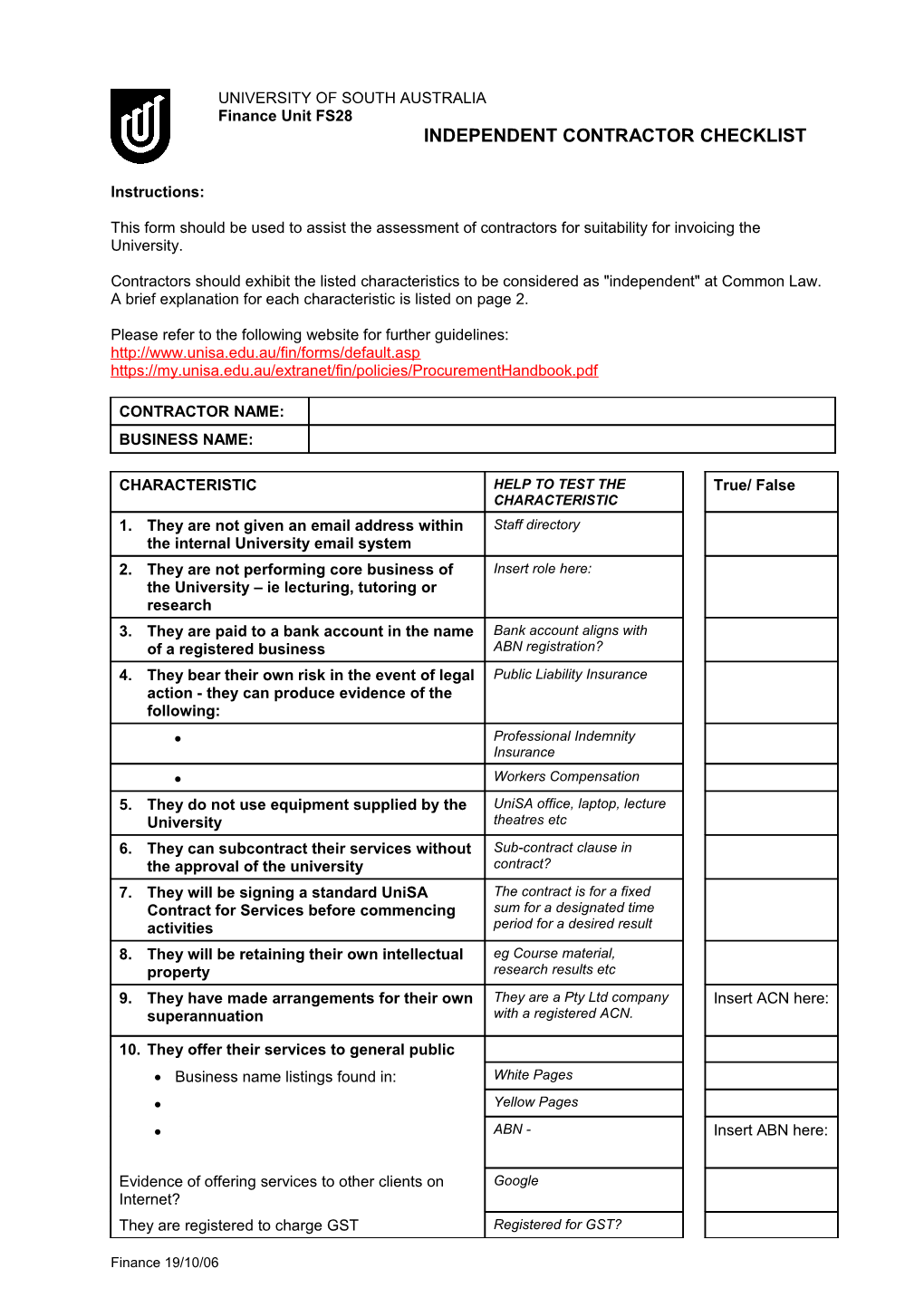

UNIVERSITY OF SOUTH AUSTRALIA Finance Unit FS28 INDEPENDENT CONTRACTOR CHECKLIST

Instructions:

This form should be used to assist the assessment of contractors for suitability for invoicing the University.

Contractors should exhibit the listed characteristics to be considered as "independent" at Common Law. A brief explanation for each characteristic is listed on page 2.

Please refer to the following website for further guidelines: http://www.unisa.edu.au/fin/forms/default.asp https://my.unisa.edu.au/extranet/fin/policies/ProcurementHandbook.pdf

CONTRACTOR NAME: BUSINESS NAME:

CHARACTERISTIC HELP TO TEST THE True/ False CHARACTERISTIC 1. They are not given an email address within Staff directory the internal University email system 2. They are not performing core business of Insert role here: the University – ie lecturing, tutoring or research 3. They are paid to a bank account in the name Bank account aligns with of a registered business ABN registration? 4. They bear their own risk in the event of legal Public Liability Insurance action - they can produce evidence of the following: Professional Indemnity Insurance Workers Compensation 5. They do not use equipment supplied by the UniSA office, laptop, lecture University theatres etc 6. They can subcontract their services without Sub-contract clause in the approval of the university contract? 7. They will be signing a standard UniSA The contract is for a fixed Contract for Services before commencing sum for a designated time activities period for a desired result 8. They will be retaining their own intellectual eg Course material, property research results etc 9. They have made arrangements for their own They are a Pty Ltd company Insert ACN here: superannuation with a registered ACN.

10. They offer their services to general public Business name listings found in: White Pages Yellow Pages ABN - Insert ABN here:

Evidence of offering services to other clients on Google Internet? They are registered to charge GST Registered for GST?

Finance 19/10/06 Please refer this checklist to Manager: Financial Support Services in Finance Unit on Phone 830- 21321 for assessment of contractor status.

Finance 19/10/06 GUIDELINES INDEPENDENT CONTRACTOR CHARACTERISTICS FOR FS28

1. They are not given access to email within the University All people who are given email access must sign an application acknowledging adherence to the University’s email policy. This is a common indicator of an employee rather than an independent contractor as it involves adherence to HR policy of a business. A true independent contractor would not normally be integrated into a business to the extent that they are given email access within the University unless they are employed through a registered Proprietary Limited company. People already employed on a Casual Contract basis with the University cannot be paid by invoice as they have established an employment relationship with the University. 2. They are not performing core business of the University. That is, teaching and research. Independent Contractors are commonly contracted to perform non-core activities that a staff members normally would not be able to perform such as specialist advice etc. 3. They are paid to a bank account in the name of a Proprietary Limited company with a current A.C.N. A common attribute of an independent contractor is that they incur costs associated with the running of a business, which in this case includes the maintenance of a business bank account. Payment to a bank account in the name of an individual is one of the indicators that the supplier may not satisfy the Common Law tests for independent contractor status. The minimum we may consider accepting would be a bank account in the name of a business registered with the relevant State Registrar of Business Names. 4. They bear their own risk in the event of legal action. Associated with the normal costs of running an independent contractor business are the obtaining of professional indemnity insurance, public liability insurance and provide for their own workers compensation insurance. An independent contractor would not be covered under the University’s workers compensation arrangements. An independent contractor would also normally own their intellectual property. 5. They do not use equipment supplied by the University. An independent contractor would normally supply their own computer, laptop, desk, office space. The use of university owned offices, computers and laptops, projection equipment in lecture theatres and tutorials is indicative of a person integrated into the Uni as an employee. 6. They can sub-contract their services without the approval of the University An independent contractor would normally be able to sub-contract their work to another party, but the nature of the teaching or research work often performed by the university requires special and often unique skills, making sub-contracting a difficult proposition. 7. They sign a standard University Contract for Services before commencing activities. A University standard contract would normally be signed by an authorized person of the business or company being contracted. The contract is for a fixed sum for a designated time period for a desired result. The contract should not be based on an hourly rate and should not make reference to awards or collective enterprise agreements. 8. They will be retaining their own intellectual property. An Independent Contractor would normally retain the intellectual property of the work produced. i.e. Lecture notes, tutorial exercises etc. 9. They have made arrangements for their own superannuation. The University is liable to pay contributions towards any person’s superannuation scheme who is paid in excess of $450 in any one month. Several exemptions apply including being a company registered with ASIC and therefore having a current A.C.N. The University must pay Compulsory Superannuation Guarantee obligations into UniSuper because we are exempt from the provisions of Super Choice. 10. They normally offer their services to the general public. They would be listed in White Pages, Yellow Pages and /or would be locatable as a separate business entity on the Internet via search engines such as Google etc. Finance 19/10/06