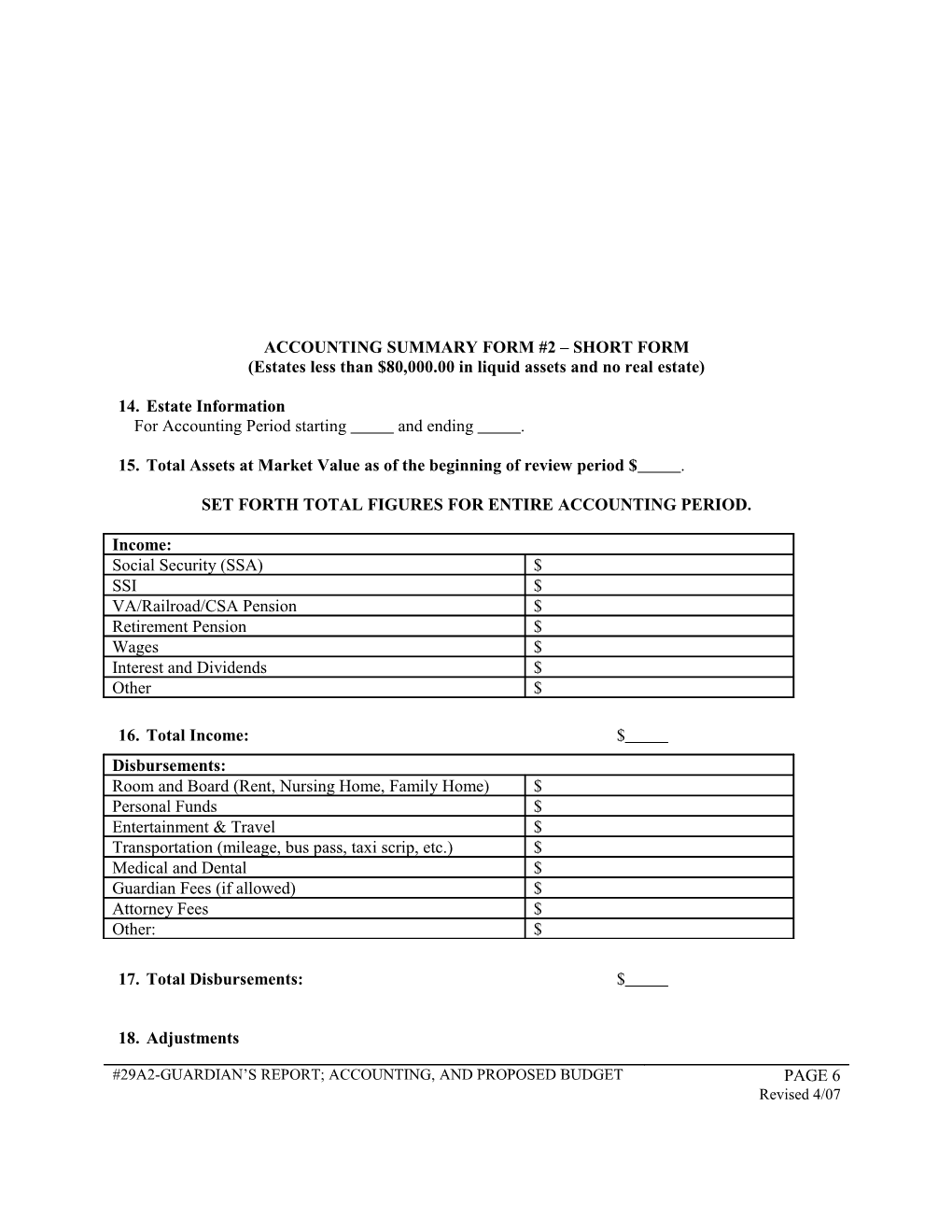

ACCOUNTING SUMMARY FORM #2 – SHORT FORM (Estates less than $80,000.00 in liquid assets and no real estate)

14. Estate Information For Accounting Period starting and ending .

15. Total Assets at Market Value as of the beginning of review period $ .

SET FORTH TOTAL FIGURES FOR ENTIRE ACCOUNTING PERIOD.

Income: Social Security (SSA) $ SSI $ VA/Railroad/CSA Pension $ Retirement Pension $ Wages $ Interest and Dividends $ Other $

16. Total Income: $ Disbursements: Room and Board (Rent, Nursing Home, Family Home) $ Personal Funds $ Entertainment & Travel $ Transportation (mileage, bus pass, taxi scrip, etc.) $ Medical and Dental $ Guardian Fees (if allowed) $ Attorney Fees $ Other: $

17. Total Disbursements: $

18. Adjustments

#29A2-GUARDIAN’S REPORT; ACCOUNTING, AND PROPOSED BUDGET PAGE 6 Revised 4/07 (Net gain/loss in value of assets over accounting period) $

19. Total Assets (as of closing date of accounting period) $

(Line 15, plus Line 16, minus Line 17 plus or minus Line 18 should equal Line 19. If it does not, your account does not balance. The account must balance to be approved by the Court.)

20. Explanation (for any large or unusual expenditures, adjustments, or purchases)

21. Asset List as of accounting period ending date stated on Line 14 above. List all financial accounts and include the type of account, last four digits of account number, financial institution or company name. You may use the figures from the last statement received from a financial institution or company corresponding to the date of the accounting period.

Financial Institution Type of Account Acct # (last 4 digits only) Balance/Market Value $ $ $ Other Assets: Description Value $ $

TOTAL: (This total should equal line 19.) $

Supporting Documents: Cancelled checks, (if not available, copies or images of cancelled checks or copies of check registers), monthly bank statements, brokerage statements, and an itemized list of all transactions must be included for each account for the reporting period to support the declarations made #29A2-GUARDIAN’S REPORT; ACCOUNTING, AND PROPOSED BUDGET PAGE 7 Revised 4/07 in this report. The supporting documents must be submitted to the Guardianship Monitoring Program Office with a copy of this report. Do not file the supporting documentation in the court legal file.

I certify (or declare) under penalty of perjury under the laws of the State of Washington that to the best of my knowledge the statements in this Guardian’s Report, Accounting, and Proposed Budget and attached Accounting Summary are true and correct and hereby petition the Court for approval.

SIGNED AT , WASHINGTON THIS DAY OF , 20 .

Signature of Guardian Printed Name of Guardian, WSBA/CPG#

Address City, State, Zip Code

*Telephone/Fax Number Email Address

*Under GR 22 (b) (6), parties’ personal telephone number(s) are confidential information. If you do not want your personal phone number(s) on this public form, complete form #S2-Sealed Confidential Information and file in the confidential file.

#29A2-GUARDIAN’S REPORT; ACCOUNTING, AND PROPOSED BUDGET PAGE 8 Revised 4/07