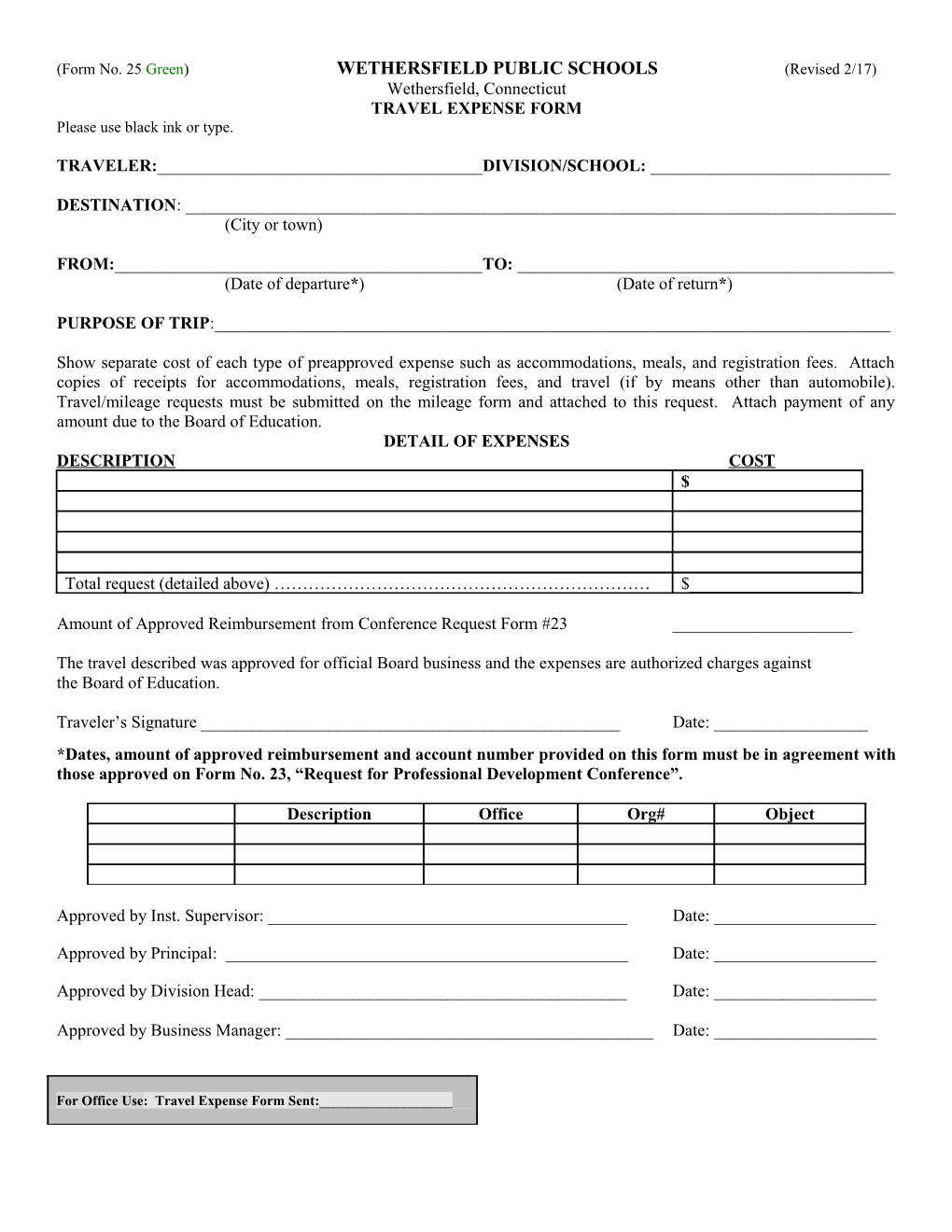

(Form No. 25 Green) WETHERSFIELD PUBLIC SCHOOLS (Revised 2/17) Wethersfield, Connecticut TRAVEL EXPENSE FORM Please use black ink or type.

TRAVELER:______DIVISION/SCHOOL: ______

DESTINATION: ______(City or town)

FROM:______TO: ______(Date of departure*) (Date of return*)

PURPOSE OF TRIP:______

Show separate cost of each type of preapproved expense such as accommodations, meals, and registration fees. Attach copies of receipts for accommodations, meals, registration fees, and travel (if by means other than automobile). Travel/mileage requests must be submitted on the mileage form and attached to this request. Attach payment of any amount due to the Board of Education. DETAIL OF EXPENSES DESCRIPTION COST $

Total request (detailed above) ………………………………………………………… $______

Amount of Approved Reimbursement from Conference Request Form #23 ______

The travel described was approved for official Board business and the expenses are authorized charges against the Board of Education.

Traveler’s Signature ______Date: ______*Dates, amount of approved reimbursement and account number provided on this form must be in agreement with those approved on Form No. 23, “Request for Professional Development Conference”.

Description Office Org# Object

Approved by Inst. Supervisor: ______Date: ______

Approved by Principal: ______Date: ______

Approved by Division Head: ______Date: ______

Approved by Business Manager: ______Date: ______

For Office Use: Travel Expense Form Sent:______See reverse for travel reimbursement guidelines Travel Reimbursement

OUT OF STATE TRAVEL

The U.S. General Services Administration Domestic Per Diem Rate for the Hartford area is used for reimbursement of meal expenditures for out of state travel. The $54 total allocation is comprised of $13 for breakfast, $15 for lunch and $26 for dinner. An employee may spend less than the maximum allowable amount on any particular meal but cannot apply the balance to a subsequent meal. Evening meals incurred in state during return trips are unallowable based on necessity and reasonability.

All efforts should be made to reserve lodging through the district accounts and fulfill payment by purchase order. The district MasterCard is available for those vendors that will not accept a purchase order. Costs incurred due to additional travel days with a spouse or significant other that coincide with business travel are unallowable.

All expenditures must have an independent itemized receipt to be eligible for reimbursement. Gratuities for public transportation and meals are at the employee’s discretion and can only be reimbursed if electronically substantiated by a vendor or reconciled to a credit card statement. Forms with proper supporting documentation and authorization must be submitted within 30 days after expenses paid or incurred. Costs for other individuals and consolidated employee group receipts are unallowable.

IN STATE TRAVEL

An employee required to travel outside the regular place of work without an overnight stay will adhere to the same guidelines as stated above with the exception of meal expenditures. Employees may be reimbursed for the actual cost of meals for the day, regardless of time incurred, not to exceed $18. Travel must be necessary to program objectives and include a minimum of six hours of work related activity to qualify for reimbursement.

OTHER ALLOWABLE TRAVEL COSTS

Airport/Hotel Parking Tolls on route to business destination Public transportation from airport/lodging to business destination

OTHER UNALLOWABLE TRAVEL COSTS

Alcoholic beverages Entertainment, recreation or social events and associated travel Car rental (unless documented as cost effective alternative)

TRIP ITINERARY AND PROJECTED REIMBURSEMENT MUST BE APPROVED BY THE BUILDING ADMINISTRATOR, DISTRICT DIRECTOR AND BUSINESS MANAGER PRIOR TO TRAVEL

GUIDELINES APPLY TO EMPLOYEES AND INDEPENDENT CONTRACTORS PROVIDING SERVICES TO THE DISTRICT

D:\Docs\2018-04-18\0a29dedd408b390e1704d4189da7996e.doc