September 29, 2011

Rite Aid Corporation (RAD-NYSE)

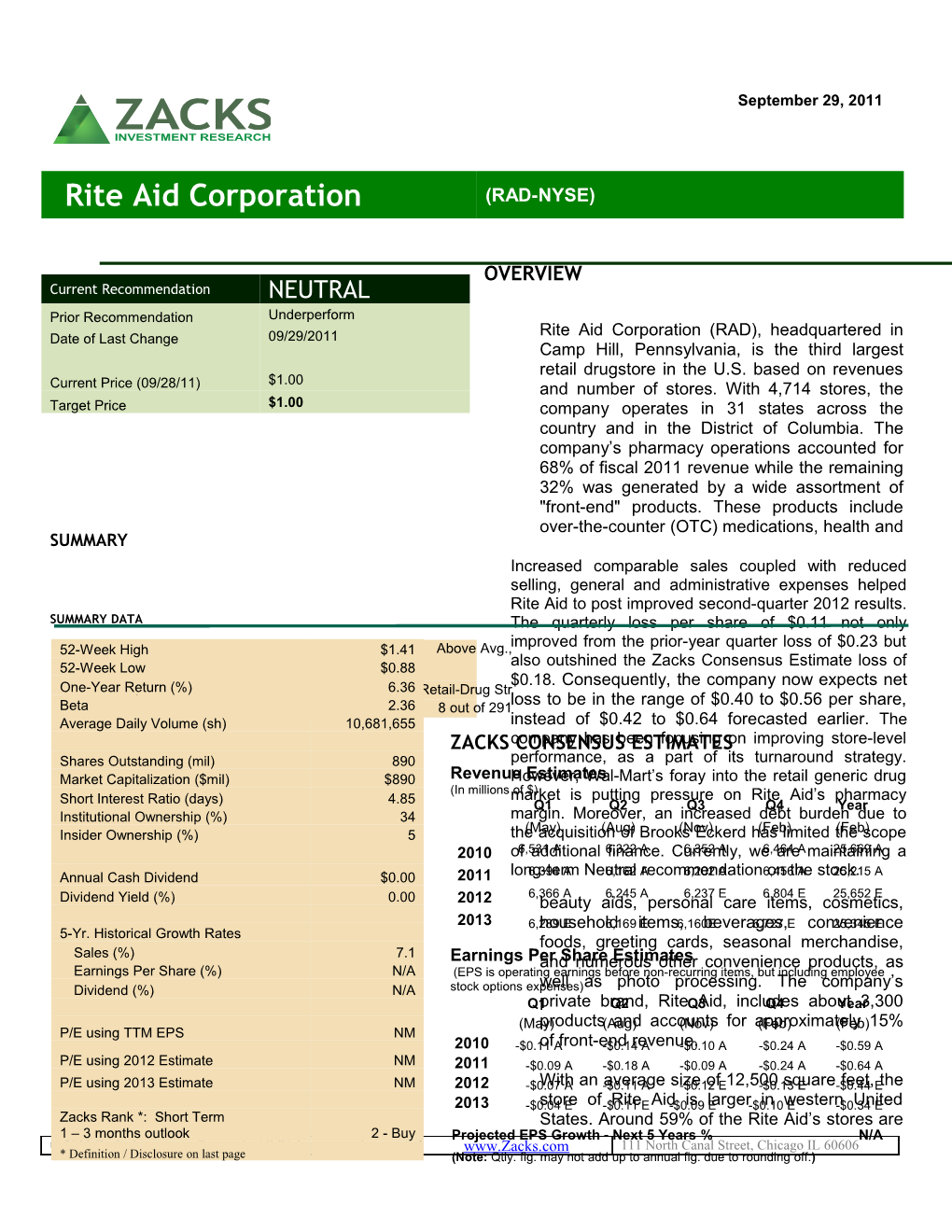

OVERVIEW Current Recommendation NEUTRAL Prior Recommendation Underperform Rite Aid Corporation (RAD), headquartered in Date of Last Change 09/29/2011 Camp Hill, Pennsylvania, is the third largest retail drugstore in the U.S. based on revenues $1.00 Current Price (09/28/11) and number of stores. With 4,714 stores, the Target Price $1.00 company operates in 31 states across the country and in the District of Columbia. The company’s pharmacy operations accounted for 68% of fiscal 2011 revenue while the remaining 32% was generated by a wide assortment of "front-end" products. These products include over-the-counter (OTC) medications, health and SUMMARY Increased comparable sales coupled with reduced selling, general and administrative expenses helped Rite Aid to post improved second-quarter 2012 results. SUMMARY DATA The quarterly loss per share of $0.11 not only improved from the prior-year quarter loss of $0.23 but 52-WeekRisk HighLevel * $1.41 Above Avg., 52-WeekType Low of Stock $0.88 also outshined the Zacks Consensus Estimate loss of $0.18. Consequently, the company now expects net One-YearIndustry Return (%) 6.36 Retail-Drug Str loss to be in the range of $0.40 to $0.56 per share, Beta Zacks Industry Rank * 2.36 8 out of 291 Average Daily Volume (sh) 10,681,655 instead of $0.42 to $0.64 forecasted earlier. The ZACKS companyCONSENSUS has been ESTIMATES focusing on improving store-level Shares Outstanding (mil) 890 performance, as a part of its turnaround strategy. Market Capitalization ($mil) $890 RevenueHowever, Estimates Wal-Mart’s foray into the retail generic drug (In millions marketof $) is putting pressure on Rite Aid’s pharmacy Short Interest Ratio (days) 4.85 Q1 Q2 Q3 Q4 Year Institutional Ownership (%) 34 margin. Moreover, an increased debt burden due to (May) (Aug) (Nov) (Feb) (Feb) Insider Ownership (%) 5 the acquisition of Brooks Eckerd has limited the scope 2010 of6,531 additional A 6,322finance. A Currently,6,352 A we6,464 are A maintaining25,669 A a Annual Cash Dividend $0.00 2011 long-term6,394 A Neutral6,162 Arecommendation6,202 A 6,456on the A stock.25,215 A 6,366 A 6,245 A 6,237 E 6,804 E 25,652 E Dividend Yield (%) 0.00 2012 beauty aids, personal care items, cosmetics, 2013 6,289household E 6,169 items,E 6,160E beverages, 6,727 E convenience25,345 E 5-Yr. Historical Growth Rates foods, greeting cards, seasonal merchandise, Sales (%) 7.1 Earnings Perand Share numerous Estimates other convenience products, as Earnings Per Share (%) N/A (EPS is operating earnings before non-recurring items, but including employee well as photo processing. The company’s Dividend (%) N/A stock options expenses) Q1private brand,Q2 RiteQ3 Aid, includesQ4 aboutYear 3,300 (May)products(Aug) and accounts(Nov) for approximately(Feb) (Feb) 15% P/E using TTM EPS NM 2010 -$0.11of A front-end -$0.14 revenue. A -$0.10 A -$0.24 A -$0.59 A P/E using 2012 Estimate NM 2011 -$0.09 A -$0.18 A -$0.09 A -$0.24 A -$0.64 A P/E using 2013 Estimate NM 2012 -$0.07With A an -$0.11average A size-$0.12 of E 12,500-$0.13 square E -$0.44 feet, Ethe 2013 -$0.04store E of-$0.11 Rite E Aid-$0.09 is largerE -$0.10 in westernE -$0.34 United E Zacks Rank *: Short Term States. Around 59% of the Rite Aid’s stores are 1 – 3 months outlook 2 - Buy Projected EPS Growth - Next 5 Years % N/A © 2011 Zacks Investment Research, All Rights reserved. www.Zacks.com 111 North Canal Street, Chicago IL 60606 * Definition / Disclosure on last page (Note: Qtly. fig. may not add up to annual fig. due to rounding off.) freestanding, about 50% consist of drive-thru REASONS TO SELL pharmacy, around 40% contain one-hour photo shops and 40% include a GNC store within Rite Aid Store. In the United States, pharmacy sales growth has slowed down due to longer Rite Aid purchases almost all of its FDA approval process, drug safety pharmaceutical products (approximately 94% of concern, loss of individual health insurance the dollar value of its prescription drugs) from a resulting from unemployment and an single supplier, McKesson Corp. The generic increase in the use of non-brand drugs, (non-brand) pharmaceutical products are which are less expensive but generate directly purchased from the manufacturers. higher gross margin. Due to these factors, However, the company purchases its non- the company’s same-store-sales are pharmaceutical merchandise from various expected to remain weak. The company manufacturers and suppliers. has reported loss for the last fourteen consecutive quarters.

REASONS TO BUY Rite Aid is a highly leveraged company (with approximately 162% debt-to- capitalization ratio), limiting cash flow Generic (non-brand) drugs are less availability and the company’s ability to expensive but generate higher gross obtain additional financing. The debt margin. Recent trend in the U.S. is burden from the Brooks Eckerd acquisition witnessing a growing demand for generic has increased interest expense, which has drugs. The company is expected to expand been weighing upon the bottom-line. This its generic drug portfolio in order to has put the company at a competitive enhance its top-line as well as market disadvantage relative to its competitors share. Rite Aid has an edge over its with less indebtedness. competitors as it is the third largest retail drugstore in the U.S. based on revenues Rite Aid’s generic drug sales are negatively and number of stores. affected by Wal-Mart’s strategy of entering the retail generic drug market. Due to Wal- Strong top-line performance and lower Mart’s broad array of manufacturers in operating expenses boosted Rite Aid to India, Israel, and the U.S., the mass post a better second-quarter 2012 results. merchant can offer generic drugs at a The quarterly loss of $0.11 per share not discounted price compared with the only improved from the prior-year loss of average $10 generic drug co-pay. $0.23 but also outpaced the Zacks Consensus Estimate loss of $0.18. The company also registered a marginal RECENT NEWS revenue growth of 1.8% from the prior-year period. Consequently, the company now expects net loss to be in the range of $0.40 Rite Aid Narrows Loss in 2Q – September 22, to $0.56 per share, instead of $0.42 to 2011 $0.64 forecasted earlier. Drugstore chain operator Rite Aid Corp. posted The company is in the process of various a net loss of $94.7 million in the second quarter cost cutting initiatives including centralized of fiscal 2012 compared with a much wider loss indirect procurement of drugs, of $199.3 million in the year-ago period. administrative headcounts requirement, reducing supply chain costs, reducing debt, The quarterly loss per share of $0.11 not only etc. which will certainly benefit the improved from the prior-year loss of $0.23 but company to improve its bottom-line. also outpaced the Zacks Consensus Estimate loss of $0.18. Growth in same-store sales and reduced selling, general & administrative

Equity Research RAD | Page 2 (SG&A) expenses had a positive influence on In fiscal 2012, the company expects to incur recent results. capital expenditure of $250 million mostly on store remodels and prescription file buys. Quarterly Details Guidance Rite Aid's revenues came in at $6,271.1 million for the quarter compared with $6,161.8 million Looking ahead, Rite Aid expects fiscal 2012 in the prior-year period. The marginal increase revenue to be between $25.8 billion and $26.1 of 1.8% was mostly attributable to growth in billion based on same-store sales increase of same-store sales partially offset by store 0.75% to 2.0%. Net loss is now expected to be closings. Same-store sales for the quarter in the range of $345 million to $495 million (or showed an increase of 2.2%. Total revenue $0.40 to $0.56 per share). beat the Zacks Consensus Estimate of $6,207.0 million. VALUATION Pharmacy same-store sales inched up 2.0%, despite the negative impact of 148 basis points from the introduction of new generic drugs. The company’s management was engaged in Prescriptions filled at comparable stores the execution of a turnaround strategy centered increased 0.1% from the year-ago quarter. on increasing the profitability of the existing Front-end same-stores sales recorded a growth stores. However, an increased debt burden and of 2.5% in the quarter. interest expenses due to the acquisition of Brooks Eckerd has limited the scope of Other than prescription drugs, Rite Aid sells a additional finance. Rite Aid competes with wide assortment of other merchandise, which it Walgreens and CVS, both of which are terms as "front end" products, including over- expanding. In addition, both companies have the-counter medications, health and beauty higher margins than Rite Aid due to structural aids, personal care items and cosmetics. cost advantages, including purchasing power to obtain lower cost merchandise and significantly Rite Aid's gross profit edged up 1.0% year over less interest expense. In addition, Wal-Mart’s year to $1648.9 million while gross margin entry into the retail generic drug market has dropped by 100 basis points to 26.0%. SG&A proven to be detrimental to the company’s contracted 1.0% year over year to $1,603.8 pharmacy sales. Currently, we have a long-term million, mainly owing to cost containment Neutral recommendation on the stock with a measures from management. target price of $1.00.

The company recorded a 43.0% decrease in P/E P/E lease termination and impairment charges to Key Indicators 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low $15.1 million, primarily driven by lower store F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) closures Rite in theAid Corporation reported (RAD) quarter. Rite Aid 319.0 275.5 reported adjusted EBITDA of $184.3 million comparedIndustry with an Average adjusted EBITDA of $181.217.9 14.6 14.3 12.8 18.4 103.7 35.9 S&P 500 12.2 11.2 10.7 11.2 16.0 27.7 13.8 million in the prior-year quarter. Walgreen Company (WAG) 11.4 10.0 12.9 10.5 12.8 25.8 11.4 Balance SheetAmerisourceBergen and Cash FlowCorp. (ABC) 15.3 13.9 13.0 15.1 16.0 22.1 10.4 Herbalife Limited (HLF) 18.8 16.2 14.0 18.8 20.5 21.5 3.9 Pharmerica Corp. (PMC) 15.3 13.8 17.0 7.4 14.4 45.5 6.6 At the end of the quarter, RiteTTM Aid is hadtrailing cash 12 months; and F1 is 2012 and F2 is 2013, CF is operating cash flow cash equivalents of $78.4 million and long-term debt of $6,052.4 million. During theP/B quarter, the company deployed $49.3 millionLast toward P/B debt P/B ROE D/E Div Yield EV/EBITDA repayment and $41.5 million towardQtr. 5-Yr capital High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Rite Aid expenditure.Corporation (RAD) 0.2 2.9 0.2 -147.1 -2.4 0.0 13.6

Industry Average 2.8 2.8 2.8 -21.0 0.1 0.7 9.9 S&P 500 3.3 Equity5.2 Research2.9 27.1 RAD2.1 | Page 3 Equity Research RAD | Page 4 Earnings Surprise and Estimate Revision History

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Rite Aid Corporation (RAD) at StockResearchWiki.com:

http://www.stockresearchwiki.com/tiki- index.php?page=RAD/Ticker

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of RAD. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will underperform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1034 companies covered: Outperform - 14.6%, Neutral - 78.0%, Underperform – 6.1%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better.

Equity Research RAD | Page 5 Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research RAD | Page 6