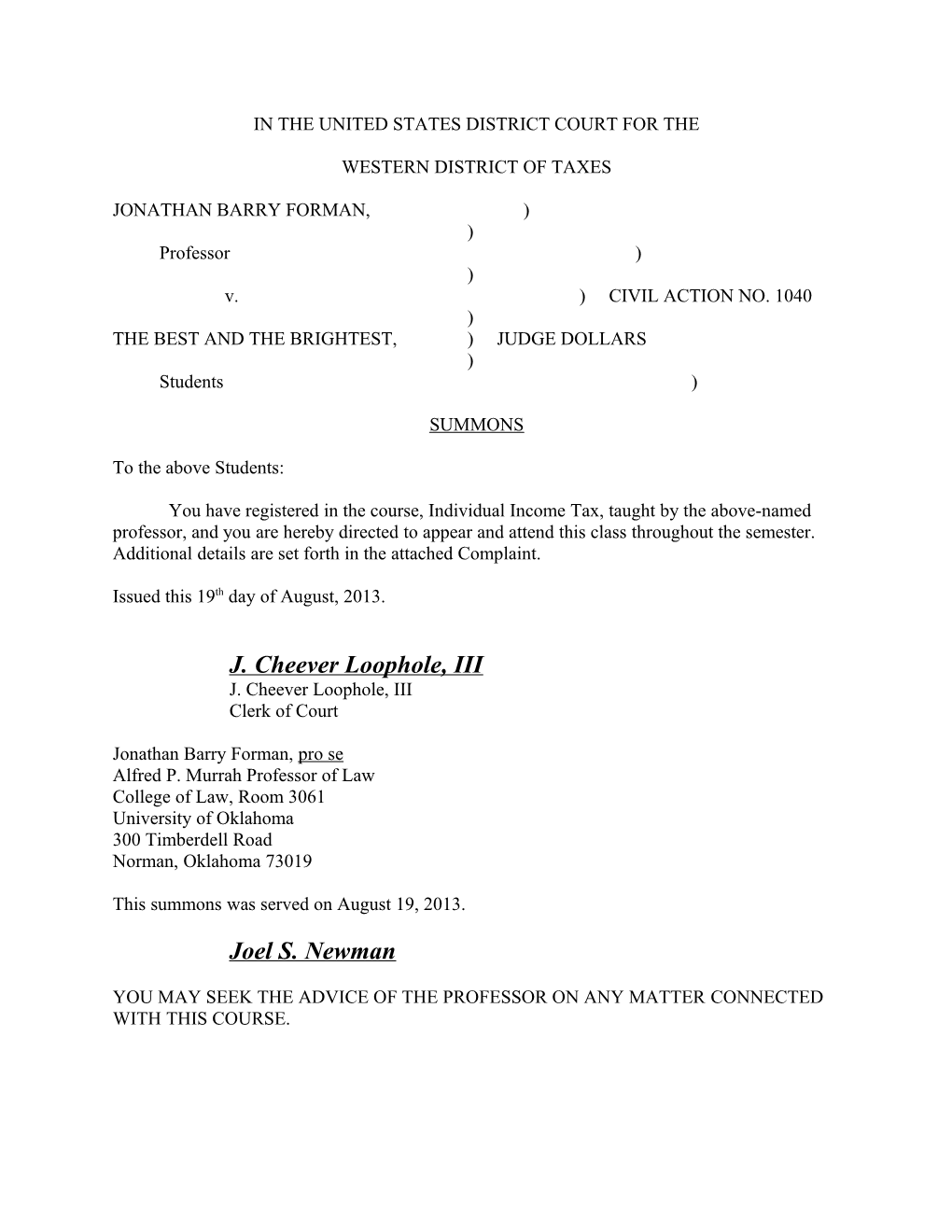

IN THE UNITED STATES DISTRICT COURT FOR THE

WESTERN DISTRICT OF TAXES

JONATHAN BARRY FORMAN, ) ) Professor ) ) v. ) CIVIL ACTION NO. 1040 ) THE BEST AND THE BRIGHTEST, ) JUDGE DOLLARS ) Students )

SUMMONS

To the above Students:

You have registered in the course, Individual Income Tax, taught by the above-named professor, and you are hereby directed to appear and attend this class throughout the semester. Additional details are set forth in the attached Complaint.

Issued this 19th day of August, 2013.

J. Cheever Loophole, III J. Cheever Loophole, III Clerk of Court

Jonathan Barry Forman, pro se Alfred P. Murrah Professor of Law College of Law, Room 3061 University of Oklahoma 300 Timberdell Road Norman, Oklahoma 73019

This summons was served on August 19, 2013.

Joel S. Newman

YOU MAY SEEK THE ADVICE OF THE PROFESSOR ON ANY MATTER CONNECTED WITH THIS COURSE. IN THE UNITED STATES DISTRICT COURT FOR THE

WESTERN DISTRICT OF TAXES

JONATHAN BARRY FORMAN, ) ) Professor ) ) v. ) CIVIL ACTION NO. 1040 ) THE BEST AND THE BRIGHTEST, ) JUDGE DOLLARS ) Students )

COMPLAINT

The Professor, Jonathan Barry Forman, complains and alleges as follows:

1. Class Content. This is the basic course in federal income taxation. The course focuses on the interpretation of federal tax laws and the development of statutory analytical skills. Topics include the income tax treatment of damage awards, compensation for services, marriage and divorce, gifts and inheritances, simple business operations, and elementary real estate transactions. There are no prerequisites, and no facility with mathematics or accounting is needed. Classes consist primarily of case and problem analysis. Students will be called upon at random. Problems discussed in class are similar to those on the final examination.

2. Required Texts. The following books are required for this course: a. James J. Freeland, Daniel J. Lathrope, Stephen A. Lind, & Richard B. Stephens, Fundamentals of Federal Income Taxation (Foundation Press, 17th ed., 2013), ISBN: 9781609303570. b. Daniel J. Lathrope, Selected Federal Taxation Statutes & Regulations: 2014 (West, 2013), ISBN: 9780314288981. 3. Assignments. Assignments in this course refer to the casebook. Except as otherwise provided below, read the assignments in the casebook, and read the Code and regulation sections referred to by the casebook. Also, work out the problems in the casebook for discussion in class. We will often discuss cases and revenue rulings in class, but we will spend most of class time working through the problems. Readings alone will not suffice to prepare students to deal with problem analysis. Students will need to read and study the applicable Code and regulation sections in order to work out the problems.

Subject to possible revision, we will proceed through the material in the order set forth below. It is the student’s responsibility to stay up with the pace of the class—and to stay ahead. The assignments below are estimates only, and we may not get through all the material. The

1 final examination will be comprehensive based upon all assignments through the last assignment that is covered in class.

Class Assignment 1 Chapter 1. 2 2A, B. 3 2C; 3A, B. 4 3C; just read 4A. 5 Just read 4B, 5. 6 6A, B1. 7 6B2. 8 6B3, 4. 9 6C. 10 Just read 7A, B and work the problem. 11 8. 12 9. 13 10A1. 14 10A2. 15 10B, C. 16 Just read 11. 17 12A, B. 18 12C. 19 14A, B1, 2. 20 14B3, C1. 21 14C2. 22 14C3, 4. 23 14D1, 2. 24 14E1 25 14E2 26 14E3. 27 15A. 28 16A, skim 16B, C, D. 29 17C, D, F. 30 18A; just read B 31 Just read 18C, D, E. 32 18F. 33 21A, B. 34 21C. 35 27A. 36 27B. 37 30. 38+ We’ll see.

4. Final Examination. Your final examination will be on Friday, December 6, 2013, at 2:00 p.m. For the final exam, you are allowed to bring in only your Statutes and Regulations and

2 up to three 8½” by 11” sheets (both sides) of hand-written or typed notes. If your notes are typed, use a standard font like Times New Roman 11 or 12 (with a minimum type height of 10 pt. and a maximum of 15 characters per inch). Your Statutes and Regulations may be tabbed and underlined, and an occasional phrase or annotation may be hand-written in the margins. You may not use a Statutes and Regulations which has extensive notes, outlines, or insertions (moreover, it probably would not help).

5. Grading. Your grade will be based primarily upon the final examination. Also, I may raise or lower the student’s grade based upon class attendance and participation.

6. Office Hours. Generally, MTW before and after class but stop by anytime.

7. Class Attendance Policy. Each student must attend class, and students are expected to be on time. If you come to class, I will assume that you are prepared and will feel free to call on you and, as previously mentioned, I may raise or lower your grade based upon class attendance and participation. If you miss or are unprepared for more than eight classes, however, you will receive an AF.@

8. Computer Policy. Personal computers are tolerated as long as they do not distract other students. Research suggests that students are better off not bringing a computer to class. Cell phones and pagers must be turned off.

9. Students with disabilities. The University of Oklahoma is committed to providing reasonable accommodation for all students with disabilities. Students with disabilities who require accommodations in this course are requested to speak with the professor as early in the semester as possible. Students with disabilities must be registered with the Disability Resource Center prior to receiving accommodations in this course. The Disability Resource Center is located in Goddard Health Center, Suite 166, phone 405/325-3852 or TDD only 405/325-4173.

10. Other (latest at http://jay.law.ou.edu/faculty/jforman).

Some Job Hunt Locations on the Web. The following are a few locations for finding jobs on the web. Be active. It’s up to you to find a job and build your career. Good luck! a. USA Jobs: http://www.usajobs.gov b. American Bar Association Career Center: http://www2.americanbar.org/careercenter/Pages/careercenter2.aspx c. U.S. Department of Justice: http://www.justice.gov/careers/legal/summer- intern.html d. Internal Revenue Service: http://jobs.irs.gov/ ; http://www.youtube.com/IRSVideos#g/c/C229B1637C71A518 1) In general: http://jobs.irs.gov/; http://jobs-irs- gov.tmpqa.com/car_other_atty_intern.html 2) Office of Chief Counsel: http://jobs.irs.gov/midcareer/occ-apply.html 3) Criminal Investigation Division: http://jobs.irs.gov/midcareer/law- enforcement.html

3 e. Recruiters 1) Tax Search: www.taxsearchinc.com 2) Tax Talent: http://www.taxtalent.com 3) ET Search, Inc.: http://www.etsearch.com b. Accounting Firms 1) Ernst & Young: http://www.ey.com/US/en/Careers 2) Deloitte: http://www.deloitte.com/view/en_US/us/Careers/index.htm 3) KPMG: http://www.kpmg.com/Global/en/JoinUs/Pages/default.aspx 4) PricewaterhouseCoopers: http://www.pwc.com/us/en/careers/index.jhtml c. Benefits Link: http://employeebenefitsjobs.com/jobs/by_date.html d. The American College of Employee Benefits Counsel, http://www.acebc.com/public-docs/law-students/lawstudent.pdf e. Benefits Consulting Firms 1) Aon: http://www.aon.com/about-aon/careers.jsp 2) Buck Consultants: http://www.aon.com/about-aon/careers.jsp 3) Hewitt: http://www.hewittassociates.com/Intl/NA/en- US/WorkingHere/Careers.aspx 4) Mercer: http://www.mercer.com/careershome.htm?siteLanguage=100 5) Milliman: http://careers.milliman.com/home/index.php 6) Towers Watson: http://www.towerswatson.com/careers/ f. American Bar Association Section of Taxation Public Service Fellowships: http://taxprof.typepad.com/taxprof_blog/2010/06/aba-tax-section-2.html g. U.S. Department of Labor Jobs: http://www.dol.gov/dol/jobs.htm h. Fellowships for Aspiring Law Professors, http://taxprof.typepad.com/taxprof_blog/2010/08/fellowships-for- aspiring.html i. LawCrossing, [email protected] Writing and Moot Court Competitions: a. http://www.tannenwald.org/competition; http://taxprof.typepad.com/taxprof_blog/2011/01/2011-tannenwald.html b. ABA Section of Taxation Law Student Tax Challenge, http://www.abanet.org/tax/lstc/home.html c. American College of Trust and Estate Counsel, http://www.actec.org/public/WenigCompetition.asp d. Paul Faherty Writing Competition (employee benefits), http://www.jmls.edu/academics/tax_eb_law/faherty.shtml e. Albert R. Mugel National Tax Moot Court Competition, http://wings.buffalo.edu/law/bmcb/mugel11.html f. American College of Employee Benefits Counsel: http://www.law.unlv.edu/pdf/2012_ACEBC_Competition_Announcement.pdf ; http://www.acebc.com/content/writing.asp g. International Fiscal Association (IFA) USA Branch Writing Competition: http://taxprof.typepad.com/taxprof_blog/2013/01/ifa-international.html Some LL.M in Taxation Information:

4 a. The Value of an LLM, http://taxprof.typepad.com/taxprof_blog/2012/01/the- value-of-.html b. Links to Tax LL.M. programs as of 2009, http://jay.law.ou.edu/faculty/jforman/TeachingMaterial/TaxLLMPresentation. doc c. Special programs: 1) John Marshall Law School offers an LL.M. in Employee Benefits, http://www.jmls.edu/admission/admission_llm_main.shtml 2) Loyola-LA now offers an Accelerated Tax LLM Program for Visiting JD Students, http://www.lls.edu/programs/jd-taxllm/visiting.html. b. To Get a Tax LL.M. or Not, http://jay.law.ou.edu/faculty/jforman/TeachingMaterial/TaxLLM.ppt c. Pursuing a Tax LLM Degree: Why and When?, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1577966 d. Pursuing a Tax LLM Degree: Where?, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1597337 e. Recruiter: An LL.M. May Hurt Your BigLaw Job Prospects -- Except in Tax, http://taxprof.typepad.com/taxprof_blog/2012/01/recruiter-an-llm-.html

WHEREFORE, the professor, Jonathan Barry Forman, prays that the students learn Individual Income Tax and that they demonstrate that knowledge in class and on the final examination.

Jonathan Barry Forman Jonathan Barry Forman pro se Alfred P. Murrah Professor of Law College of Law, Room 3061 University of Oklahoma 300 Timberdell Road Norman, Oklahoma 73019

5