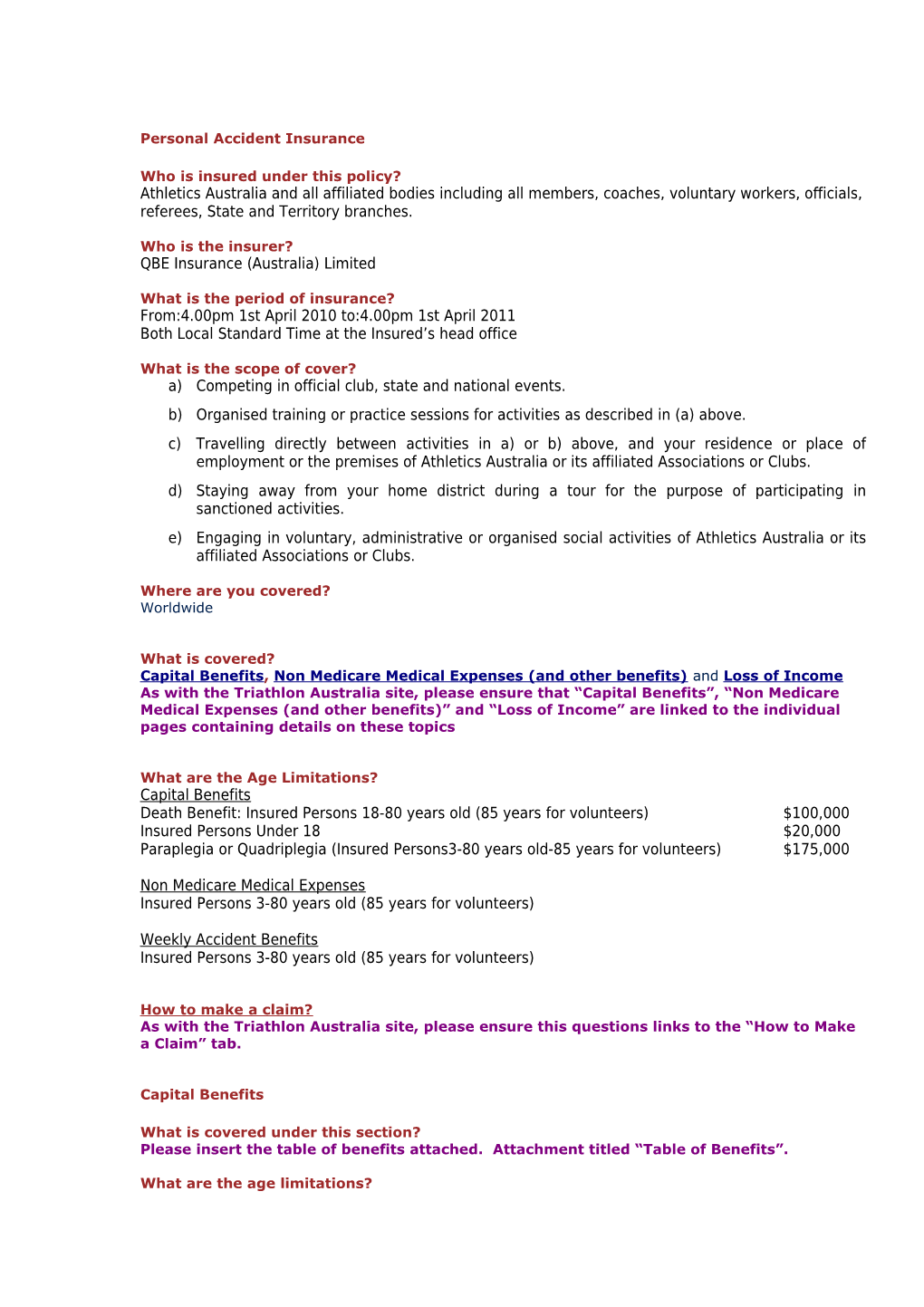

Personal Accident Insurance

Who is insured under this policy? Athletics Australia and all affiliated bodies including all members, coaches, voluntary workers, officials, referees, State and Territory branches.

Who is the insurer? QBE Insurance (Australia) Limited

What is the period of insurance? From:4.00pm 1st April 2010 to:4.00pm 1st April 2011 Both Local Standard Time at the Insured’s head office

What is the scope of cover? a) Competing in official club, state and national events. b) Organised training or practice sessions for activities as described in (a) above. c) Travelling directly between activities in a) or b) above, and your residence or place of employment or the premises of Athletics Australia or its affiliated Associations or Clubs. d) Staying away from your home district during a tour for the purpose of participating in sanctioned activities. e) Engaging in voluntary, administrative or organised social activities of Athletics Australia or its affiliated Associations or Clubs.

Where are you covered? Worldwide

What is covered? Capital Benefits, Non Medicare Medical Expenses (and other benefits) and Loss of Income As with the Triathlon Australia site, please ensure that “Capital Benefits”, “Non Medicare Medical Expenses (and other benefits)” and “Loss of Income” are linked to the individual pages containing details on these topics

What are the Age Limitations? Capital Benefits Death Benefit: Insured Persons 18-80 years old (85 years for volunteers) $100,000 Insured Persons Under 18 $20,000 Paraplegia or Quadriplegia (Insured Persons3-80 years old-85 years for volunteers) $175,000

Non Medicare Medical Expenses Insured Persons 3-80 years old (85 years for volunteers)

Weekly Accident Benefits Insured Persons 3-80 years old (85 years for volunteers)

How to make a claim? As with the Triathlon Australia site, please ensure this questions links to the “How to Make a Claim” tab.

Capital Benefits

What is covered under this section? Please insert the table of benefits attached. Attachment titled “Table of Benefits”.

What are the age limitations? Capital Benefits Death Benefit: Insured Persons 18-80 years old (85 years for volunteers) $100,000 Insured Persons Under 18 $20,000 Paraplegia or Quadriplegia (Insured Persons3-80 years old-85 years for volunteers) $175,000

What is excluded? The policy will not respond to any claim under this section of the policy if the claim arises directly or indirectly out of any of the following;

Any injury, medical condition, or weakness known to the insured person or which would have been known to a reasonable person in the circumstances to have existed prior to the commencement of this policy Illness Any injury where you are entitled to receive a benefit from any statutory transport accident scheme or statutory workers compensation scheme

Please refer to the policy document & product disclosure statement (please link the words in red to the “Policy Wording” tab) for details of policy conditions and exclusions.

Loss of Income

What is covered under this section? This benefit provides cover for insured persons who are disabled from an injury relating to events covered and are unable to work.

What are the benefits payable? 80% of your net weekly income up to a maximum of $600 per week, the benefit period is 52 weeks from the date of injury.

What is the policy excess? The first 7 days income from the date of injury is excluded.

What are the age limitations?

Insured Persons 3-80 years old (85 years for volunteers)

What is excluded? The policy will not respond to any claim under this section of the policy if the claim arises directly or indirectly out of any of the following;

Any injury, medical condition, or weakness known to the insured person or which would have been known to a reasonable person in the circumstances to have existed prior to the commencement of this policy Illness Any condition that is caused by repetitive movements or actions of your sport

The insurer will not pay weekly benefits;

For junior persons While you or the insured person are awaiting surgery unless agreed in writing by the insurer If you or the insured person recommence participation in any sport For more than one injury at any one time

Please refer to the policy document & product disclosure statement (please link the words in red to the “Policy Wording” tab) for details of policy conditions and exclusions.

Non-Medicare Medical Expenses and Other Benefits

What is covered under this section? This section covers;

Non Medicare Medical Expenses Student Assistance Benefit Home Help Benefit Parents Inconvenience Benefit Funeral Benefit Lifestyle Modification Benefit Broken Bones

What are the benefits payable?

1) Non-Medicare Medical Expenses This covers insured persons for NON-MEDICARE MEDICAL Expenses. The policy is for reimbursement only. That is, the member must pay the account and then claim reimbursement under this insurance cover.

NOTE: Only NON-MEDICARE items are claimable (i.e The “Medicare gap” is not claimable due to government

legislation).

The most common “Non Medicare” expenses include:- - Private Hospital - Dental - Ambulance - Chiropractic - Physiotherapy - Osteopathy

Medical expenses that are covered by Medicare (i.e. not covered by this sports injury policy) include:- - Doctors Fees - Surgeons - Anesthetists Fees - X-rays

Note: Private hospital expenses relate to Private hospital bed fee and theatre fees only."

Benefit Reimbursement up to 100% of Non Medicare medical costs, up to $2,500 per injury.

Excess $100 excess applies to each injury. There is a nil excess if a member belongs to a private health fund.

Conditions If a member belongs to a private health fund, they must claim from that fund first. Non Medicare Medical costs are only reimbursed by this policy if incurred within 52 weeks from the date of injury.

2) Student Assistance Benefit Benefit Pays 75% of actual expenses incurred for home tutorial by a qualified tutor to assist full time student.

Excess The first 7 days from the date of injury are excluded.

Benefit Period 26 weeks from the date of injury.

Conditions The claimant must be registered as a full time student. Home tutorial services must be carried out by persons other than members of the claimant’s family or other relatives.

3) Home Help Benefit

Pays non-wage earners up to 100% of cost to a maximum of $500 per week being for reimbursement of actual costs incurred for cooking, ironing, washing, cleaning, and child minding expenses as a result of injury.

Excess The first 7 days from the date of injury are excluded.

Benefit Period 52 weeks from the date of injury.

Conditions Such child-minding services and domestic help are carried out by persons other than members of the claimant’s family or other relatives or person’s permanently living with the claimant. Such child-minding services and domestic help are certified by a doctor as being necessary for the recovery of the claimant.

4) Parents Inconvenience Benefit

Pays up to 80% of costs to a maximum of $300 per week, whilst the child is hospitalised to off set costs incurred for baby-sitting, taxi fares etc.

Excess The first 14 days from the date of injury are excluded. Benefit 52 weeks from the date of injury.

5) Funeral Benefit

If a Death Benefit has been paid under capital benefits, an amount of $5,000 is available for reimbursement of funeral expenses.

6) Lifestyle Modification Benefit

If an insured person is paid a capital benefit due to total permanent disablement, permanent paraplegia or quadriplegia or permanent and incurable paralysis of all limbs, then an additional payment of up to $10,000 for reimbursement of home or motor vehicle modifications or in relocating to a suitable home is also available. 7) Broken Bones Benefit Pays up to $3,000 for broken bones as per the following schedule:- Accidental Bodily Injury resulting in: Broken Bone Benefits – Accidental Bodily Injury (a) Neck skull or spine $3,000 (b) Hip $2,250 (c) Jaw, pelvis, leg, ankle or knee $1,500 (d) Cheekbone or shoulder $900 (e) Arm, elbow or wrist $300 (f) Nose or collarbone $600 (g) Foot or hand $150 (h) In the case of established non $150 union of any of the above breaks, an additional payment is made Maximum Compensation any one $3,000 Accident. Note: "Break" means a complete break of a bone and does not include a fracture

What is excluded? The policy will not respond to any claim under this section of the policy if the claim arises directly or indirectly out of any of the following;

Any injury, medical condition, or weakness known to the insured person or which would have been known to a reasonable person in the circumstances to have existed prior to the commencement of this policy Illness Expenses incurred for which a Medicare benefit is payable. The Health Insurance Act (Cth) 1973 does not permit the Trustee or Insurer to contribute to any charges covered by Medicare (including the Medicare Gap). Expenses incurred more than 12 months after the date of injury Accounts covered by private health insurance whether claimed or not

Please refer to the policy document & product disclosure statement (please link the words in red to the “Policy Wording” tab) for details of policy conditions and exclusions.