Chapter 23 Solutions

1.

a) Riding the yield curve. If the yield curve is expected to remain upward

sloping and unchanged, the investor can purchase a longer term security than

the investor holding period and sell it for a going at the end of the holding

period. The gain as the rule will be greater than the loss of reinvestment

income thereby providing an increase in the realized yield of the investment.

b) Swapping the buying and selling of similar types of securities in order to

increase the realized yield without increasing the risk.

c) Work out period – the amount of time it takes for the mispricing of a security

to be corrected.

d) Duration-a measure of the life or maturity of a bond which is calculated as

the present value of each cash flow relative to the total present value of the

bond multiplied by when the cash flow occurs.

e) Immunization – Regardless of the changes in interest rate, the yield of the

holding period of a bond is unchanged, i.e. the promise yield equals the

realized yield.

f) Cross over yield – that yield where the yield to maturity is equal to the yield

to call.

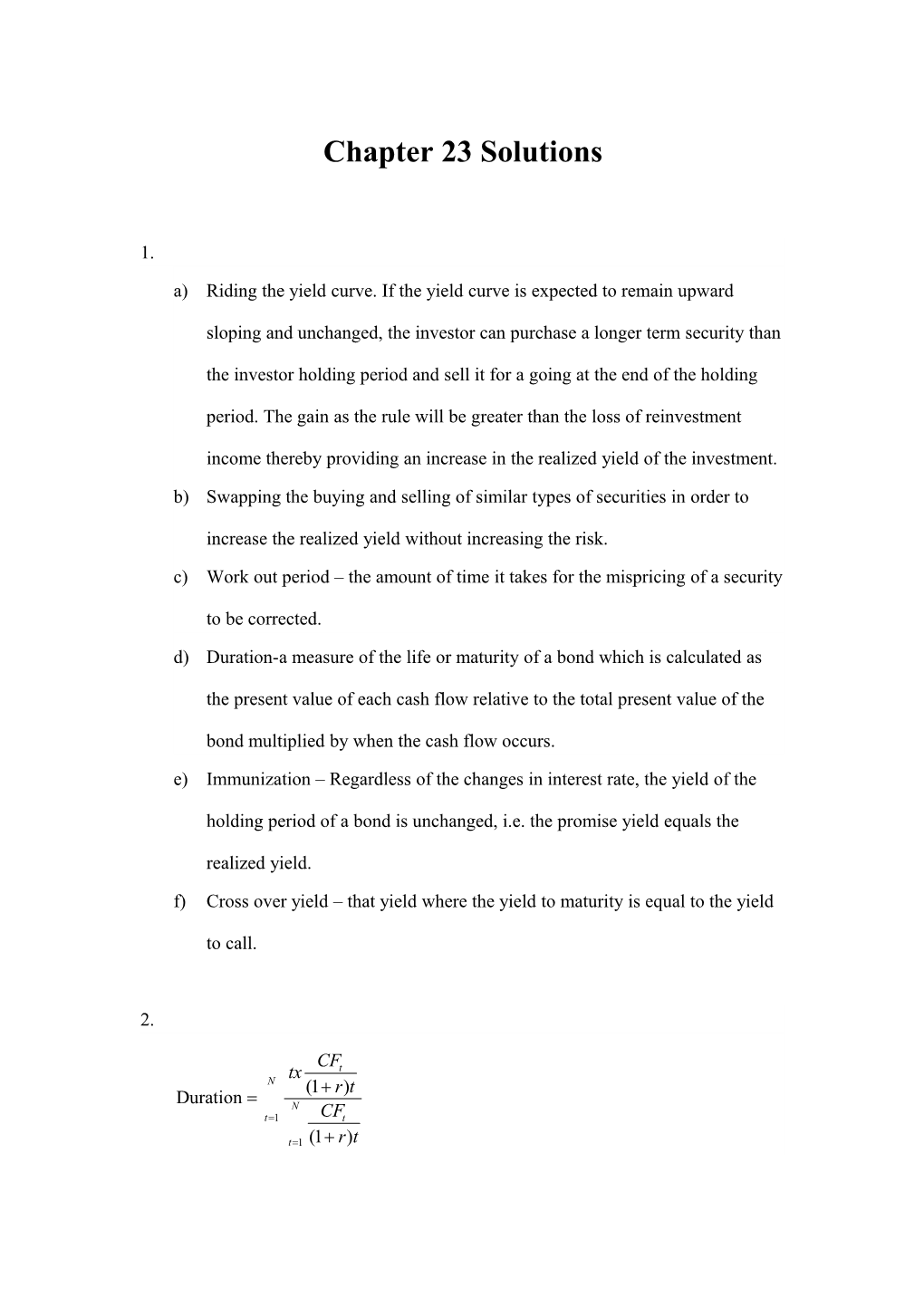

2.

CF tx t N (1+ r ) t Duration = N t=1 CFt

t=1 (1+ r ) t Cashflow PV Factor CFXPVF Weight Duration 1. 150 .8696 130.44 130.44 .1304 × 1 = .1304 = 999.98 2. 150 .7561 113.415 113.415 .1304 × 2 = .2268 = 999.98 3. 1150 .6575 726.125 726.125 .7561 × 3 = 2.2688 = 999.98 999.98

D = 2.6 years 2.6255

3. Reinvestment Rate Risk – the risk that the future cash flow of the bond will have

to be invested at lower (higher) interest rates than the yield to maturity.

Interest Rate Risk – the change in the value of the bond caused by increases or

decreases in the future interest rate and its effect on realized yield.

4.

H P Original Investment $1,000 $ 950 Two coupons 100 100 Interest on coupon @10% for 1/2 yr. $ 2.44 $ 2.44 50(1.1).5 – 50 = Principal Value at end of year @10% 1,000 1,000 Total # accrued $ 1,102.44 $ 1,102.44 Total Gain $ 102.44 $ 152.44 Gain per $ invested .10244 .15244 Realized coupon yield 9.999 ≈ 10% (1 + x/2)2 = 1.10244/1 14.7% (1 + x/2)2 = 1.10244/1 Value of Swap 470 basis points

5. H P Interest yield to maturity 10% 11% TM at work out 10% 10.5% Speed narrows from 100 basis points to 50 basis points Workout 1 year Reinvestment rate 10% Original Investment $ 680.00 $1,000 Two coupons during year 50 100 Interest on the coupon @10% 40(1.1)5 − 50 for 6 months 25(1.1)5 − 25 1.22 2.44 Principal Value at end of year $ 658.00 $1,015.00

Total # accrued $ 736.22 $1,117.44 Total Gain $ 56.22 $ 117.44 Gain per $ invested .08267 .11744 Realized coupon yield 8.10% 11.42% (1 + x/2)2 = 1.08267/1 (1 + x/2)2 = 1.11744/1 Value of Swap 332 basis points

6. The longer the workout period, the smaller the value of the swap.

7. If an investor expects that interest rates will change dramatically i.e., the investor

expects rates to go up. He sells his current long term investments and puts the

funds into short term investments. If rates increase, he can then reinvest his funds

in the new higher long term yield. He is hoping that the loss of going from long

term to short term is less than the gain between current long term yields and

expected future long term yields.

8. The maturity and duration for a zero coupon bond are equal.

The duration is always less than the maturity for a coupon bond selling at par. The duration is less than and then it becomes greater than the maturity for a

coupon bond selling at a discount. This depends on the maturity of the bond as

shown below:

For coupon bonds selling at a premium, the duration is always less than the

maturity of the bond.

9. The WATM only considers the timing of the cash flows and not the time value of

money, whereas the duration considers both the timing of the cash flows and the

time value of money. Hence, the WATM is always larger than the duration of a

bond.

10.

N tx CFt WATM = N t=1 CFt t=1

A, B, and C

CASHFLO CF/TCF Tx = CF/TCF yield to maturity of A

W 1 50 50 .04(1) = .04 5 50 1000 = .04 $957.80=t 5 YTM = 6% 1250 t=1 (1+y ) (1 + y ) 2 50 50 .04(2) = .08 = .04 1250 yield to maturity of B 3 50 50 .04(3) = .12 5 50 1000 = .04 $1044.65=t 5 YTM = 4% 1250 t=1 (1+y ) (1 + y ) 4 50 50 .04(4) = .16 = .04 1250 5 1050 1050 .84(5) = 4.20 = .84 1250 TCF = 1250 1.00 WATM = 4.60 yield to maturity of C N 5 t t 5 Duration=tx CFt (1 + y ) 1000= 50 (1 +y ) + 1000 (1 + y ) YTM = 5% t=1 t=1

CF APV CF×PV wt Duration 1 50 .943 47.15 .049 × 1 .049 47.15 = 957.60 2 50 .890 44.5 .046 × 2 .092 44.5 = 957.60 3 50 .840 42 .044 × 3 .132 42 = 957.60 4 50 .792 39.6 .041 × 4 .164 39.6 = 957.60 5 1.050 .747 748.35 .819 × 5 4.095 748.35 = 957.60 Duration = 4.532

Duration B

CF APV CF×PV wt Duration 1 50 .962 48.1 .046 × 1 .046 48.1 = 1044.65 2 50 .925 46.25 .044 × 2 .088 46.25 = 1044.65 3 50 .889 44.45 .043 × 3 .129 44.45 = 1044.65 4 50 .855 42.75 .041 × 4 .164 42.75 = 1044.65 5 1050 .822 863.10 .826 × 5 4.13 863.10 = 1044.65 1044.65 Duration = 4.557

Duration C

CF APV CF×PV wt Duration 1 50 .952 46.70 .048 × 1 .048 46.70 = 1,000 2 50 .907 45.35 .045 × 2 .09 45.35 = 1,000 3 50 .864 43.2 .043 × 3 .129 43.2 = 1,000 4 50 .823 41.15 .041 × 4 .164 41.15 = 1,000 5 1050 .784 823.2 .823 × 5 4.115 823.2 = 1,000 1000.00 Duration = 4.546

The change in YTM does not effect WATM it is 4.6 in all three cases. The

change in YTM causes the duration to change.

A. 4.53

B. 4.55 the higher the yield to maturity the lower the duration

C. 4.54

11. If you expect interest rates to fall, the portfolio should have a duration longer

than the length of the investment horizon.

12. The higher the coupon rate for a given maturity bond the lower the duration.

13. The duration of a callable bond is shorter than the duration of a noncallable bond, sentis paribus.

14. The convexity of a bond is the second-order approximation of the bond price

changes when the yield to maturity changes. The percentage of bond price can

be calculated as the equation (23.6) when the YTM changes.

DP = -D* D i + 0.5创 Convexity ( D i )2 (23.6) P Where the Convexity is the rate of change of the slope of the price-yield curve as follows 2 n 1P 1 CFt 2 Convexity=� 2 + 2 [t ( t t )] (23.7) P洞 i P(1+ i )t=1 (1 + i ) In Equation (23.6), the first term of on the right-hand side is the duration rule, and the

second term is the modification for convexity. Notice that for a bond with

positive convexity, the second term is positive, regardless of whether the yield

rises or falls.

The convexity is positively related to the bond price regardless of whether the yield

rises or falls. The value of duration rule with convexity is larger than the value

of duration rule without convexity. In other words, the bond price estimated by

the duration rule without convexity is always less than the bond price estimated

by the duration rule with convexity. Therefore, the bond price estimated by the

duration rule with convexity is more accurate.

15. price- principal Interest + years to call Cross over yield = Average Investment 1100- 1000 100 + = 10 1100+ 1000 2 110 Cross over yield= = 10.47% 1050

16.

CF APV CF×PV wt Duration 1 100 .9091 90.91 .0909 × 1 .0909 90.91 = 1000 2 100 .8264 82.64 .0826 × 2 .1652 82.64 = 1000 3 100 .7513 75.13 .0751 × 3 .2253 75.13 = 1000 4 100 .6830 68.30 .041 × 4 .2732 68.30 = 1000 5 1150 .6209 714.04 .7140 × 5 3.57 714.04 = 1000 1000 Duration = 4.32

17.

By equation (23.1), we can calculate the duration of bond as following formula

n 轾 Ct t 犏 t t=0 犏(1+ k ) 臌 d , D = n Ct t t=0 (1+ kd )

Where Ct = the payment at time t, kd = the YTM or required rate of return of the bondholders in the market; and n= the maturity in years.

The coupon payment isCt =1000(0.06) = 60 , yield to maturity kd is 6%, and present bond value is sold at par $1000.

Time t in years 1 t t2 + t t t t (1+ 0.06) (1+ 0.06) (1+ 0.06)

1 0.943396 0.943396 1.88679 2 0.889996 1.779993 5.33998 3 0.839619 2.518858 10.07543 4 0.792094 3.168375 15.84187 5 0.747258 3.736291 22.41775 6 0.704961 4.229763 29.60834 7 0.665057 4.655400 37.24320 8 0.627412 5.019299 45.17369 Sum 26.051374 167.58705

n 轾18 轾 1 邋t犏t= t 犏 t =26.051374 t=0臌犏(1+kd ) t = 0 臌犏( 1 + 0.06)

n 轾8 轾 21 2 1 邋(t+ t )犏t = ( t + t ) 犏 t =167.58705 t=0臌犏(1+kd ) t = 0 臌犏( 1 + 0.06)

The duration of bond is

8 轾 1 1000(8) 60 t 犏 t + 8 t=0 犏(1+ 0.06) ( 1 + 0.06) 60(26.051374)+ 1000(5.019299) D =臌 = = 6.582381 1000 1000

The modified duration is D 6.582381 D*= = = 6.2098 (1+ kd ) 1.06

By using equation (23.7), 2 n 1P 1 CFt 2 Convexity=� 2 + 2 [t ( t t )] P洞 i P(1+ kd )t=1 (1 + k d ) DP - D P + � 108 [ ] P P

The exactly value of convexity is

8 1 CFt 2 Convexity=2 [t ( t + t )] 1000� (1+ kd )t=1 (1 k d ) 8 t2+ t 8 2 + 8 60 [ ]+ 1000 (1+ 0.06)t (1 + 0.06)8 = t=1 1000� (1 0.06)2 60(167.58705)+ 1000(45.17369) = = 49.153536 1000� (1 0.06)2

The approximation value needs the information of DP - is the capital loss from a

one-basis-point (0.0001) increase in interest rates and DP + is the capital gain

from a one-basis-point (0.0001) decrease in interest rates.

Time t in years 1 1 t t (1+ 0.0601) (1+ 0.0599)

1 0.943307 0.943485 2 0.889829 0.890164 3 0.839382 0.839857 4 0.791795 0.792393 5 0.746906 0.747611 6 0.704562 0.70536 7 0.664618 0.665496 8 0.626939 0.627886 Bond price 999.3793 1000.621

8 Ct t t=0 (1+ kd ) Therefore, the approximation value of convexity is

DP - D P + Convexity �108 [ ] P P (1000- 999.3793) (1000.621 - 1000) =108 [ + ] = 49.153541 1000 1000

18. Based on the solution in question 17, when yield to maturity increases from 6% to

8%, the percentage change of bond price is

DP = -D* D i = - 6.2098(0.02) = - 0.1241959, or - 12.41959% P

The bond price estimated by the duration rule is

1000+1000(-12.41959%) = 875.804

By duration-with-convexity rule, the percentage change of bond price is

DP = -D* D i + 0.5创 Convexity ( D i )2 P = - 6.2098� 0.02 创 0.5 49.1535 = (0.02)2 - - 0.114365, or 11.4365%

Then, the bond price estimated by the duration-with-convexity rule is

1000+1000(-0.114365) = 885.635

The actual bond price when YTM is 8% is 885.0672 which can be calculated as the

table below:

Time t in years 1 t (1+ 0.08)

1 0.925926 2 0.857339 3 0.793832 4 0.73503 5 0.680583 6 0.63017 7 0.58349 8 0.540269 Bond price 885.0672

8 Ct t t=0 (1+ kd )

19. Based on the solution in question 17, when yield to maturity decreases from 6% to

5.5%, the percentage change of bond price is

DP = -D* D i = - 6.2098( - 0.005) = 0.031049, or 3.1049% P

The bond price estimated by the duration rule is

1000+1000(3.1049%) = 1031.049

By duration-with-convexity rule, the percentage change of bond price is

DP = -D* D i + 0.5创 Convexity ( D i )2 P = - 6.2098� ( + 0.005) 创 0.5 49.1535 - ( = 0.005)2 0.0316634, or 3.16634%

Then, the bond price estimated by the duration-with-convexity rule is

1000+1000(3.16634%) = 1031.6634

The actual bond price when YTM is 5.5% is 1031.67283 which can be calculated as

the table below:

Time t in years 1 t (1+ 0.055)

1 0.947867 2 0.898452 3 0.851614 4 0.807217 5 0.765134 6 0.725246 7 0.687437 8 0.651599 Bond price 1031.67283

8 Ct t t=0 (1+ kd )