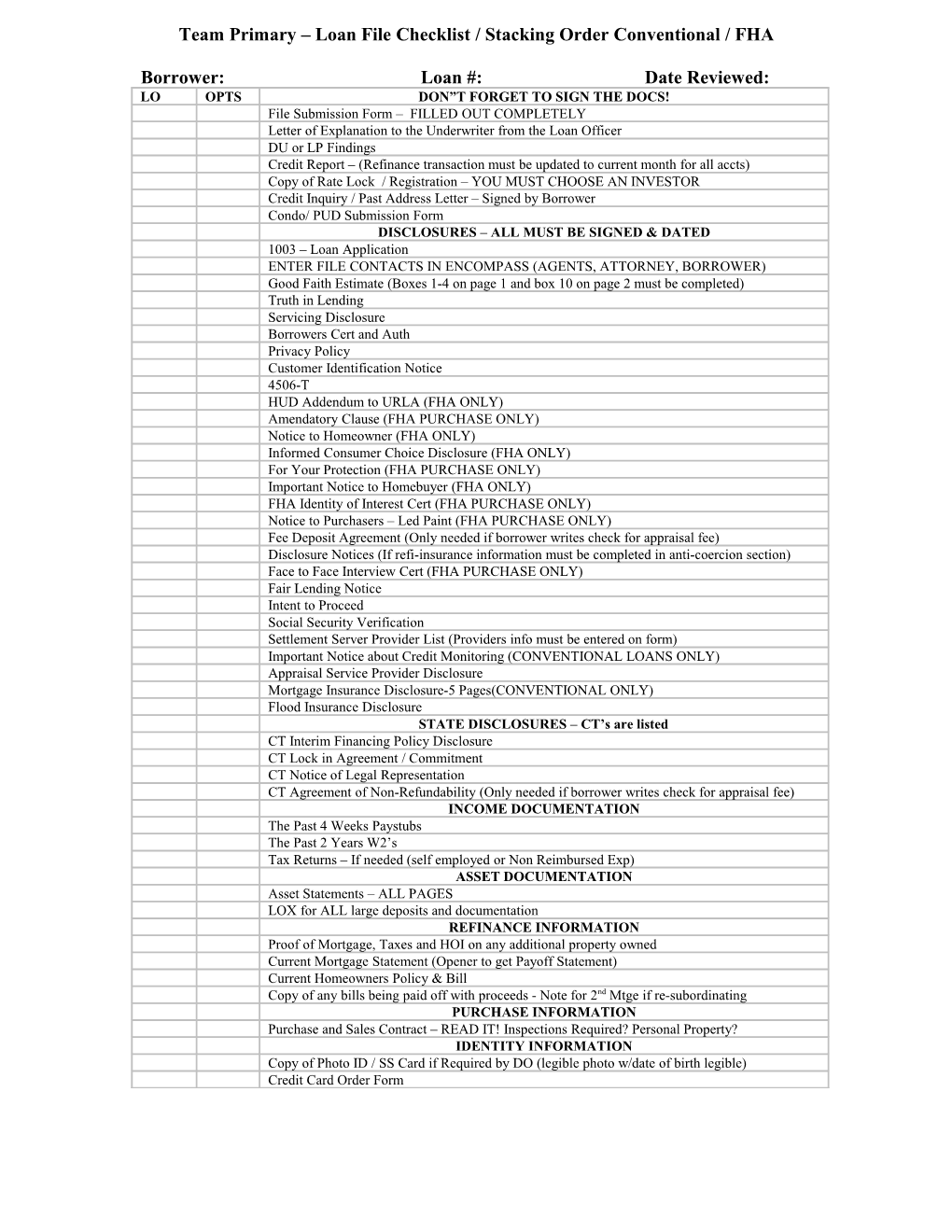

Team Primary – Loan File Checklist / Stacking Order Conventional / FHA

Borrower: Loan #: Date Reviewed: LO OPTS DON”T FORGET TO SIGN THE DOCS! File Submission Form – FILLED OUT COMPLETELY Letter of Explanation to the Underwriter from the Loan Officer DU or LP Findings Credit Report – (Refinance transaction must be updated to current month for all accts) Copy of Rate Lock / Registration – YOU MUST CHOOSE AN INVESTOR Credit Inquiry / Past Address Letter – Signed by Borrower Condo/ PUD Submission Form DISCLOSURES – ALL MUST BE SIGNED & DATED 1003 – Loan Application ENTER FILE CONTACTS IN ENCOMPASS (AGENTS, ATTORNEY, BORROWER) Good Faith Estimate (Boxes 1-4 on page 1 and box 10 on page 2 must be completed) Truth in Lending Servicing Disclosure Borrowers Cert and Auth Privacy Policy Customer Identification Notice 4506-T HUD Addendum to URLA (FHA ONLY) Amendatory Clause (FHA PURCHASE ONLY) Notice to Homeowner (FHA ONLY) Informed Consumer Choice Disclosure (FHA ONLY) For Your Protection (FHA PURCHASE ONLY) Important Notice to Homebuyer (FHA ONLY) FHA Identity of Interest Cert (FHA PURCHASE ONLY) Notice to Purchasers – Led Paint (FHA PURCHASE ONLY) Fee Deposit Agreement (Only needed if borrower writes check for appraisal fee) Disclosure Notices (If refi-insurance information must be completed in anti-coercion section) Face to Face Interview Cert (FHA PURCHASE ONLY) Fair Lending Notice Intent to Proceed Social Security Verification Settlement Server Provider List (Providers info must be entered on form) Important Notice about Credit Monitoring (CONVENTIONAL LOANS ONLY) Appraisal Service Provider Disclosure Mortgage Insurance Disclosure-5 Pages(CONVENTIONAL ONLY) Flood Insurance Disclosure STATE DISCLOSURES – CT’s are listed CT Interim Financing Policy Disclosure CT Lock in Agreement / Commitment CT Notice of Legal Representation CT Agreement of Non-Refundability (Only needed if borrower writes check for appraisal fee) INCOME DOCUMENTATION The Past 4 Weeks Paystubs The Past 2 Years W2’s Tax Returns – If needed (self employed or Non Reimbursed Exp) ASSET DOCUMENTATION Asset Statements – ALL PAGES LOX for ALL large deposits and documentation REFINANCE INFORMATION Proof of Mortgage, Taxes and HOI on any additional property owned Current Mortgage Statement (Opener to get Payoff Statement) Current Homeowners Policy & Bill Copy of any bills being paid off with proceeds - Note for 2nd Mtge if re-subordinating PURCHASE INFORMATION Purchase and Sales Contract – READ IT! Inspections Required? Personal Property? IDENTITY INFORMATION Copy of Photo ID / SS Card if Required by DO (legible photo w/date of birth legible) Credit Card Order Form