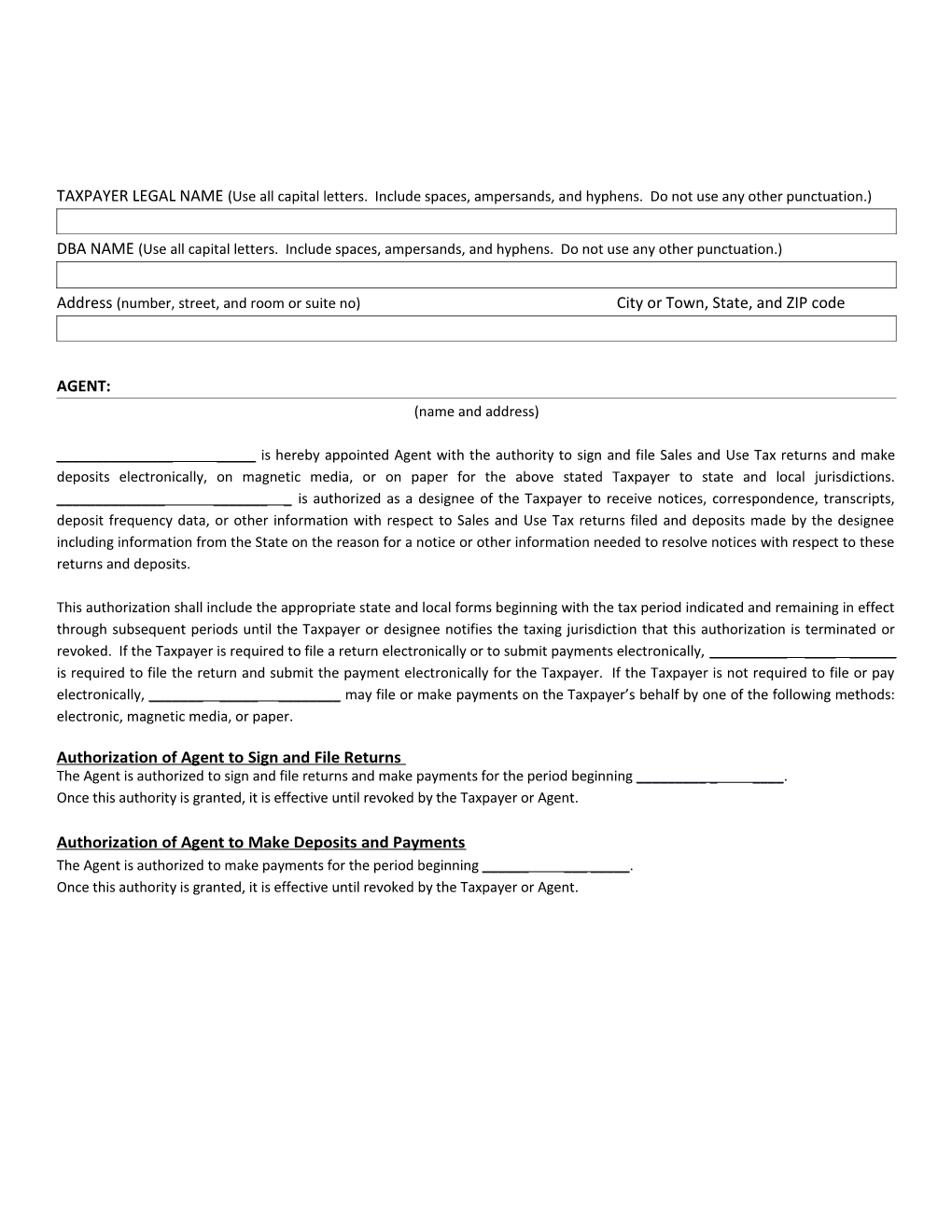

TAXPAYER LEGAL NAME (Use all capital letters. Include spaces, ampersands, and hyphens. Do not use any other punctuation.)

DBA NAME (Use all capital letters. Include spaces, ampersands, and hyphens. Do not use any other punctuation.)

Address (number, street, and room or suite no) City or Town, State, and ZIP code

AGENT: (name and address)

______is hereby appointed Agent with the authority to sign and file Sales and Use Tax returns and make deposits electronically, on magnetic media, or on paper for the above stated Taxpayer to state and local jurisdictions. ______is authorized as a designee of the Taxpayer to receive notices, correspondence, transcripts, deposit frequency data, or other information with respect to Sales and Use Tax returns filed and deposits made by the designee including information from the State on the reason for a notice or other information needed to resolve notices with respect to these returns and deposits.

This authorization shall include the appropriate state and local forms beginning with the tax period indicated and remaining in effect through subsequent periods until the Taxpayer or designee notifies the taxing jurisdiction that this authorization is terminated or revoked. If the Taxpayer is required to file a return electronically or to submit payments electronically, ______is required to file the return and submit the payment electronically for the Taxpayer. If the Taxpayer is not required to file or pay electronically, ______may file or make payments on the Taxpayer’s behalf by one of the following methods: electronic, magnetic media, or paper.

Authorization of Agent to Sign and File Returns The Agent is authorized to sign and file returns and make payments for the period beginning ______. Once this authority is granted, it is effective until revoked by the Taxpayer or Agent.

Authorization of Agent to Make Deposits and Payments The Agent is authorized to make payments for the period beginning ______. Once this authority is granted, it is effective until revoked by the Taxpayer or Agent.