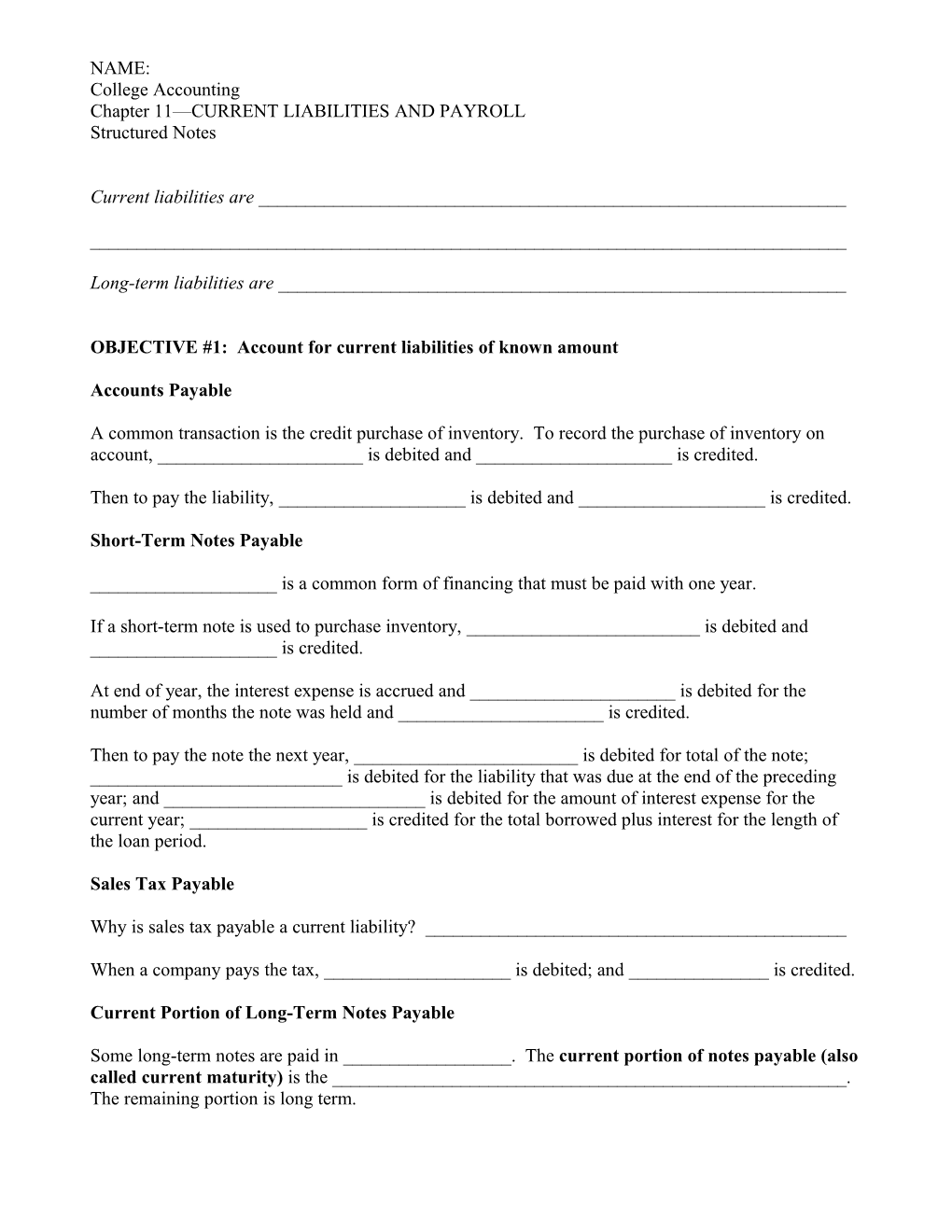

NAME: College Accounting Chapter 11—CURRENT LIABILITIES AND PAYROLL Structured Notes

Current liabilities are ______

______

Long-term liabilities are ______

OBJECTIVE #1: Account for current liabilities of known amount

Accounts Payable

A common transaction is the credit purchase of inventory. To record the purchase of inventory on account, ______is debited and ______is credited.

Then to pay the liability, ______is debited and ______is credited.

Short-Term Notes Payable

______is a common form of financing that must be paid with one year.

If a short-term note is used to purchase inventory, ______is debited and ______is credited.

At end of year, the interest expense is accrued and ______is debited for the number of months the note was held and ______is credited.

Then to pay the note the next year, ______is debited for total of the note; ______is debited for the liability that was due at the end of the preceding year; and ______is debited for the amount of interest expense for the current year; ______is credited for the total borrowed plus interest for the length of the loan period.

Sales Tax Payable

Why is sales tax payable a current liability? ______

When a company pays the tax, ______is debited; and ______is credited.

Current Portion of Long-Term Notes Payable

Some long-term notes are paid in ______. The current portion of notes payable (also called current maturity) is the ______. The remaining portion is long term. NAME: At the end of the year, the company may make an adjusting entry to shift the current installment of the long-term note payable to a current liability by debiting ______and crediting ______.

Accrued Expenses (Accrued Liabilities)

An accrued expense is an ______. That’s why accrued expenses are also called accrued liabilities. An example of an accrued expense is ______because accrued expenses typically occur with the passage of time.

Payroll, also called ______, also creates accrued expenses.

Unearned Revenues

Unearned revenue is also called ______. The business has received cash in advance and, therefore, has an obligation to ______

An example of unearned revenue is the receipt of cash for magazine subscription. To record the receipt of cash for a magazine subscription, the company would debit ______and credit ______.

If a third of the subscriptions are delivered during the first of three years, the adjusting entry to decrease the liability and increase the revenue would be to debit ______and credit ______

CURRENT LIABILITIES THAT MUST BE ESTIMATED

OBJECTIVE #2: Account for current liabilities that must be estimated.

An example of a liability that a company knows exists but does not know the exact amount is ______, common for companies like General Motors and Sony.

The ______says to record warranty expense in the same period that revenue is recorded. The expense occurs when you ______, not when you pay warranty claims. Because the exact amount is not known, the business estimates it warranty expense and related liability.

To record the accrued warranty expense, ______is debited and ______is credited.

Then when the payments are made, ______is debited and ______is credited.

Contingent Liabilities

A contingent liability is not an ______. Instead, it is a potential liability that depends on ______.

The accounting profession divides contingent liabilities into three categories: NAME:

Likelihood of Actual Loss How to Report the Contingency Remote

Reasonably possible

Probable, and the amount of the loss can be estimated

ACCOUNTING FOR PAYROLL

OBJECTIVE #3: Compute payroll amounts.

Numerous ways to express employee’s pay:

______is pay stated at an annual, monthly, or weekly rate.

______are pay amounts stated at an hourly rate.

______is pay stated as a percentage of a sale amount

______is pay over and above base salary (wage or commission). A bonus is usually paid for ______--in a single amount after year-end.

______are extra compensation—items that are not paid directly to the employee. Some example of benefits include ______

Businesses pay employees at a base rate for a set period called ______. For additional hours--______, the employee may get a higher pay rate.

Gross Pay and Net (Take-Home) Pay

Gross Pay: ______

______

______

Net Pay (Take-Home Pay): ______

______

The employer writes a paycheck to each employee for his/her ______.

Amounts withheld from paychecks are called ______. NAME: PAYROLLWITHHOLDING DEDUCTIONS

Payroll withholding deductions are the difference between ______and ______pay.

Payroll deductions fall into 2 categories:

Required deductions, examples include: ______

Optional deductions, examples include: ______

After being withheld, payroll deductions become the ______, who then pays the outside party—taxes to the government, etc.

U.S. law requires companies to withhold______. The income tax deducted from gross pay is called ______. The amount withheld depends on ______.

An employee files Form ______with his employer to indicate the ______. Each allowance lowers the amount of tax withheld.

The Federal Insurance Contributions Act ______, also known as the Social Security Act, created the Social Security Tax.

The Social Security program provides ______.

The law requires employers to withhold ______from employees’ paychecks.

The FICA tax has two components:

1. ______

2. ______

The OASDI tax rate in 2008 was ______%, applied to the first $ ______of employee earnings in a year.

The Medicare portion of the FICA tax applies to ______. The most recent rate is ______% The text will use a ______% FICA tax rate.

Many employers offer ______plans that let workers select from a menu of insurance coverage.

Employer Payroll Taxes

In addition to income tax and FICA tax, which are withheld from employee paychecks, ______Must pay at least three payroll taxes—which do ______come out of employee paychecks. NAME: 1. ______2. ______3. ______

EMPLOYER FICA TAX

In addition to the employee’s Social Security tax, the employer must pay ______.

STATE AND FEDERAL UNEMPLOYMENT COMPENSATION TAXES

______finance workers’ compensation for people laid off from work.

In recent years, employers have paid a combined tax of ______% on the first $______of each employee’s annual earnings. The proportion paid to the state is ______%, plus _____% to the federal government.

Employers use two liability accounts: ______

Payroll Accounting

Objective #4: Record basic payroll transactions.

To record Salary Expense: The gross salary amount is debited to ______. The net (take-home pay) is credited to ______. The difference amount(s) are credited to ______.

To record the Benefits Expense: The various expenses are debited and ______is credited.

To record Payroll Tax Expense: ______is debited and these three accounts are credited: ______

THE PAYROLL SYSTEM

Objective #5: Use a payroll system

The components of the payroll system are: ______, ______, and ______

Payroll Record

Each pay period the company organizes payroll data in a special journal called the ______. The payroll record works like a ______for recording payroll checks.

The payroll record gives the employer the information needed to ______NAME:

Payroll Checks

Most companies pay employees by ______or ______. A paycheck has an attachment that ______.

Earnings Record

The employer must file a payroll tax return with both ______. These forms must be filed no later than ______after the end of a quarter.

The employer must also provide the employee with a wage and tax statement, Form ______, at the end of the year.

The employee earnings record is neither a journal nor a ledger, and it is not required by law. It helps the employer ______.

The W-2 is used to prepare ______.

Paying the Payroll

Most employers make three cash payments for payrolls: ______

NET (TAKE-HOME) PAY TO EMPLOYEES

To pay employees, the company debits ______and credits ______.

BENEFITS PAID TO INSURANCE COMPANIES AND INVESTMENT COMPANIES

The employer might pay for employees’ insurance coverage and their retirement plans, ______is debited and ______is credited.

PAYROLL TAXES AND OTHER DEDUCTIONS

The employer must send the government two sets of payroll taxes: ______

INTERNAL CONTROL OVER PAYROLL

There are two main controls for payroll: ______

______

CONTROLS FOR EFFICIENCY NAME: Reconciling the bank account can be time-consuming because there may be many outstanding paychecks. To limit the outstanding checks, a company may use ______.

CONTROLS TO SAFEGUARD PAYROLL DISBURSEMENTS

Companies have separate department for the following payroll functions: ______

______

______

______

REPORTING CURRENT LIABILITIES

Objective #6: Report current liabilities on the balance sheet.

At the end of each period, the company reports all of its current liabilities on the ______.

ETHICAL ISSUES IN REPORTING LIABILITIES

If a company fails to accrue warranty expense, total expenses will be ______and net income to be ______.