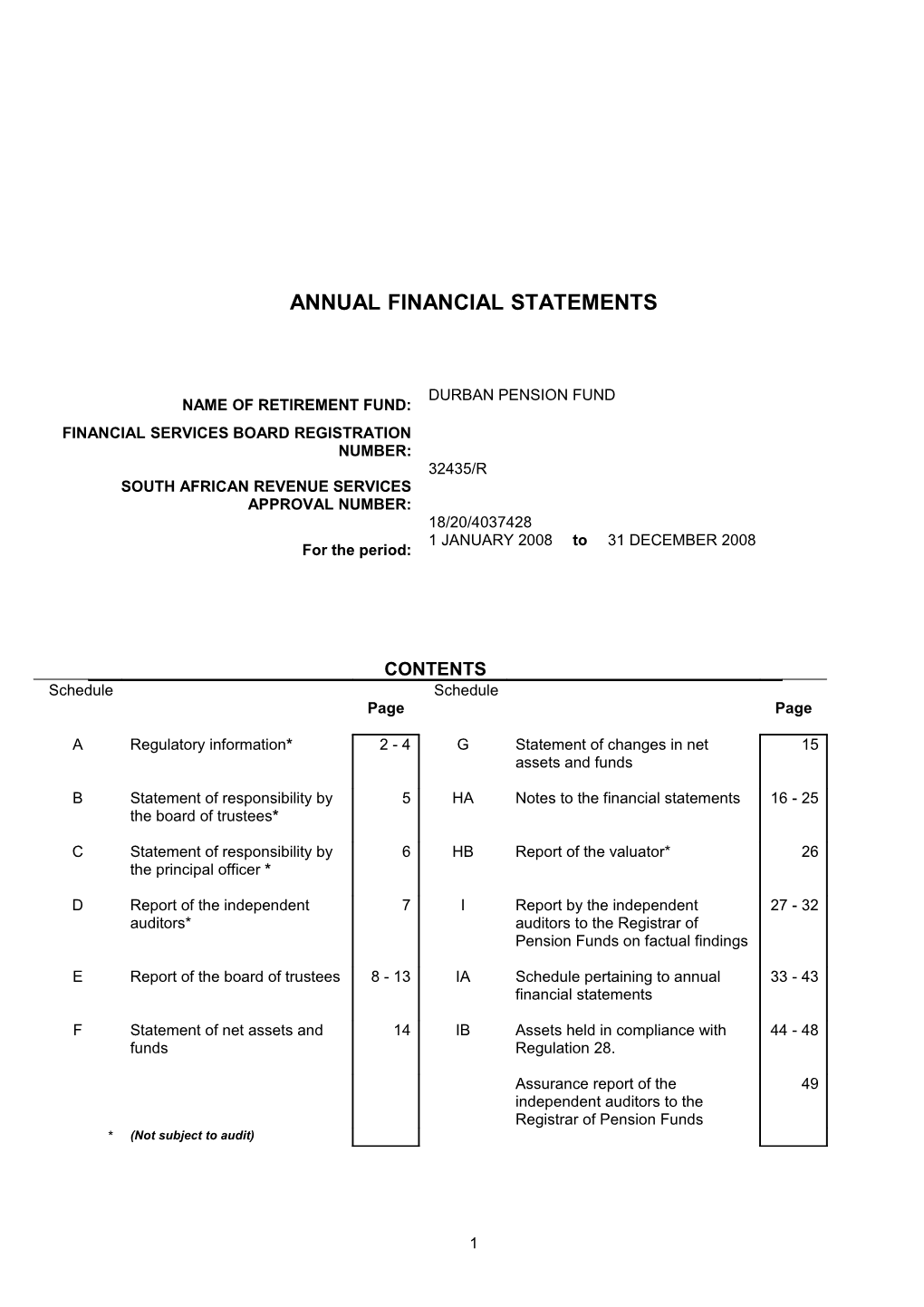

ANNUAL FINANCIAL STATEMENTS

DURBAN PENSION FUND NAME OF RETIREMENT FUND: FINANCIAL SERVICES BOARD REGISTRATION NUMBER: 32435/R SOUTH AFRICAN REVENUE SERVICES APPROVAL NUMBER: 18/20/4037428 1 JANUARY 2008 to 31 DECEMBER 2008 For the period:

CONTENTS Schedule Schedule Page Page

A Regulatory information* 2 - 4 G Statement of changes in net 15 assets and funds

B Statement of responsibility by 5 HA Notes to the financial statements 16 - 25 the board of trustees*

C Statement of responsibility by 6 HB Report of the valuator* 26 the principal officer *

D Report of the independent 7 I Report by the independent 27 - 32 auditors* auditors to the Registrar of Pension Funds on factual findings

E Report of the board of trustees 8 - 13 IA Schedule pertaining to annual 33 - 43 financial statements

F Statement of net assets and 14 IB Assets held in compliance with 44 - 48 funds Regulation 28.

Assurance report of the 49 independent auditors to the Registrar of Pension Funds * (Not subject to audit)

1 DURBAN PENSION FUND

SCHEDULE A REGULATORY INFORMATION For the year ended 31 December 2008

Registered office of the fund

Postal address: P O Box 1017, Durban, 4000 Physical address: 1st Floor, Florence Mkhize Building, 251 Anton Lembede (Smith) Street, Durban

Financial reporting periods

Current: 1 January 2008 to 31 December 2008 Previous: I January 2007 to 31 December 2007

Board of trustees

Full name Capacity Date appointed Date terminated Board * meetings attended (13 held) Krishnaperdash Aswanth-Kumar E 29 May 1996 10 David Alexander Dorrofield P 20 June 2006 10 Mervyn James Dunn P 17 June 2003 12 Lawrence John Gibson C 17 June 2003 12 Keith Anthony Goodsell M 9 February 2000 9 Primrose Phumzile Hlengwa E 4 December 2008 0 Ammanulah Khan M 23 April 1997 12 Margaret Thandi Mabaso E 10 June 2003 11 Mkhonzeni Emmanuel Mgobozi M 12 February 2008 11 Lindiwe Mhlongo-Ntaka E 3 May 2006 13 James Sikhosiphi Nxumalo E 10 June 2003 5 Trevor Lennard Palmer M 22 July 2003 3 January 2008 0 Sibusiso Sbonelo Sibiya E 3 May 2006 30 September 2008 6 Davanand Singh E 3 May 2006 10

* ‘C’ denotes chairperson ‘E’ denotes employer appointed ‘M’ denotes member elected * ‘ P’ denotes pensioner elected

Fund officers

Principal officer Retired 31 January 2008 Appointed 12 February 2008 Full name: Rory Turner Samantha Davidson Postal address: P O Box 1017, Durban, 4000 P O Box 205, Durban, 4001 Physical address: 1st Floor, Florence Mkhize Building, Scotswood, 35 Samora Machel 251 Anton Lembede (Smith) Street, (Aliwal) Street, Durban Durban Telephone number: 031 311 1136 031 302 0376 E-mail address: [email protected] [email protected]

2 DURBAN PENSION FUND

REGULATORY INFORMATION – CONTINUED For the year ended 31 December 2008

Professional service providers

Actuary/Valuator Auditor Full name: Costa Economou of Alexander PricewaterhouseCoopers Inc. Forbes Financial Services Postal address: P O Box 787240, Sandton, 2146 P O Box 1049, Durban, 4000 Physical address: 61 Katherine Street, Sandown 102 Essenwood Road, Durban Telephone number: 011 269 0000 031 250 3700

Benefit administrator Full name: eThekwini Municipality Postal address: P O Box 1017, Durban, 4000 Physical address: 1st Floor, Florence Mkhize Building, 251 Anton Lembede (Smith) Street, Durban Telephone number: 031 311 1611 Registration number in terms of section 13B: 24/415

Investment advisor Investment advisor Full name: Allan Gray Limited Coronation Asset Management (Pty) Limited Postal address: P O Box 51318, Victoria and P O Box 993, Cape Town, 8000 Alfred Waterfront, Cape Town, 8002 Physical address: Granger Bay Court, Beach Road, Coronation House, Boundary Terrace, Victoria and Alfred Waterfront, 1 Mariendahl Lane, Newlands, Cape Cape Town Town Telephone number: 021 415 2300 021 680 2000 FAIS registration number 704 548

Investment advisor Full name: Investec Asset Management Postal address: P O Box 1655, Cape Town, 8000 Physical address: 36 Hans Strydom Avenue, Foreshore, Cape Town Telephone number: 021 416 2000 FAIS registration number 587

3 DURBAN PENSION FUND

REGULATORY INFORMATION – CONTINUED For the year ended 31 December 2008

Professional service providers-continued

Risk insurer Custodian and/or nominee Full name: Self insured Standard Bank Postal address: P O Box 61344, Marshalltown, 2107 Physical address: Standard Bank Centre, 3 Simmonds Street, Johannesburg Telephone number: 011 636 9115 FSB approval no.: 11827

Investment performance monitor Full name: Brockhouse Cooper Postal address: P O Box 783440, Sandton, 2146 Physical address: Suite 309, 3rd Floor, West Tower, Nelson Mandela Square at Sandton Telephone number: 011 884 6578 FSB approval no.:

Participating employer The following employer participates in the fund in terms of the rules of the fund: eThekwini Municipality

4 DURBAN PENSION FUND

SCHEDULE B STATEMENT OF RESPONSIBILITY BY THE BOARD OF TRUSTEES For the year ended 31 December 2008

Responsibilities

The board of trustees hereby certifies to the best of its knowledge and belief that, during the period under review, in the execution of its duties it: ensured that proper registers, books and records of the operations of the fund were kept, inclusive of proper minutes of all resolutions passed by the board of trustees; ensured that proper internal control systems were employed by or on behalf of the fund; ensured that adequate and appropriate information was communicated to the members of the fund, informing them of their rights, benefits and duties in terms of the rules of the fund; took all reasonable steps to ensure that contributions, where applicable, were paid timeously to the fund or reported where necessary in accordance with section 13A and regulation 33 of the Pension Funds Act in South Africa; obtained expert advice on matters where they lacked sufficient expertise; ensured that the rules and the operation and administration of the fund complied with the Pension Funds Act in South Africa, the Financial Institutions (Protection of Funds) Act and all other applicable laws; ensured that fidelity cover was maintained. This cover was deemed adequate and in compliance with the rules of the fund; and ensured that investments of the fund were implemented and maintained in accordance with the fund’s investment strategy.

Approval of the annual financial statements

The annual financial statements of the Durban Pension Fund are the responsibility of the board of trustees. The board of trustees fulfils this responsibility by ensuring the implementation and maintenance of accounting systems and practices adequately supported by internal financial controls. These controls, which are implemented and executed by the fund and/or its benefit administrator, provide reasonable assurance that:

the fund’s assets are safeguarded; transactions are properly authorised and executed; and the financial records are reliable.

The annual financial statements set out on pages 8 to 25 have been prepared for regulatory purposes in accordance with:

the basis of accounting applicable to retirement funds in South Africa as indicated in the principal accounting policies contained in the notes to the financial statements on page 16; the financial rules of the fund; and the provisions of the Pension Funds Act in South Africa.

These financial statements have been reported on by the independent auditor, PricewaterhouseCoopers Inc., who was given unrestricted access to all financial records and related data, including minutes of all relevant meetings. The board of trustees believes that all representations made to the independent auditors during their audit were valid and appropriate. The report of the independent auditors is presented on page 7.

These financial statements: were approved by the board of trustees on 12 May 2009 are certified by them to the best of their knowledge and belief to be correct; fairly represent the net assets of the fund at 31 December 2008 as well as the results of its activities for the year then ended; and are signed on behalf of the board of trustees by:

______

CHAIRPERSON EMPLOYER APPOINTED EMPLOYEE ELECTED BOARD BOARD MEMBER MEMBER 12 May 2009 12 May 2009 12 May 2009

5 DURBAN PENSION FUND

SCHEDULE C STATEMENT OF RESPONSIBILITY BY THE PRINCIPAL OFFICER For the year ended 31 December 2008

I confirm that for the period under review the Durban Pension Fund has lodged with the Registrar of Pension Funds all such returns, statements, documents and any other information required in terms of the Pension Funds Act in South Africa.

Samantha Davidson PRINCIPAL OFFICER 12 May 2009

6 PricewaterhouseCoopers Inc Reg. no. 1998/012055/21 102 Essenwood Road Berea 4001 P O Box 1049 Durban 4000 Telephone +27 (31) 250 3700 SCHEDULE D Facsimile +27 (31) 202 8220 www.pwc.com/za REPORT OF THE INDEPENDENT AUDITORS TO THE BOARD OF TRUSTEES OF DURBAN PENSION FUND AND THE REGISTRAR OF PENSION FUNDS

We have audited the annual financial statements of Durban Pension Fund, which comprise the report of the board of trustees, and the statement of net assets and funds as at 31 December 2008, and the statement of changes in net assets and funds for the year then ended, and the notes to the financial statements, which include the principal accounting policies and other explanatory notes, as set out on pages 8 to 25.

Board of Trustees’ Responsibility for the Financial Statements The board of trustees is responsible for the preparation and presentation of these financial statements for regulatory purposes, in accordance with the basis of preparation applicable to retirement funds in South Africa, as set out in the notes to the financial statements. This responsibility includes: designing, implementing and maintaining internal control relevant to the preparation and presentation of financial statements that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion In our opinion, the financial statements of Durban Pension Fund for the year ended 31 December 2008 have been prepared, in all material respects, in accordance with the basis of preparation applicable to retirement funds in South Africa as set out in the notes to the financial statements.

Emphasis of matter Without qualifying our opinion, we draw attention to note 11 in the Report of the Board of Trustees which indicates that the Fund did not meet the requirements of Section 19(4) of the Pension Funds Act with respect to the maximum limit prescribed for investments in a participating employer.

Restriction on use The financial statements are prepared for regulatory purposes in accordance with the basis of preparation indicated above. Consequently, the financial statements and related auditor’s report may not be suitable for another purpose.

PricewaterhouseCoopers Inc Director: Hemant Govind Registered Auditor 12 May 2009

C Beggs Chief Executive Officer 7 F Tonelli Chief Operating Officer S J Ashforth Director – Managing KwaZulu-Natal region and Durban office Resident Directors S J Ashforth, S Bauristhene, J S Dixon, A K Essack, H N Govind, M E Jones, K N Kooverjee, N R C Mbhele, T P J McCarthy, M R Mthethwa, B K Rajkaran, N Ramlagan, H Ramsumer, S F Randelhoff, M H Telfer, T S White The Company's principal place of business is at 2 Eglin Road, Sunninghill where a list of directors' names is available for inspection. PricewaterhouseCoopers Inc is an authorised financial services provider. VAT reg.no. 4950174682 DURBAN PENSION FUND

SCHEDULE E REPORT OF THE BOARD OF TRUSTEES For the year ended 31 December 2008

1. DESCRIPTION OF THE FUND

1.1 Type of Fund

In terms of section 1 of the Income Tax Act, 1962 the fund is classified as a pension fund. The fund is a defined benefit fund.

1.2 Benefits

1.2.1 Pensionable age

63 years

1.2.2 Bonus service

An additional year on completion of each of 20, 25 and 30 years qualifying service.

1.2.3 Final average emoluments

Average annual pensionable emoluments over the last 12 completed calendar months.

1.2.4 Benefit on retirement at pensionable age or after 40 years service

Pension of 2,25% and gratuity of 7% of final average emoluments per year of pensionable service.

1.2.5 Bonus

A bonus equivalent to half the November monthly pension is payable. The employer pays an equivalent amount.

1.2.6 Early retirement

Members may retire at any age from 55 years after the completion of at least 10 years’ service at a discount of 5% per annum for each year of early retirement.

1.2.7 Late retirement

Service may be extended to age 65. Retirement factor is increased by 5/12 of one percent for each month after age 63.

1.2.8 Benefit on retirement because of ill health

The greater of the benefit as set out in 1.2.4 above based on pensionable service to actual retirement age or, after ten years pensionable service, the pension based on 60% of the potential service to age 63. For pensionable service less than 10 years the discounting factor of 60% is reduced by 3% for each year of pensionable service less than ten.

1.2.9 Commutation

Up to one third of the pension on retirement may be commuted for a lump sum.

8 DURBAN PENSION FUND

REPORT OF THE BOARD OF TRUSTEES - CONTINUED For the year ended 31 December 2008

1.2.10 Spouse pension on death in service

33% of the pension the member would have received had he retired on grounds of ill heath after one year’s service increasing to 60% after completion of ten or more years’ service.

1.2.11 Child pension on death in service

To the extent that the actual service exceeds 60% of the potential service a child pension is payable equivalent to between 25% and 66,6% of the spouse pension depending on the number of children. The amount payable is doubled if no spouse pension is payable.

1.2.12 Spouse pension on death of pensioner

Pensioner’s pension continues in full for three months and thereafter, 60% of pensioner’s pension before commutation, if married before retirement, or 40% if married after retirement.

1.2.13 Child pension on death of pensioner

To the extent that the actual service exceeds 60% of the potential service a child pension is payable equivalent to between 25% and 66,6% of the spouse pension depending on the number of children. The amount payable is doubled if no spouse pension is payable.

1.2.14 Lump sums on death in service

Lump sum equivalent to amount that would have been paid on commutation of pension if member had retired on grounds off ill-health on the date of his death plus gratuity of 7% of final average emoluments per year of service.

1.2.15 Withdrawal on termination of service

The greater of the member’s contributions plus 5/12th’s of 1% for each month of membership increased by a further 5% for each completed year of membership up to a maximum of 100% or the minimum individual reserve as set out in the Pension Funds Act. A member with at least 10 years membership may elect to receive a deferred pension.

1.2.16 Strategy of board of trustees towards unclaimed benefits

Benefits are retained in the fund. In respect of unclaimed benefits, complete records, as prescribed, are maintained.

1.3 Contributions

1.3.1 Members contribute at a rate of 7,5% of pensionable salary.

1.3.2 Participating employer contributes at a rate of 19,68% of pensionable salary whilst enjoying a contribution holiday to the extent of 3,01% of pensionable salary with effect from 1 January 2008.

9 DURBAN PENSION FUND

REPORT OF THE BOARD OF TRUSTEES - CONTINUED For the year ended 31 December 2008

1.4 Rule amendments

Revised rules effective from 1 January 2008 were approved by the Registrar on 20 July 2008.

2. INVESTMENTS

2.1 Investment Strategy

2.1.1 With a view to matching the funds liabilities the investment strategy requires that the investments of contributing members’ assets be invested with an absolute return type mandate with a benchmark of headline consumer price inflation plus 6% net of expenses. Furthermore, the strategy provides for level pensions to be matched by investing monies with merchant banks in exchange for contracted future cash flows. Presently the bulk of the estimated level pensions payable for the ensuing 15 years are matched in this manner. The matching of level pensions is required to be reviewed annually to account for changes in the amounts of level pensions payable. Inflation linked Government stock has been acquired to further assist with the matching of level pensions. Pensioners’ assets in excess of that required to match level pensions are invested with an absolute return type mandate with a benchmark of headline consumer price inflation plus 6% net of expenses. These investments are utilised in the main to provide for pension increases and to provide cover for the longevity risk carried by the fund.

The investment strategy provides for the investment of up to 20% of the funds assets offshore provided the 5% exemption granted by the Registrar has been retained. In addition, the investment strategy provides for up to 5% in socially responsible investments.

The investment strategy complies with the Pension Funds Act in South Africa and is reviewed annually.

2.1.2 The Fund has no specific investment strategy towards unclaimed benefits.

2.1.3 Both the risk reserve and employer’s surplus account have been credited with investment returns equivalent to that earned by the funds invested in the active members account.

10 DURBAN PENSION FUND

REPORT OF THE BOARD OF TRUSTEES - CONTINUED For the year ended 31 December 2008

2.2 Management of investments

With a view to diversifying risk the fund has continued with the appointment of three managers, namely Allan Gray, Coronation and Investec to manage its local investments and two managers, namely Allan Gray and Investec to manage its offshore investments. Each of the three local managers manage an active members’ portfolio and a pensioner members’ portfolio. The mandate for each of the active members’ portfolio is a fully discretionary mandate, whilst the mandate for each of the pensioner members’ portfolio was revised to require equity holdings of between 70% to 100% with the balance in short term money market instruments. The managers are remunerated on a performance based management fee structure.

The investment managers have been mandated to reduce the fund’s exposure to volatile investment returns as far as possible whilst maintaining a real return of 6% per annum net of expenses. This is the level of real return calculated by the fund’s actuary as being sufficient to meet the prime objective of the fund of paying the pension benefits in terms of the rules.

The fund’s socially responsible investments continue to be placed with two managers, namely Futuregrowth and Frater. These investments are via pooled investments. Both managers are remunerated by a fee based on a fixed percentage of the market values of their respective portfolios.

The Investment Sub-Committee meets at quarterly intervals to discuss investment policy and to monitor the asset allocation and performance of the investment managers against the investment strategy of the fund. Brockhouse Cooper has been engaged as an investment performance monitor. The investment managers present to the Committee of Management quarterly on their portfolios.

The fair value of the fund’s investments, invested with the investment advisors/merchant banks/employer and held directly by the fund at the end of the period was:

Current Previous period period Rm Rm Allan Gray 2 555,0 2 986,3 Coronation 1 115,5 1 623,0 Investec 995,0 1 497,6 Futuregrowth 372,1 334,4 Fraters 34,3 40,3 Deposits providing guaranteed annuities: ABSA Bank 524,9 442,3 J P Morgan Bank 108,2 122,1 Nedbank 175,5 201,2 Rand Merchant Bank 107,5 122,0 Standard Bank 864,0 856,6 eThekwini Municipality: Funds advanced 961,4 37,0 Durban Pension Fund – bonds 405,0 - Total value of investments managed 8 218,4 8 262,8

11 DURBAN PENSION FUND

REPORT OF THE BOARD OF TRUSTEES - CONTINUED For the year ended 31 December 2008

3. MEMBERSHIP

Active Deferred Pensioners Beneficiaries Unclaimed members pensioners benefits Numbers at beginning of period 4,101 476 4,892 6,691 116 Adjustments 2 2 - - (34) Additions - 2 181 528 Transfers in - - - - - Transfers out - - - - - Withdrawals (86) - - - - Retirements (138) (15) - - - Retrenchments - - - - - Deaths (55) (5) (257) (133) - Transfers from deferred pensioners - - - - - Numbers at end of period 3,824 460 4,816 7,086 82

4. ACTUARIAL VALUATION

The financial statements summarise the transactions and net assets of the fund. They do not take account of liabilities to pay pensions and other benefits in the future. In accordance with the rules, the actuarial position of the fund, which does take account of such liabilities, is examined and reported on by the actuary at intervals not exceeding three years. The last statutory valuation was completed at 31 December 2006. Refer to the report of the valuator on page 26.

5. PENSIONER ACCOUNT AND ACTIVE MEMBER ACCOUNT

In terms of the Fund rules, Pensioner and Active Member Accounts have been established, with effect from 1 January 2008, to avoid cross-subsidisation by separating the assets underlying the pensioner liability from the assets held by the fund to pay benefits to active members. The opening balances have been determined by the actuary and reflect the respective liabilities of pensioners and active members including existing actuarial surpluses. These accounts are adjusted to record the shift in liability on retirement, contributions received, net investment returns and benefits paid.

6. EMPLOYER SURPLUS ACCOUNT

An employer surplus account was established in 2007 to fund an employer contribution holiday. Investment returns equivalent to that earned on the investments of the active members’ assets is credited to the surplus account after taking into account the value of the monthly contribution holiday (2008: 3,01%).

7. RISK RESERVE

A risk reserve was established in 2007 to make provision for death in-service benefits in addition to the risk premium being paid. Investment returns equivalent to that earned on the investments of the active members’ assets is credited to the reserve account.

12 DURBAN PENSION FUND

REPORT OF THE BOARD OF TRUSTEES - CONTINUED For the year ended 31 December 2008

8. CODE OF CONDUCT

A code of conduct has been drawn up for trustees and the principal officer. The code of conduct which includes an acceptance of appointment, a gift policy and a declaration of interest is reviewed annually.

9. COMMUNICATIONS POLICY

The fund provides annual benefit statements and communicates with members via circulars as and when required. The rules, investment strategy, annual financial statements and a guide to benefit calculation are available on the internet.

10. HOUSING LOAN FACILITIES

No loans or guarantees were granted to members and all previous loans have been paid up.

11. INVESTMENTS IN PARTICIPATING EMPLOYER

The fund's investment in the participating employer comprises funds advanced of R961,4 million at 31 December 2008. These funds were invested by the employer in fixed and call deposits. R645 million of this amount is a provisional sum to meet the transfer of members to the KZN Municipal Pension Fund.

The investment in the participating employer at 31 December 2008 representing 11,7% of total investments, exceeds the maximum limit of 5% prescribed by Section 19(4) of the Pension Funds Act. Application is being made to the Registrar of Pension Funds for exemption from the 5% limit. Subsequent to the year end the investment was reduced to below the maximum prescribed limit of 5%.

12. SUBSEQUENT EVENTS

Active members were given a third option to transfer to the KZN Municipal Pension Fund. A total of 1344 active members elected to transfer. The transfer is effective from 1 January 2009 and is awaiting FSB approval.

13. SIGNIFICANT MATTERS

Nil

14. CONTINGENCY

Nil

13 DURBAN PENSION FUND

SCHEDULE F STATEMENT OF NET ASSETS AND FUNDS At 31 December 2008

Notes 2008 2007 R’000 R’000 ASSETS

Non-current assets Investments 1 8,218,666 8,225,657

Current assets 16,951 45,769 Accounts receivable 2 16,397 44,572 Contributions receivable 6 554 1,197

Total assets 8,235,617 8,271,426

FUNDS AND LIABILITIES

Funds 8,091,643 8,062,374 Accumulated funds - 8,062,374 Active member account 3,454,022 - Pension account 4,637,621 -

Reserves 1,666 27,242 Reserve account 12 1,666 27,242

Total funds and reserves 8,093,309 8,089,616

Non-current liabilities 77,692 94,962 Employer surplus account 12 77,692 94,962

Current liabilities 64,616 86,848 Benefits payable 3 20,498 24,908 Accounts payable 4 43,919 60,097 Bank Overdraft 199 1,843 Retirement Fund Tax 5 - -

Total funds and liabilities 8,235,617 8,271,426

14 DURBAN PENSION FUND

SCHEDULE G STATEMENT OF CHANGES IN NET ASSETS AND FUNDS For the year ended 31 December 2008

A B A + B Notes Accumulated Pension Active Reserves Total Total funds account member 2008 2007 account R’000 R’000 R’000 R’000 R’000 R’000

Contributions received and accrued 6 - - 124,825 - 124,825 124,467 Contributions transferred from surplus accounts 12 - - 13,812 - 13,812 9,355 Net investment income 7 - 291,678 12,489 - 304,167 809,317 Other income 7 - - 6 - 6 74 - 291,678 151,132 - 442,810 943,213

Less: - (11,558) (3,726) - (15,284) (17,309) Administration expenses 8 - (11,558) (3,726) - (15,284) (16,469) Retirement fund taxation 5 - - - - - (840)

Net income before transfers and benefits - 280,120 147,406 - 427,526 925,904

Transfers and benefits - (294,919) (118,884) (13,488) (427,291) (428,335) Transfers to other funds 13 ------Benefits 3 - (294,919) (118,884) (13,488) (427,291) (428,335) Net income after transfers and benefits - (14,799) 28,522 (13,488) 235 497,569

Funds and reserves Balance at beginning of period 8,062,374 - - 27,242 8,089,616 7,696,364 Transfer between accounts (8,062,374) 4,652,420 3,425,500 (12,088) 3,458 (104,317) Creation of fund accounts (8,062,374) 4,459,123 3,603,251 - - - Transfer of new pension liability - 193,297 (181,685) (11,612) - - Investment return allocated 12 - - 3,934 (476) 3,458 (11,817) Surplus apportionment - - - - - (92,500)

Balance at end of period - 4,637,621 3,454,022 1,666 8,093,309 8,089,616

15 DURBAN PENSION FUND SCHEDULE HA NOTES TO THE FINANCIAL STATEMENTS For the year ended 31 December 2008

PRINCIPAL ACCOUNTING POLICIES The following are the principal accounting policies used by the fund, which are consistent with those of the previous period.

Purpose and basis of preparation of financial statements The financial statements are prepared for regulatory purposes in accordance with the Regulations to the Pension Funds Act. The Regulations require that the basis of accounting applied by pension funds primarily adheres to South African Statements of Generally Accepted Accounting Practice, except for the following:

Disclosure of cash flow information Disclosure of prior year adjustments Presentation of consolidated financial statements in which investments in subsidiaries are consolidated in accordance with the standard on consolidated and separate financial statements. The financial statements are prepared on the historical cost and going concern bases, modified by the valuation of certain financial instruments to fair value. The financial statements are measured and prescribed in the functional currency.

Financial instruments Measurement Financial instruments include cash and bank balances, investments, receivables and accounts payable. Financial instruments are initially measured at cost as of trade date, which includes transaction costs. Subsequent to initial recognition, these instruments are measured as set out below.

Investments Investments are classified as investments at fair value through profit or loss and are measured at fair value. The fair value of marketable securities is calculated by reference to the applicable Stock Exchange quoted selling prices at the close of business on the year end date.

Collective Investment Schemes Collective investment schemes are valued at fair value. The fair value is calculated by reference to the applicable Stock Exchange quoted selling prices of the underlying assets at the close of business on the year end date.

Insurance policies Insurance policies linked to listed investments are valued at fair value and are therefore equivalent to market value of the underlying assets as certified by the Investment Insurer concerned.

Deposits with banks Deposits, secured by bonds, providing guaranteed annuity receipts are measured at fair value using market interest rates at the year end date.

Accounts receivable Accounts receivable are stated at amortised cost less provision for doubtful debts.

Cash Cash is measured at fair value.

Accounts payable Accounts payable is recognised at amortised cost, namely original debt less principal payments and amortisations.

Contributions Contributions are brought to account on the accrual basis except for voluntary contributions, which are recorded in the period in which they are received.

Dividend income, insurance policy income, interest and rentals Interest is recognised on a time proportion basis, taking account of the principal outstanding and the effective rate over the period to maturity, when it is determined that such income will accrue to the fund. Insurance policy income and dividends are recognised when entitlement to revenue is established. Gains and losses on subsequent measurement to fair value of investments and of all other financial instruments are recognised in net investment income during the period in which the change arises.

Transfers from the fund Section 14 transfers from the fund are recognised on approval being granted by the Financial Services Board.

Comparatives Where necessary, comparative figures have been reclassified to conform to changes in presentation in the current period.

16 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

1. Investments

1.1 Investment summary

A B A+B Notes Local Foreign Total Total Fair value Amortised Categorised cost per IAS 39 2008 2007 2008 2008 R’000 R’000 R’000 R’000 R’000 R’000 Cash and deposits 2,223,623 - 2,223,623 2,720,543 2,223,623 - Note 1.1 Debentures 97,775 - 97,775 66,906 97,775 - Note 1.1 Bills, bonds and securities 533,108 - 533,108 180,493 533,108 - Note 1.1 Equities: - Equities with primary listing on JSE 2,030,666 - 2,030,666 2,970,280 2,030,666 - Note 1.1 - Equities with secondary listing on JSE 396,039 - 396,039 481,714 396,039 - Note 1.1 - Foreign listed equities - 164,815 164,815 - 164,815 - Note 1.1 - Unlisted equities 1,872 - 1,872 317 1,872 - Note 1.1 Preference shares 45,383 - 45,383 86,882 45,383 - Note 1.1 Insurance policies: - Market related policies 372,090 - 372,090 334,351 372,090 - Note 1.1 Collective investment schemes 124,022 1,267,873 1,391,895 1,347,171 1,391,895 - Note 1.1 Investments in participating employer 1.2 961,400 961,400 37,000 961,400 - Note 1.1 Total 6,785,978 1,432,688 8,218,666 8,225,657 8,218,666 -

Note 1.1 All investments are classified as investments at fair value through profit or loss and are valued at fair value.

17 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

1. Investments – continued

1.2 Investment in participating employer

A B C D E A+B-C+D+-E At beginning of Additions Repaid/ Interest Other At end of period Disposals Capitalised adjustments period R’000 R’000 R’000 R’000 R’000 R’000 Funds advanced 37,000 1,379,700 455,300 - - 961,400 TOTAL 37,000 1,379,700 455,300 - - 961,400

2 Accounts receivable

2008 2007 R’000 R’000 Unsettled Investment Income 10,383 33,755 Accrued Investment Income 2,354 10,544 Other 3,660 273 TOTAL 16,397 44,572

18 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

3 Benefits – current members

A B C D E A+B+C-D-E At beginning of Benefits for Return Payments Transferred At end of period current allocated to unclaimed period period benefits R’000 R’000 R’000 R’000 R’000 R’000 Monthly pensions 547 294,919 - 294,677 - 789 Lump sums on retirements Pensions commuted 651 38,729 - 38,850 - 530 Lump sums before retirement Disability benefits - 2,234 - 2,234 - - Death benefits 11,564 4,629 - 5,403 - 10,790 Minimum benefit payments made in terms of section 15 - 48,017 - 48,017 - - Other – Gratuity 12,146 38,763 - 42,520 - 8,389 Total 24,908 427,291 - 431,701 - 20,498 Benefits for current period 427,291 Return allocated - Statement of changes in net assets and 427,291 funds

19 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

4 Accounts payable

2008 2007 R’000 R’000 Unsettled investment transactions 3,241 5,507 Management and performance fees accrued 7,129 19,174 Trust account 30,217 26,057 Sundry payables 3,332 9,359 43,919 60,097

5 Retirement fund taxation

2008 2007 R’000 R’000 Taxable income - 20,092 Less: Formulae reduction - (10,759) Retirement fund taxable amount 9,333

Retirement fund taxation @ relevant rate - 840 Adjustments - - Retirement fund taxation (per statement of changes in net assets and funds) - 840 At beginning of period - 688 Retirement fund taxation - 840 Penalties and interest Other adjustments Retirement fund taxation paid - (1528) At end of period - -

6 Contributions receivable

A B C D A+B+C-D At Towards Towards re- Contributions At end of beginning retirement insurance and received period of period expenses R’000 R’000 R’000 R’000 R’000

Member contributions - received and accrued 153 34,413 - 34,413 153 Employer contributions - received and accrued 1,044 90,364 - 91,007 401 Additional voluntary contributions - members - 48 - 48 - Total 1,197 124,825 125,468 554 Towards retirement 124,825 Toward re-insurance and expenses -

20 DURBAN PENSION FUND Statement of changes in net assets and funds 124,825

21 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

7 Net investment income

7.1 Income from investments

2008 2007 R’000 R’000 Income from investments 580,805 275,342 Dividends 139,435 117,710 Interest 441,370 157,632 Adjustment to fair value (239,274) 583,308 341,531 858,650 Less: Expenses incurred in managing investments (37,364) (49,333) Total 304,167 809,317

7.2 Other income

2008 2007 R’000 R’000 Sundry income 6 74 Total 6 74

22 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

8 Administration expenses

Notes 2008 2007 R’000 R’000 Actuarial fees 416 416 Administration fees 4,948 5,416 Audit fees Audit services - current year 310 320 - underprovision prior year 85 - Other 161 166 Consultancy fees 311 304 Fidelity Insurance 82 83 Vat and Levies 5,264 7,200 Interest on trust accounts 3,091 2,367 Other 616 197 Total 15,284 16,469

9 Risk management policies

Solvency risk Solvency risk is the risk that the investment returns on assets will not be sufficient to meet the funds contractual obligations to members.

Continuous monitoring by the Board and the fund’s actuary takes place to ensure that appropriate assets are held where the funds obligation to members are dependent upon the performance of specific portfolio assets and that a suitable match of assets exists for all other liabilities.

Credit risk Credit risk is the risk that a counter-party to a financial instrument will fail to discharge an obligation, and cause the fund to incur a financial loss.

The Board monitors receivable balances on an ongoing basis with the result that the fund’s exposure to bad debts is not significant. No provision is currently maintained.

Legal risk Legal risk is the risk that the fund will be exposed to contractual obligations which have not been provided for.

Legal representatives of the fund monitor the drafting of contracts to ensure that rights and obligations of all parties are clearly set out.

23 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

Risk management policies – continued

Cash flow risk Cash flow risk is the risk that future cash flows associated with monetary financial instrument will fluctuate in amount.

The Board monitors cash flows by using regular cash flow projections.

Currency risk Currency risk is the risk that the value of an instrument will fluctuate in Rands owing to changes in foreign exchange rates. The fund’s exposure to currency risk is mainly in respect of foreign investments for the purpose of seeking desirable international diversification of investments.

The Board monitors this aspect of the fund’s investments and limits it to 20% of total assets.

Liquidity risk Liquidity risk is the risk that the fund will encounter difficulty in raising funds to meet commitments associated with financial instruments.

The fund’s liabilities are backed by appropriate assets and it has significant liquid resources.

Market risk Market risk is the risk that the value of a financial instrument will fluctuate as a result of changes in market prices of market interest rates.

The Fund’s investments are structured to minimize market risk.

Investments Investments in equities are valued at fair value and therefore susceptible to market fluctuations.

Investments are managed with the aim of maximising the fund’s returns while limiting risk to acceptable levels within the framework of statutory requirements. Continuous monitoring takes place to ensure that appropriate assets are held where the liabilities are dependent upon the performance of specific portfolios of assets and that a suitable match of assets exists for all non–market related liabilities.

10 Promised retirement benefits

The actuarial present value of promised retirement benefits, distinguishing between vested benefits and non-vested benefits is set out in the report of the valuator.

11 Related party transactions

The following transactions between the participating employer and the fund occurred during the period:

- The participating employer made contributions to the fund for members’ retirement to the value of R90,4 million (2007: R89,4 million). (Refer note 6 of the financial statements) - The fund’s investments in the participating employer comprise funds advanced to the eThekwini Municipality. (Refer note 1.2 of the financial statements for transactions and balances in respect of this investment)

24 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

12 Surplus and reserve accounts

A+B+C+D+E+F A B C D E F Member/ Employer Reserve Employer Contingency Investment Risk reserve Pensioner Other pensioner surplus Accounts protection reserve reserve reserve reserves surplus account reserve account R’000 R’000 R’000 R’000 R’000 R’000 R’000 R’000 R’000 At beginning of period 94,962 27,242 27,242 Contributions transferred to active member account (13,812) - - Net income before transfers and benefits 81,150 27,242 27,242

Transfer and benefits Transfer of new pension liability - (11,612) (11,612) Benefits - (13,488) (13,488) Net income after transfers and benefits 81,150 2,142 2,142 Transfer between reserve accounts Net investment return (3,458) (476) (476)

At end of period 77,692 1,666 1,666

25 DURBAN PENSION FUND

NOTES TO THE FINANCIAL STATEMENTS – CONTINUED For the year ended 31 December 2008

13 Transfers to other funds

A B C D A+B+C-D

Effective date No. of Applied for Beginning Transfers Return on Assets At end of members not yet of period approved transfers transferred period approved (contingency) R’000 R’000 R’000 R’000 R’000 R’000

In terms of section 14 KZN Municipal Pension Fund 1 January 2009 1,344 645,000 - - - - -

Total 1,344 645,000 - - - - -

Transfers approved - Return on transfers - Statement of changes in net assets - and funds

26 DURBAN PENSION FUND

Registration number: 12/8/32435/1

REPORT OF THE VALUATOR For the year ended 31 December 2008

Costa Economou VALUATOR Fellow of the Institute of Actuaries In my capacity as the valuator of the fund and as an employee of Alexander Forbes Financial Services (a division of Alexander Forbes Group (Proprietary) Limited) Johannesburg

Effective date of actuarial valuation: 31 December 2006 (last statutory submitted)

Particulars of financial condition of the fund

1. Net assets available for benefits (a): R7 696 million 2. The actuarial value of the net assets available for benefits, for the purposes of comparison with the actuarial present value of promised retirement benefits: R5 792 million 3. The actuarial present value of promised retirement benefits (b), split into vested (c). and non- vested benefits: R5 077 million 4. Contingency reserve account balances: Nil 5. Details of the valuation method adopted (including that in respect of any contingency reserve) and details of any changes since the previous summary of report: Projected Unit Credit Method – per Section 4 of the 31 December 2006 Statutory Valuation Report. 6. Details of the actuarial basis adopted (including that in respect of any contingency reserve) and details of any changes since the previous summary of report: As per Appendix II of the 31 December 2006 Statutory Valuation Report. 7. Any other particulars deemed necessary by the valuator for the purposes of this summary: None 8. A statement as to whether the fund was in a sound financial condition for the purposes of the Pension funds Act, 1956: The Fund was in a sound financial position as at 31 December 2006

REMARKS

For the purposes of this summary of report:

(a) Net assets available for benefits are the fair value of the assets of the fund less liabilities other than the actuarial present value of promised retirement benefits.

(b) The actuarial present value of promised retirement benefits means:

i. The actuarial liabilities in respect of past service benefits (including accrued bonus service) of active members, with due allowance for future salary increases where these affect the benefits in respect of past service, and with due allowance for increases in pension and deferred pensions at rates consistent with the pension increase policy of the fund; ii. The actuarial liabilities in respect of pensions in course of payment and deferred pensions, including any contingent annuity payable on the death of a pensioner, with due allowance for increases at rates consistent with the pension increase policy of the fund; and iii. Any other accrued liability.

(c) Vested benefits are benefits, the right to which, under the conditions of the fund, are not conditional upon continued employment.

27 PricewaterhouseCoopers Inc Reg. no. 1998/012055/21 102 Essenwood Road Berea 4001 P O Box 1049 Durban 4000 Telephone +27 (31) 250 3700 SCHEDULE I Facsimile +27 (31) 202 8220 REPORT OF THE INDEPENDENT AUDITORS OF DURBAN PENSION FUND www.pwc.com/za TO THE REGISTRAR OF PENSION FUNDS ON FACTUAL FINDINGS

Scope

We have performed the procedures agreed with you and enumerated below with respect to the accounting records of Durban Pension Fund for the year ended 31 December 2008 as required by you in terms of section 15 of the Pension Funds Act of South Africa, (the Act). Our engagement was undertaken in accordance with the International Standard on Related Services (4400) Engagements to perform agreed-upon procedures regarding financial information. The responsibility for determining the adequacy or otherwise of the procedures agreed to be performed is that of the Registrar of Pension Funds.

Procedures and Findings

Our procedures and the corresponding findings thereon are set out in the table below.

Procedures Findings 1 We selected the participating employer and for the following three months: March, June and December 2008, performed the following procedures: 1.1 We agreed, in total, the data received by The data received by the administrator agreed to the administrator to the cash received by the cash received by the fund. the fund. 1.2 We inspected the bank statements, as Contributions were deposited with a registered appropriate, for the date on which the cash bank in accordance with section 13A of the Act was received to determine whether the and late payment interest had been raised in contributions were deposited with a terms of regulation 33 where applicable. registered bank in accordance with section 13A of the Act and whether late payment interest has been raised in terms of regulation 33, where applicable. 1.3 We inspected the accounting records of Amounts disclosed as arrear contributions at the fund to determine whether amounts year-end have been paid to the fund in disclosed as arrear contributions at year- accordance with the requirements of section 13A end have been paid to the fund in of the Act. accordance with the requirements of section 13A of the Act. 2 We inspected the list of investments held The fund holds an investment prohibited in terms by the fund for any investments prohibited of section 19(4) of the Act. The investment in the in terms of section 19 (4) of the Act. participating employer comprises amounts advanced which exceed the 5% limit prescribed by section 19 (4) of the Act.

C Beggs Chief Executive Officer F Tonelli Chief Operating Officer S J Ashforth Director – Managing KwaZulu-Natal region and Durban office Resident Directors S J Ashforth, S Bauristhene, J S Dixon, A K Essack, H N Govind, M E Jones, K N Kooverjee, N R C Mbhele, T P J McCarthy, M R Mthethwa, B K Rajkaran, N Ramlagan, H Ramsumer, S F Randelhoff, M H Telfer, T S White The Company's principal place of business is at 2 Eglin Road, Sunninghill where a list of directors' names is available for inspection. PricewaterhouseCoopers Inc is an authorised financial services provider. VAT reg.no. 4950174682 Procedures Findings 2.1 Where investments held in the The fund has not obtained the required Financial participating employer exceeded 5%, we Services Board approval. inspected the appropriate Financial Services Board approval. 2.2 We obtained written confirmations of The details of the confirmations received agreed investment balances and agreed details of to the investment balances reflected in the the confirmations received to the general ledger. investment balances reflected in the general ledger. 3 We obtained the list of housing loans Not applicable. The fund does not grant housing granted to members by the fund in terms loans to members. of section 19(5) of the Act by the fund as at 31 December 2008 and performed the following procedures: 3.1 We agreed the loans on the above list to Not applicable. the corresponding account in the general ledger. 3.2 From the above list, we selected a sample Not applicable. of the lesser of 25 or 10% of housing loans. We determined whether the selected housing loans were granted in terms of the requirements of section 19(5) of the Act, in terms of the security provided and the interest rates applied to the loans. 3.3 If the fund issued more than 100 loans or Not applicable. the total principal debt of all outstanding loans exceeded R500 000, we determined whether the fund was registered as a credit provider under the National Credit Act, 2005 (the NCA) and whether an assurance report had been issued to the National Credit Regulator in terms of section 16(1) (b) of the NCA and regulations 67 and 68 to the NCA. 4 We obtained the list of housing loan Not applicable. guarantees granted to members by the fund in terms of section 19(5) of the Act as at 31 December 2008. We selected a sample of the lesser of 25 or 10% of housing guarantees from the list. For the sample selected, we compared the total for guarantees issued on behalf of the members to the total of member individual fund credits, to determine whether the total guarantees issued exceeded the total member individual fund credits allowed in terms of the Act and/or the rules of the fund. 5 We obtained a list of other loans as at 31 Not applicable. The fund does not grant other December 2008 and determined whether loans to members. these loans were granted in terms of the requirements of section 19(5)B. 6 We obtained written confirmation from the Fidelity insurance cover was in place throughout fund’s insurer that fidelity insurance cover the period ended 31 December 2008. was in place throughout the period ended 31 December 2008.

29 Procedures Findings 7 We obtained the list of section 14 transfers There were no section 14 transfers to and from to and from the fund throughout the period the fund for the year ended 31 December 2008. ended 31 December 2008, selected a sample of the lesser of 25 or 10% transfers in and the lesser of 25 or 10% transfers out, and performed the following procedures: 7.1 We agreed the section 14 transfers to and Not applicable. from the fund to the approved section 14 documentation received from the Financial Services Board in respect of each transfer. 7.2 We agreed the above list of section 14 Not applicable. transfers to the corresponding account in the general ledger. 7.3 We determined by inspection whether the Not applicable. transfers were received/paid within 60 days of approval and whether the growth and interest return had been allocated from date of receipt/payment. 7.4 In respect of unitised funds, we selected a Not applicable. sample of the lesser of 25 or 10% of the members transferred and recalculated the purchase of units for the amount received using the unit price per the administration system on the date of receipt. (Where units were purchased after date of receipt investment return was included from the date of receipt to the date of purchase) 8 We obtained a list of accumulated member Not applicable. The fund is a defined benefit fund. credits as reflected on the administrator’s member register as at 31 December 2008 and performed the following procedures: 8.1 We agreed the closing balance on the list Not applicable. to the corresponding account in the annual financial statements as at 31 December 2008. 8.2 We selected a sample of the lesser of 25 Not applicable. or 10% of the members from the list and performed the following procedures: 8.2.1 We agreed the member and employer Not applicable. contributions received for the selected members per the administrator’s system to information supplied by the participating employers for a sample of 3 months. 8.2.2 In respect of unitised investment products, Not applicable. we recalculated the conversion of the selected contributions at the unit price per the administration system on the dates that the contributions were invested and determined whether these units were correctly calculated and added to the existing units for the full period.

30 Procedures Findings 8.2.3 In respect of unitised investment products, Not applicable. we recalculated the conversion of units at the end of the period at the period end unit price and agreed the amount to the member’s record on the member register. 8.2.4 In respect of unitised investment products, Not applicable. we agreed the period end unit price as authorised in terms of the rules of the fund to the unit prices on the administration system used to calculate the member credits. 8.2.5 In respect of non-unitised investment Not applicable. products, we agreed the return allocated to the member’s fund credit on the administrator’s records to the return approved in accordance with a resolution of the Board of Trustees or the rules of the fund 8.3 We selected a sample of the lesser of 25 Not applicable. or 10% of members who switched between investment portfolios during the period and determined whether the portfolios were correctly switched and that the correct amount was switched in accordance with notification of the member’s election. We inspected whether any fees deducted were approved by the Board of Trustees. 8.4 If a surplus apportionment scheme was Not applicable. approved by the FSB in the current period, we selected a sample of the lesser of 25 or 10% from the surplus schedules and we agreed the allocation of the fund surplus of the scheme to the individual allocation in the member records per the administration system. 8.5 For unitised investment products where Not applicable. member portfolios are backed by specific portfolios, we agreed the values of investments specified by the members investment choice to the members liabilities per product for that choice and inspected the accuracy of reconciling items.

9 We inspected the most recent statutory In accordance with the valuation report dated 31 valuation report to determine whether the December 2006, the fund was not under funded. fund was under-funded. For under-funded funds we determined whether a scheme, as required in terms of section 18 of Pension Fund Act in South Africa, has been implemented to remedy the shortfall. 10 We obtained the analysis of the movements in the fund’s reserve accounts from the financial statements and performed the following procedures:

31 Procedures Findings 10.1 We agreed the opening balance to the The opening balance agreed to the prior period prior period financial statements. financial statements. 10.2 We inspected the rules of the fund to The movements in fund’s reserve accounts were determine whether the movements in the in terms of the rules of the fund. fund’s reserve accounts were in terms of the rules of the fund and the Act. 11 We obtained a list of lump sum benefits reflected as expenses in the fund’s Statement of Changes in Net Assets and Funds and performed the following procedures: 11.1 We agreed the list to the respective The list agreed to the respective general ledger general ledger benefit expense accounts. benefit expense accounts. 11.2 We selected a sample of the lesser of 25 benefits or 10% of the total benefit expenses from the list and performed the following procedures: 11.2.1 We agreed the claim to the applicable, The claim agreed to the applicable, authorised authorised supporting documentation. supporting documentation. 11.2.2 For death benefits, where a portion of the Not applicable. benefit was reinsured by the fund, we determined whether the recovery from the insurer was received by the fund. 11.2.3 We agreed that the calculation of the The calculation of the benefit payment agreed to benefit payment to the requirements of the the requirements of the rules of the fund. rules of the fund and/or the Act.

11.2.4 We inspected whether the payments The payments were authorised. agreed to relevant authorisation. 12 We obtained a copy of the listing of pensioners and performed the following procedures: 12.1 We agreed the total pensions paid to the The total pensions paid agreed to the corresponding account in the general corresponding account in the general ledger. ledger. 12.2 We selected a sample of the lesser of 25 or 10 % of pensions paid from the above list and performed the following procedures: 12.2.1 We agreed the pensioner increases to The pensioner increases agreed to a resolution authorisation by the Board of Trustees or approved by the Board of Trustees. other relevant supporting documentation. 12.2.2 We inspected evidence supporting the fact Except for one pensioner selected, the evidence that the pensioners selected were still indicated that the pensioners selected were alive. alive. The pension in respect of the non-confirming member has been suspended. 13 Where the fund has reinsured its Not applicable. pensioners with an insurer, we obtained a written confirmation of the pensions paid from the insurer including asset and liability balances and agreed this to the fund’s general ledger pension expense, asset and liability accounts.

32 As the above procedures do not constitute either an audit or a review made in accordance with International Standards on Auditing or International Standards on Review Engagements, we do not express any assurance on the procedures performed. Had we performed additional procedures, other matters might have come to our attention that would have been reported to you.

Our report is solely for regulatory purposes and may not be distributed to, or relied on, by parties other than the Registrar of Pension Funds.

Hemant Govind Director Chartered Accountant (SA) 12 May 2009

33 DURBAN PENSION FUND

SCHEDULE IA ANNEXURE A - SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS For the year ended 31 December 2008

Investments

A B C D A+B+C+D X Y X+Y Notes Direct Non-market Market Collective Total Local Foreign Total Investments related related investment percentage insurance insurance schemes of foreign policies polices exposure R’000 R’000 R’000 R’000 R’000 R’000 R’000 % Cash and deposits A 2,223,623 - - - 2,223,623 2,223,623 - Bills, bonds and securities B 533,108 - - - 533,108 533,108 - Debentures B 97,775 - - - 97,775 97,775 - Equities: C - Equities with primary listing on JSE 2,030,666 - - - 2,030,666 2,030,666 - - Equities with secondary listing on JSE 396,039 - - - 396,039 396,039 - - Foreign listed equities 164,815 - - - 164,815 - 164,815 2,0 - Equity index-linked instruments ------Unlisted equities 1,872 - - - 1,872 1,872 - Preference shares D 45,383 - - - 45,383 45,383 - Collective investment schemes E - - - 1,391,895 1,391,895 124,022 1,267,873 15,4 Insurance policies: - Market related policies - - 372,090 - 372,090 372,090 - Derivative market instruments F ------Other G 961,400 - - - 961,400 961,400 - Total investments 6,454,681 - 372,090 1,391,895 8,218,666 6,785,978 1,432,688 17,4

34 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

A DIRECT CASH AND DEPOSITS

Direct Cash and Deposits Total R’000 ABSA Bank NCD 34,706 ABSA Bank – Deposits secured by bonds 524,914 ACSA PN-Allan Gray 10,204 Investec Internal Money Fund 111,000 Investec NCD 19,396 JP Morgan Chase Bank- Coronation 32,400 JP Morgan Chase Bank – Deposit secured by bonds 108,187 Nedbank NCD 62,406 Nedcor - Coronation 39,450 Nedcor – Deposit secured by bonds 175,474 RMB NCD 28,568 RMB – Deposit secured by bonds 107,497 Safex Initial Margin 5,412 Sanlam Cap Market Call Bonds 32,000 Standard Bank 65,880 Standard Bank- Deposit secured by bonds 863,956 Standard bank NCD 2,173 Total Cash and Deposits 2,223,623

35 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

B DIRECT BONDS AND DEBENTURES

B1 Bills, bonds and securities

Direct Holdings Secured Fair value by/unsecured R’000 Government or provincial administration R153 13% Unsecured 283 R157 10% Unsecured 166 R157 9.50% Unsecured 263 R197 5.50% Unsecured 102,030 R201 8.75% Unsecured 1,660 R202 3.45% Unsecured 302,952 R206 7.50% Unsecured 522

Corporate bonds ABSA 14.25% Unsecured 15,770 ABSA 8.10% Unsecured 5,709 ABSA 8.80% Unsecured 1,015 ABSA 4.16% Unsecured 22,274 Barloworld 10.7% Unsecured 1,616 Barloworld 11.67% Unsecured 1,407 Beer 01 9.935 (SABMiller) Unsecured 6,184 Dev Bank 14.5% Unsecured 567 FSR 8.5% Unsecured 11,081 Firstrand 9% Unsecured 505 Firstrand 9.25% Unsecured 2,073 Group 5 9.2% Unsecured 4,185 Investec IV03 16% Unsecured 7,507 Liberty Group 8.93% Unsecured 1,539 MTN 10.01% Unsecured 17,531 Nedbank 9.03% Unsecured 1,034 Nedbank 7.845% Unsecured 592 Nedbank 9.84% Unsecured 1,350 Sappi 9.34% Unsecured 251 Sappi 10.64% Unsecured 2,097 Standard Bank 9.5% Unsecured 1,020 Standard Bank 9.63% Unsecured 1,577 Standard Bank 11.005% Unsecured 2,352 Standard Bank 17.017% Unsecured 7,000 Standard Bank 17.667% Unsecured 6,000 Standard Bank Senior Bond Unsecured 2,996 Total bills, bonds and securities 533,108

B2 Debentures

Secured Redemption Fair value DIRECT HOLDINGS by/unsecured value R’000 R’000 Listed debentures New Gold ETF Gold 97,775 97,775 Total debentures 97,775 97,775

36 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

C DIRECT EQUITIES

Total R’000 C1: Primary listing on JSE 2,030,666 C2: Secondary listing on JSE 396,039 C3: Foreign listed Equity 164,815 C4: Unlisted Equities 1,872 Total equities 2,593,392

C1 Primary listing on JSE

Direct Holdings Issued shares Holding % Holding Fair value number R’000 ABSA 680,278,000 264,344 0.04 28,589 Adcock Ingram 172,907,000 165,148 0.10 6,441 Adcorp 54,089,000 138,003 0.27 3,105 AECI 118,847,000 129,000 0.11 6,579 African Bank Investments 804,175,000 733,075 0.09 18,840 African Oxygen 342,853,000 1,191,076 0.35 28,884 African Rainbow Minerals 211,626,000 279,311 0,13 31,004 Alexander Forbes 100,000,000 781,116 0.78 7,327 Anglo American PLC 1,342,919,000 131,000 0.01 27,640 Anglogold Ashanti 353,483,000 463,730 0.13 116,860 Arcelomittal SA Ltd 445,752,000 110,400 0.02 9,765 Aspen Healthcare Holdings 399,265,000 228,592 0.06 7,681 Assore 27,572,000 81,292 0.29 39,427 Astral Food 42,136,000 174,748 0.41 16,776 AVI Ltd 342,638,000 1,442,100 0.42 30,342 Aveng 391,111,000 291,778 0.07 8,963 Avusa Limited 103,821,000 103,936 0.10 2,026 Avusa Opco Holdings 146,670,099 611,240 0.42 12,498 Bidvest 332,645,000 239,536 0.07 25,139 Business Connexion 262,637,000 268,030 0.10 978 Caxton & CTP Publishers 495,640,000 838,020 0.17 10,056 City Lodge Hotels 42,645,000 13,333 0.03 960 Cipla Medpro SA 443,266,000 2,622,011 0.59 6,031 Coronation Fund Managers 315,774,000 946,865 0.30 4,375 Datatec 175,546,000 493,800 0.28 8,098 Delta Electrical 49,166,000 277,900 0.57 2,501 Discovery Holding 591,953,000 857,350 0.14 22,137 Distell Group 201,092,000 218,275 0.11 11,132 Element One 103,821,000 1,227,140 1.18 14,664 Exxaro Resources Ltd 355,037,000 153,500 0.04 11,037 Firstrand 5,637,942,000 2,537,825 0.05 40,884 Gencor 348 590,257 70,220 0,00 1 Gold Fields 653,243,000 52,500 0.01 4,825 Grindrod 478,476,000 360,900 0.08 5,522 Harmony Gold Mining Co Ltd 417,638,000 722,616 0.17 70,600 Hosken consolidated Inv 127,369,000 15,343 0.01 614 Hudaco Industries 33,431,000 57,100 0.17 3,597 Illovo Sugar 350,610,000 1,314,591 0.37 29,591 Impala Platinum Holdings 631,579,000 387,522 0.06 52,315 Imperial 212,130,000 60,000 0.03 3,572 Investec Ltd 263,738,000 294,395 0.11 12,362 JD Group 170,500,000 589,175 0.35 21,593 JSE Limited 85,140,000 537,712 0.63 19,680 Sub-total carried forward 785,011

37 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

C1 Primary listing on JSE -continued

Direct Holdings Issued shares Holding % Holding Fair value number R’000 Sub-total brought forward 785,011 Kagiso Media 133,792,000 673,100 0.50 8,077 KWV Beleggings 42,000,000 142,405 0.27 6,857 Liberty Holdings 286,022,000 277,400 0.10 17,326 Makalani Holdings 23,593,000 62,350 0.26 4,364 Metorex 613,077,000 543,725 0.09 1,174 Metorex NPL 129,462,000 77,916 0.06 18 Metropolitan Holdings 541,604,000 3,304,976 0.61 35,694 Mobile Industries 1,068,040,000 4,945,800 0.46 6,924 Mondi Limited 146,896,000 544,980 0.37 18,420 Mr Price 247,156,000 356,671 0.14 8,828 MTN Group 1,868,010,000 1,809,313 0.10 196,310 Mutual and Federal 317,696,000 173,867 0.05 2,229 Mvelaphanda Group Ltd 443,000,000 2,504,291 0.57 12,396 Nampak 658,142,000 2,122,788 0.32 28,021 Naspers 403,569,000 517,842 0.13 86,091 Network Healthcare Holdings 1,858,708,000 3,762,342 0.20 31,604 New Clicks Holdings 324,139,000 713,348 0.22 12,127 Northam Platinum 359,716,000 293,446 0.08 6,045 Oceana Group 118,388,000 741,200 0.63 16,714 Peregrine 228,129,000 171,457 0.08 1,423 Pick‘n Pay Holdings 527,249,000 49,261 0.01 732 Pick’n Pay Stores 506,134,000 537,324 0.11 19,349 Remgro 439,480,000 1,458,016 0.33 111,451 Reunert 196,992,000 190,302 0.10 9,648 RMB Holdings 1,209,111,000 288,206 0.02 7,407 Sanlam 2,190,108,000 3,482,381 0.16 59,200 Sappi 537,118,000 537,118 0.29 59,531 Sasol 636,765,000 257,770 0.04 72,181 Shoprite Holdings 543,479,000 652,461 0.12 34,580 Spar 169,924,000 374,260 0.22 21,333 Standard Bank 1,525,008,000 1,385,514 0.09 114,998 Steinhoff International 1,369,418,000 1,124,359 0.08 14,111 Super Group 545,516,000 2,531,298 0.46 4,227 Sun International 106,330,000 547,047 0.51 51,067 Telkom SA Ltd 520,784,000 247,420 0.05 28,330 Tiger Brands 173,043,000 527,578 0.30 75,676 Tongaat-Hulett 103,247,000 184,274 0.18 11,701 Trencor 187,399,000 401,647 0.21 7,872 Truworths 454,432,000 322,500 0.07 10,997 Woolworths 798,656,000 2,409,284 0.30 30,622 Total Primary Listing on JSE 2,030,666

38 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

C2 Secondary listing on JSE

Direct Holdings Issued shares Holding % Holding Fair value number R’000 BHP Billiton Plc 2,231,121,000 239,970 0.01 42,624 Compagnie Financiere Richmont 5,220,000,000 4,957,269 0.09 88,983 Dimension Data 1,694,604,000 5,303,830 0.31 30,762 Investec Plc 424,937,000 125,413 0.03 5,025 Reinet Inv SA 1,088,563,000 2,002,882 0.18 19,428 SAB Miller Plc 1,507,236,000 1,288,919 0.09 209,217 Total Secondary Listing on JSE 396,039

C3 Foreign Listed Equity

Direct Holdings Issued Holding % Holding Fair value shares number R’000 British American Tobacco 2,025,022 672,003 0.33 164,815

Total Unlisted Equities 164,815

C4 Unlisted equities

Direct Holdings Issued shares Holding % Holding Fair value number R’000 JCI Ltd 2,224,799,000 4,152,033 0.19 664 NRB Holdings 51,600 51,600 1.00 1 Randgold 100,000 100,000 1.00 890 SA Corp Real Estate Fund Mngs Ltd 1,900,000 95,000 5.00 307 Top Info Technology Holdings 974,900 974,900 1.00 10 Total Unlisted Equities 1,872

39 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

D DIRECT PREFERENCE SHARES

Direct Holdings Issued shares Holding % Holding Fair value number R’000 Absa Pref 4,945,000 36,503 0.74 31,871 Firstrand B 30,000,000 42,956 0.14 3,913 Firstrand B1 15,000,000 22,648 0.15 2,061 Investec Ltd 22,182,000 24,117 0.11 1,969 Nedbank 312,781,000 562,538 0.18 5,569 Total Preference Shares 45,383

E COLLECTIVE INVESTMENT SCHEMES

Direct Holdings Issued shares Holding % Holding Fair value number R’000 Acucap Properties 146,670,000 403,991 0.28 11,110 Apexhi A 284,592,000 1,373,090 0.48 18,880 Charter Plc 166 901,000 52 0,00 2 Fountainhead Property Trust 996,043,000 1,346,665 0.14 7,689 Frater Earth Equity Fund 110,249,531 10,280,635 9.32 34,292 Growthpoint Prop 1,280,926,000 237,300 0.02 3,560 Growthpoint Prop NPL 128,093,000 23,730 0.02 44 Hospitality Property Fund A 61,591,000 433,545 0.70 5,138 Hyprop Investments 166,113,169 242,650 0.15 17,928 Investec Global Equity 574,097,937 20,527,719 3.58 253,904 Liberty International Plc 363,023,000 181,400 0.05 12,471 Orbis Global Equity Fund 88,230,067 446,495 0.51 338,914 Orbis Optimal USD Fund 45,555,162 320,647 0.70 204,822 Orbis Japan Equity Fund 120,554,086 1,287,392 1.07 259,974 Orbis Optimal Euro Fund 20,911,391 700,693 3.35 210,257 Resillient Property Inc Fund 241,104,000 473,992 0.20 11,376 Syfrets & CU Property Fund 205,107,471 81,320 0.04 1,534 Total Collective Investment Schemes 1,391,895

40 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

F DIRECT DERIVATIVE MARKET INSTRUMENTS

Options

Direct Holdings Strike Expiry date Put/Call Premium Full price exposure (notional amount) R’000 R’000 B02766/FNDIM9 19,950 2009-06-18 P 20,093 25,328 B02768/FNDIM9 23,500 2009-06-18 P 39,611 (41,180) B02770/FNDIM9 28,000 2009-06-18 C 2,519 (7,608) Total Options (23,460)

Futures/forward – SAFEX/foreign

Direct Holdings Put/call Expiry date Full exposure (notional amount) R’000 ALSFH9/J200 2009-03-19 (18,671) Total Futures (18,671)

G OTHER

Direct Holdings Description Holding % Holding Fair value number R’000

Local - Investment in participating employer Funds advanced - - 961,400 Total other investments 961,400

41 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

Risk management Credit / counter party risk

Counter party Any other Direct Deposit/liquid Scrip lending Open Guarantees Total Exposure to instrument investment asset with transactions financial per counter party (Secured in counter counter party instruments Counter party as a % of the Claim) party mark to fair value of (equity & market value the assets of bonds) the fund R’000 R’000 R’000 R’000 R’000 R’000 % R’000 Banks ABSA 105,228 559,620 - - - - 664,848 8.09 ACSA - 10,204 - - - - 10,204 0.12 Investec 26,863 130,396 - - - - 157,259 1.91 JP Morgan Chase Bank - 140,587 - - - - 140,587 1.71 Nedbank 8,545 277,330 - - - - 285,875 3,48 Rand Merchant Bank 7,407 136,065 - - - - 143,472 1.75 Standard Bank 135,943 932,009 - - - - 1,067,952 12.99 Asset managers – local Coronation Fund Managers 4,375 - - - - - 4,375 0.05 Insurance companies Discovery Holding 22,137 - - - - - 22,137 0.27 Liberty Group 18,865 - - - - - 18,865 0.23 Metropolitan Holdings 35,694 - - - - - 35,694 0.43 Sanlam 59,200 32,000 - - - - 91,200 1.11 Participating employers eThekwini Municipality - 961,400 - - - - 961,400 11.70 Other Institutions Safex (Initial margin) - 5,412 - - - - 5,412 0.07

Investments are reflected at fair value at the end of the financial period.

42 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

Market risk EQUITY HOLDINGS List the 10 largest rand-value equity holdings

Investment Equity holding at Open financial Total fair value Market fair value instruments equity holdings movement by marked to and open 15% market value instruments R’000 R’000 R’000 R’000 SAB Miller Plc 209,217 - 209,217 31,383 MTN Group 196,310 - 196,310 29,447 British American Tobacco 164,815 - 164,815 24,722 Anglogold Ashanti 116,860 - 116,860 17,529 Standard Bank 114,998 - 114,998 17,250 Remgro 111,451 - 111,451 16,718 Compagnie Financiere Richmont 88,983 - 88,983 13,347 Naspers 86,091 - 86,091 12,914 Tiger Brands 75,676 - 75,676 11,351 Sasol 72,181 - 72,181 10,827 Total value of 10 largest equity holdings 1,236,582 185,488 Total movement as % of non-current assets plus bank 2.26%

43 DURBAN PENSION FUND

ANNEXURE A SCHEDULES PERTAINING TO THE ANNUAL FINANCIAL STATEMENTS - CONTINUED For the year ended 31 December 2008

OTHER FINANCIAL INSTRUMENTS

List the 10 largest rand-value other financial instruments

Instrument Holding Fair value at end Market of period movement by 5% R’000 R’000 Funds advanced to participating employer - 961,400 48,070 Standard Bank deposit secured by bonds - 863,956 43,198 ABSA Bank deposit secured by bonds - 524,914 26,246 Futuregrowth insurance policy - 372,090 18,605 RSA 202 bond - 302,952 15,148 Nedbank deposit secured by bonds - 175,474 8,774 Investec internal money fund - 111,000 5,550 J P Morgan Chase Bank deposit secured by bonds - 108,187 5,409 Rand Merchant Bank deposit secured by bonds - 107,497 5,375 R197 - bond - 102,030 5,102 Total value of 10 largest other instruments 3,629,500 181,477 Total movement as % of non-current assets plus bank 2,21

Foreign currency exposure

Foreign instruments Fair value at Market end of period movement by 5% R’000 R’000 British American Tobacco 164,815 8,241 Charter Plc 2 0 Orbis Global Equity Fund 338,914 16,946 Orbis Optimal USD Fund 204,822 10,241 Orbis Japan Equity (Yen) Fund 259,974 12,999 Orbis Optmal (Euro) Fund 210,257 10,513 Investec Global Managed Fund 253,904 12,695 Total value of foreign instruments 1,432,688 71,635 Total movement as % of non-current assets plus bank 0,87

44 DURBAN PENSION FUND

SCHEDULE IB ASSETS HELD IN COMPLIANCE WITH REGULATION 28

R’000 A Total assets of the fund as per Statement of Net Assets and Funds 8,235,617 B Less: Non-investment items of Statement of Net Assets and Funds: 16,951 B.1 Property Plant and Equipment - B.2 Current Assets (excluding cash at bank) 16,951

C Sub-total (A-B) 8,218,666

Fair % of Categories of assets % Value Fair Value R’000

1. Deposits in banks, mutual banks, Postbank and SAFEX: 100% 2,244,86 1 27,3 (a) Deposits and balances in current and savings accounts with a bank or mutual bank, including negotiable deposits and money market instruments in terms of which such bank is liable,, or deposits and savings accounts, accounts with the Post Office Savings Bank and margin 2,244,86 deposits with Safex: 100% 1 27,3 (i) Per Bank or mutual bank 20% (ii) Postbank 20% (iii) SAFEX 5% (b) Deposits and balances in current and savings accounts with a bank outside the Republic including negotiable deposits 15% and money instruments in terms of which such a bank is liable 2. Krugerrands 10% - - 3. Bills, bonds and securities issued or guaranteed loans to or guaranteed by- 100% - - (a) Inside the Republic- (i) Local authorities by law to levy 100% rates upon immovable property - - - per local authority 20% - - (ii) Development boards established by section 4 of the Black 20% Communities Development Act, 1984 (Act No. 4 of 1984) - - (iii) Rand Water Board 20% - - (iv) Eskom 20% - - (v) Land and Agricultural Bank of 20% South Africa - - (vi) Local Authorities Loans Fund 20% Board - -

(b) Territories outside the Republic - Bills, bonds and securities issued or guaranteed by the foreign Government concerned 15% - -

SUBTOTAL 2,244,86 1 27,3

45 DURBAN PENSION FUND

ASSETS HELD IN COMPLIANCE WITH REGULATION 28 – CONTINUED

% of Categories of assets % Fair Value Fair Value R’000 4. Bills, bonds and securities issued by and loans to an institution in the Republic, which bills, bonds, securities and loans the Registrar approved in term of section 19(1)(h) of the Act before the deletion of that section by section 8(a) of the Act No. 53 of 1989, also bills, bonds and securities issued by and loans to an institution in the Republic, which institution the Registrar likewise approved before such deletion 100% 125,232 1,5 - per institution 20% 5. Bills, bonds and securities issued by and loans to an institution in the Republic, which bills, bonds, securities and loans the Registrar approved in term of section 19(1)(i) of the Act before the deletion of that section by section 8(a) of the Act 100% No. 53 of 1989, also bills, bonds and securities issued by and loans to an institution in the Republic, which institution the Registrar likewise approved before such deletion - - - per institution 20%

Limitations in respect of investments in items 6 90% and 7

6. Immovable property and claims secured by mortgage bonds thereon. Units in collective investment schemes in property shares and shares in, loans to and debentures, both convertible and non-convertible, of property companies: 25% 89,730 1,1 These investments are subject to the following limitation: (a) Inside the Republic- 25% Per any single property or property 5% development project (b) Outside the Republic - 10% - - Per any single property or property 5% development project 7. Preference and ordinary shares in companies excluding shares in property companies. Convertible debentures, whether voluntarily or compulsorily convertible and units in equity unit trust schemes which objective is to invest their assets mainly in shares: 75% 4,057,039 49,4 Subject to the following limitations: (a) Inside the Republic - 75% Preference and ordinary shares in companies, convertible debentures whether voluntarily or compulsorily convertible (i) Unlisted shares, unlisted convertible debentures, shares and convertible debentures listed in the Development Capital Sector of the JSE 5% 17,544 0,2 (ii) Shares and convertible debentures listed on the JSE, other than the Development Capital Sector 75% 2,572,515 31,3 (aa) Companies with a market capitalisation of R2 000 million 75% or less - per Company 10% (bb) Companies with a market capital of more than R2 000 75% million - per Company 15%

(b) Territories outside the Republic 15% 164,815 2,0

SUBTOTAL 6,516,862 79,3

46 DURBAN PENSION FUND

ASSETS HELD IN COMPLIANCE WITH REGULATION 28 – CONTINUED

% of Categories of assets % Fair Value Fair Value R’000

Preference and ordinary shares in companies, convertible debentures whether voluntarily or compulsorily convertible (i) Unlisted shares, unlisted 2.5% convertible debentures - - (ii) Shares and convertible debentures listed on any recognised foreign 15% exchange - - (aa) Companies with a market capitalisation of R2 000 15% million or less - per Company 10% (bb) Companies with a market capitalistion of more than 15% R2 000 million - per Company 15%