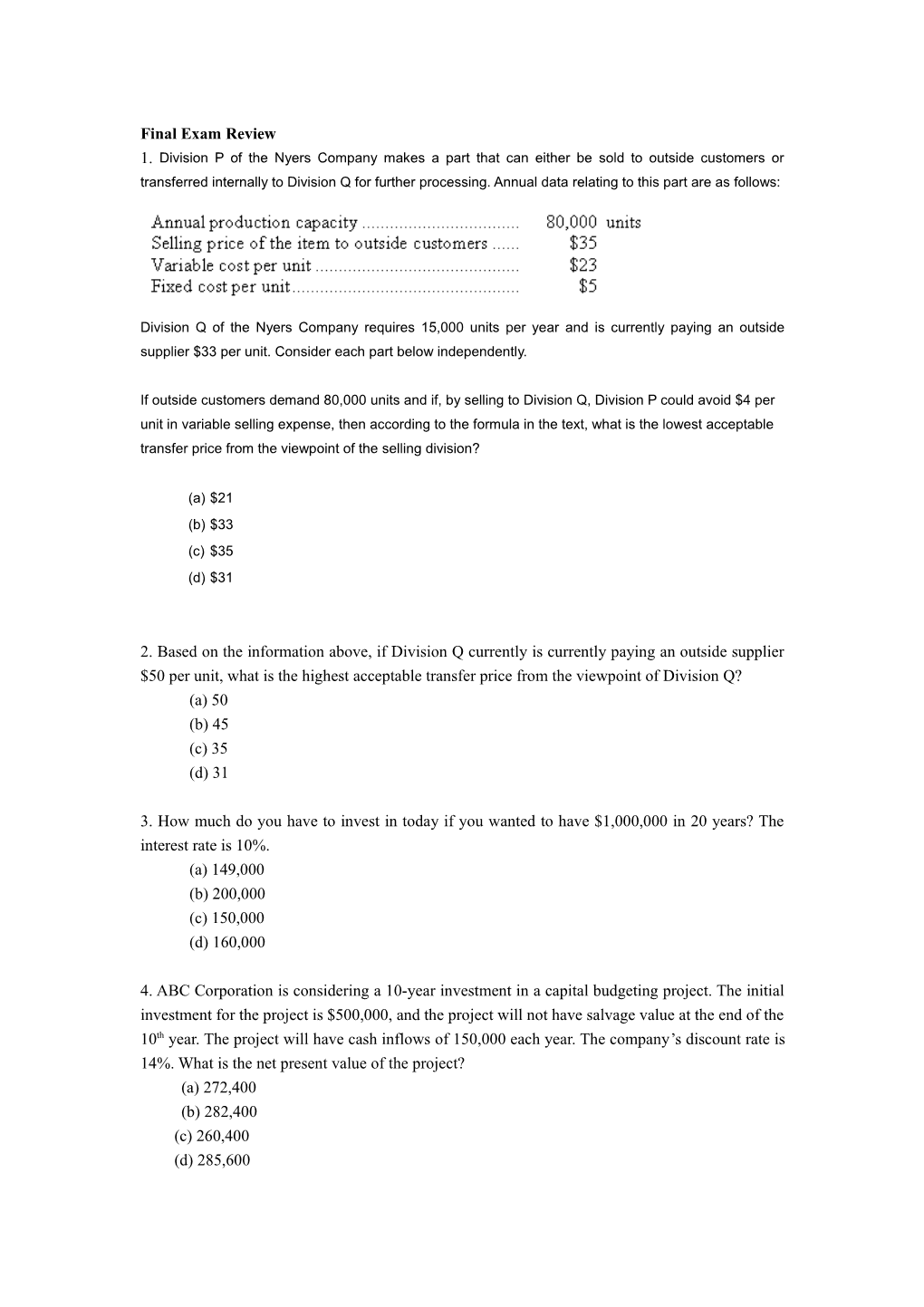

Final Exam Review 1. Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred internally to Division Q for further processing. Annual data relating to this part are as follows:

Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

(a) $21 (b) $33 (c) $35 (d) $31

2. Based on the information above, if Division Q currently is currently paying an outside supplier $50 per unit, what is the highest acceptable transfer price from the viewpoint of Division Q? (a) 50 (b) 45 (c) 35 (d) 31

3. How much do you have to invest in today if you wanted to have $1,000,000 in 20 years? The interest rate is 10%. (a) 149,000 (b) 200,000 (c) 150,000 (d) 160,000

4. ABC Corporation is considering a 10-year investment in a capital budgeting project. The initial investment for the project is $500,000, and the project will not have salvage value at the end of the 10th year. The project will have cash inflows of 150,000 each year. The company’s discount rate is 14%. What is the net present value of the project? (a) 272,400 (b) 282,400 (c) 260,400 (d) 285,600 5. X Corporation is considering a project that would require an investment of $500,000. The annual net operating income of the project would be $100,000. What is the payback period of the project? (a) 3 years (b) 5 years (c) 7 years (d) 4 years

6. Porter Company is considering investing in a 5-year project that has an initial investment of $500,000. The project will generate $125,219 income each year. If there is no salvage value at the end of the period, what is internal rate of return for the project? (a) 4% (b) 5% (c) 8% (d) 9%

7. The management of Plotnik Corporation is investigating purchasing equipment that would increase sales revenues by $559,000 per year and cash operating expenses by $206,000 per year. The equipment would cost $264,000 and have a 6 year life with no salvage value. The simple rate of return on the investment is closest to:

(a) 117% (b) 123.7% (c) 55.3% (d) 16.7%

8. If the annual net operating income from a project is $5,000, which includes depreciation of $1,500, What is the net annual cash flow? (a) 6,500 (b) 3,500 (c) 5,000 (d) 1,500

9. The following selected data pertain to Beck Co.'s Beam Division for last year:

Sales $2,000,000

Variable expenses $600,000

Traceable fixed expenses $730,000

Average operating assets $540,000

Minimum required rate of return 15% Note: the traceable fixed expenses do not include any interest expense.

How much is the return on the investment?

(a) 130% (b) 124% (c) 15% (d) 48%

10. The following selected data pertain to Beck Co.'s Beam Division for last year:

Sales $2,190,000 Variable expenses $690,000 Traceable fixed expenses $880,000 Average operating assets $588,500 Minimum required rate of return 25%

How much is the residual income?

(a) $472,875 (b) $291,500 (c) $620,000 (d) $588,500

11. Wendler Inc. uses a job-order costing in which any underapplied or overapplied overhead is closed out to cost of goods sold at the end of the month. The company's cost of goods manufactured for July was $229,000 and its beginning and ending inventories were:

Inventories: Beginning Ending

Work in process $17,000 $13,000

Finished goods $32,000 $53,000

During the month, the manufacturing overhead cost incurred was $51,000 and the manufacturing overhead cost applied was $54,000.

The cost of goods sold that appears on the income statement for July and that has been adjusted for any underapplied or overapplied overhead is closest to:

(a) $263,000 (b) $246,000 (c) $205,000 (d) $211,000

12. The following information has been provided by the Ellen Stores. Inc. Sales: $200,000 Fixed selling and administrative expense: $50,000 Variable selling and administrative expense: $20,000 Cost of goods sold: $80,000

The gross margin of the company is: (a) 100,000 (b) 80,000 (c) 120,000 (d) 70,000

13.Kiefer Company, which has only one product, has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

What is the net operating income for the month under absorption costing?

(a) $11,600 (b) $6,800 (c) $29,200 (d) $9,600

14. Tricia Corporation is a single product firm that sells its product for $3.50 per unit. Variable expense per unit at Tricia is $2.10. Tricia expects fixed expenses to total $18,900 for next year. How many units would Tricia have to sell next year in order to break-even?

(a) 32,400 (b) 14,495 (c) 66,150 (d) 13,500