BREAK-EVEN ANALYSIS

Today the manager is a principal factor in the success or failure of any business enterprise. The primary function of management is to make a profit for the firm. Essentially, profit is generated by effective sales and/or distribution of products or services. Any decision-making organization actively concerned with profits will find itself involved in the analysis of costs and revenues. Since the firm must first recover its costs before it can make a profit. There are definite relationships between costs, revenues and profits. There are three levels of activity that are of the greatest concern to the management of any profit-seeking business. 1. Break-even point The activity level at which the firm has exactly enough revenue to recover all costs.

Revenue = Unit Selling Price X Sales ( in units ) (sales)

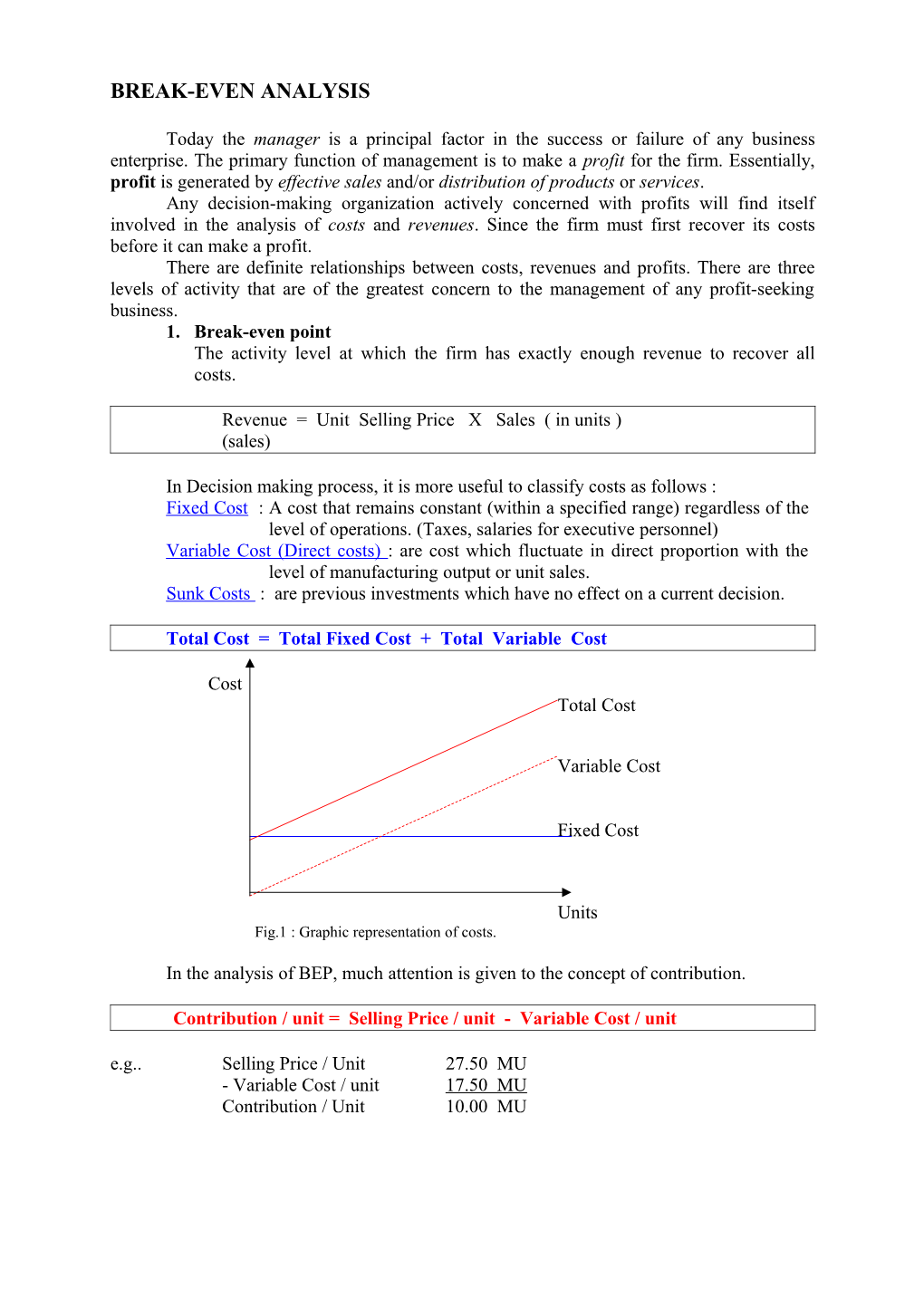

In Decision making process, it is more useful to classify costs as follows : Fixed Cost : A cost that remains constant (within a specified range) regardless of the level of operations. (Taxes, salaries for executive personnel) Variable Cost (Direct costs) : are cost which fluctuate in direct proportion with the level of manufacturing output or unit sales. Sunk Costs : are previous investments which have no effect on a current decision.

Total Cost = Total Fixed Cost + Total Variable Cost

Cost Total Cost

Variable Cost

Fixed Cost

Units Fig.1 : Graphic representation of costs.

In the analysis of BEP, much attention is given to the concept of contribution.

Contribution / unit = Selling Price / unit - Variable Cost / unit e.g.. Selling Price / Unit 27.50 MU - Variable Cost / unit 17.50 MU Contribution / Unit 10.00 MU Linear Analysis

Total Revenue (Total Income) = Selling Price / Unit X Sales ( Units) E = P X Total Cost = Total Fixed Costs + Total Variable Costs K = F + v x

Income E ( p, x) Cost K (F + vx)

Profit

BEP(MU) Break-even

Variable Cost Loss

Fixed Costs Units BEP (units) Fig.2: Break-Even point.

At Break-Even : E = K p x = F + v x p x - v x = F x ( p - v ) = F F X 0 p v

Fixed Cost Break Even (units) = UnitSelling price variable cost / unitı

Fixed Cost Break Even (units) = M arginal revenue M arginal cost

Example 1

Total Cost = 200 + 5 X Fixed Cost = 200 MU Total Revenue = 7 X Marginal Revenue = 7 MU Marginal Cost = 5 MU

Application of formula F 200 BE = X = = 100 units 0 MR MC 7 5 or 7 X = 200 + 5 X 7 X - 5 X = 200 2 X = 200 X = 100 units The firm must produce and sell 100 units. If the firm produces and/or sells than 100 units it will incur a loss, if it produces and sells more than 100 units, it will make a profit.

Break-Even in MU F X p p 0 p v F X (MU ) 0 v BE (MU) = 1 p

Break-Even as % Capacity

F BE(%) 100% ( p v)(unit capacityt)

F or BE(%) 100% (1 v / p)t p

Example 2

Demir Furniture Co. manufactures and sells bedroom suites. Each suite costs 250MU and sells for 400 MU. Fixed costs at Demir Furniture total 75 000 MU. Determine the Break- Even point using a). Algebraic analysis b). The general formula approach

Solution:

Data Summary : Unit selling price = 400 MU Cost per unit = 250 MU Total fixed cost = 75000 MU

a) Use of the algebraic approach requires us to equate the total revenue equation and the total cost equation. The breakeven point is the output (X0) where this equality is valid. TR = TC E = K p X = F + v X 400 X = 250 X + 75000 400 X – 250 X = 75000 X0 = 500 units Demir Furniture Co. has a breakeven point of 500 units. b) The general formula approach for strict breakeven requires the use of following formula F X 0 75000 BE = p v = = 500 units 400 250

The breakeven point equals 500 units.

Example 3

Best Cut Shops Ltd. Operates 10 haircut shops in Famagusta on a 250-days-per-year, 8 hours-per day basis. They charge 10 MU for a haircut. One shop has annual fixed costs of 84000 MU and variable costs estimated at 3 MU per customer. a) What is the contribution per customer? b) How many customers per hour must the shop average in order to break even?

Solution: a) Contribution = p – v = 10 MU – 3MU = 7 MU per customer F X 0 84000 84000 b) p v = 12000 customers/year 10 3 7

12000Customer / year i.e. 6 customers/hour (250 days / year)(8hours / day)

Example 4

If fixed costs are 40000 MU and available costs are estimated at 50% of the unit selling price of 160 MU, what is BEP?

Solution: F X 0 40000 p v = 500 units 160 80

Example 5

The owners of a professional football team have leased a 30000-seat-stadium for six games for a fixed cost of 1680000 MU. They expect variable costs to run 4 MU per spectator and tickets will sell for an average of 24 MU each. How many tickets, on average, must be sold per game for the owners to just break even?

Solution: F X 0 1680000 1680000 p v = 84000 seats / year 24 4 20

84000seats Seats / game = 14000 seats / game 6 games / year Example 6

A computer company plans to produce 30000 computers next year. They will sell for 700 MU each. The fixed cost of operation care 5 million and total variable costs are 6 million MU. What is the break-even point?

Solution: F X 0 6000000 MU p v where v = 200 MU / unit 30000 units

5000000 MU X 0 = 10000 units (700 MU 200 MU) / unit

Example 7

A DVD player sells for 350 MU and has variable cost of 85 MU. a) Find the contribution b) Find the contribution ratio

Solution: a) Contribution = p –v = 350 MU – 85 MU = 265 MU p v v 85 265 b) Contribution margin 1 1 0.76 p p 350 350

Example 8

Izmir Shoe-City Ltd. Produces 24000 pairs of running shoes per month. Annual fixed costs are 840000 MU and the contribution from each pair is 60% of their 20 MU per-unit selling price. Find the break-even volume.

Solution: F 840000 X 0 70000 pairs Where p – v = 0.60 (20) = 12 p v 12

F 840000 X (MU) 1400000 0 v 0.6 or 1 MU p 1400000 MU X 0 (Units) 70000 pairs 20 MU / unit

Example 9

Turkish airlines offers customers a vacation plan for 520 MU. The Airline estimates that the fixed costs associated with this plan are 720000 MU and at a volume of 3000 passengers total variable cost would be 480000 MU and profits should be 360000 MU. a) Find the break-even volume b) If fixed costs remained constant, how many additional passengers (beyond Break- even) would be required to increase profits to 500000 MU? Solution: F 720000 48000 a) X 0 2000 passengers Where v 160MU/passenger p v 520 160 3000

b) Contribution = p – v = 520 – 160 = 360 MU/passengers 500000 # of passenger = 1389 passengers 360 or π = ( TS – BEP )( p – v ) 500 000 = ( X1 – 2 000 )( 360 ) X1 = 3 389 passengers 1 389 additional passengers over break-even point.

Example 10

Cyprus Packing Ltd. Packages orange juice in 300 cl. – cans which they sell to grocery distribution warehouses for 48 MU/case. The packing company has fixed costs of 324000 MU and variable costs of 30 MU/case. The plant has a capacity of 100000 cases per season. a) Find the contribution b) How many cases must be sold to break-even? c) What is the profit (or loss) if the plant operates at full capacity for the season?

Solution:

a) Contribution = price/unit – variable cost/unit = p – v = 48 MU/case – 30 MU/case = 18 MU/case F 324000 MU / season b) X 0 18000 cases / season p v 18 MU / case

b) = (100000 – 18000) (18) = 1476000 MU

Example 11

Azim Electronics has the capacity to produce 30000 networking devices per year at a plant in Cyprus. Their variable costs are 12 MU/Unit. They are currently operating at 80% of plant capacity, which generates a revenue of 720 000 MU/year, at current volume, the fixed costs are 360000 MU. a) What is the current annual profit or loss? b) What is the break-even quantity? c) What would be the firm’s profit, if they could operate at 95% of capacity?

Solution:

a) Current volume = 80% ( 30000 units) = 24000 units Profit = = TR – TC = 720000 MU – ( 360000 + 24000 x 12 ) = 720000 – (360000 + 288000) = 720000 – 648000 = 72000 MU 720000 MU (TR) b) p 30 MU / unit 24000 units (X ) 360000 360000 X 20000 units 0 30 12 18 c) What would be the profit for 95% of capacity? Capacity = 95%, Volume = 0.95 (30000) = 28500 units = (Sales Volume – BEP) (Contribution) = (28500 – 20000) (18) = 153000 MU

Example 12

Tahil Ticaret Company has 30 employees and handles 1500 loads per year of grain from a konya warehouse. The firm has fixed costs of 70000 MU/year and variable costs of 170 MU/load. The production and operations manager is considering installing an 80000 MU automated material handling system that will increase fixed costs by 20000 MU/year. It will also increase the per unit contribution of each load by 20 MU. The firm operates 250 days/year and they receive an average of 300 MU revenue for each load passed through the warehouse. a) what is the current annual profit (or loss)? b) What is the new BEP volume if the investment is made?

Solution: F 70000 70000 a) X 0 538.46 units p v 300 170 130

= (1500 – 538.46) (300 – 170) = 125000 MU or = TR – TC = 1500 (300) – 70000 + 1500 (150) = 450000 – 325000 = 125000 MU b) New Fixed Cost = 70000 + 20000 = 90000 MU Contribution = 300 – 170 = 130 MU New Contribution = 130 MU + 20 MU = 150 MU F 90000 X 600 units 0 p v 150 Example 13

Process A has fixed cost of 80000 MU per year and variable cost of 18 MU/unit, whereas process B has fixed costs 32000 MU per year and variable costs of 48 MU/unit. At what production quantity X0 are the total costs of A and B equal?

Solution:

Set total costs equal : TCA = TCB FA + VA X = FB + VB X 80000 + 18 X = 32000 + 48 X 48000 = 30 X

X0 = 1600 units

Example 14

A firm has annual fixed costs of 6.4 million MU and variable costs of 14 MU/unit. It is considering and additional investment of 1600000 MU, which will increase the fixed costs by 300000 MU/year and will increase contribution by 4 MU/unit. No change is anticipated in the sales volume or sales price of 30 MU/unit. What is the BE quantity if the new investment is made?

Solution:

The 4 MU increase in contribution will decrease variable cost per unit to 14MU – 4 MU = 10 MU/unit The addition to Fixed Costs makes them 6.4 million + 300000 MU = 6.7 million MU F 6700000 X 335000 units 0 p v 30 10

Example 15

Mohuiddin Computer Ltd. Produces a computerized monopoly game and wishes to establish a break-even analysis report. The game sells for 37.50 MU each, but volume has never been dropped below 4000 units and the costs are not accurately classified into fixed and variable costs. Although 72000 MU of costs are reported as “fixed”, some of the “variable” cost items (e.g selling and administrative) have fixed components. The following cost data is available for two representative volumes.

Costs at volume of 4000 units 12000 units Labor 20000 MU 40000MU Material 50000 110000 Overhead 78000 88000 Sell& Adm. 30000 40000 Total other costs 178000 MU 278000 MU Known fixed costs 72000 72000 250000 MU 350000 MU

Solution:

change in Total Costs a) The slope of the total cost line, i.e. , gives us the change in Total Quantity variable cost / unit.

350000 MU 250000 MU 100000 MU v 12.50 MU/unit 12000 units 4000 units 8000 units

b) In order to find fixed costs, we can subtract total variable cost from total cost of either for 4000 units or 12000 units. F = Total Cost @ 4000 units – 4000 x 12.50 = 250000 MU – 50000 MU = 200000 MU

c) Contribution is = p – v = 37.50 MU – 12.50 MU = 25.00 MU/unit 200000 d) X 8000 units 0 25 e) Estimation of profit at a volume of 10000 units Profit = TR –TC = (10000 x 37.50) – (200000 + 10000 x 12.50) = 50000 MU or = (Total Sales – BEP) (p – v) = (10000 – 8000) (37.50 – 12.50) = 5000 MU

Example 16

Cheap-Shot Retailing is currently purchasing a certain commodity at a cost of 7 MU/unit and is selling the item at a price 10 MU/unit. Total fixed cost is 15,000 MU. An offer is made by the wholesaler to provide the item at a cost of 6 MU/unit, if Cheap-Shot will guarantee a minimum annual purchase of 7,500 units. In considering the offer, it is determined that acceptance will require a 20% increase in fixed costs; and, because of the reduced unit cost, the product could be sold at a 15% lower price than the current retail price. The current sales level is 6,000 units per year; it is estimated that the price reduction will increase sales by 30%. Should the offer be accepted or rejected?

Solution:

Data Summary: Current Operating Data Projected Operating Data Fixed Cost 15000 MU 40000MU Variable cost/unit 7 6 Unit Selling price 10 8.5 Estimated Sales level (units) 6000 7800 Units Purchased 6000 7800

* F.Cost = 15000 MU + 0.20 (15000 MU) = 18000 MU S. Price / unit = 10 MU – 0.15 (10MU) = 8.50 MU Sales (units) = 6000 + 0.30 (6000) = 7800 units

a) Method 1 : Break-Even Analysis 15000 X 5000 units (For current operations) 01 10 7 18000 X 7200 units (For projected operations) 0 2 8.5 6

Acceptance of the wholesaler’s offer will increase the BEP_ from its current level of 5000 units to 72000 units, a 44% increase. This, in turn, will REDUCE the sales above the BEP from 1000 units (6000 – 5000) to 600 units (7800 – 7200).

Decision : The wholesaler’s offer should NOT be accepted. b) Method 2 : Cost-Profit Analysis i. Current operations = (6000 – 5000) (10 – 7) = 1000 (3) = 3000 MU or Total Revenue : 10 (6000) = 60000 MU Total Cost : 15000 + 7 (6000) = 57000 MU Profit : 3000 MU The current operation produces a profit of 3000 MU.

ii. Projected Operations = (7800 – 7200) (8.5 – 6) = 600 (2.5) =1500 MU or Total Revenue : 8.5 (7800) = 66300 MU Total Cost : 18000 + 6 (7800) = 64800 MU Profit : 66300 – 64800 = 1500 MU The projected operation will result in a profit of only 1500 MU.

Decision : The wholesaler’s offer should be rejected because it will decrease the profit level.

Example 17

ABC Inc., operates a medium-sized assembly line. At the present time the management of ABC, Inc., is considering the addition of a new press to its assembly operation. If the press is added, it will reduce variable cost by 20% per unit; however, the cost of the new press will increase fixed cost-by 75,000 MU. Assuming no other change, and given the following current operating data, determine whether or not the new press should be purchased.

Current operating data: Fixed cost 250,000 MU Variable cost per unit 40 MU Unit Selling price 65 MU Projected Sales 20,000 units

Solution:

Data Summary. Current Operating Addition of New Press Fixed Cost 250000 MU 325000MU (increased by 75000MU) Unit Selling price 65 MU 65 MU (no change) Unit variable cost 40 MU 32 MU (reduced by 20%) Projected Sales (units) 20000 20000 a) Method 1 : F 250000 current operations : BE X 0 10000 units p v 65 40 F 325000 New Press BE X 0 9848.49 units p v 65 32 Under linear analysis, the best decision with a fixed level of output is simply “select the program that has the lowest breakeven volume”. ABC Inc. should install the new press. Although this decision will increase fixed costs by 75000 MU, it will decrease unit costs enough to more than compensate for the change. b) Method 2 : total contribution analysis Current Operations Addition of New press Total Revenue : 1300000 MU 1300000 MU - Cost of Goods sold 800000 MU 640000 MU Gross Margin (contribution) 500000 MU 660000 MU - Total fixed cost 250000 MU 325000 MU Profit 250000 MU 335000 MU

Or (current operations) = (20000 – 10000) (65 – 40 ) = 10000 (25) = 250000 MU (new press) = (20000 – 9849) (65 – 32) = 10151 (65-32) = 334983 MU

Using total contribution analysis, addition of the new press will increase profit from 250,000 MU to 335,000 MU. ABC Inc., should install the new press.

Example 18

A producer of digital cameras sells his product through a credit card firm at 60 MU each. The production costs at volume 10,000 and 25,000 units are as follows:

10,000 units 25,000 units . Labor 120,000 MU 200,000 MU Materials 240,000 400,000 Overhead (F + V) 180,000 220,000 Selling & administration 100,000 120,000 Depreciation & other fixed cost 160,000 160,000 ------Total 800,000 MU 1,100,000 MU ------Use the data to determine the BEP. Solution:

Note that the slope of the total cost line (that is, change in Y/change in X) is the variable cost per unit. Y change in Total Costs 1100000 800000 v X change in Total Quantity 25000 10000 300000 v 20 MU / unit 15000 In order to find Fixed Costs, we can subtract total variable cost from total cost of E.G. 10000 units. F = Total Cost @ 10000 units – 10000 x 20 = 800000 – 200000 = 600000 MU 600000 60000 X 15000 units 0 60 20 40

Example 19

Data for a break-even analysis revealed that total costs at volumes of 600 and 800 units were 160,000 MU and 192,000 MU respectively. Revenue is 288 MU/unit. Based upon this information, what are a). the variable costs per unit b). the fixed costs

Solution: Total Cost 192000 160000 32000 a) Variable Cost 160 MU/unit quantity 800 600 200

b) F = TC@600 - vx@600 = 160000 – 600 (160) = 160000 – 96000 = 64000 MU

Example 20

Guzel Havuz Ltd. Sells their product for 6,000 MU each, at a volume of 20 units, their labor, materials, overhead and other costs total is 120,000 MU and at a volume of 40 units the total is 160,000 MU. a) What is your best estimate of the variable cost per unit? b) Estimate the fixed costs. c) At what volume does the firm break-even? d) Estimate the profit at a volume of 60 units.

Solution:

Total Cost 160000 120000 40000 a) v 2000 MU/unit quantity 40 20 20

b) F = TC@20 - vx = 120000 – 20 (2000) = 80000 MU 80000 80000 c) X 20 units 0 6000 2000 4000 d) = (60 – 20) (6000 – 2000) = 40 (4000) = 160000 MU

Example 21

ABC, a medium-sized manufacturing firm, is considering the addition of a new machine to its present assembly operation. The machine is expected to reduce variable cost by 15% per unit; however, it will add 60,000 MU to total fixed cost. Assuming no other change, and given the following current operating data, determine whether or not the new machine should be purchased.

Current operating data: Fixed cost 200,000 MU Variable cost per unit 20 MU Unit selling price 30 MU Expected annual sales 30,000 units Solution:

Data Summary. Current Operating Anticipated Operating Data (before purchase) Data (after purchase) Fixed Cost 200000 MU 260000 MU Unit variable cost 20 MU 17 MU Unit Selling price 30 MU 30 MU Estimated annual sales 30000 Units 30000 units Method 1 : Break-Even Analysis 200000 a) Prior to acquisition : X 20000 units 0 30 20

260000 b) After acquisition: X 20000 units (For projected operations) 0 30 17

Break-even analysis suggests that ABC should be indifferent with regard to the purchase of the additional equipment. The decrease in variable cost per unit is exactly offset at the level by the increase in fixed cost. So the firm does not appear to benefit from the acquisition.

Method 2 : Cost-Profit Analysis a) Prior to acquisition Total Revenue : 30 (30000) = 900000 MU Total Cost : 200000 + 20 (30000) = 800000 MU Profit : 900000 – 800000 = 100000 MU or = Sales (units) – BEP (units) p – v = (30000 – 20000) (30 – 20) = 100000 MU

b) After acquisition Total Revenue : 30 (30000) = 900000 MU Total Cost : 260000 + 17 (30000) = 770000 MU Profit : 900000 – 770000 = 130000 MU or = Sales (units) – BEP (units) p – v = (30000 – 20000) (30 – 17) = 130000 MU If the new equipment is purchased, ABC will receive a profit of 130000 MU.

Break-Even Analysis alone may no be sufficient to solve a DECISION problem. If Sales Levels are known or can be estimated with a satisfactory degree of accuracy, these should be incorporated into the analysis. The joint utilization of BE and C-P calculations is one way of extracting meaningful information for Decision Making.

Example 22

Azim Industries is considering a revision of its current advertising program. The current program requires a fixed investment of 15,000 MU. The proposed program will require a fixed investment of 25,000 MU. Azim’s products currently retail at 125 MU/unit and cost 100 MU/unit. a) Using the data at hand, what effect would the revised program have on Azim’s break-even volume? b) If the maximum output for the Azim is 1,500 units, should the revised program be undertaken? Why or why not?

Solution:

Data Summary. Current Program Revised Program Fixed Cost 15000 MU 25000 MU Selling price / unit 125 MU 125 MU Cost / unit 100 MU 100 MU a). i. Break-even using the current program 15000 X 600 units 01 125 100 ii Break-even using the revised program 25000 X 1000 units 02 125 100 The revised program has a break-even point of 1000 units b) Since Azim’s output is fixed at 1500 units, a decision on implementing the revised program can be made on the basis of optimum profit. Current Program Revised program Sales (units) 1500 1500 Total Revenue 187500 MU 187500 MU Cost of Goods 150000 MU 150000 MU Gross Margin 37500 MU 37500 MU Total variable costs 0 0 Total contribution 37500 MU 37500 MU Total fixed cost 15000 MU 25000 MU Profit 22500 MU 12500 MU

or (current) = (1500 – 600) (125 – 100) = 900 (25) = 22500 MU (revised) = (1500 – 1000) (125 – 100) = 500 (25) = 12500 MU

On the basis of profit, the revised program should not be undertaken. Since there are no adjustments in the selling price per unit or unit costs, the revised program will simply decrease Azim’s profit by the amount of the cost increase.

IMPORTANT!

Under linear analysis, the best decision with a fixed level of output is simply “Select the program that has the lowest BE volume”. ______

Example 23

Refinery operations at Altinoglu Station, a single-proprietor operation, necessitate the leasing of certain equipment at the rate of 350 MU/month. Altimoglu has three employees whose total wages are 1,650 MU/month. Utilities cost Altinoglu a total of 250 MU/month. The contribution margin is 0.20 MU/gallon. What is the break-even point for Altinoglu? Solution:

Data Summary : Cost of Utilities = 250 MU / month Employee wage = 1650 MU / month Lease rate = 350 MU/ month 2250 MU / month Contribution margin 0.20 MU / Gallon F 2250 BEP X 11250 gallons 0 p v 0.20 Altinoglu will break even at a volume of 11250 gallons of gasoline.

Example 24

Azim Consultants is operating on an annual volume of 750,000 MU revenue from services. Total variable cost for Azim is 250,000 MU. If Azim has a total fixed cost of 200,000 MU, at what volume revenue does it break even?

Solution:

Data Summary : Total variable cost / year = 250000 MU Total fixed cost = 200000 MU Total revenue = 750000 MU

Fixed Cost F 200000 200000 BE(MU ) X (MU ) 300000 MU 0 Total variable cost vx 250000 1 1 1 1 1 Total annual sales px 750000 3 Azim Consultants will break even with an annual volume of 300000 MU.

Example 25

Genel Saglik Hospital currently purchases a certain type of surgical supply at a cost of 15 MU/unit. When the surgical units are required, Hospital charges 25 MU/unit. A local medical supplier has offered to provide the surgical supply a cost of 10 MU/unit if Hospital will guarantee a minimum annual purchase of 4,000 units. In considering the offer, the directors of Saglik Hospital have determined that acceptance will require a 30% increase in fixed cost; however the patient charge could be reduced 20% on a per unit basis. At the present time, Saglik uses 2,500 units each year, but it has been said that the hospital will increase its use rate by 40% in the coming year. In addtion Saglik current policy requires a fixed investment of 30,000 MU in its supply program. Acceptance of this offer will increase this fixed investment to 50,000 MU. Should the offer be accepted or rejected? Why? Solution:

Data Summary. Current Policy Revised Policy Fixed Cost 30000 MU 39000 MU Price / unit - service 25 MU 20 MU Cost / unit - service 15 MU 10 MU Annual purchase 3500 units 4000 units

Method 1 Break even Analysis a) Current Policy 30000 X 3000 units 0C 25 15

= (use rate – BEP) (p – v) = (3500 – 3000) (25 – 15) = 5000 MU

b) Revised Policy 39000 X 3900 units 0R 20 10 = (use rate – BEP) (p – v) = (4000 – 3900) (20 – 10) = 1000 MU

Under its current purchase policy, hospital can expect to break even when it uses 3000 units of surgical material. Its expected usage is 3500 units, a situation which will result in an expected profit of 5000 MU. Under the revised purchase policy, hospital expected break-even point is 3900 units. This leads the hospital to 1000 MU profit. Hospital should not accept supplier’s offer. The current purchase policy is more economical.