Teaching Assistant Term time changes

Hourly rate The current hourly rate is based on working 32.5 hours as their full time hours.

if they earn £16830 / 1694.6428525 (32.5hrs x 52.142857weeks) = £9.93123

In the future the standard full time hours will be 37 hours

If they earn £ 16830 / 1929.2857 (37 x 52.142857) = £8.7234

Therefore their hourly rate will reduce.

Working weeks

Currently teaching assistants are paid for 52 weeks of the year. Therefore they work 39 weeks (term time) and have 13 weeks holiday. This is changing.

Example is based on someone with more than 5 years service (38 days annual leave and bank hols) and working 39 weeks (some work 38 and don’t work the 1 week of inset days or however many weeks they actually work)

For a full year person – we will work 44.542857 weeks (52.142857- 7.6) and have 7.6 weeks of holidays (this is 38 days).

For a term time only person – they will work 39 weeks and then have a pro- rata amount of annual leave.

The calculation to work out their pro rata amount of annual leave is :-

38 Days annual leave x (39 (tt working wks)/44.542857 (FY working wks)) =

38 x 0.875561 = 33.2713 days or 6.6543 wks

They will therefore be paid 39 weeks working plus 6.6543 weeks (annual leave) = 45.6543 weeks instead of 52.

Their annual salary will then be calculated:

Weekly Hours x hourly rate x 45.6 weeks = annual salary

This is then divided by 12 months so they get the same amount each month Ready Reckoner for all term time staff including Teaching Assistants

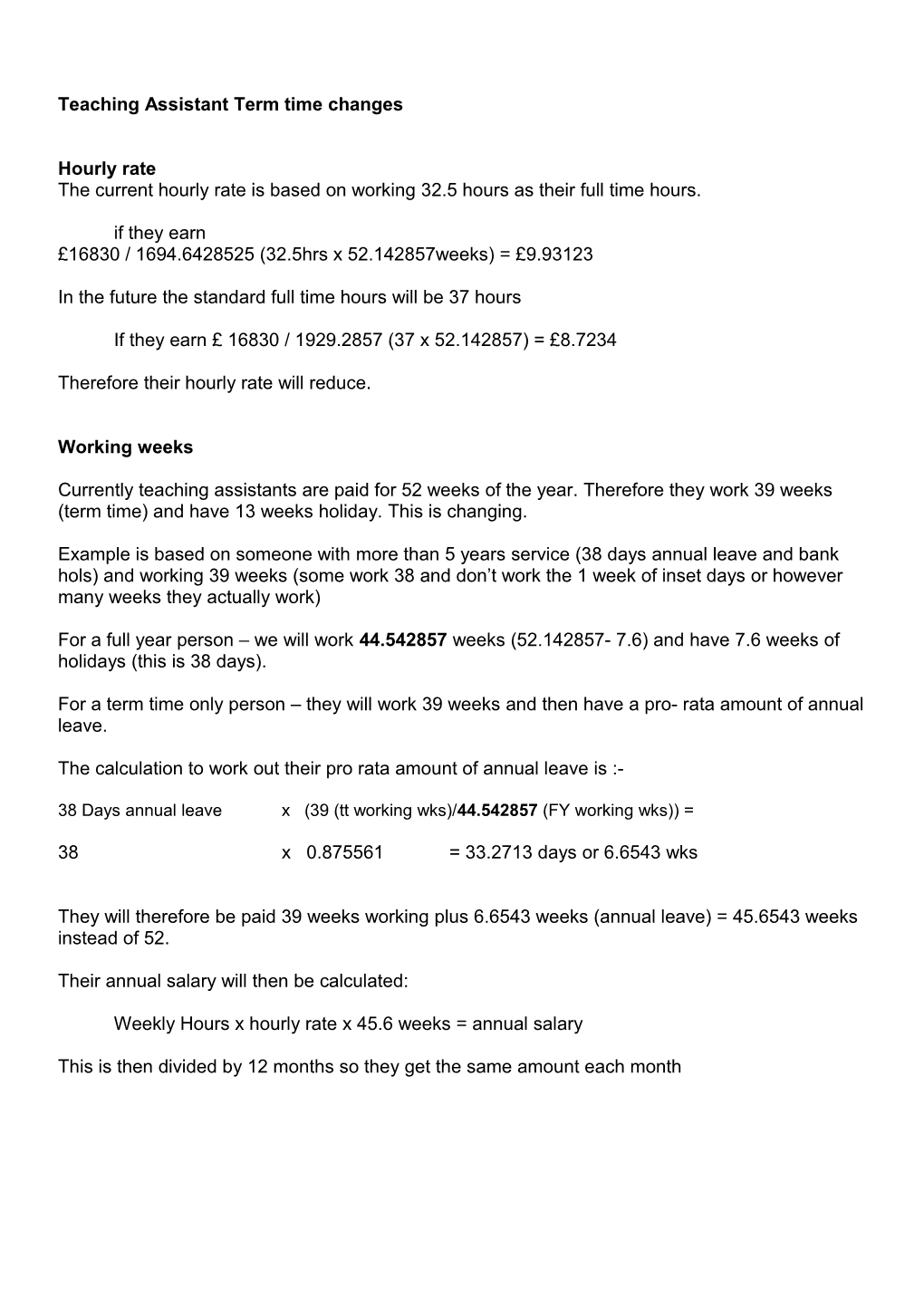

Number Number Number of days Full Year of days of days hols working hols Paid hols Paid based Paid Full weeks - based weeks based weeks on 40 weeks Year 52.142857 on 38 (38) on 39 (39) weeks (40) Number Full Year Hols in - annual weeks plus weeks plus per plus of Years Entitlement weeks leave per year leave per year leave year leave 1 32 6.4 45.742857 26.5834 43.3167 27.2829 44.4566 27.9825 45.5965 2 33 6.6 45.542857 27.5345 43.5069 28.2591 44.6518 28.9837 45.7967 3 35 7 45.142857 29.4620 43.8924 30.2373 45.0475 31.0127 46.2025 4 37 7.4 44.742857 31.4240 44.2848 32.2510 45.4502 33.0779 46.6156 5 38 7.6 44.542857 32.4182 44.4836 33.2713 45.6543 34.1244 46.8249

To calculate salary

1. Calculate hourly rate

Full time annual salary / 1929.2857

2. Number of hours worked per week e,g 20

3. Calculate the number of weeks worked per year .e.g 39 weeks with 4 years service = 45.4502

4. Multiply

Hourly rate x number of hours worked per week x paid weeks plus leave

E.g Annual Salary = £16830 Working 20 hours per week 39 weeks working 4 years service

Hourly rate £16830 / 1929.2857 = £8.7234

Annual Salary Hourly rate x hours per week x weeks worked plus hols £8.7234 x 20 X 45.4502 = £7929.63

Gross monthly salary £7929.63 / 12 (months in the year) = £660.80