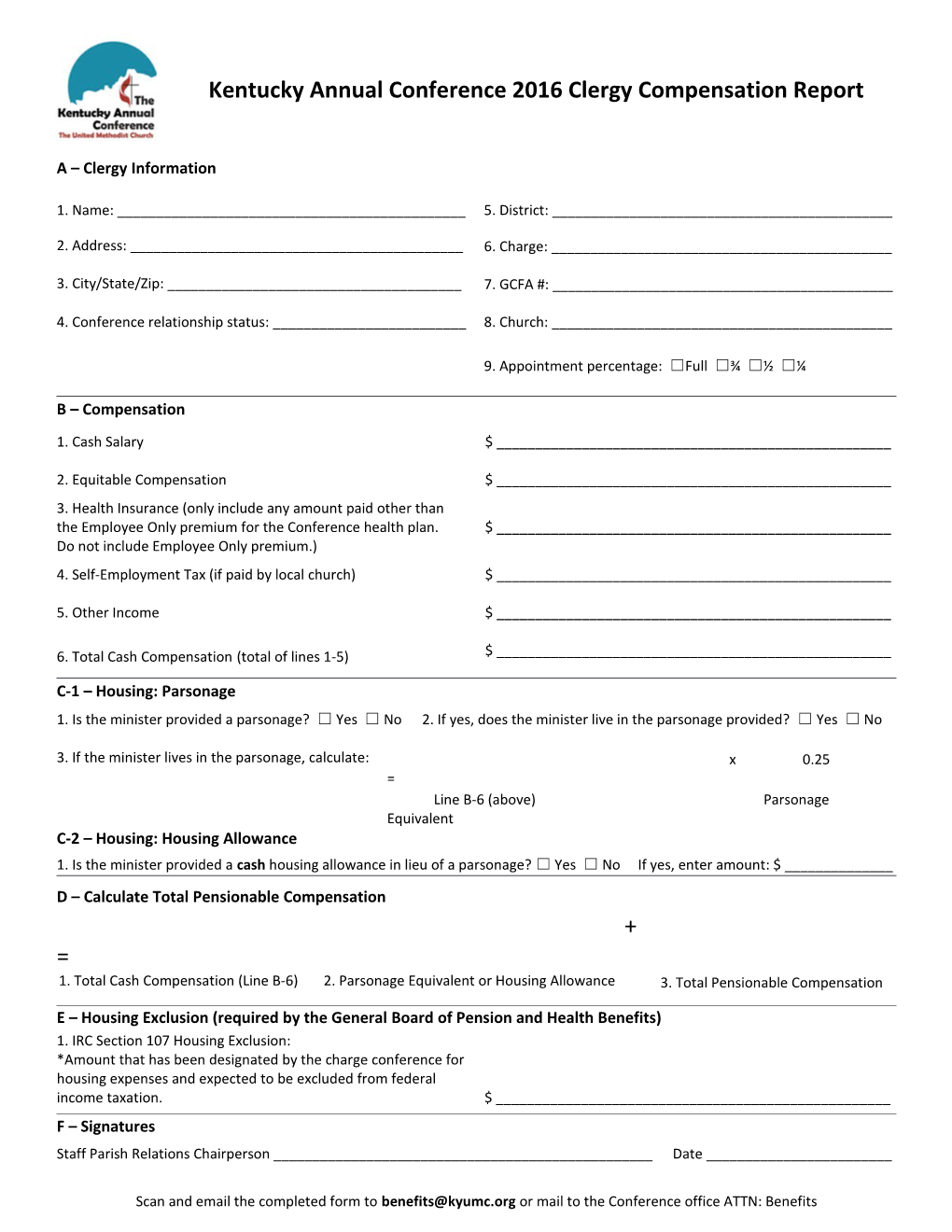

Kentucky Annual Conference 2016 Clergy Compensation Report

A – Clergy Information

1. Name: ______5. District: ______

2. Address: ______6. Charge: ______

3. City/State/Zip: ______7. GCFA #: ______

4. Conference relationship status: ______8. Church: ______

9. Appointment percentage: ☐Full ☐¾ ☐½ ☐¼

B – Compensation

1. Cash Salary $ ______

2. Equitable Compensation $ ______3. Health Insurance (only include any amount paid other than the Employee Only premium for the Conference health plan. $ ______Do not include Employee Only premium.) 4. Self-Employment Tax (if paid by local church) $ ______

5. Other Income $ ______

6. Total Cash Compensation (total of lines 1-5) $ ______

C-1 – Housing: Parsonage 1. Is the minister provided a parsonage? ☐ Yes ☐ No 2. If yes, does the minister live in the parsonage provided? ☐ Yes ☐ No

3. If the minister lives in the parsonage, calculate: x 0.25 = Line B-6 (above) Parsonage Equivalent C-2 – Housing: Housing Allowance 1. Is the minister provided a cash housing allowance in lieu of a parsonage? ☐ Yes ☐ No If yes, enter amount: $ ______D – Calculate Total Pensionable Compensation + = 1. Total Cash Compensation (Line B-6) 2. Parsonage Equivalent or Housing Allowance 3. Total Pensionable Compensation

E – Housing Exclusion (required by the General Board of Pension and Health Benefits) 1. IRC Section 107 Housing Exclusion: *Amount that has been designated by the charge conference for housing expenses and expected to be excluded from federal income taxation. $ ______F – Signatures Staff Parish Relations Chairperson ______Date ______

Scan and email the completed form to [email protected] or mail to the Conference office ATTN: Benefits Clergy ______Date ______

District Superintendent ______Date ______