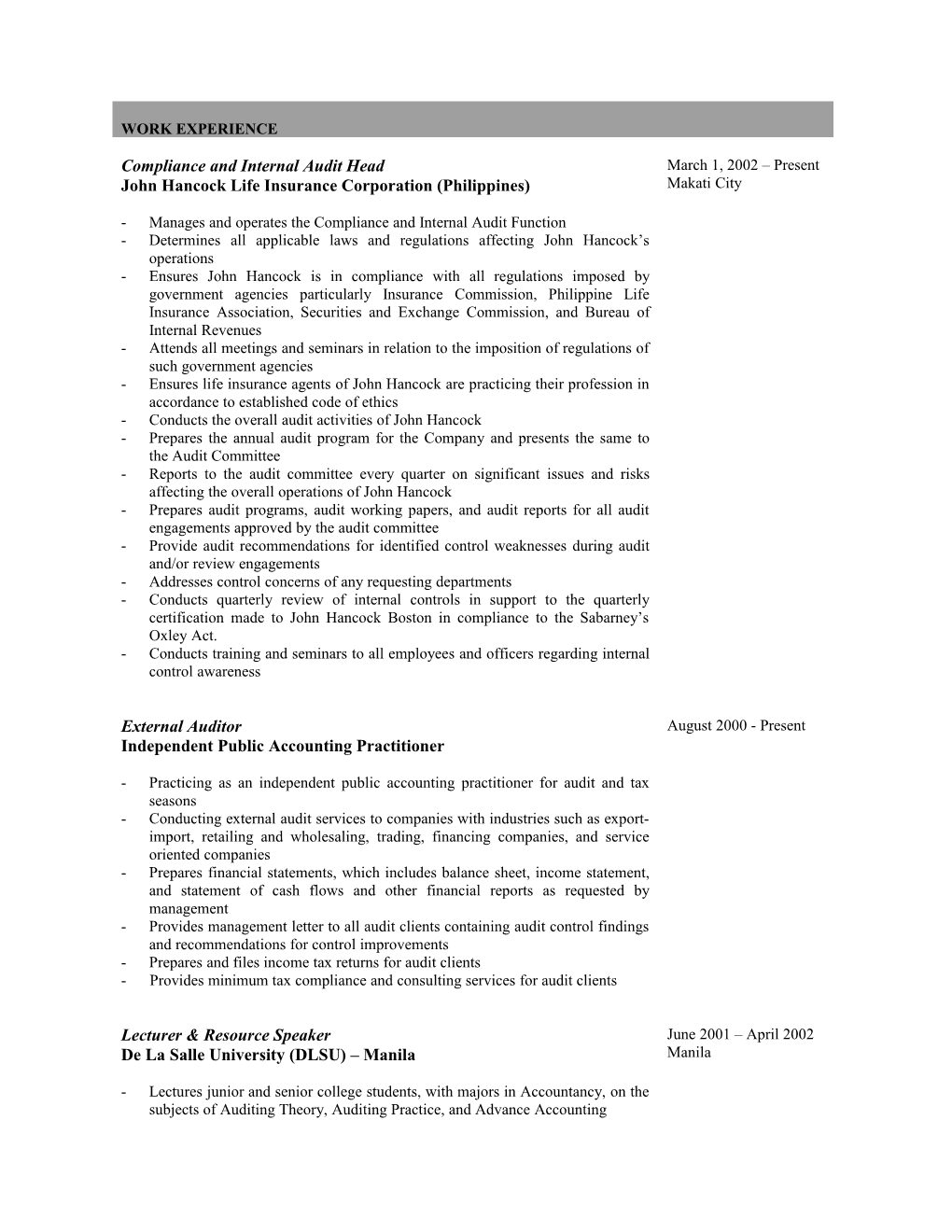

WORK EXPERIENCE

Compliance and Internal Audit Head March 1, 2002 – Present John Hancock Life Insurance Corporation (Philippines) Makati City

- Manages and operates the Compliance and Internal Audit Function - Determines all applicable laws and regulations affecting John Hancock’s operations - Ensures John Hancock is in compliance with all regulations imposed by government agencies particularly Insurance Commission, Philippine Life Insurance Association, Securities and Exchange Commission, and Bureau of Internal Revenues - Attends all meetings and seminars in relation to the imposition of regulations of such government agencies - Ensures life insurance agents of John Hancock are practicing their profession in accordance to established code of ethics - Conducts the overall audit activities of John Hancock - Prepares the annual audit program for the Company and presents the same to the Audit Committee - Reports to the audit committee every quarter on significant issues and risks affecting the overall operations of John Hancock - Prepares audit programs, audit working papers, and audit reports for all audit engagements approved by the audit committee - Provide audit recommendations for identified control weaknesses during audit and/or review engagements - Addresses control concerns of any requesting departments - Conducts quarterly review of internal controls in support to the quarterly certification made to John Hancock Boston in compliance to the Sabarney’s Oxley Act. - Conducts training and seminars to all employees and officers regarding internal control awareness

External Auditor August 2000 - Present Independent Public Accounting Practitioner

- Practicing as an independent public accounting practitioner for audit and tax seasons - Conducting external audit services to companies with industries such as export- import, retailing and wholesaling, trading, financing companies, and service oriented companies - Prepares financial statements, which includes balance sheet, income statement, and statement of cash flows and other financial reports as requested by management - Provides management letter to all audit clients containing audit control findings and recommendations for control improvements - Prepares and files income tax returns for audit clients - Provides minimum tax compliance and consulting services for audit clients

Lecturer & Resource Speaker June 2001 – April 2002 De La Salle University (DLSU) – Manila Manila

- Lectures junior and senior college students, with majors in Accountancy, on the subjects of Auditing Theory, Auditing Practice, and Advance Accounting - Prepares accounting manual studies and reviewers for senior accounting students - Conducts seminars on topics such as Philippine Auditing Standards and Accounting Systems sponsored by the University - Represents DLSU as a Resource Speaker for the Philippine Institute of Certified Public Accountants (PICPA) regarding topics on Practicing Public Accounting or External Auditing – basic and advance, and Internal Auditing Concepts and Practices

Internal Auditor August 2001 – April Lasallian Supervising School’s Office (LASSO) 2002 Manila - Conducts internal auditing activities to all schools being supervised by the De La Salle University - Prepares audit programs, audit working papers, and conduct audit field-works for all internal audit engagements - Ensures that all control systems are in place effectively and efficiently and that all affected employees and officers are in compliance to such controls - Attends quarterly board of meetings of all schools being audited and discuss all control findings and recommendations - Ensures all schools are in compliance to established LASSO regulations and procedures

Audit Field In-Charge July 1999 – May 2001 Laya Mananghay CPA’s and Management Consultants A member firm of KPMG International

- Conducts external audit services to audit clients - Prepares audit programs, audit working papers, audit reports, financial statements and income tax returns - Application of audit programs by performing established audit procedures and document all audit findings - Performs audit risk assessment as part of the overall audit planning activity - Finalization and wrap-up of audit working papers - Conducting other consulting services such as due diligence and special engagements

WORKING CAPABILITIES

Capable of managing internal audit operations, corporate compliance functions, external audit services, taxation function, accounting and finance operations Knowledgeable in all accounting, auditing, and taxation aspects in terms of theory, standards, and application Knowledgeable in risk assessment process as part of the overall audit planning for the internal or external audit function or as part of the strategic planning conducted by corporate management Capable of conducting all types of audit such as operational audit, financial audit, compliance audit, information technology audit, due diligence, agreed- upon procedures audit, and review procedures Capable of doing research studies on different government and professional regulations Capable of conducting tax compliance procedures SEMINARS & TRAININGS ATTENDED

2003 Imposition and Implementation of the Compliance Regulation Laws for Life Insurance Companies John Hancock Web Based Training on Internal Controls Information Technology Audit (Conducted by the Philippine Institute of Certified Public Accountants)

Insurance Commission Law on Corporate Governance & Anti-Money 2002 Laundering Updates on the new Statements of Financial Accounting Standards Salt & Light Business Training Management Team Building 2001 The New Philippine Standards on Auditing Teaching Methodologies KPMG Risk Based Management & Audit

KPMG Audit Process 2000 Real Estate Examination Review

GOVERNMENT LICENSURE EXAMINATION PASSED

Real Estate Licensure Examination 2000

Certified Public Accountant Board Examination 1999

EDUCATION

Masters in Business Administration 2003 De La Salle University Status: Currently Enrolled

Bachelor of Science in Accountancy 1999 Philippine School in Business Administration Status: Graduated in 1999

Certificate Course in Basic Microsoft Office CAL Computer School Status: Completed in 1998 1998

REFERENCES References may be provided upon request