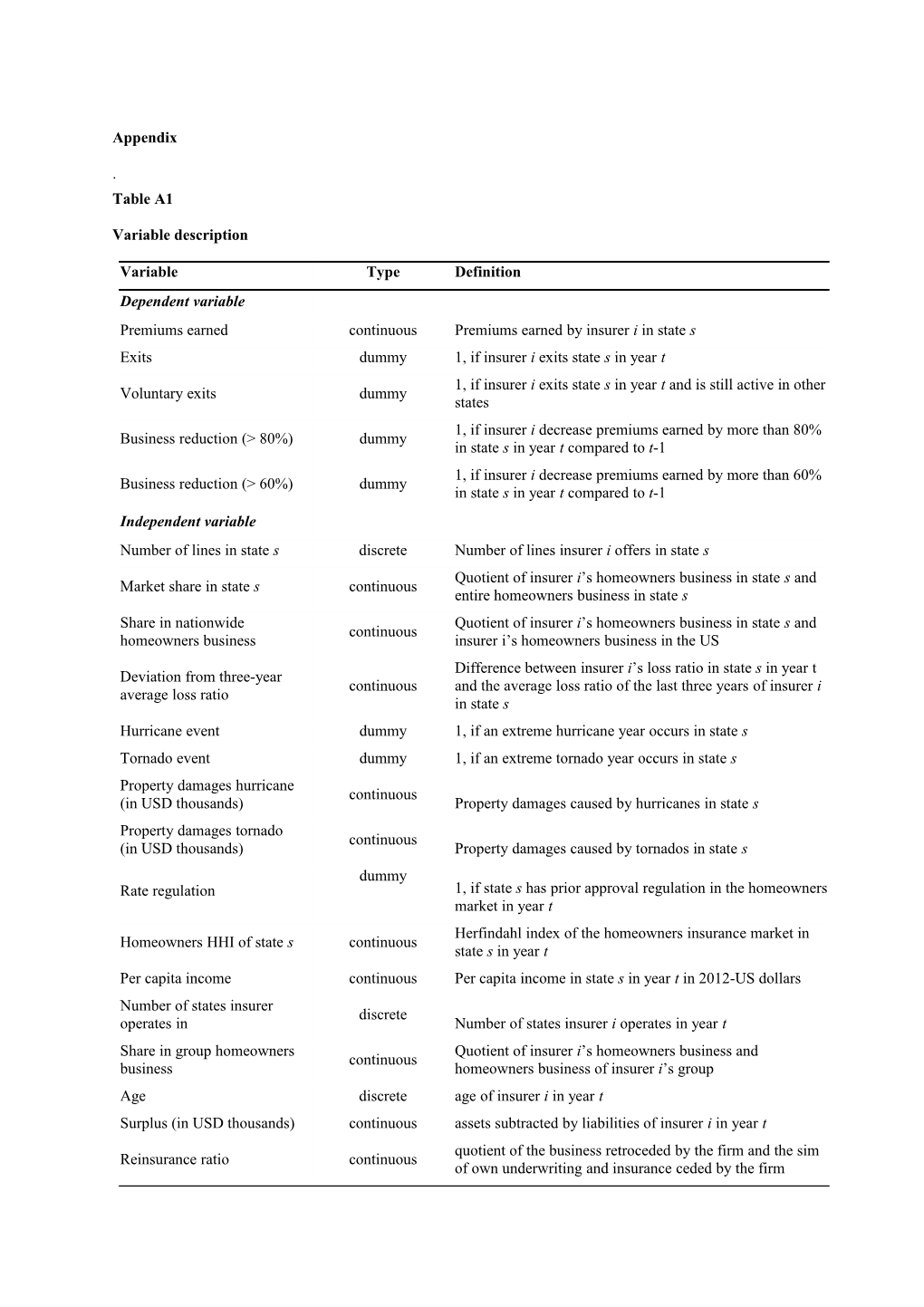

Appendix

. Table A1

Variable description

Variable Type Definition Dependent variable Premiums earned continuous Premiums earned by insurer i in state s Exits dummy 1, if insurer i exits state s in year t 1, if insurer i exits state s in year t and is still active in other Voluntary exits dummy states 1, if insurer i decrease premiums earned by more than 80% Business reduction (> 80%) dummy in state s in year t compared to t-1 1, if insurer i decrease premiums earned by more than 60% Business reduction (> 60%) dummy in state s in year t compared to t-1 Independent variable Number of lines in state s discrete Number of lines insurer i offers in state s Quotient of insurer i’s homeowners business in state s and Market share in state s continuous entire homeowners business in state s Share in nationwide Quotient of insurer i’s homeowners business in state s and continuous homeowners business insurer i’s homeowners business in the US Difference between insurer i’s loss ratio in state s in year t Deviation from three-year continuous and the average loss ratio of the last three years of insurer i average loss ratio in state s Hurricane event dummy 1, if an extreme hurricane year occurs in state s Tornado event dummy 1, if an extreme tornado year occurs in state s Property damages hurricane continuous (in USD thousands) Property damages caused by hurricanes in state s Property damages tornado continuous (in USD thousands) Property damages caused by tornados in state s dummy Rate regulation 1, if state s has prior approval regulation in the homeowners market in year t Herfindahl index of the homeowners insurance market in Homeowners HHI of state s continuous state s in year t Per capita income continuous Per capita income in state s in year t in 2012-US dollars Number of states insurer discrete operates in Number of states insurer i operates in year t Share in group homeowners Quotient of insurer i’s homeowners business and continuous business homeowners business of insurer i’s group Age discrete age of insurer i in year t Surplus (in USD thousands) continuous assets subtracted by liabilities of insurer i in year t quotient of the business retroceded by the firm and the sim Reinsurance ratio continuous of own underwriting and insurance ceded by the firm Table A2

Panel data regression results—linear fixed-effects and system GMM without Florida: dependent variable = ln(premiums earned)

Linear fixed effects System GMM ln (premiums earned) ln (premiums earned) coefficient coefficient Explanatory variable [SE] [SE]

Hurricane event -0.421*** -0.359* [0.132] [0.183] Tornado event -0.015 0.205 [0.053] [0.160] Hurricane event (t-1) -0.071 -0.053 [0.111] [0.240] Tornado event (t-1) -0.048 0.285 [0.041] [0.190] Hurricane event (t-2) -0.251** -0.413** [0.125] [0.202] Tornado event (t-2) -0.061 -0.078 [0.037] [0.106] ln(property damages hurricane) -0.002** 0.007* [0.001] [0.004] ln(property damages tornado) 0.000 0.006 [0.001] [0.004] ln(property damages hurricane) (t-1) -0.001 0.006 [0.001] [0.004] ln(property damages tornado) (t-1) 0.000 0.006 [0.001] [0.004] ln(property damages hurricane) (t-2) -0.002** 0.009** [0.001] [0.004] ln(property damages tornado) (t-2) 0.000 0.006 [0.001] [0.004] Market share in state s 28.193*** 7.985*** [5.730] [3.032] Share in nationwide homeowners bus. 1.950*** 0.258 [0.155] [0.310] Number of lines in state s 0.076*** 0.026** [0.010] [0.012] Number of states insurer operates in 0.046*** 0.016*** [0.004] [0.004] Share in group homeowners business 0.401*** -0.502*** [0.112] [0.115] Age 0.004 -0.021*** [0.003] [0.003] Surplus in USD millions 0.000 0.000*** [0.000] [0.000] Reinsurance ratio 0.001** 0.005 [0.001] [0.011] Deviation from three year avg. loss ratio 0.002 0.025 [0.006] [0.019] Rate regulation -0.050 -0.344 [0.033] [0.249] Homeowners HHI of state s -2.776*** -4.516 [0.865] [4.421] Per capita income in USD thousands 0.004 0.090** [0.005] [0.036] ln (premiums earned) (t-1) 0.712*** [0.044] Constant 10.997*** 3.052*** [0.226] [0.983]

Observations 97,435 91,978 R-squared 0.263 Number of panelvar 10,553 10,215 Insurer FE YES YES Year FE YES YES Adj. R-squared 0.263 . F value 18.16 . d.f. 43 44 AR 1 -3.37*** AR 2 -5.98*** AR 3 -3.38*** AR 4 1.55 Hansen test 239.5*** Diff-in- Hansen test 20.22*(12) Notes: Standard errors are robust to heteroscedasticity and clustered at the firm-state level in the linear fixed effects model. The two-step GMM estimates are reported with corrected standard errors (Windmeijer 2005). AR(1) to AR(4) are tests for serial correlation in the first-differenced residuals (Arrelano and Bond, 1991). (Difference) Hansen statistics are chi2 distributed; number in brackets behind difference Hansen test provides the number of restrictions/degrees of freedom. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD and premiums earned were winsorised at the 1/99 per cent level.

Table A3

Logit results without Florida: dependent variable = response (insurer exit/voluntary insurer exit/business reduction) Business reduction Business reduction Exits > 80 per cent > 60 per cent coefficient coefficient coefficient Explanatory variable [SE] [SE] [SE]

Hurricane event 0.431 0.813** 0.792** [0.507] [0.374] [0.343] Tornado event 0.106 -0.086 0.063 [0.467] [0.304] [0.266]

Hurricane event (t-1) 0.570 0.715* 0.738* [0.548] [0.412] [0.377]

Tornado event (t-1) -0.256 -0.517 -0.498 [0.561] [0.354] [0.318]

Hurricane event (t-2) 1.120** 1.322*** 1.079*** [0.549] [0.430] [0.404]

Tornado event (t-2) -0.267 -0.365 -0.236 [0.501] [0.322] [0.279] ln(property damages hurricane ) 0.013* 0.013*** 0.008** [0.007] [0.005] [0.004] ln(property damages tornado) 0.009 0.002 0.001 [0.008] [0.005] [0.005] ln(property damages hurricane ) (t-1) 0.015** 0.020*** 0.019*** [0.007] [0.005] [0.004] ln(property damages tornado) (t-1) 0.008 0.003 0.005 [0.008] [0.005] [0.005] ln(property damages hurricane ) (t-2) 0.009 0.008* 0.009** [0.007] [0.005] [0.004] ln(property damages tornado) (t-2) -0.001 0.001 0.001 [0.008] [0.005] [0.005] Market share in state s -379.509*** -216.338*** -167.953*** [28.427] [13.623] [10.811] Share in nationwide homeowners bus. -0.512 -0.798*** -0.469** [0.325] [0.233] [0.216] Number of lines in state s -0.454*** -0.306*** -0.261*** [0.018] [0.011] [0.010] Number of states insurer operates in -0.150*** -0.107*** -0.095*** [0.008] [0.005] [0.004] Share in group homeowners business 0.389* -0.096 -0.332** [0.216] [0.142] [0.133] Age -0.023** -0.014*** -0.009** [0.010] [0.005] [0.004] Surplus in USD millions -0.000*** -0.000*** -0.000*** [0.000] [0.000] [0.000] Reinsurance ratio -0.004 -0.000 -0.000 [0.005] [0.001] [0.001] Deviation from three-year avg. loss ratio 0.000 0.006 0.007 [0.004] [0.005] [0.005] Rate regulation -0.245 -0.949*** -0.705*** [0.279] [0.173] [0.161] Homeowners HHI of state s 7.133 8.745*** 6.709*** [4.493] [2.643] [2.424] Per capita income in USD thousands -0.053 -0.067*** -0.069*** [0.039] [0.021] [0.019]

Observations 29,909 41,298 42,673 Insurer FE YES YES YES Year FE YES YES YES Log-likelihood -3067 -7508 -8814 Chi2 9073 7984 7971 p-value 0 0 0 Pseudo-R2 0.597 0.347 0.311 Notes: Standard errors are robust to heteroscedasticity. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD.

Table A4

Wald test results for regressions models without Florida

Dependent variable: ln(premiums earned)

Liner fixed-effects panel regression

Event Damages

Year F-statistic p-value F-statistic p-value t 8.05*** 0.0046 2.85* 0.0915 t-1 0.04 0.8433 1.30 0.2537 t-2 2.05 0.1523 3.99** 0.0459

System GMM regression

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 8.55*** 0.0035 0.07 0.7979 t-1 2.09 0.1482 0.00 0.9764 t-2 2.56 0.1094 0.36 0.5495

Dependent variable: Pr(Exit)

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 0.22 0.6386 0.20 0.6559 t-1 1.11 0.2926 0.40 0.5275 t-2 3.46* 0.0629 0.94 0.3326

Dependent variable: Pr(business reduction > 60 per cent)

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 3.47* 0.0624 2.36 0.1242 t-1 5.13** 0.0235 6.30** 0.0121 t-2 9.84*** 0.0017 1.02 0.3136

Dependent variable: Pr(business reduction > 60 per cent) Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 2.81* 0.0934 1.21 0.2704 t-1 6.27** 0.0123 5.01** 0.0253 t-2 7.13*** 0.0076 1.39 0.2389 Notes: *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively.

Table A5

Logit Results – Comparison of exits and strategic voluntary exits: dependent variable= response (insurer exit / voluntary insurer exit)

Voluntary Exits exits coefficient coefficient Explanatory variable [SE] [SE]

Hurricane event 0.069 0.027 [0.392] [0.481] Tornado event -0.184 -0.122 [0.375] [0.420]

Hurricane event (t-1) 1.031** 0.814 [0.406] [0.601]

Tornado event (t-1) -0.491 -0.229 [0.427] [0.468]

Hurricane event (t-2) 1.202*** 1.311* [0.427] [0.702]

Tornado event (t-2) -0.217 -0.083 [0.348] [0.397] ln(property damages hurricane ) 0.011 0.007 [0.007] [0.008] ln(property damages tornado) 0.010 0.009 [0.008] [0.009] ln(property damages hurricane ) (t-1) 0.012* 0.007 [0.007] [0.008] ln(property damages

tornado) (t-1) 0.008 0.003 [0.008] [0.009] ln(property damages hurricane ) (t-2) 0.004 0.005 [0.007] [0.008] ln(property damages

tornado) (t-2) -0.000 0.000 [0.008] [0.009] Market share in state s -339.248*** -446.371*** [25.868] [34.443] Share in nationwide homeowners bus. -0.822*** -6.990*** [0.316] [0.636] Number of lines in state s -0.459*** -0.430*** [0.018] [0.020] Number of states insurer operates in -0.153*** -0.159*** [0.008] [0.009] Share in group homeowners business 0.318 0.395 [0.211] [0.254] Age -0.024** -0.033*** [0.010] [0.007] Surplus in USD millions -0.000*** -0.001*** [0.000] [0.000] Reinsurance ratio -0.005 0.015 [0.004] [0.014] Deviation from three year avg. loss ratio 0.003 0.002 [0.002] [0.002] Rate regulation -0.176 -0.275 [0.279] [0.309] Homeowners HHI of state s 4.496 1.891 [4.028] [4.755] Per capita income in USD thousands -0.058 -0.149*** [0.039] [0.044]

Observations 31,028 23,996 Insurer FE YES YES Year FE YES YES Log-Likelihood -3168 -2362 Chi2 9429 7528 p-value 0 0 Pseudo-R2 0.598 0.614 Notes: Standard errors are robust to heteroscedasticity. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent respectively. Dollar values are inflation-adjusted and expressed in 2012 USD.

Table A6

Panel data regression results—linear fixed-effects and system GMM for states with joint hazard exposure: dependent variable = ln(premiums earned)

Linear fixed effects System GMM ln (premiums earned) ln (premiums earned) coefficient coefficient Explanatory variable [SE] [SE]

Hurricane event -0.251*** -0.289*** [0.084] [0.091] Tornado event -0.016 -0.119** [0.044] [0.054]

Hurricane event (t-1) -0.029 -0.133 [0.066] [0.104]

Tornado event (t-1) -0.014 -0.040 [0.041] [0.063]

Hurricane event (t-2) -0.086 -0.138 [0.080] [0.107] Tornado event (t-2) -0.061 -0.175*** [0.042] [0.067] ln(property damages hurricane ) -0.001 0.000 [0.001] [0.001] ln(property damages tornado) 0.000 -0.004 [0.001] [0.004] ln(property damages hurricane ) (t-1) -0.001 -0.001 [0.001] [0.002] ln(property damages tornado) (t-1) 0.000 -0.004 [0.001] [0.004] ln(property damages hurricane ) (t-2) -0.001 0.000 [0.001] [0.002] ln(property damages tornado) (t-2) 0.001 -0.003 [0.001] [0.004] Market share in state s 31.182*** 2.796 [6.535] [2.464] Share in nationwide homeowners bus. 1.854*** 0.219 [0.180] [0.213] Number of lines in state s 0.073*** 0.040*** [0.010] [0.010] Number of states insurer operates in 0.044*** 0.012*** [0.005] [0.003] Share in group homeowners business 0.476*** -0.461*** [0.115] [0.088] Age 0.005* -0.020*** [0.003] [0.002] Surplus in USD millions 0.000 0.000*** [0.000] [0.000] Reinsurance ratio 0.002*** 0.007 [0.001] [0.004] Deviation from three-year avg. loss ratio -0.008*** -0.019 [0.001] [0.014] Rate regulation -0.056 -0.253 [0.038] [0.193] Homeowners HHI of state s -1.363** 1.597 [0.668] [2.631] Per capita income in USD thousands 0.002 0.048** [0.007] [0.023] ln (premiums earned) (t-1) 0.865*** [0.039] Constant 11.253*** 1.679* [0.256] [0.887]

Observations 49,307 46,433 R-squared 0.249 Number of panelvar 5,482 5,281 Insurer FE YES YES Year FE YES YES Adj. R-squared 0.249 . F value 18.14 . d.f. 43 44 AR 1 -4.70*** AR 2 -6.57*** AR 3 -2.80*** AR 4 1.19 Hansen test 312.76*** Diff-in- Hansen test 29.67***(12) Notes: Standard errors are robust to heteroscedasticity and clustered at the firm-state level in the linear fixed effects model. The two-step GMM estimates are reported with corrected standard errors (Windmeijer 2005). AR(1) to AR(4) are tests for serial correlation in the first-differenced residuals (Arrelano and Bond, 1991). (Difference) Hansen statistics are chi2 distributed; number in brackets behind difference Hansen test provides the number of restrictions/degrees of freedom. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD and premiums earned were winsorised at the 1/99 per cent level.

Table A7

Logit results for states with joint hazard exposure: dependent variable = response (insurer exit/business reduction)

Business reduction Business reduction Exits > 80 per cent > 60 per cent coefficient coefficient coefficient Explanatory variable [SE] [SE] [SE]

Hurricane event -0.059 0.174 0.165 [0.397] [0.272] [0.257] Tornado event -0.107 -0.003 -0.063 [0.383] [0.251] [0.226]

Hurricane event (t-1) 0.980** 0.953*** 0.911*** [0.414] [0.289] [0.274]

Tornado event (t-1) -0.316 0.121 -0.046 [0.444] [0.263] [0.243]

Hurricane event (t-2) 1.168*** 1.133*** 0.983*** [0.437] [0.325] [0.310]

Tornado event (t-2) -0.209 -0.245 -0.350 [0.382] [0.263] [0.242] ln(property damages hurricane 0.010 0.006 0.002 ) [0.007] [0.005] [0.004] ln(property damages tornado) 0.001 -0.010 -0.007 [0.012] [0.008] [0.007] ln(property damages hurricane 0.006 0.011** 0.011** ) (t-1) [0.007] [0.005] [0.004]

ln(property damages tornado) 0.001 0.002 0.005 (t-1) [0.013] [0.008] [0.007] ln(property damages hurricane -0.003 -0.001 -0.000 ) (t-2) [0.007] [0.005] [0.004]

ln(property damages tornado) -0.009 -0.002 -0.001 (t-2) [0.012] [0.008] [0.007] Market share in state s -286.904*** -144.894*** -129.511*** [27.799] [14.401] [12.565] Share in nationwide -1.189*** -1.035*** -0.647** homeowners bus. [0.394] [0.273] [0.253] Number of lines in state s -0.446*** -0.305*** -0.251*** [0.026] [0.015] [0.014] Number of states insurer -0.144*** -0.096*** -0.084*** operates in [0.010] [0.006] [0.006] Share in group homeowners 0.204 -0.154 -0.356** business [0.282] [0.188] [0.178] Age -0.019 -0.013** -0.008 [0.012] [0.006] [0.006] Surplus in USD millions -0.000 -0.000*** -0.000*** [0.000] [0.000] [0.000] Reinsurance ratio -0.006 -0.001 -0.001 [0.004] [0.001] [0.002] Deviation from three-year 0.005 0.007 0.008 avg. loss ratio [0.004] [0.006] [0.006] Rate regulation -0.411 -1.002*** -0.685*** [0.348] [0.214] [0.200] Homeowners HHI of state s 9.142* 9.281*** 8.610*** [4.868] [2.963] [2.719] Per capita income in USD -0.008 -0.094*** -0.095*** thousands [0.056] [0.030] [0.027]

Observations 16,264 21,845 22,643 Insurer FE YES YES YES Year FE YES YES YES Log-likelihood -1634 -3930 -4611 Chi2 4945 4354 4439 p-value 0 0 0 Pseudo-R2 0.602 0.356 0.325 Notes: Standard errors are robust to heteroscedasticity. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD.

Table A8

Wald test results for states with joint hazard exposure

Dependent variable: ln(premiums earned)

Liner fixed-effects panel regression

Event Damages

Year F-statistic p-value F-statistic p-value t 6.05** 0.0104 1.24 0.2649 t-1 0.04 0.8445 1.67 0.1960 t-2 0.08 0.7813 3.77* 0.0524

System GMM Regression

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 2.89* 0.0893 0.99 0.3199 t-1 0.62 0.4299 0.33 0.5639 t-2 0.15 0.6999 0.67 0.4143

Dependent variable: Pr(Exit)

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 0.01 0.9287 0.4 0.5253 t-1 4.72** 0.0298 0.11 0.7378 t-2 5.91** 0.015 0.14 0.7057

Dependent variable: Pr(business reduction > 60 per cent)

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 0.24 0.6264 3.20* 0.0737 t-1 4.76** 0.0291 0.92 0.3386 t-2 11.26*** 0.0008 0.02 0.8874

Dependent variable: Pr(business reduction > 60 per cent)

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 0.45 0.5005 1.16 0.2815 t-1 7.11*** 0.0077 0.52 0.4724 t-2 11.84*** 0.0006 0.00 0.9462

Table A9

Panel data regression results—linear fixed-effects and system GMM excluding insurers with nationwide premium income below USD 10 million: dependent variable = ln(premiums earned)

Linear fixed effects System GMM ln (premiums earned) ln (premiums earned) coefficient coefficient Explanatory variable [SE] [SE]

Hurricane event -0.281*** -0.027 [0.089] [0.132] Tornado event 0.009 -0.104* [0.045] [0.061] Hurricane event (t-1) -0.075 0.160 [0.059] [0.141] Tornado event (t-1) -0.012 0.027 [0.036] [0.084] Hurricane event (t-2) -0.098 0.254 [0.081] [0.156] Tornado event (t-2) -0.041 -0.074 [0.034] [0.075] ln(property damages hurricane ) -0.001 0.002 [0.001] [0.002] ln(property damages tornado) 0.000 -0.001 [0.001] [0.003] ln(property damages hurricane ) (t-1) -0.001 0.001 [0.001] [0.002] ln(property damages tornado) (t-1) 0.000 -0.002 [0.001] [0.003] ln(property damages hurricane ) (t-2) -0.000 0.004 [0.001] [0.003] ln(property damages tornado) (t-2) 0.000 -0.002 [0.001] [0.003] Market share in state s 22.387*** 2.668 [4.823] [2.023] Share in nationwide homeowners bus. 4.622*** -0.457 [0.335] [0.426] Number of lines in state s 0.055*** 0.018** [0.011] [0.008] Number of states insurer operates in 0.039*** 0.012*** [0.005] [0.004] Share in group homeowners business 0.493*** -0.363*** [0.143] [0.114] Age 0.005* -0.016*** [0.003] [0.002] Surplus in USD millions 0.000 0.000*** [0.000] [0.000] Reinsurance ratio -0.135* -0.062*** [0.072] [0.024] Deviation from three-year avg. loss ratio -0.005*** -0.011 [0.001] [0.014] Rate regulation -0.044 0.227 [0.033] [0.276] Homeowners HHI of state s -1.681** 8.998** [0.814] [3.944] Per capita income in USD thousands 0.005 0.058** [0.005] [0.029] ln (premiums earned) (t-1) 0.742*** [0.038] Constant 11.230*** 1.184 [0.226] [1.339]

Observations 78,858 73,433 R-squared 0.294 Number of panelvar 8,734 8,262 Insurer FE YES YES Year FE YES YES Adj. R-squared 0.294 . F value 19.18 . d.f. 43 44 AR 1 -1.63 AR 2 -7.02*** AR 3 -1.05 AR 4 1.58 Hansen test 278.55*** Diff-in- Hansen test 21.95**(12) Notes: Standard errors are robust to heteroscedasticity and clustered at the firm-state level in the linear fixed effects model. The two-step GMM estimates are reported with corrected standard errors (Windmeijer 2005). AR(1) to AR(4) are tests for serial correlation in the first-differenced residuals (Arrelano and Bond, 1991). (Difference) Hansen statistics are chi2 distributed; number in brackets behind difference Hansen test provides the number of restrictions/degrees of freedom. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD and premiums earned were winsorised at the 1/99 per cent level.

Table A10

Logit results excluding insurers with nationwide premium income below USD 10 million: dependent variable = response (insurer exit/voluntary insurer exit/business reduction)

Business reduction > 80 per Business reduction > 60 per Exits cent cent coefficient coefficient coefficient Explanatory variable [SE] [SE] [SE]

Hurricane event 0.200 0.083 0.138 [0.568] [0.346] [0.321] Tornado event 0.179 -0.085 -0.141 [0.495] [0.302] [0.278] Hurricane event (t-1) 1.325** 1.001*** 0.968*** [0.566] [0.361] [0.342] Tornado event (t-1) -0.390 -0.166 -0.138 [0.616] [0.333] [0.300] Hurricane event (t-2) 1.422** 1.270*** 1.008*** [0.575] [0.404] [0.383] Tornado event (t-2) -0.143 -0.161 -0.104 [0.533] [0.312] [0.276] ln(property damages hurricane ) 0.009 0.009 0.006 [0.009] [0.006] [0.005] ln(property damages tornado) 0.008 0.003 0.003 [0.010] [0.006] [0.006] ln(property damages Hurricane) (t-1) 0.015 0.012** 0.013** [0.010] [0.006] [0.005] ln(property damages tornado) (t-1) 0.008 -0.001 0.001 [0.011] [0.006] [0.006] ln(property damages Hurricane) (t-2) -0.001 0.007 0.008 [0.010] [0.006] [0.005] ln(property damages tornado) (t-2) -0.008 -0.001 -0.002 [0.010] [0.006] [0.006] Market share in state s -202.662*** -129.558*** -114.396*** [25.712] [12.658] [10.513] Share in nationwide homeowners bus. -11.368*** -8.768*** -4.824*** [1.444] [0.897] [0.691] Number of lines in state s -0.460*** -0.291*** -0.245*** [0.026] [0.014] [0.012] Number of states insurer operates in -0.198*** -0.128*** -0.110*** [0.012] [0.007] [0.006] Share in group homeowners business 0.456 -0.067 -0.276 [0.327] [0.201] [0.186] Age -0.016 -0.017*** -0.012** [0.014] [0.006] [0.006] Surplus in USD million -0.001*** -0.000*** -0.000*** [0.000] [0.000] [0.000] Reinsurance ratio 0.353*** 0.279*** 0.319*** [0.091] [0.047] [0.042] Deviation from three-year avg. loss ratio 0.003 0.006 0.007 [0.002] [0.007] [0.007] Rate regulation -0.581* -1.052*** -0.784*** [0.346] [0.204] [0.189] Homeowners HHI of state s 5.188 8.869*** 8.663*** [5.591] [2.929] [2.668] Per capita income in USD thousands -0.106** -0.086*** -0.080*** [0.053] [0.027] [0.024]

Observations 17,784 26,893 28,749 Number of panelvar 2,573 3,630 3,763 Insurer FE YES YES YES Year FE YES YES YES Adj. R-squared . . . F value . . . d.f. 43 43 43 Notes: Standard errors are robust to heteroscedasticity. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD.

Table A11

Wald test results for regressions models excluding insurers with nationwide premium income below USD 10 million

Dependent variable: ln(premiums earned) Liner fixed-effects panel regression Event Damages Year F-statistic p-value F-Statistic p-value t 8.86*** 0.0030 0.80 0.3725 t-1 0.68 0.4115 0.70 0.4039 t-2 0.20 0.6533 0.36 0.5499 System GMM regression Event Damages Year Χ²-statistic p-value Χ²-statistic p-value t 0.29 0.5883 0.42 0.5151 t-1 0.60 0.4383 0.89 0.3447 t-2 5.71** 0.0169 2.97* 0.0848 Dependent variable: Pr(exit) Event Damages Year Χ²-statistic p-value Χ²-Statistic p-value t 0.00 0.9775 0.00 0.9697 t-1 4.28** 0.0385 0.20 0.6541 t-2 4.06** 0.0439 0.22 0.6421 Dependent variable: Pr(business reduction > 60 per cent) Event Damages Year Χ²-statistic p-value Χ²-statistic p-value t 0.14 0.7090 0.41 0.5222 t-1 5.90** 0.0151 2.09 0.1482 t-2 8.12*** 0.0044 0.72 0.3956 Dependent variable: Pr(business reduction > 60 per cent) Event Damages Year Χ²-statistic p-value Χ²-statistic p-value t 0.45 0.5036 0.19 0.6613 t-1 6.17** 0.0130 2.26 0.1329 t-2 5.70** 0.0170 1.45 0.2281

Table A12

Panel data regression results—linear fixed-effects and system GMM: dependent variable = ln(premiums earned) by U.S. state Linear fixed effects System GMM ln (premiums earned) ln (premiums earned) coefficient coefficient Explanatory variable [SE] [SE] Hurricane event -0.467 -0.443 [0.468] [0.739] Tornado event -0.014 -0.015 [0.013] [0.054] Hurricane event (t-1) 0.101 0.557 [0.131] [0.515] Tornado event (t-1) -0.016 0.116 [0.037] [0.144] Hurricane event (t-2) 0.228*** 0.227 [0.050] [0.367] Tornado event (t-2) -0.000 0.017 [0.050] [0.033] ln(property damages hurricane ) -0.003** -0.002 [0.002] [0.001] ln(property damages tornado) -0.000 0.002 [0.001] [0.003] ln(property damages hurricane ) (t-1) -0.003* -0.000 [0.002] [0.002] ln(property damages tornado) (t-1) 0.000 0.001 [0.001] [0.003] ln(property damages hurricane ) (t-2) -0.001 -0.000 [0.001] [0.002] ln(property damages tornado) (t-2) 0.001 0.001 [0.001] [0.003] Rate regulation 0.043 0.113 [0.052] [0.179] Homeowners HHI of state s -1.235** -0.426 [0.549] [2.147] Per capita income in USD thousands -0.005 0.002 [0.005] [0.004] ln (premiums earned) (t-1) 0.966*** [0.102] Constant 19.947*** 0.647 [0.115] [1.920]

Observations 1,050 1,000 R-squared 0.895 Number of states 50 50 Insurer FE YES YES Year FE YES YES Adj. R-squared 0.892 . F value . . d.f. 33 35 AR 1 --1.76* AR 2 0.33 Hansen test 11.12 Diff-in- Hansen test 7.52(12) Notes: Standard errors are robust to heteroscedasticity and clustered at the state level in the linear fixed effects model. The two-step GMM estimates are reported with corrected standard errors (Windmeijer 2005). AR(1) to AR(4) are tests for serial correlation in the first-differenced residuals (Arrelano and Bond, 1991). (Difference) Hansen statistics are chi2 distributed; number in brackets behind difference Hansen test provides the number of restrictions/degrees of freedom. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD and premiums earned were winsorised at the 1/99 per cent level.

Table A13

Wald test results for premiums earned regression models by U.S. state

Dependent variable: ln(premiums earned)

Linear fixed effects regression

Event Damages

Year F-statistic p-value F-statistic p-value t 0.97 0.3295 3.61* 0.0634 t-1 1.13 0.2923 3.29* 0.0759 t-2 41.26*** 0.0000 1.16 0.2877 System GMM model

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 0.32 0.5694 1.26 0.2625 t-1 0.62 0.4294 0.42 0.5151 t-2 0.31 0.5770 0.29 0.5891

Table A14 Panel data regression results—linear fixed-effects and system GMM using two disaster events with similar damage size: dependent variable = ln(premiums earned) Linear fixed effects System GMM ln (premiums earned) ln (premiums earned) coefficient coefficient Explanatory variable [SE] [SE]

Texas hurricane event 2001 -0.273** -0.302* [0.112] [0.174] Alabama tornado event 2011 -0.085 0.622** [0.109] [0.268] Texas hurricane event 2001(t-1) -0.108 -0.135 [0.111] [0.182] Alabama tornado event 2011(t-1) 0.049 0.807*** [0.096] [0.271] ln(property damages hurricane ) -0.001** 0.006** [0.001] [0.003] ln(property damages tornado) 0.000 0.009 [0.001] [0.005] ln(property damages hurricane ) (t-1) -0.001 0.006* [0.001] [0.003] ln(property damages tornado) (t-1) 0.000 0.008 [0.001] [0.005] Market share in state s 28.112*** 4.664 [5.914] [3.324] Share in nationwide homeowners bus. 1.930*** 0.224 [0.155] [0.308] Number of lines in state s 0.076*** 0.024** [0.010] [0.011] Number of states insurer operates in 0.047*** 0.018*** [0.004] [0.004] Share in group homeowners business 0.410*** -0.513*** [0.107] [0.122] Age 0.004 -0.020*** [0.003] [0.003] Surplus in USD millions 0.000 0.000*** [0.000] [0.000] Reinsurance ratio 0.002*** -0.001 [0.001] [0.012] Deviation from three-year avg. loss ratio -0.005*** 0.009 [0.002] [0.013] Rate regulation -0.049 -0.406 [0.032] [0.270] Homeowners HHI of state s -1.901** -4.930 [0.793] [4.589] Per Capita income in USD thousands 0.008* 0.093** [0.005] [0.039] ln (premiums earned) (t-1) 0.736*** [0.047] Constant 10.895*** 2.712*** [0.218] [1.045]

Observations 94,176 94,176 R-squared 0.257 Number of panelvar 10,518 10,518 Insurer FE YES YES Year FE YES YES Adj. R-squared 0.256 . F value 22.00 . d.f. 38 40 AR 1 -3.11*** AR 2 -7.24*** AR 3 -2.22*** AR 4 1.82* Hansen test 241.65*** Diff-in- Hansen test 9.73(8) Notes: Standard errors are robust to heteroscedasticity and clustered at the firm-state level in the linear fixed effects model. The two-step GMM estimates are reported with corrected standard errors (Windmeijer 2005). AR(1) to AR(4) are tests for serial correlation in the first-differenced residuals (Arrelano and Bond, 1991). (Difference) Hansen statistics are chi2 distributed; number in brackets behind difference Hansen test provides the number of restrictions/degrees of freedom. *, ** and *** denote statistical significance at the 10, 5 and 1 per cent levels, respectively. Dollar values are inflation-adjusted and expressed in 2012 USD and premiums earned were winsorised at the 1/99 per cent level.

Table A15

Wald test results for premiums earned regression models using two disaster events with similar damage size

Dependent variable: ln(premiums earned)

Linear fixed effects regression

Event Damages

Year F-statistic p-value F-statistic p-value t 1.47 0.2262 2.57 0.1095 t-1 1.20 0.2737 2.10 0.1473 System GMM model

Event Damages

Year Χ²-statistic p-value Χ²-statistic p-value t 9.34*** 0.0022 0.25 0.6185 t-1 8.66*** 0.0033 0.18 0.6720