SPE Process Narrative – SOX Project / IT Fixed Assets Process owner(s) Steve Cross, Zahara Esmail, Brad Yamasaki, Jodi interviewed: Flaherty, Mickey Corcoran, Rob Jepsen (section brought over from IT Studio) Process owner sign-off by: Zahara Esmail-Ramji Prepared by: Angelo DiBasilio – 10/11/07 Last updated by: Zahara Esmail-Ramji 07-13-2012 Reviewed by:

Purpose: To identify and record the significant documents, systems and procedures used in the recording of Corporate Information Technology (“IT”) capital expenditures.

Financial Objectives/Significant Accounts (Assertions): Computer Software/Applications: Completeness, Existence/Occurrence, Rights & Obligations, Valuation/ Measurement and Restricted Access Depreciation Expense: Completeness, Existence/Occurrence, Rights & Obligations, Valuation/Measurement and Restricted Access

Background: Sony Pictures Entertainment (the “Company” or “SPE”) policy is to capitalize internally developed assets with useful lives of more than one year and aggregate acquisition/development costs greater than $5,000. In addition, SPE policy also allows pooling of multiple assets less than $5,000 individually but like kind and similar in use purchased from external third-party vendors over the financial fiscal quarter as one asset.

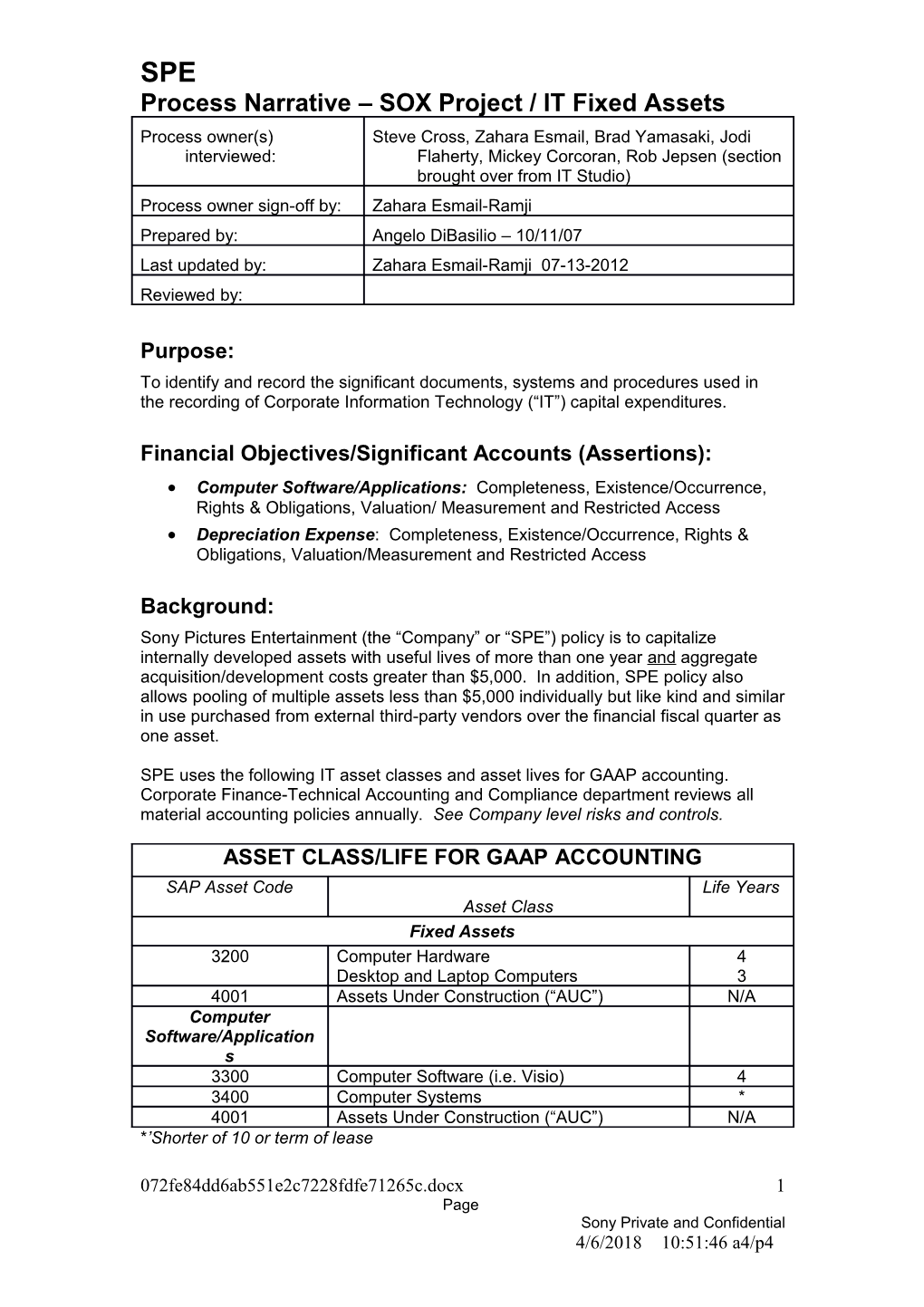

SPE uses the following IT asset classes and asset lives for GAAP accounting. Corporate Finance-Technical Accounting and Compliance department reviews all material accounting policies annually. See Company level risks and controls.

ASSET CLASS/LIFE FOR GAAP ACCOUNTING SAP Asset Code Life Years Asset Class Fixed Assets 3200 Computer Hardware 4 Desktop and Laptop Computers 3 4001 Assets Under Construction (“AUC”) N/A Computer Software/Application s 3300 Computer Software (i.e. Visio) 4 3400 Computer Systems * 4001 Assets Under Construction (“AUC”) N/A *’Shorter of 10 or term of lease

072fe84dd6ab551e2c7228fdfe71265c.docx 1 Page Sony Private and Confidential 4/6/2018 10:51:46 a4/p4 SPE Process Narrative – SOX Project / IT Fixed Assets SPE uses the SAP Fixed Asset Module (“SAP”) to record its capital expenditures. The Capital Expenditures / Fixed Asset Manager (“CAPEX Mgr) is responsible for reconciliation of the domestic SPE fixed assets in SAP. IT capital expenditures are accounted for using the “project method”. Under this method, IT Finance opens a project in SAP to capture all capital costs that are associated with the final fixed asset(s). SAP holds the project in Assets under Construction account accumulating costs until it settles the project into one or more fixed assets. IT projects fall into the following categories:

Pooled Assets – Considered immaterial for SOX. Projects –New Systems, replacement of old system or very large enhancement to existing system. Enhancements – Minor enhancements to new or existing systems. Multiple small enhancements may-be bundled into a single project.

SPE uses the following systems to record and monitor capital expenditures:

System Name Description Process Interface SAP – R/3 SPE general ledger System of record Strategic Fixed Assets for fixed assets Enterprise Module Management (“SAP”) (SEM) SAP – Strategic SAP budget and Monitor R/3 Enterprise planning tool accumulation BW (PPM) System of project costs (SEM) to budget PPM Web-based IT Weekly time report Manual JE to SAP Time for internal, then to PPM Management external labor. System and Payment of Project external labor. Management Planning IT tool capital. MS Excel Various Various Various Spreadsheets

Major Classes of Transactions: Setting up new projects Monitoring projects against budget Maintenance of fixed assets records in SAP

Key Sub-Processes or Transactions: The following key sub-processes are discussed:

Project Approval and Setup Accounting for IT Projects

2 SPE Process Narrative – SOX Project / IT Fixed Assets Fixed Asset Maintenance o Asset Impairment o Disposition of Fixed Assets Depreciation

Process Narrative:

Project Approval New IT capital projects are proposed by being uploaded into PPM as a request by the project manager. PPM is the web-based project and portfolio management tool used to manage projects. Initial information regarding the project is entered in PPM including: estimated project start and end dates, executive sponsor, expected productivity, and risk. Once the preliminary information is entered in PPM, the project awaits the PMO’s approval. The PMO will review the preliminary project details and either approve or reject the project. If the project is rejected, it ends and does not proceed. If the PMO approves the project, the project can move forward with the greenlighting process. At this time the project does not receive funding nor is the project ultimately approved. It only has the approval to proceed with greenlighting.

The VP or the Executive Director of IT Finance determines if the project requires a Cost Benefit Analysis (“CBA”) for greenlighting. If the project does not require a CBA, it proceeds to the greenlighting committee review. Projects not requiring CBAs include projects hardware pools or where IT is a component of a larger business- wide initiative. These initiatives are typically long-term, multi-year fixed fee projects. In these cases, the CBA and project approvals are performed at a higher level than the IT Finance Department. For these projects, the IT Finance Department will not obtain separate approvals for the IT component as it has already been approved as part of the entire project. IT will maintain the overall project approvals with the language regarding the IT component attached as part of its project documentation to evidence approval for the related IT billings. Additionally, a CBA is not required for projects under $100K as projects requiring such minimal funding tend to be minor enhancements that should be tracked separately and not a part of an enhancement pool and are done as part of a business requirement rather than an investment.

In preparation for project greenlighting, the project manager is responsible for preparing a CBA and the project charter. The project manager will submit the CBA to IT Finance for review to make sure assumptions are correct and it is ready for review and approval by the VP of IT Finance. The VP and/or Executive Director of IT Finance will review the project CBA for reasonableness and completeness prior to the greenlight meeting (R00409, C00618) and approve or hold the project. Approved projects move to the greenlighting process described below.

IT Finance makes sure a formal greenlight approval request is either being prepared or is in circulation for approval. IT Finance follows up on all IT Capital Project Requests (“CPR”), making sure that proper COFA approval is obtained within a reasonable time (as signatures are sometimes difficult to obtain due to executives’ travel schedule). IT Finance maintains all approved project documentation and is also responsible for monitoring the projects for Corporate Compliance (i.e., COFA).

072fe84dd6ab551e2c7228fdfe71265c.docx 3 Page Sony Private and Confidential 4/6/2018 10:51:46 a4/p4 SPE Process Narrative – SOX Project / IT Fixed Assets

Projects are ultimately reviewed at the greenlighting meeting. Members of the greenlighting audience include the respective DCIO, CIO, VP or ED of IT Finance, and required executives for COFA review (e.g., EVP Corporate Finance and CFO). If the project is approved, the CPR is signed per COFA requirements and IT Finance maintains the original signed CPR (R00409, C00618).

Labor pools do not go through the standard greenlighting process. The CIO allocates funds to External Labor pools at the beginning of the year and a CPR is obtained and retained by IT Finance. However, if all projected pool spend has already been COFA approved and documented through alternate processes (i.e., external labor approved under a SOW), that documentation may be used in lieu of a CPR (R00409, C00618). The CIO also allocates funds to Internal Labor pools at the beginning of the year but a CPR is not required as the salaries for those resources have already been approved as part of the Annual Overhead Budget. The Internal Labor pool costs are a reclassification of capitalizable FTE hours.

Accounting for IT Projects

In accordance with SOP 98-1, Accounting for the Costs of Computer Software Developed or Obtained for Internal Use, SPE capitalizes certain cost associated with developing software application. These costs include payroll and payroll-related costs for employees who are directly associated with software development costs as well as the direct costs of materials and services consumed in developing the software. SPE expenses all overhead costs.

Materials and labor charges make up majority of the total cost of an IT project. Actual material costs post to the project at the WBS level when the goods are received in ARIBA for purchases made using the SAP purchase order (“PO”) system, when the invoices are vouchered in SAP for Non PO purchases, and when journal entries are recorded. See Corporate Accounts Payable narrative for additional information on procurement. For most Time & Material external labor costs, IT Finance creates a PO in ARIBA based on the actual time posted in PPM and approved by the Project Manager (R00122, C00510). The Project Manager reviews time entered into PPM to verify time has been charged to appropriate project tasks and hours charged are reasonable. IT Projects remain in the AUC account accumulating costs until the project is technically closed (“TECO”). Once all charges have been processed, the project is then moved to “CLOSED” status and settled to a final fixed asset(s).

PPM is a time and human resources management tool. The PMO sets up the project in PPM, which uses a standardized set of tasks for each phase of the project. These standardized tasks were defined and approved by IT Finance during the implementation phase of the PPM Time Entry module (March 2008). Any proposed changes to these standardized tasks would need to be approved by the IT Finance Executive Director or above. Each standardized task is mapped to an Activity Code which determines whether the task is capitalizable. If PM’s need to add a non-standardized task to their project, they need to map the task to one of the approved Activity Codes. IT Finance runs a report on a weekly basis to identify any projects that have created non-standardized tasks without assigning an Activity Code. IT Finance works with the PM to get an Activity Code assigned to the new task. Any proposed changes to the approved Activity Code list would need to be approved by the IT Finance Executive Director or above. 4 SPE Process Narrative – SOX Project / IT Fixed Assets

Monitoring Projects against the Annual Budget

IT Finance produces monthly Spend View and Project View reports to monitor the project spend and forecasts against annual budget and COFA approvals. The reports are e-mailed to the CIO, DCIO’s and Project Managers for review. The VP or ED of IT Finance signs off on the monthly Spend View and Project View reports and escalates issues as appropriate to the CIO and to Sr. Finance Management.

The IT Finance Mgr prepares and maintains the following monthly capital expenditures report:

Monthly [detail and summary] Spending Report –The report provides monthly spending & cumulative transfer activities for each project. Beginning cumulative spending is shown for carry-over projects. He summarizes the information for each Company Code and agrees the ending balance to the general ledger (account #162000). IT Finance compares this report against their Spend View report for accuracy and completeness. Discrepancies are investigated and resolved.

After all the journal entries are posted to SAP, the estimate to complete (“ETC”) and the approved budget for each project is downloaded from PPM into SAP SEM for reporting with the actual data. IT Finance generates the following month-end report from SAP BW to check against budget and review for reasonableness (R00407, C00299):

Spend View [detail & summary] – This report captures the current fiscal year spending plus the forecasted spending (committed and uncommitted) against the most recent current fiscal year budget. IT Finance and project managers use this report for monitoring against budget and note for reasonableness. Significant variances are investigated and if needed, elevated to the CIO to review for further actions.

Project View [detail & summary] – This report captures the life-to-date (“LTD”) actuals plus the future spending against the approved CPR’s.

The Project Managers are responsible for the charges made against their project(s). They have access in SAP to print the detail cost reporting for their assigned projects.

Fixed Asset Maintenance Asset Impairment In accordance with FAS 144; on an annual basis or upon occurrence of a triggering event, the IT Finance Director or above documents in a memo format the impairment test performed on material assets. Annually or upon occurrence of a triggering event, if any of the asset is deemed impaired, an analysis to determine the fair market value of the property takes place and entry is created in SAP to adjust the cost of the asset. The VP-IT Finance reviews and approves the impairment memo

072fe84dd6ab551e2c7228fdfe71265c.docx 5 Page Sony Private and Confidential 4/6/2018 10:51:46 a4/p4 SPE Process Narrative – SOX Project / IT Fixed Assets (In his/her absence, the schedule is reviewed and approved by the ED of IT Finance).(R00365, R00374, C00568).

Depreciation Expense

At the end of each month, the ITF Mgr triggers the monthly depreciation process in SAP. SAP automatically calculates the depreciation expense based on the AMR life provided by IT Finance. IT Finance maintains a depreciation schedule which lists each asset that is currently being depreciated and the amount of depreciation to be calculated during the fiscal year as well as assets that are forecasted to begin being depreciated during the fiscal year and the forecasted depreciation amount. On a quarterly basis, the Manager-IT Finance or analyst updates the depreciation schedule based on the amount of depreciation calculated by the ITF Mgr and updated forecast information and reviews for reasonableness against budget. Variances for expected depreciation expense for the full fiscal year greater than $500,000 and monthly variances greater than 15% of forecasted amount are researched and resolved. In addition the increase in the calculated depreciation expense as a result of newly transferred assets is compared to the expected increase for reasonableness and variances greater than $500,000 are researched and resolved. This schedule is reviewed and approved by the IT Finance Exec Director (R00048, C00870). (In his/her absence the schedule is reviewed and approved by the VP-IT Finance.)

6