ITNS – 65 INCOME TAX DEPARTMENT

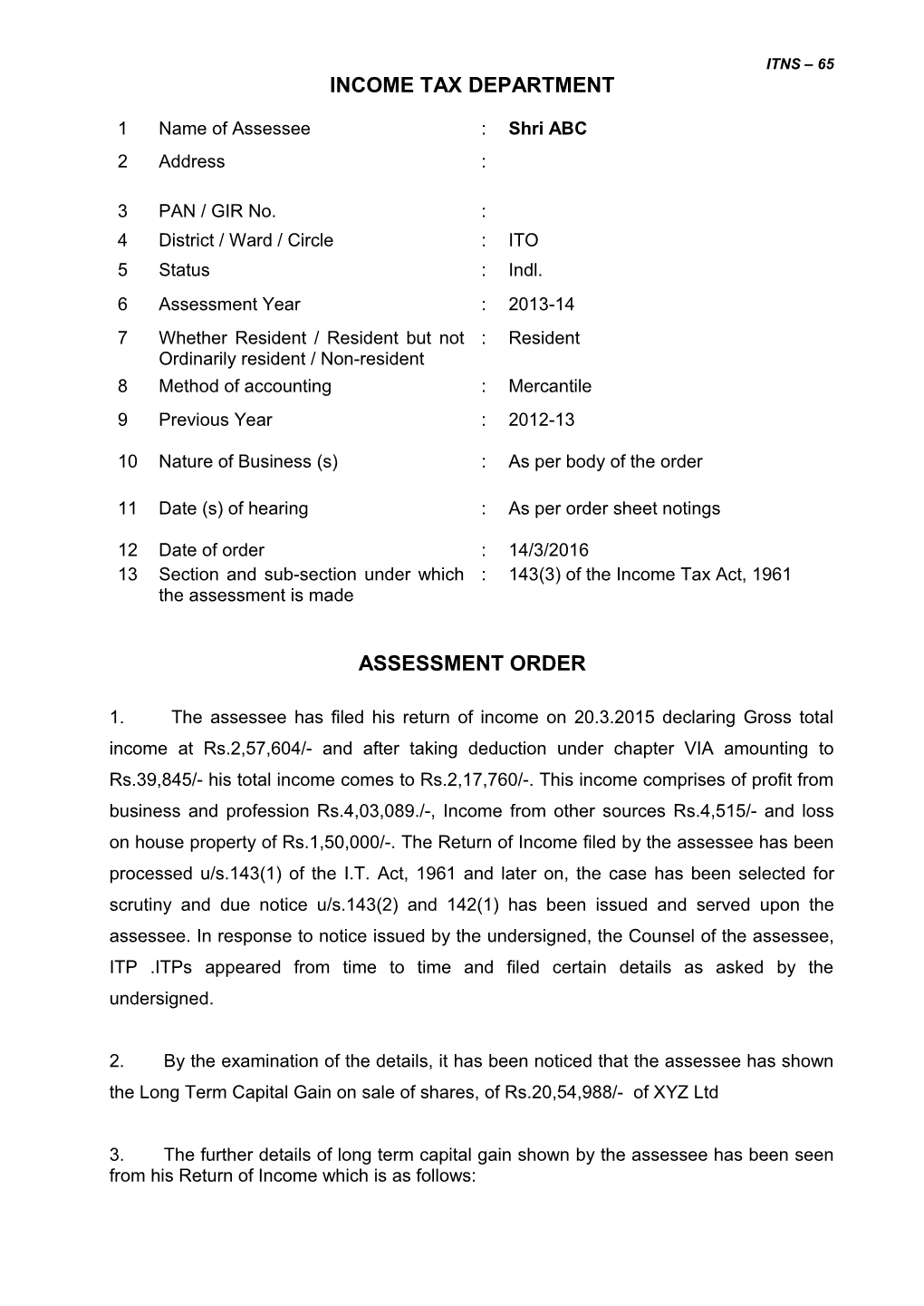

1 Name of Assessee : Shri ABC 2 Address :

3 PAN / GIR No. : 4 District / Ward / Circle : ITO 5 Status : Indl. 6 Assessment Year : 2013-14 7 Whether Resident / Resident but not : Resident Ordinarily resident / Non-resident 8 Method of accounting : Mercantile 9 Previous Year : 2012-13

10 Nature of Business (s) : As per body of the order

11 Date (s) of hearing : As per order sheet notings

12 Date of order : 14/3/2016 13 Section and sub-section under which : 143(3) of the Income Tax Act, 1961 the assessment is made

ASSESSMENT ORDER

1. The assessee has filed his return of income on 20.3.2015 declaring Gross total income at Rs.2,57,604/- and after taking deduction under chapter VIA amounting to Rs.39,845/- his total income comes to Rs.2,17,760/-. This income comprises of profit from business and profession Rs.4,03,089./-, Income from other sources Rs.4,515/- and loss on house property of Rs.1,50,000/-. The Return of Income filed by the assessee has been processed u/s.143(1) of the I.T. Act, 1961 and later on, the case has been selected for scrutiny and due notice u/s.143(2) and 142(1) has been issued and served upon the assessee. In response to notice issued by the undersigned, the Counsel of the assessee, ITP .ITPs appeared from time to time and filed certain details as asked by the undersigned.

2. By the examination of the details, it has been noticed that the assessee has shown the Long Term Capital Gain on sale of shares, of Rs.20,54,988/- of XYZ Ltd

3. The further details of long term capital gain shown by the assessee has been seen from his Return of Income which is as follows: -: 2 :-

Sr. Details F.Y of (Q*R)Acq Indexed Indexe Sale Selling Exemptions No Acq. . Cost cost of d Impr. Consider. Expense . Acq. Cost s 1. LTCG on 11-12 145234 157630 0 22,00,22 0 20,54,988 sale of 2 share

4. Before coming the investigation part of the case, it is worthwhile to discuss the modus operandi of the case to understand how the prices are being rigged up and how the transactions of purchase and sale of a penny stock takes place.

Modus Operandi adopted by the Operators in order to fabricate share transactions (in particular of penny stocks). The step wise modus operandi adopted by the Operators are as follows:

i) Initially the prices of the penny stock are ramped up by circular trading involving Operator’s persons who are benami entities or name lenders. The shares (Penny stocks) which were once traded for less than a rupee or just a few rupees each are targeted and their prices are manipulated all the way up to a very high price. Sometimes the shares are split into shares of smaller face value in this process. The purchase bills are most likely back dated one. These purchases are generally off market and not reported to the stock exchange. ii) The operators then would give physical shares to the beneficiary, whose market value is roughly equivalent to the money, the beneficiary intends to launder. Such shares would be accompanied by a backdated contract note showing the sale of shares to beneficiary at less than a rupee or just a few rupees per share, as they were quoted earlier (about an year or so). iii) Since the shares cannot be sold in physical Format, the beneficiary sends the shares to depositary to be dematerialized and converted into electronic form. iv) The beneficiary sells such dematerialized shares on secondary market at the artificially ramped up (operator driven) price and receives cheque payment thereby converting black money into white. Depending upon how far the contract note for purchase of such shares was backdated, the beneficiary launders the money by either paying zero or 10% capital gain tax (depending on the rates of taxation of capital gains for the relevant A.Y.). -: 3 :-

v) The operators by using benami entities/name lenders recycle the same set of shares several times over by re-materialization, i.e., conversion of shares from electronic form to physical form and thereby extending the facility of laundering black money to another Beneficiary. It has been found during the course of investigation that this cycle of re-materialization has been used several times over in the case of such Penny stocks. During such process, huge amount of black money were converted by fabricating artificial capital gains.

5. As per the above modus operandi, it is clear that there are two key players involved in such a sham transaction, i.e., the operator and the beneficiary. The operator is the one who manipulates the market and perform all the transactions necessary to fabricate the capital gains on account of shares, including rigging the prices of such shares. The beneficiary is the one who purchases such artificial/bogus capital gains from operator by paying up the gross amount of sale price of such shares in cash, to reap the tax benefits attached to Long Term Capital Gain. The process of arranging the whole transaction includes the manipulation of purchase date, demating of penny scrip shares, accounting of penny scrips in the balance sheet. The complete modus operandi of this process is as follows :

(a) Manipulation of purchase-date

Since the minimum holding period is 12 months for becoming eligible for the definition of LTCG, the beneficiary with the help of the broker manipulates the date of purchase of shares. For such backdated purchases, the broker also issues backdated contract notes, bills, etc to the assessee so as to give genuine colour to the otherwise bogus transactions. The back dating of purchases is done by the brokers by showing the purchases as off market deal. The crucial problem arises as to how to show payments for such back-dated purchase. This is done in either of the following two methods. The entire purchase price is paid in cash or, which is more subtle method. It may be mentioned that sometimes purchase price can also be paid by cheque, and yet the sale transactions of shares, resulting into LTCG, may be bogus. The reason being the rates of penny scrips are artificially hiked by the vested interests, said there are no real buyers for such scrips when rates are quoted very high in the market. Thus, even if the purchases are genuine in a given case, the sales of such penny scrips can be bogus because the market rates are manipulated. -: 4 :-

(b) Dematting of Penny Scrip Shares

The demating of penny scrip shares is done often after a long period, because of backdating of share purchase transactions and other stages. The delayed demating is often an indicator that purchase has been backdated.

(c) Accounting of penny scrips in the balance sheet

5.1 Holding of the back dated penny scrips is easily reflected by the beneficiary in the balance sheet of the year, prior to the year in which such shares are sold. This is so because at the time of arranging of these bogus sale transactions resulting in LTCG, the return of income for the earlier year is pending, and once the deal for LTCG is clinched, assessee can file return for the prior year in which bogus purchase of shares is to be shown, and accordingly reflect in the balance sheet as on of the last date of the prior year.

5.2 By the modus as stated above, the unaccounted money is laundered and brought into the books as capital gains on account of transactions in shares attracting either full tax exemption or concessional rates of taxation. For engineering such as bogus LTCG, the operator also charges - quite naturally -, a certain amount of commission/service charges, which may range from 4% to 8%, depending upon the bargaining power of the operator and the beneficiary. These type of transactions usually occurs in the penny stock of the shares. The term penny stock is defined by US authorities and by Indian authorities also and generally, the stock whose floating capital in the market or below Rs.50 crores are being considered as a penny stock. The details analyzed by various markets with respect to penny stock are as follows : -: 5 :-

Penny Stock :

“In the U.S. financial markets, the term penny stock commonly refers to any stock trading outside one of the major exchanges (NYSE, NASDAQ, or AMEX), and is often considered pejorative. However, the official Securities & Exchange Commission definition[1] of a penny stock is a low-priced, speculative security of a very small company, regardless of market capitalization or whether it trades on a securitized exchange (like NYSE or NASDAQ) or an "over the counter" listing service, such as the OTCBB or Pink Sheets. The terms penny stocks, microcap stocks, small caps, and nano caps are also all sometimes used interchangeably, however per the SEC definition, penny stock status is determined by share price, not market capitalization or listing service.

In the UK markets, penny stocks, or penny shares as they are more commonly called, generally refer to stocks and shares in small cap companies, defined as being companies with a market capitalization of less than £100 million and/or a share price of less than £1 with a bid/offer spread greater than 10%...[2] In the UK Penny Shares are covered by a standard regulatory risk warning issued by the Financial Services Authority(FSA)[3]

Penny stocks generally have market caps under $500M and are considered extremely speculative, particularly those that trade on low volumes over the counter. The Securities and Exchange commission warns that, "Penny stocks may trade infrequently, which means that it may be difficult to sell penny stock shares once you own them. Because it may be difficult to find quotations for certain penny stocks, they may be impossible to accurately price. Investors in penny stocks should be prepared for the possibility that they may lose their whole investment."[4]

In terms of liquidity, since a penny stock has fewer shareholders, it is less 'liquid', meaning it will not trade as many shares per day as a larger company. Any sudden change in demand or supply of stock can lead to a lot of volatility in the stock price. This lack of liquidity can send a stock price soaring up quickly or come crashing down. Lack of liquidity and volatility also makes penny stocks much more vulnerable to manipulation by management, market makers, or third parties. A lack of liquidity can also make it extremely difficult to sell a stock, particularly if there are no buyers that day. This can also make the stocks extremely difficult to short.

Secondly, unlike NASDAQ or the NYSE, there are only minimal listing requirements for a stock to remain on the OTCBB, namely that they make their filings with the SEC on time.[6] In fact, companies that fail to meet minimum standards on one of the broader exchanges and are delisted often relist on the OTCBB or the Pink Sheets. -: 6 :-

Furthermore, stocks trading on the Pink Sheets (recognizable with a .PK suffix) have little to no regulatory or listing requirements whatsoever, at least compared to major markets. There are no minimum accounting standards, change in notification of ownership of shares, and reported other material changes affecting the financial viability of a company, all of which are designed to protect shareholders.

6. By the detailed definition and parameters as stated above, it may be concluded that there are following parameters of penny stock.

i) It is a very low priced stock.

ii) Sometimes they are selling at a few pennies per shares.

iii) They are speculative in nature.

iv) These are speculative security of a very small company.

v) Their market capitalization are very low. As per U.K. market, their market capitalization is less than 100 million pound. In U.S. market, their market capitalization is under 500 million dollar.

vi) They have fewer shareholders and it is less liquid. It means it will not trade as many shares per day as a larger company.

vii) Generally, the financial records of these companies are not attractive one.

7. During the course of assessment proceedings, assessee has submitted contract cum bill from M/s. Mihir Consultancy and Trading Pvt. Ltd. in respect of his claim of purchase of shares. On perusal of the contract-cum-bill it is observed that the assessee has purchased 1,800 shares of M/s. Santoshima Tradelinks Ltd. The shares have been purchased at the rate of Rs.25 per share and the total cost of purchase has been shown at Rs.45,233/- . As per this contract cum bill it is also observed that on the same date assessee has sold 1,800 shares of Sampada Chemicals @ Rs.28.10 per share. The total sale consideration to be received by the assessee on sale of shares of Sampada Chemicals is shown as Rs.50,400/-. Thus the net amount payable to the assessee has been shown to be Rs.5,166/-. Further, it is also observed that the contract cum bill which the assessee has claimed to have received from Mihir Consultancy and Trading Pvt. Ltd. is unsigned. -: 7 :-

8. It has been submitted that the company M/s. Santoshima Tradelinks got merged with XYZ Ltd and on merger, the assessee got 1760 shares of XYZ Ltd The assessee has also submitted that he has purchased 5,000 shares of XYZ Ltdon 5.1.2011 @ Rs.20 per share and total purchase consideration paid was Rs.1,00,000/-.

8.1 In respect of the shares of M/s. Santoshima Tradelinks, it is observed that the Company was never listed on any recognized stock exchange and the transaction of purchase of shares of this Company has to be off-market . Further, on verification of the shares of Sunrise Asia Ltd., from the website of BSE it is seen that the shares of XYZ Ltdwere listed only after June 2011. Thus, the transactions of both the shares has to be off-market transactions which were not through any recognized stock exchanges. The assessee has not submitted the Balance Sheet of 2010-11 and 2011-12 in respect of accounting of this shares in his regular books.

9. To analyze more to understand that whether M/s Sunrise Asian Ltd is a penny stock or not, the Financial Result of the company for the FY 2009-10,10-11, 11-12 and 12- 13 were analysed and the details are as follows :

Analysis of Financial Data of Sunrise Asian Ltd. The financial data of M/s Sunrise Asian Ltd for the F.Ys.2010-11, 2011-12 and 2012-13 are detailed as under: -: 8 :-

PARTICULARS ( FY 12-13 11-12 10-11 09-10 CR) NET SALES 73.84 0.38 0.63 0.17 OPERATING 0.45 -0.01 0.08 -0.34 PROFIT OTHER INCOME 0.01 0.00 0.10 0.00 INTEREST 0.00 0.00 0.00 0.00 DEPRECIATION 0.04 0.00 0.00 0.00 PROFIT BEFORE 0.41 -0.01 0.08 -0.34 TAX TAX 0.13 0.00 0.03 0.00 PROFIT AFTER TAX 0.28 -0.01 0.05 -0.34 SHARE CAPITAL 4.26 4.26 4.26 4.26 RESERVES 73.61 -4.43 -4.43 -4.48 NET WORTH 77.87 -0.17 -0.17 -0.22 LOANS 5.43 0.06 0.00 0.00 GROSS BLOCK 0.17 0.00 0.00 0.01 INVESTMENTS 6.82 0.00 0.00 0.00 CASH 0.13 0.00 0.01 0.04 DEBTORS 55.31 0.81 0.43 0.00 NET WORKING 76.35 -0.11 -0.17 -0.23 CAPITAL OPERATING PROFIT MARGIN 0.61 -2.63 12.70 -200.00 (%) NET PROFIT 0.38 -2.63 7.94 -200.00 MARGIN (%) EARNING PER 0.65 0.00 0.12 0.00 SHARE (RS) DIVIDEND (%) 0.00 0.00 0.00 0.00 DIVIDEND PAYOUT 0.00 0.00 0.00 0.00

As per the details mentioned above, it is very clear that the company does not have sound financial result. Therefore, the quantum of share traded clearly indicate the engineering of the share price in this scrip and their speculative nature. As per the financial result, this is a very small company and as per the shareholders chart, the company has fewer shareholders and it is less liquid. As per the statement filed by the assessee, the stock is a very low priced stock. From the Profit & Loss Account for the F.Ys. ended on 31.3.2010, 31.3.2011, 31.3.12. and 31.3.13 it is seen that the company suffered loss for the FY’s 2009-10 and 2011-12. The net profit for the FY 2010-11 was a meagre Rs 8,000/- and for the FY 2012-13 it was Rs 41 lacs. The EPS of the company for the FY’s FY’s 2009-10 and 2011-12 was zero and for the FY’s 2010-11 and 2012-13 it was 0.12 and 0.65 respectively. The networth of the company for the FY’s 2009-10 to 11- 12 was negative and the for the FY 12-13 it was 77.7 crores. These financial details -: 9 :- clearly indicate that M/s Sunrise Asian Ltd did not have any financial strength to support any phenomenal gains in its share price. The company had meager profits, no dividend was being declared by the company. Therefore, it is improbable that the share price of such a company would register such handsome growth on the basis of its financial parameters. The prices of such shares can only be increased by artificially engineering them which exactly has happened in this case.

9.1 The details of the share price movement of the share of M/s Sunrise Asian Ltd were also analysed. it was observed that the during the FY 2011-12 the share was traded only on two days, having only 1 trade on each day. On day 1 i.e. 17/8/11 only 5 shares were taded and on day two i.e. 9/0/911, only 300 shares were traded. There was no movement in the share price.

In the FY 2012-13, the transaction in the share started only on 16/1/012 and on all days, barring one, the number trades were only 1. The number shares transacted were very few. The deatils of the transactions in the shares of thecompany M/s Sunrise Asian Ltd (as downloaded form the website of Bombay Stock Exchange bseindia.com) is as under:

NO OF No OF TOTAL DELIVERABLE DATE OPEN HIGH LOW CLOSE SHARES TRADES TURNOVER QTY 17/08/1 50.00 50.00 50.00 50.00 5 1 250 5 1 9/09/11 60.00 60.00 60.00 60.00 300 1 18,000 300 16/10/1 63.00 63.00 63.00 63.00 5 1 315 5 2 18/10/1 66.15 66.15 66.15 66.15 5 1 330 5 2 23/10/1 69.45 69.45 69.45 69.45 10 1 694 10 2 25/10/1 72.90 72.90 72.90 72.90 10 1 729 10 2 31/10/1 80.30 80.30 80.30 80.30 10 1 803 10 2 2/11/12 84.30 84.30 84.30 84.30 10 1 843 10 16/11/1 102.35 102.35 102.35 102.35 10 1 1,023 10 2 19/11/1 107.45 107.45 107.45 107.45 10 1 1,074 10 2 22/11/1 112.80 112.80 112.80 112.80 10 1 1,128 10 2 13/12/1 137.00 137.00 137.00 137.00 20 1 2,740 20 2 27/12/1 174.75 174.75 174.75 174.75 15 1 2,621 15 2 2/01/13 192.60 192.60 192.60 192.60 10 1 1,926 10 31/12/1 183.45 183.45 183.45 183.45 10 1 1,834 10 2 20/12/1 158.55 158.55 158.55 158.55 20 1 3,171 20 2 -: 10 :-

14/12/1 143.85 143.85 143.85 143.85 50 1 7,192 50 2 15/11/1 97.50 97.50 97.50 97.50 10 1 975 10 2 6/11/12 88.50 88.50 88.50 88.50 10 1 885 10 4/12/12 124.30 124.30 124.30 124.30 250 2 31,075 250 24/12/1 166.45 166.45 166.45 166.45 15 1 2,496 15 2 18/12/1 151.00 151.00 151.00 151.00 20 1 3,020 20 2 11/12/1 130.50 130.50 130.50 130.50 50 1 6,525 50 2 27/11/1 118.40 118.40 118.40 118.40 10 1 1,184 10 2 26/10/1 76.50 76.50 76.50 76.50 10 1 765 10 2 7/11/12 92.90 92.90 92.90 92.90 10 1 929 10 17/08/1 50.00 50.00 50.00 50.00 5 1 250 5 1 9/09/11 60.00 60.00 60.00 60.00 300 1 18,000 300 16/10/1 63.00 63.00 63.00 63.00 5 1 315 5 2 18/10/1 66.15 66.15 66.15 66.15 5 1 330 5 2 23/10/1 69.45 69.45 69.45 69.45 10 1 694 10 2 25/10/1 72.90 72.90 72.90 72.90 10 1 729 10 2 31/10/1 80.30 80.30 80.30 80.30 10 1 803 10 2 2/11/12 84.30 84.30 84.30 84.30 10 1 843 10 16/11/1 102.35 102.35 102.35 102.35 10 1 1,023 10 2 19/11/1 107.45 107.45 107.45 107.45 10 1 1,074 10 2 22/11/1 112.80 112.80 112.80 112.80 10 1 1,128 10 2 13/12/1 137.00 137.00 137.00 137.00 20 1 2,740 20 2 27/12/1 174.75 174.75 174.75 174.75 15 1 2,621 15 2 2/01/13 192.60 192.60 192.60 192.60 10 1 1,926 10 31/12/1 183.45 183.45 183.45 183.45 10 1 1,834 10 2 20/12/1 158.55 158.55 158.55 158.55 20 1 3,171 20 2 24/12/1 2 166.45 166.45 166.45 166.45 15 1 2496 15 27/12/1 2 174.75 174.75 174.75 174.75 15 1 2621 15 31/12/1 2 183.45 183.45 183.45 183.45 10 1 1834 10 02/01/1 3 192.6 192.6 192.6 192.6 10 1 1926 10 04/01/1 3 202.2 202.2 202.2 202.2 10 1 2022 10 08/01/1 3 212.3 212.3 212.3 212.3 15 1 3184 15 10/01/1 3 222.9 222.9 222.9 222.9 15 1 3343 15 15/01/1 3 234 234 234 234 10 1 2340 10 17/01/1 3 245.7 245.7 245.7 245.7 10 1 2457 10 18/01/1 3 257.95 257.95 257.95 257.95 10 1 2579 10 22/01/1 270.8 270.8 270.8 270.8 15 1 4062 15 -: 11 :-

3 24/01/1 3 284.3 284.3 284.3 284.3 15 1 4264 15

From the above it can be observed that very few shares were tarnsacted during the period under review and thus the probability of manipulating the shares and rigging the price are very high.

Therefore, it is a clearly a penny stock without any doubt.

10. Inquiry conducted u/s 133(6) of the I.T. Act, 1961

Information was called u/s. 133(6) from M/s. Mihir Consultancy and Trading Pvt. Ltd. at the address given on contract cum bill which was given by the assessee. As per the contract cum bill the address of M/s. Mihir Consultancy and Trading Pvt. Ltd. was 25, Zera mansion, 3rd Floor, 264 /268 Yusuf Meher Ali Road Mumbai 400 003. However, the same could not be served on M/s. Mihir Consultancy and Trading Pvt. Ltd. at the given address as the concerned party was not available at the given address. Information was also sought from M/s. Pune e-Stock Broking Pvt. Ltd. and the details of Demat account opening details were called for. From KYC details submitted by M/s. Pune e-Stock Broking Pvt. Ltd. it was found that the account was opened on 30.11.2010 and it was also observed that the shares of M/s. Santoshima Tradelinks were credited to the Demat account on 9.1.2013 and 24.1.2013. It was also observed that the dematerialization request form was submitted by the assessee to Pune E Stock Broking Ltd. on 9.1.2013.

By the above discussion, the following facts may be concluded which are as under: i) The broker i.e. M/s. Mihir Consultancy and Trading Pvt. Ltd. through whom the assessee has claimed to have purchased shares of M/s. Santoshima Tradelinks is not available at the given address. The contract cum bill which the assessee has claimed to have received from Mihir Consultancy and Trading Pvt. Ltd. is unsigned ii) The assessee has opened Demat account on 30.11.2010 and the shares of M/s. Santoshima Tradelinks Ltd. have been claimed to have been purchased in the month of June 2011. Thus, the shares were sent for dematerialization only after a gap of 18 months i.e. in the month of January 2013. iii) The Demat account has been utilized only for the purpose of the transaction in the scrip under consideration. iv) The depository has given the account of statement of holdings of Shri Karamshi D Nandu for the period January 2013 to March 2013. By going through that account, it is -: 12 :- found that except the scrip under consideration, assessee has not done any investment/trading activity in any other shares. This fact gives a further support of the opinion that the assessee has only transacted in these shares for having the accommodation entry for the artificial capital gain. v) On perusal of the contract-cum-bill it is observed on the day of purchase of 1,800 shares of M/s. Santoshima Tradelinks Ltd, the assessee has sold 1,800 shares of Sampada Chemicals @ Rs. 28.10 per share. Thus the payment for purchase of shares has been squared off. Thus for the payment, profit is purchased from the market. Thus, this is a clear indication of backdating of purchase of shares. vi) Then the market was rigged and the share prices went up and assessee sold his shares. vii) Thereafter, the operator came out of the market and the shares have gone at the place where it was in the month of June 11 in terms of rate.

In view of the above discrepancies, a summons u/s. 131 of the Act was issued to the assessee and his statement was recorded under oath on 7.3.2016. In the statement, the assessee was confronted with the above findings and was asked to explain the same. The relevant extracts of the statement of the assessee dt. 7.3.2016 is reproduced as under:

Q3 Please state your educational qualifications and business activities. A I am educated upto 5th standard. I am a partner in Om Medical along with Partner Ratansey Kathad Gala. I have also earned commission on trading in grains, pulses, spices etc. Q4 Please state since when you have been investing in shares of companies. Please also give the details of the investments made in the shares till date (other than impugned purchases) during last 5 years:

A During A.Y. 2010-11, I have invested in the shares of M/s. Sampada Chemicals Pvt. Ltd. Thereafter, I have purchased shares of M/s. Santoshima Leasing Ltd. This has been the only investments I have made in the last 5 years. Q5 How do you invest in shares. Whether you seek any professional advice/ Name and address of the person who recommended the purchase alongwith relationship with him/her. A I invest on professional advice. The person who advised me to purchase the shares is Shri Sanjay Shah. As far as my knowledge goes, he stays somewhere in Santacruz (E). I don’t know his present whereabouts. -: 13 :-

Q6 Please let me why you choose to invest in the shares of M/s Santoshima? What business is the company doing and what are the products they are dealing in?

A I chose to invest in the shares of M/s. Santoshima on the advice of Shri Sanjay Shah. I was told that this Company would be delisted. He said after listing, the price of the share would increase. Hence, I bought the same. I don’t know about the business of the Company and what products they are dealing in. Q7 Did you analyze the financial performance of M/s Santoshima, before purchase of the shares?

A I have not analyzed the financial performance of M/s. Santoshima before purchase of the shares. Q8 Did you know at what price multiples (P/E ratio) the shares purchased was trading

A I am unaware of the P/E ratio of the shares traded … Q9 Please let me know as to whether you were keeping track of share price movement? If yes, how, and the source of information. Also, the frequency of getting such updation. A Till the share was not listed I had no price updates. After it was listed, I used to get quarterly updates from Pune E Stock Broking. My younger son Praful K Nandu had the information that the price is increasing from media, newspaper, etc. My Partner’s son also does share trading. He and my son passed information to me. Q1 Please let me know the stock exchange on which the shares of M/s 0 Santoshima were listed A M/s. Santoshima Leasing was unlisted. Q1 Please let me know as to whether you had prior knowledge that share 1 transactions were off-market transactions? When did you know about the nature of the transaction?

A I knew that the share transactions were off-market. I knew about the nature of the transaction in June 2011 when I purchased. Q1 Please give the date/(s) on which the company M/s Santoshima got 2 merged. A The merger date is 22.5.2013. Copy of the merger order of the Bombay High Court has been submitted vide submission dt. 11.1.2016. Q1 How the delivery of the shares was taken. 3 A Delivery of shares was physical. Q1 Please let me know as to when was the demat account opened? what 4 were the instructions given to demat participant for transfer of shares?

A Demat account was first opened in 2009 with Religare Securities Ltd. -: 14 :-

That was closed and subsequently fresh demat account was opened on 30.11.2010 with Pune E stock broking Ltd.. Q1 Please let me know as to why the physical delivery of the shares was 5 taken when you have a Demat Account A Physical delivery of the shares was taken because the seller had not dematted his shares. The name of the seller is M/s. Shipra Fabrics Pvt. Ltd. And the date of taking physical delivery of the shares is 2.10.2011. Q1 Please let me know why the shares were dematerialized after a gap of 6 more than 2 years. A First we had dematted these shares with Religare. They said that it is a very low priced share which they do not deal in. Hence, they refused to keep the shares in the Demat account and get it transferred elsewhere. Hence, it was transferred to Pune Stock Broking on 9.1.2013. Q1 Please give the status of that demat account now? 7 A The Demat account is still continuing. However, no other transactions are being carried on in the said account. Q1 Please let me the name of the broker through whom the shares were 8 purchased. How did you got introduced to broker? Who introduced to this broker?

A The name of the broker is M/s. Mihir Consultancy and Trading P Ltd. I had sold shares of M/s. Sampada Chemicals Ltd. And I purchased this share of M/s. Santoshima Leasing Ltd. Through M/s. Mihir Consultancy and Trading P Ltd. This entire exercise was done by Mr. Sanjay Shah. Q1 Please let me know as to whether you have ever been to the office of 9 broker? If yes, whom did he meet?

A I have never been to the office of the broker M/s. Mihir Consultancy and Trading P Ltd. I have never met anyone from that office. Q2 Please let me as to how the purchase orders was placed with broker? 0 To whom did you speak / instruct for placing the orders and how did the contract notes were received from broker?

A Mr. Sanjay Shah advised me to sell M/s. Sampada Chemical ltd. Share and asked me to buy shares of M/s. Santoshima Leasing and he placed order with broker. Right upto bringing the physical shares in my hands, all the work was done by Mr. Sanjay Shah. Contract notes from broker were also brought by Mr. Sanjay Shah. Q2 Please let me as to whether you have filled the client introduction form / 1 KYC forms? If yes copies thereof.

A Someone from Pune Stock Exchange came to my shop and brought the form for KYC and took my photos etc. and completed the formalities. I am not sure I have the client introduction form / KYC forms. I will check and inform about the same. Q2 Please let me know the basis for the decision to sell the shares? -: 15 :-

2 A As I said earlier my son informed me about the prevailing rates. On that basis I took the decision of selling the shares. Q2 Please let me know how was the payment made/received to/from 3 broker?

A The first 1,760 shares @ Rs.25 per share of M/s Santoshima Leasing were purchased against the sale of Sampada Chemicals sold @Rs.50,400/- i.e. @Rs.28 Per share 1800 shares. It was transferred on 2.11.2011 to me. Thereafter 4,000 shares of M/s. Santoshima @25 per share of Rs.1,00,000/- were purchased vide a/c payee cheque dt. 5.1.2011 drawn on Punjab National Bank. Q2 When was the return of income for the previous year filed? 4 A A.Y. 2012-13 ROI filed on 22.5.2013. Q2 What did Mr. Sanjay Shah charge you? 5 A The shares of Sampada Chemicals was sold against which the shares of M/s. Santoshimata Leasing were purchased. The difference between sale and purchase that is the profit of Rs.5,166/- was not given by Mr. Sanjay Shah. It was taken by him. Q2 When you had gone to Religare for dematting the shares? 6 A I am not aware of the exact date. It is somewhere in F.Y. 2009-10. Q2 After Religare refused to keep the shares in Demat a/c on what date 7 did you demat the shares with Pune e Stock Broking? A I opened account with Pune e Stock Broking on 30.11.2010 Q2 Why the 5,000 shares of M/s. Sunrise Asian Ltd. Were purchased even 8 though not listed? A Shri Sanjay Shah informed that the shares which are delisted, after they are listed they tend to rise in price and showed some examples of such scrips. Hence I had purchased these shares. Q2 Why the broker note from M/s. Mihir Consultancy is not signed? 9 A I don’t know how it is so? I didn’t check. Q3 Why is there such a long gap from purchase to Demat of the shares of 0 Santoshima and Sunrise? A Religare was not accepting these shares for Demat. Hence an account was opened in Pune e stock broking Ltd. And the shares were dematted there. I don’t know how the dematting was delayed. Q3 Why the transaction in the share should not be treated as sham in view 1 of the findings and as such the artificial claim of LTCG should not be disallowed and why the credits of Rs.20.54 lacs should not be treated as unexplained cash credits u/s. 68 A This does not prove that the transaction is sham since nothing has been brought on record to show that the transaction is sham. Further, we have paid by account payee cheque and also received sale -: 16 :-

proceeds by account payee cheque through regular stock exchange.

From the above statement it is observed that the assessee did not have any professional knowledge in respect of investment in shares. Prior to investment in the shares of M/s. Santoshima Tradelinks, the assessee had not invested in any other share barring a transaction in the share of M/s. Sampada Chemicals. After the transaction in M/s. Santoshima Tradelinks, the assessee has not invested in any other share. Even the investment in M/s. Santoshima Tradelinks was on advice of a third party. The assessee had no knowledge of the financials of M/s. Santoshima Tradelinks. Thus, the assessee is not a regular investor who is dealing in shares on a very regular basis and who can be said to be capable of investing in shares to earn a huge gain as has been shown in the return of income. The specific finds in this regard are as under: i) The purchase of the shares have been done off-market. Why the assessee has done the off-market transaction has not been explained by him. ii) The details taken from the Bombay Stock Exchange clearly establishes the fact that shares have been manipulated to give the profit to some of the persons and as soon as that job was over, the prices of the shares has gone rock bottom. Before the purchase of shares by the assessee, the prices were nominal and after the sale of the shares by the assessee, again the prices were insignificant. Again it cannot be a coincidence. But it is a structured story only to provide artificial gain to the assessee. iii) The payment made by the assessee to M/s. Mihir Consultancy and Trading Pvt. Ltd also gives an interesting aspect. The shares have been purchased by the assessee and for the payment of same shares, the speculation profit was claimed to have generated in the market. The assessee has entered into a speculation transaction on the same date on which he had claimed to have purchased shares of Santoshima Tradelink ltd. The speculation profit earned by the assessee is almost equal to the purchase price of the shares of M/s. Santoshima Tradelink ltd and the purchases are set off against the speculation profit. The speculative profit that the assessee has claimed to have earned on the same day on which the assessee has claimed to have purchased the shares clearly establishes the sham nature of transaction. iv) On the analysis of the case records of the assessee, it has been found that in past the assessee has seldom entered into any transactions with respect to the sale and purchase of shares. But in this year, the assessee, has been engaged in the huge transactions of sale and purchase of shares of mainly one scrip, i.e., Santoshima -: 17 :-

Tradelink ltd which got merged with Sunrise Asian Ltd. The purchase of the shares is at a very nominal rate and the sale of the shares is at a substantially high rate. How the assessee understood that the scrip Santoshima Tradelink ltd which got merged with Sunrise Asian Ltd will have such a phenomenal rise in the market in the short span of approximately one year needs to be understood. The educational qualification of all the assessee is not such that he can predict the phenomenal rise of such a lesser known stock. Therefore, as far as the educational qualification and technical expertise of the assessee is concerned, it does not give any indication that he can understand the market parameters on his own. When the Stock Market was booming and sensex is going strong day by day at that time, not investing in the shares which has the role in enhancing the sensex value, but investing in the shares which was known by only a limited number of people gives the clear indication that something wrong somewhere with respect to the whole transaction. As discussed earlier, seeing assessee’s track record, his educational qualification, his knowledge in the financial market and his past history in the capital market, it is amply clear that the transaction done in Santoshima Tradelink ltd which got merged with Sunrise Asian Ltd is only a device to convert his black money into white. v) One more issue which needs to be addressed here that whether Financial Results of Sunrise Asian Ltd Construction are in a position to attract the investors. The matter has been discussed in detail in this order under the heading ‘Analysis of Financial Results’. As per above discussion, it is amply clear that there is nothing in the Financial results of the company by which any person may be attracted to purchase the shares. At the cost of the repetition, it may be mentioned here that the company has almost nil profit before tax, no assets, very ordinary turnover, non-declaration of dividend. In this scenario, it is almost impossible to any investor to go ahead for the purchase of share. Seeing the facts as discussed here, the approach of the assessee under consideration to invest in the share of Sunrise Asian Ltd is difficult to understand. vi) The purchase transaction are claimed to have been done through M/s. Mihir Consultancy and Trading Pvt. Ltd. However, the information called for u/s. 133(6) was returned unserved. No further details have been filed. The Contract note cum bill furnished from Mihir Consultancy and Trading Pvt. Ltd is unsigned. vi) The purchase transaction has been claimed to have been entered in the month of June 2011 and the delivery of the shares has been claimed to have been received physically. However, the dematerialization of the shares have taken place only in January 2013. Thus, there is a huge gap of 1 year and 6 months between the physical -: 18 :- delivery of shares and dematerialization. No explanation has been offered for such a huge time gap. This clearly indicates back dating of the purchases so as to enable the assessee to claim the so called “Long Term Capital Gain”.. vii) In the return of income filed by the assessee for A.Y. 2012-13, the purchase transactions in shares of M/s. Santoshima Trade Link were not shown. viii) The transaction of purchase of shares of M/s. Santoshima trdae Link was off market transaction. However, it is not submitted as to whether the recognized stock exchange was intimated regarding such off market transaction. There is a defined procedure in Bombay Stock Exchange for reporting off-market transaction. The Exchange vide its Circular dtd.12.12.1994 informed the members to report all the off the floor transactions with effect from 2.1.1995. The Exchange vide its notice dtd.22.6.1996 informed the members about the reporting mechanism for off-market deals which were compulsorily to be reported to the board system. SEBI vide its press release dtd.1.9.1999 directed that henceforth all the negotiated deeds (including cross deals) will no longer be permitted in the existing manner and all such deals shall be executed only on the screens of the exchange in the trade and order mechanism to the Exchange just like any other normal trade. The assessee has not followed the procedure as stated above. If he was having a genuine transaction, then why the transaction has not been reported by the assessee and why it has been done against the guidelines of Exchange and SEBI. ix) By the analysis of the case records of the assessee, it has been found that in past the assessee has seldom entered into any transactions with respect to the sale and purchase of shares. How it has been understood by the assessee that the scrip Sunrise Asian Ltd will have such a phenomenal rise in the market in the short span of approximately one year needs to be analyzed. The educational qualification of the of the assessee indicates that he has no educational background of Finance and day to day working of Bombay Stock Market . Investment profile of the assessee also established that he is has not traded and/or invested much in shares. When the Stock Market is booming and sensex is going strong day by day at that time, not investing in the shares which has the role in enhancing the sensex value, but investing in the shares which was known by only a limited persons gives the clear indication that something wrong somewhere with respect to the whole transaction. To analyze this factor the representative of the assessee was asked to as to how the assessee came to know the timing of purchase of share and timing of sale of share and who has advised the assessee about the time of purchase and sale of shares. In this regard no specific reply has been given. Therefore, the educational background of the assessee, his investments till date and other factors clearly indicates that the transaction entered by the assessee in the shares of M/s Sunrise Asian Ltd. is only a device to convert its black money into white.

Thus the final analysis of the facts of the case of the assessee are as under:

i) Off market transaction for purchase of shares, with physical delivery of shares. The trade not reported to BSE ii) Speculative profit on the same day of the same amount equivalent to purchase consideration. Thus there are no payments to the sub broker. iii) Merger of the shares with M/s Sunrise Asian Ltd -: 19 :-

iv) Huge time gap between purchase and dematerialization of the shares. v) On analysis of Financial Statistics of M/s. Sunrise Asian Ltd & the pattern of share trading in this scrip, it becomes crystal clear that the share prices were increased by artificial engineered method during the year since the company did not have any financial strain to support such phenomenal gain in its share price.

All the above facts, establishes that the assessee has back dated the purchases of the shares and entered into an engineered transaction to generate artificial long term capital gains. -: 20 :-

8. Legal precedence : On the similar issue, ITAT Chandigarh ‘A’ Bench in the case of Somnath Mani reported in 100 TTJ 917 decided the issue in favour of the Department. The facts of the case are as follows :

“ 3. The relevant facts briefly stated are that during the course of assessment proceedings, the AO observed that assessee had incurred a long-term capital loss on account of sale of gold jewellery declared under the VDIS, 1997, amounting to Rs. 19,87,705 and also there was a short term capital gain near to this amount of long –term capital loss amounting to Rs. 20,36,700 resulting into net capital gain of Rs. 48,995. The AO on perusal of record further observed that in the case of a family members of the same assessee Shri D.C. Maini, in the same assessment year, similar exercise has been done by the assessee wherein a long-term capital loss of Rs. 11,59,066 had been incurred on account of sale of gold jewellery declare under the VDIS and short-term capital gain of Rs. 11,75,100 resulting into a net gain of Rs. 16,034. On going through the nature of transactions, the AO doubted the genuineness of the short-term capital gain in the case of the assessee and he made further inquiry that during that year assessee had purchased 45,000 shares of M/s Ankur International Ltd. at varying rates from Rs. 2.06 to 3.1 per share and sold them within a short span of six-seven months at the rate varying from 47.75 to Rs. 55. These shares were purchased through a broker Munish Arora & Co. and sold through another broker M/s S.K. Sharma & Co. The AO took by surprise the astronomical rise in share price of a company from Rs. 3 to Rs. 55 and started further inquiry. The AO issued notice under section 131 to both the brokers from whom shares were purchased and sold and statements were recorded. The AO also analyzed the balance sheet of M/s Ankur International Ltd. to justify as to how the share price of a company can go up from a mere Rs. 3 to Rs. 55 in a short span of six to seven months’ time. The AO made detailed and extraneous exercise of finding the fundamental of the share of the company by different methods and concluded that these shares were not genuine and transactions were so arranged so as to cover up the loss incurred on account of sale of jewellery only. The AO also recorded the finding that transactions were done at Ludhiana where also the share price of the company is quoted but the maximum value of the share quoted was Rs. 17 but that was only in July, 1997, i.e. long before the shares were sold by the assessee to M/s S.K. Sharma & Co. in the months of February and March, 1998. The AO also recorded the finding that although the shares were transferred in the name of the assessee, they were still lying in the name of assessee much after the sale to M/s S.K. Sharma & Co. The learned CIT(A) deleted the addition on the ground that both the brokers from whom the shares have been purchased and sold were called under section 131 by the AO. Both have confirmed the sale and purchase of said shares. Other aspect of the facts and circumstances raised by the AO was not discussed by the CIT(A) in his order.

Held : Although A Ltd. is a quoted company, its shares were not being transacted at Ludhiana Stock Exchange at the relevant time. Shares have been purchased and sold through the brokers and payments have been received through cheque on different dates as per the statement of account of broker, S.K. Factual matrix of the case from start of the purchase of shares at the rate of Rs. 3 to the sale of shares at Rs. 55 in a short span of time and shares being not quoted at Ludhiana Stock Exchange and the way in which different instalment payments have been received from the brokers and non-availability of the records of the brokers and the shares remaining in the name of assessee even long after the sale of shares does not stand the test of probabilities. As rightly pointed out by the -: 21 :-

Departmental Representative, these types of companies function in capital market whose sale price is manipulated to astronomical height only to create the artificial transaction in the form of capital gain. Surrounding circumstances differ from the normal share market transactions in which they are ordinarily carried out. Taking all the steps together, final conclusion does not accord with the human probabilities. The CIT(A) only got swayed by the issuance of notice by the AO under s. 131 to both the brokers overlooking the material gathered by the AO from the statements recorded of broker and the other facts and circumstances that volume of transactions of Jaipur Stock Exchange is only 600 shares and 1000 shares. Payments have been received from the brokers only in instalments over a period of 6-7 months. It is true that when transactions are through cheques, it looks like real transaction but authorities are permitted to look behind the transaction and find out the motive behind transactions Generally, it is expected that apparent is real but it is not sacrosanct. If facts and circumstances so warrant that it does not accord with the test of human probabilities, transactions have been held to be non-genuine. It is highly improbable that share price of a worthless company can go from Rs. 3 to Rs. 55 in a short span of time. Mere payment by cheque and receipt by cheque does not render a belief. Facts of the case only lead to the inference that these transactions are not genuine and make believe only to off set the loss incurred on the sale of jewellery declared under vdis. In the totality of facts and circumstances of this case and material on record, the CIT(A) was not justified in deleing the impugned addition. Accordingly, the order of the CIT(A) is se aside and that of the AO is restored.”

8.1 As discussed above, the conclusion may be drawn that the assessee has tried to give the color of a genuine device with the help of series of the transactions. But when all the chains of the transactions have been separately analyzed and after the analysis of separate transactions, a final picture of consolidated events is taken into account, then it appears that it is not a genuine transaction, but a sham transaction. In this regard, I would like to quote a famous case of Mc Dowell & Co. Ltd. reported in 154 ITR 148 (Supreme Court), wherein it has been held that the planning avoid without breaking Law – No longer approvable – Legal avoidance to be cured – India having since attained its independence and now striving towards building a welfare society, could no longer afford to recognize the observations in certain old English decisions that tax could be so planned as to avoid its incidence, within the purview of law – similar observations in certain old Indian decisions are, therefore, not in keeping with the changed conditions are obsolete in view of the manifold evil consequences of the avoidance. The court has further held that ‘No one to be permitted to get away with a tax avoidance with the mere statement that there is nothing illegal about it – Neither fair nor desirable to expect legislature to intervene and take care of every device and scheme to a void taxation – Upto the Court to take stock to determine the nature of the new and sophisticated legal devices to avoid tax and to expose the devices for what they really are and to refuse to give judicial benefaction.

The Hon.’ble Supreme Court in the case of Mc Dowell and Co. Ltd. v CTO 154 ITR 148 has denounced this practice of tax avoidance, as “Tax, planning may be legitimate provided it is with the framework of the law. Colourable devices cannot be part of tax planning and it wrong to encourage or entertain the belief that it is honourable to avoid the payment of tax by dubious methods. It is the obligation of every citizen to pay the taxes honestly without resorting to subterfuges”. -: 22 :-

The fundamental principle laid down by the Supreme Court in this landmark judgment is as follows :

“ In our view, the proper way to construe a taxing statute, while considering a device to avoid tax, is not to ask whether the provisions should be construed literally or liberally, nor whether the transaction is not unreal and not prohibited by the statute but whether the transaction is device to avoid tax, and whether, the transaction is such that the judicial process may accord its approval to it.”

Reliance in this regard is also placed on the decision of the Hon.’ble Apex Court in the case of Juggilal Kamalapat vs CIT (1969) 73 ITR 702 (SC) , where in it was held that in cases where the same persons entered into transactions though by introducing a corporate personality into some of those transaction, the I T authorities are entitled to pierce the veil of the corporate personality and look at the reality of the transaction. The ratio laid down by this judgment is squarely applicable in the case under consideration wherein the assessee is trying to evade the legitimate taxes to be paid to the exchequer through the maze of calibrated transactions with the group concerns.

The attempt for tax avoidance by a series of preordained transactions is an old concept and restored to by tax payers in various countries. The taxing authority is entitled and is indeed bound to determine the true legal relation resulting from a transaction.

Another opinion came after the landmark judgment of Azadi Bachao Andolan reported in 263 ITR 706 that the ratio of Mc Dowell doesn’t hold good after the decision of this case. I would like to strongly deny this opinion because no where in Azadi Bachao Andolan has said that the facts and findings of Mc Dowell is no longer applicable. In fact, the decision of Mc Dowell and decision of Azadi Bachao Andolan are based on two different footings. Therefore, on the basis of one order attempt to counter or demean the findings of the other order is totally incorrect approach. The Azadi Bachao Andolan has clearly said that ‘If the courts finds that notwithstanding a series of legal steps taken by an assessee, the intended legal result has not been achieved, the court might be justified in overlooking the intermediate steps, but it is not permissible for the court to treat the intervening legal step as non est based upon some hypothetical assessment of the real motive of the assessee. An act which is otherwise valid in Law cannot be treated as non-est merely on the basis of some underlying motive supposedly resulting in some economic detriment or prejudice to -: 23 :- the national interests’. Therefore, it is crystal clear that the Azadi Bachao Andolan was based on certain facts and it has dealt with respect to the International transactions and international treaties.

8.3 The Mumbai ITAT in the case of Housing Development and Finance Corpn. Ltd. (ITA No.2913/Mum./1995, dtd.12.9.2005), after considering all the case laws on this issue including Azadi Bachao Andolan held that the findings of Mc Dowell case is still applicable and has to be respected by all means.

8.4 In the case of Sumati Dayal reported in 214 ITR 801 and Durga Prasad More reported in 82 ITR 540, the Hon’ble Supreme Court has held that matter has to be considered by applying the test of human probabilities. Having regard to the facts and circumstances as elaborately discussed in this order and inference could reasonably drawn that by all human probabilities, it is very difficult to accept that the assessee has done a genuine transaction with respect to his claim of capital gain. Therefore, after the application of the test of human probabilities, it is very difficult to conclude that the long term capital gain earned by him is genuine one.

In this regard reliance is placed on the decision of the Hon’ble Supreme Court in the case of CIT vs. Durgaprasad More 82 ITR 540. In this case the Hon’ble Surpeme Court has held that apparent must be considered real only if it is shown that there are reasons to believe that the apparent is not the real and that the taxing authorities are entitled to look into the surrounding circumstances to find out the reality and the matter has to be considered by applying the test of human probabilities. Therefore, it is clear from the above judgements that the burden is on the assessee to show that the receipt is not of an income nature by giving an explanation; the income-tax officer is not expected to put blinkers and accept it as it is; it is open to him to probe further and find out whether the apparent is real or not and take a decision on such probing, in the light of human probabilities.

Where any sum is found credited in the books of account of an assessee who offers no explanation of the nature and source of the cash credit or if the explanation is not found satisfactory or reasonable, the money has to be charged to tax as the assessee’s income from undisclosed sources. It is not necessary for the income-tax officer to locate the exact source of the credits

Therefore, the amount of Rs. 20,54,988/- shown to have received by the assessee towards the aforesaid transactions during the year has to be added to the total income of the assessee as ‘unexplained cash credit’.

8.5 The Special Bench of Mumbai ITAT in the case of Mid East Portfolio Management Ltd. reported in 271 ITR 87 (AT) has commented on the observation of the Hon’ble Supreme Court of India in the case of Mc Dowell & Co. Ltd. The observation is as follows : “The observations relating to the questions of tax evasion or avoidance made by the Supreme Court in Mc Dowell and Co. Ltd. v. CTO (1985) 54 ITR 148 have to be followed as guiding principles while deciding whether there was tax evasion or not on the facts and circumstances of a given case. The approach in such cases must be to take the entire transaction or arrangement as a -: 24 :-

whole and see if it makes any economic or commercial sense without attaching weight to the steps that go to make up the Scheme, each of which may be legally valid. The genuineness of the arrangement has to be viewed not in relation to every step taken to achieve the result but in relation to the final result. Mc Dowell (1985) 154 ITR 148 (SC), therefore, did not depart from what has already been laid down by the Supreme Court earlier except that the law regarding tax evasion was restated in much stronger expressions such as ‘dubious device’, ‘subterfuge’, ‘colourable transactions’, etc. The proper way to understand the observations in Mc Dowell (1985) 154 ITR 148 (SC) regarding tax evasion, read as a whole and in perspective, is to hold that all commercial arrangements and documents or transactions have to be given effect to, even though they result in a reduction of the tax liability, provided that they are genuine, bona-fide and not colourable transactions.”

9. Considering the above factual position as also the legal position it is held that the assessee has entered into an engineered transaction to generate artificial long term capital gains. As the explanation furnished by the assessee regarding the credits of Rs. 20,54,988/- in its books is found to be unsatisfactory, the same are hereby held as ‘unexplained cash credits’ in the books of the assessee and accordingly added to the total income of the assessee in accordance with the provisions of section 68 of the I T Act 1961.

Penalty proceedings u/s.271(1)(c) read with explanation 1 thereto are separately initiated for furnishing the inaccurate particulars of income with respect to the claim of capital gain made in light of the findings made in the preceding paragraphs.

Subject to the above remarks the total income of the assessee is computed as under:- Amount (Rs.) Amount (Rs.) Loss from House Property (1,50,000/-) Profits/Gains from 4,03,089/- Business/Profession ( as per computation of total income filed along with the return of income) Add: Unexplained cash 20,54,988/- 24,58,077/- credits u/s.68 Income from other sources 4,515/- (as per computation of income) GROSS TOTAL INCOME 23,12,592 Less : Chp. VIA Deductions 39,845 (as per computation filed with return of income) TOTAL INCOME 22,72,747 -: 25 :-

Assessed u/s 143(3) of the Income-tax Act, 1961. Give credit for prepaid taxes as per challans and TDS Certificates on record. Charge interest u/s 234A, 234B and 234C of the I T Act 1961. The calculation of interest is as per the ITNS 150 which is enclosed. Issue Demand Notice/ Challan accordingly. Penalty proceedings u/s.271(1)(c) are initiated separately for furnishing inaccurate particulars of income.

Income Tax Officer

Copy to : The assessee.

Office Note : The case was selected under CASS scrutiny for verification of suspicious Long Term Capital Gains based on inputs from the Investigation Wing. Details in this regard have been obtained, perused and placed on record.

Income Tax Officer