1) A firm currently has a debt-equity ratio of 1/2. The debt, which is virtually riskless, pays an interest rate of 6%. The expected rate of return on the equity is 12%. What would happen to the expected rate of return on equity if the firm reduced its debt-equity ratio to 1/3? Assume the firm pays no taxes.

Debt equity ratio of ½ means that debt is 1/3 of total assets and equity is 2/3.

WACC = Wd * Rd + We * Re = 1/3 * 6 + 2/3 * 12 = 10%

Debt equity ratio of 1/3 means that debt is 1/4 of total assets and equity is 3/4.

WACC = Wd * Rd + We * Re 10 = 1/4 * 6 + 3/4 * Re Re = 11.335

2) What is an interest tax shield? How does it increase the size of the "pie"for after- tax income stockholders? Explain.(Hint: Construct a simple numerical example showing how financial leverage affects the total cash flow available to debt and equity investors. Be sure to hold pretax operating income constant.

An interest tax shield is the reduction in income taxes that results from taking an allowable deduction on interest from taxable income. Since a tax shield is a way to save cash flows, it increases the value of the business, and it is an important aspect of business valuation.

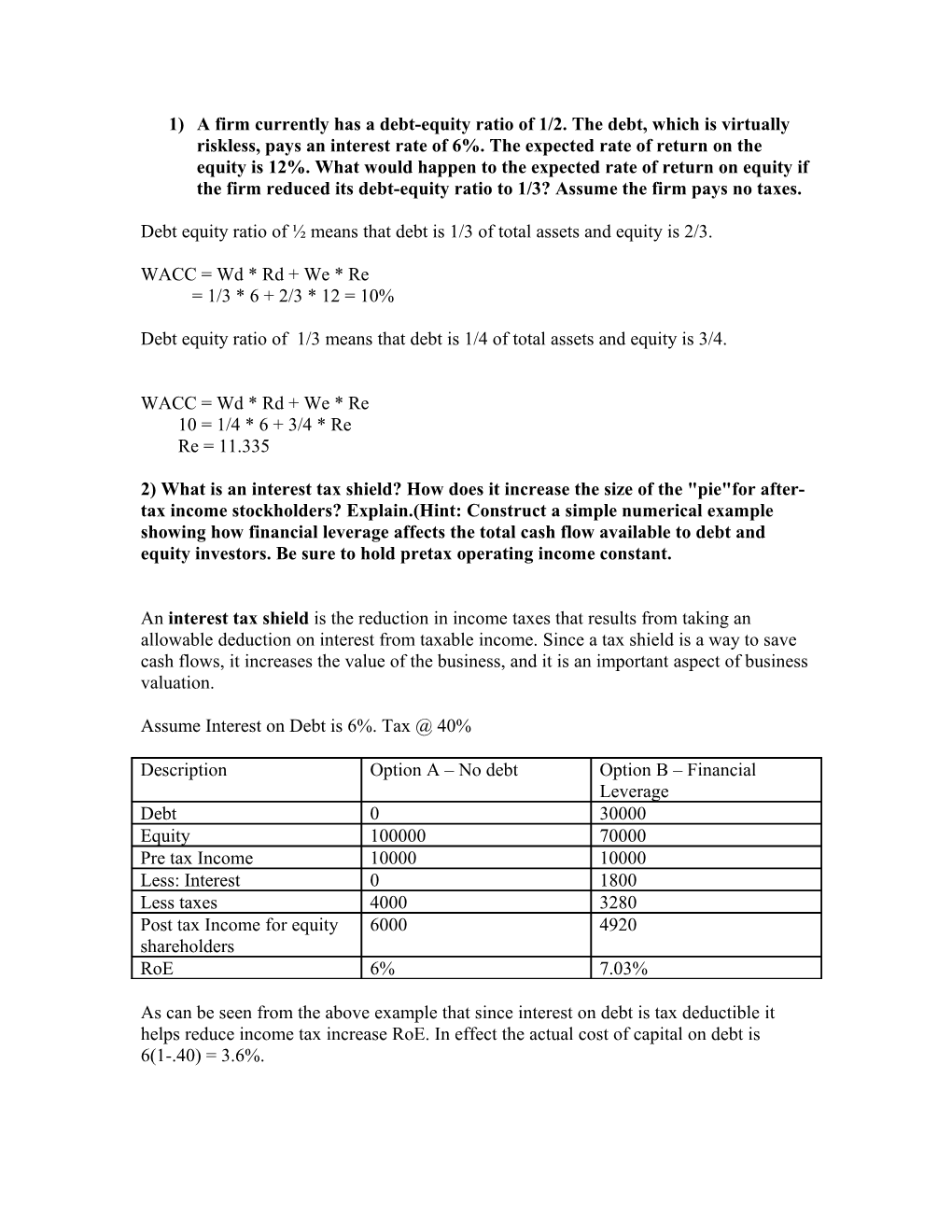

Assume Interest on Debt is 6%. Tax @ 40%

Description Option A – No debt Option B – Financial Leverage Debt 0 30000 Equity 100000 70000 Pre tax Income 10000 10000 Less: Interest 0 1800 Less taxes 4000 3280 Post tax Income for equity 6000 4920 shareholders RoE 6% 7.03%

As can be seen from the above example that since interest on debt is tax deductible it helps reduce income tax increase RoE. In effect the actual cost of capital on debt is 6(1-.40) = 3.6%.