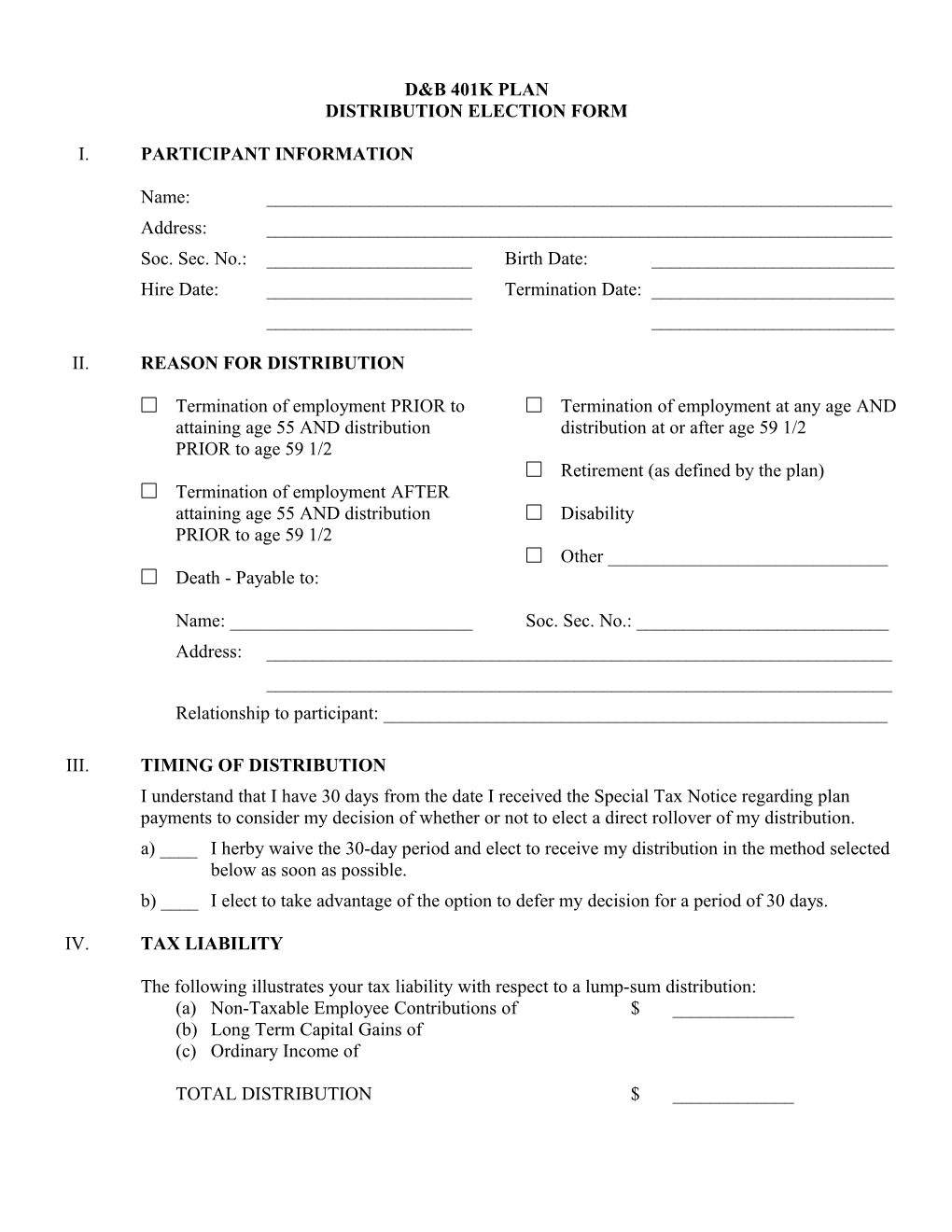

D&B 401K PLAN DISTRIBUTION ELECTION FORM

I. PARTICIPANT INFORMATION

Name: ______Address: ______Soc. Sec. No.: ______Birth Date: ______Hire Date: ______Termination Date: ______

II. REASON FOR DISTRIBUTION

Termination of employment PRIOR to Termination of employment at any age AND attaining age 55 AND distribution distribution at or after age 59 1/2 PRIOR to age 59 1/2 Retirement (as defined by the plan) Termination of employment AFTER attaining age 55 AND distribution Disability PRIOR to age 59 1/2 Other ______Death - Payable to:

Name: ______Soc. Sec. No.: ______Address: ______Relationship to participant: ______

III. TIMING OF DISTRIBUTION I understand that I have 30 days from the date I received the Special Tax Notice regarding plan payments to consider my decision of whether or not to elect a direct rollover of my distribution. a) ____ I herby waive the 30-day period and elect to receive my distribution in the method selected below as soon as possible. b) ____ I elect to take advantage of the option to defer my decision for a period of 30 days.

IV. TAX LIABILITY

The following illustrates your tax liability with respect to a lump-sum distribution: (a) Non-Taxable Employee Contributions of $ ______(b) Long Term Capital Gains of (c) Ordinary Income of

TOTAL DISTRIBUTION $ ______V.METHOD OF DISTRIBUTION AND WITHOLDING

I have received, read, and understand the special tax notice regarding plan payments which contains general information on the rules regarding rollover, direct rollover, withholding, capital gains, and income averaging treatment of distributions.

I understand that the taxable amount of this distribution is eligible for rollover treatment and that nontaxable portions are not eligible for rollover; therefore, all nontaxable portions of my accounts will be distributed to me.

If this distribution is made to a beneficiary other than the spouse, the distribution is not eligible for rollover, and option (c) below will be the deemed election.

Note: Any unpaid loan balance is considered a distribution from the Plan and is subject to the 20% withholding tax.

a) I instruct you to directly rollover the total taxable portion of the distribution requested on this form to the Qualified Retirement Plan or Individual Retirement Account ("IRA") named below in Direct Rollover Information. I understand that Federal and state income tax will not be withheld as a result of this direct rollover.

b) I instruct you to directly rollover $ of the total taxable portion of this distribution eligible for rollover to the Qualified Plan or IRA named below in Direct Rollover Information. I instruct you to distribute to me the remaining balance of the distribution. I understand that : 1) Federal and state income tax will not be withheld from the amount directly rolled over to the Qualified Plan or IRA named below; and 2) the taxable portion of the amount distributed to me is subject to mandatory Federal income tax withholding at a rate of 20% as required under current law, and state income tax will be withheld, if applicable.

c) I instruct you to distribute to me the total distribution requested on this form. I understand that Federal income tax will be withheld on the taxable amount of the distribution at a rate of 20% as required under current law, and state income tax will be withheld, if applicable.

DIRECT ROLLOVER INFORMATION

Trustee or IRA: ______Custodian Name: ______Plan Name or IRA: ______Account Number: ______Bank Routing #: ______

VI. SIGNATURE

Upon payment in full of my Account in the plan, I release the Plan Administrator, the Trustees of the Plan and from and against any and all claims the undersigned may have or hereafter claim to have against said Administrator, Trustees and, but only with respect to my interest in said Plan. Nothing contained in this release is intended to relieve any fiduciary of an obligation or duty under ERISA, or to violate the provisions of Section 410 of ERISA.

______Date Participant Signature ______Date Administrator Signature