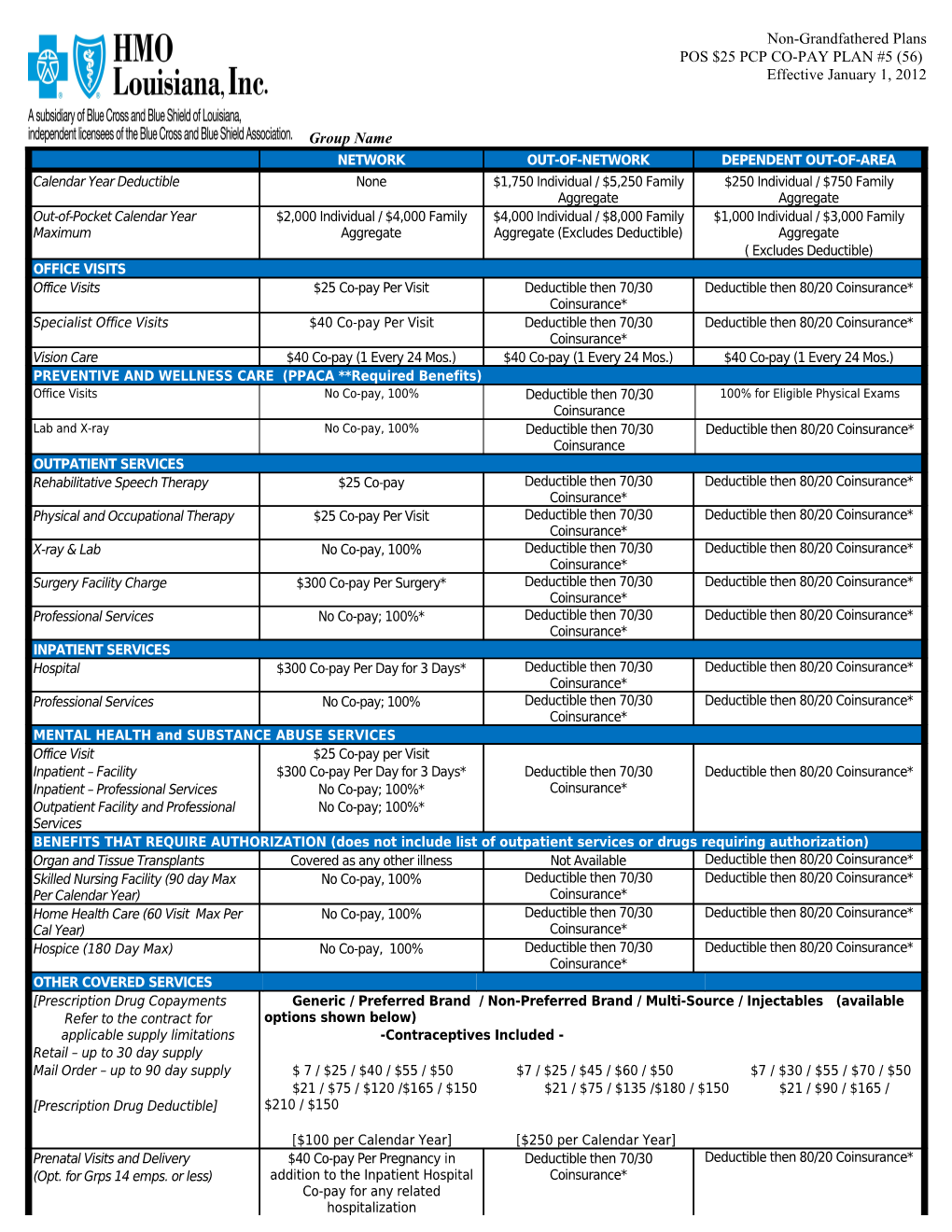

Non-Grandfathered Plans POS $25 PCP CO-PAY PLAN #5 (56) Effective January 1, 2012

Group Name NETWORK OUT-OF-NETWORK DEPENDENT OUT-OF-AREA Calendar Year Deductible None $1,750 Individual / $5,250 Family $250 Individual / $750 Family Aggregate Aggregate Out-of-Pocket Calendar Year $2,000 Individual / $4,000 Family $4,000 Individual / $8,000 Family $1,000 Individual / $3,000 Family Maximum Aggregate Aggregate (Excludes Deductible) Aggregate ( Excludes Deductible) OFFICE VISITS Office Visits $25 Co-pay Per Visit Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* Specialist Office Visits $40 Co-pay Per Visit Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* Vision Care $40 Co-pay (1 Every 24 Mos.) $40 Co-pay (1 Every 24 Mos.) $40 Co-pay (1 Every 24 Mos.) PREVENTIVE AND WELLNESS CARE (PPACA **Required Benefits) Office Visits No Co-pay, 100% Deductible then 70/30 100% for Eligible Physical Exams Coinsurance Lab and X-ray No Co-pay, 100% Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance OUTPATIENT SERVICES Rehabilitative Speech Therapy $25 Co-pay Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* Physical and Occupational Therapy $25 Co-pay Per Visit Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* X-ray & Lab No Co-pay, 100% Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* Surgery Facility Charge $300 Co-pay Per Surgery* Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* Professional Services No Co-pay; 100%* Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* INPATIENT SERVICES Hospital $300 Co-pay Per Day for 3 Days* Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* Professional Services No Co-pay; 100% Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* MENTAL HEALTH and SUBSTANCE ABUSE SERVICES Office Visit $25 Co-pay per Visit Inpatient – Facility $300 Co-pay Per Day for 3 Days* Deductible then 70/30 Deductible then 80/20 Coinsurance* Inpatient – Professional Services No Co-pay; 100%* Coinsurance* Outpatient Facility and Professional No Co-pay; 100%* Services BENEFITS THAT REQUIRE AUTHORIZATION (does not include list of outpatient services or drugs requiring authorization) Organ and Tissue Transplants Covered as any other illness Not Available Deductible then 80/20 Coinsurance* Skilled Nursing Facility (90 day Max No Co-pay, 100% Deductible then 70/30 Deductible then 80/20 Coinsurance* Per Calendar Year) Coinsurance* Home Health Care (60 Visit Max Per No Co-pay, 100% Deductible then 70/30 Deductible then 80/20 Coinsurance* Cal Year) Coinsurance* Hospice (180 Day Max) No Co-pay, 100% Deductible then 70/30 Deductible then 80/20 Coinsurance* Coinsurance* OTHER COVERED SERVICES [Prescription Drug Copayments Generic / Preferred Brand / Non-Preferred Brand / Multi-Source / Injectables (available Refer to the contract for options shown below) applicable supply limitations -Contraceptives Included - Retail – up to 30 day supply Mail Order – up to 90 day supply $ 7 / $25 / $40 / $55 / $50 $7 / $25 / $45 / $60 / $50 $7 / $30 / $55 / $70 / $50 $21 / $75 / $120 /$165 / $150 $21 / $75 / $135 /$180 / $150 $21 / $90 / $165 / [Prescription Drug Deductible] $210 / $150

[$100 per Calendar Year] [$250 per Calendar Year] Prenatal Visits and Delivery $40 Co-pay Per Pregnancy in Deductible then 70/30 Deductible then 80/20 Coinsurance* (Opt. for Grps 14 emps. or less) addition to the Inpatient Hospital Coinsurance* Co-pay for any related hospitalization Non-Grandfathered Plans POS $25 PCP CO-PAY PLAN #5 (56) Effective January 1, 2012

Group Name Emergency Room $150 Co-pay/Visit Waived if Admitted $150 Co-pay/Visit Waived if Deductible then 80/20 Coinsurance* Urgent Care Center $50 Co-pay Per Visit DeductibleAdmitted then 70/30 Deductible then 80/20 Coinsurance* Ambulance $50 Co-pay Per Trip Deductible then 70/30 Deductible then 80/20 Coinsurance* Prosthetic Appliances 80/20 Coinsurance* Deductible then 70/30 Deductible then 80/20 Coinsurance* Durable Medical Equipment 80/20 Coinsurance* Deductible then 70/30 Deductible then 80/20 Coinsurance* All benefits based on allowable charges. *Accrues to the Out of Pocket Maximum ** Patient Protection and Affordable Care Act

NOTE: This is only an outline. All benefits are subject to the terms and conditions of the Benefit Plan. In the case of a discrepancy, the Benefit Plan will prevail. Exclusions and Limitations may apply.