21st Century Instructional Guide for Career Technical Education

Banking and Finance Business and Marketing Cluster

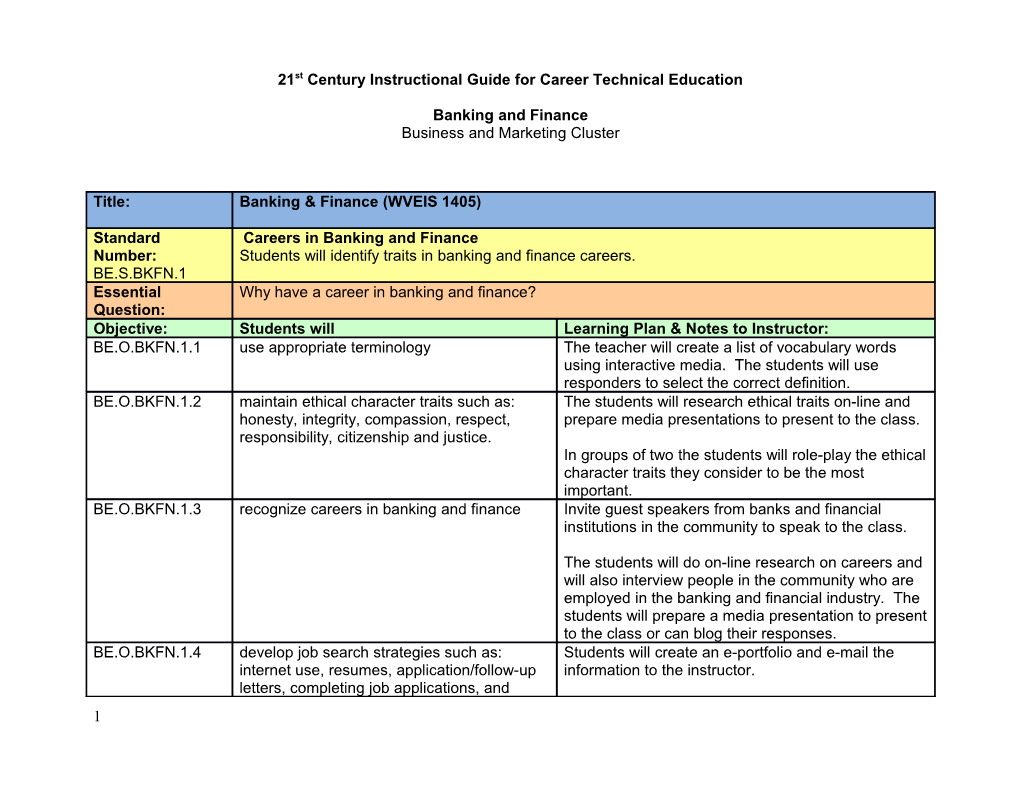

Title: Banking & Finance (WVEIS 1405)

Standard Careers in Banking and Finance Number: Students will identify traits in banking and finance careers. BE.S.BKFN.1 Essential Why have a career in banking and finance? Question: Objective: Students will Learning Plan & Notes to Instructor: BE.O.BKFN.1.1 use appropriate terminology The teacher will create a list of vocabulary words using interactive media. The students will use responders to select the correct definition. BE.O.BKFN.1.2 maintain ethical character traits such as: The students will research ethical traits on-line and honesty, integrity, compassion, respect, prepare media presentations to present to the class. responsibility, citizenship and justice. In groups of two the students will role-play the ethical character traits they consider to be the most important. BE.O.BKFN.1.3 recognize careers in banking and finance Invite guest speakers from banks and financial institutions in the community to speak to the class.

The students will do on-line research on careers and will also interview people in the community who are employed in the banking and financial industry. The students will prepare a media presentation to present to the class or can blog their responses. BE.O.BKFN.1.4 develop job search strategies such as: Students will create an e-portfolio and e-mail the internet use, resumes, application/follow-up information to the instructor. letters, completing job applications, and 1 interviewing skills. The instructor using interactive media will demonstrate the correct format for a cover letter. The instructor will prepare examples of a correct cover letter and an incorrect one. The students will make the needed corrections on the incorrect one and blog the information using a blog created by the instructor.

Invite personnel managers from local industry to speak to the students on interviewing techniques.

Students will participate in mock interviews. Standard Saving and Investing Number: Students will differentiate between saving and investing. BE.S.BKFN.2 Essential What is saving? What is investing? Question: Objective: Students will Learning Plan & Notes to Instructor: BE.O.BKFN.2.1 describe differences between saving and In groups of two, students will create a pamphlet investing representing different ways to save and invest. BE.O.BKFN.2.2 discuss the need for and risks of investing Students can use word or publisher to create the BE.O.BKFN.2.3 describe wise investment strategies for the pamphlet. present and the future BE.O.BKFN.2.4 identify options and criteria for choosing The students will use interactive media to present investments the pamphlets to the class for critiquing. BE.O.BKFN.2.5 explain uses of technology in the investment industry Invite a financial advisor and someone from the BE.O.BKFN.2.6 identify various types of stock banking industry to speak to the class. Using a BE.O.BKFN.2.7 identify various types of mutual funds spreadsheet, the students will list the pros and cons of saving and investing and will decide which method they consider to be the safest.

The students will use the internet to research .an investor blueprint and a stock selection guide and report. Students will then create an investor 2 blueprint and stock selection guide.

Students can participate in the online Stock Market Game.

In groups of two, the students will complete an Internet search on the various types of stocks and mutual funds and present their findings to the class using multimedia. . Standard BANKING Number: Students will explain the functions of banks and their role in the economy. BE.S.BKFN.3. Essential Why use a bank? Question: Objective: Students will Learning Plan & Notes to Instructor: BE.O.BKFN.3.1 explain the main functions of banks The students can create a bulletin board illustrating the functions of banks.

Students will explore the FDIC and Federal Reserve websites to learn about the banking industry. BE.O.BKFN.3.2 identify types of banks (traditional and non- Students will create a brochure describing the traditional) and their services various banking services. Students will visit banking institutions in the community to obtain the information for the brochure.

Research the Internet to investigate local banks and credit unions for the services provided. Compile the information and share it in a class blog. BE.O.BKFN.3.3. explain how banks acquire their money to do The teacher will lead a class discussion on how business banks can earn revenue other than loans. The students will create a list and will blog the information to the teacher.

The teacher will divide students into teams of three 3 or four; each student has $1,000 to invest and use for a student loan program for students who are temporarily cash poor; team members must decide how much of their cash they are willing to loan and at what interest rate. Using word processing software each group will create a loan application. BE.O.BKFN.3.4. identify government regulations of the Students will research the regulations on the Internet banking industry and compile a list using a spreadsheet to indicate the types of government regulation.

Students will explore the FDIC and Federal Reserve websites to learn about banking regulations.

Contact the West Virginia Banking Association to request a speaker. BE.O.BKFN.3.5 compute simple and compound interest The instructor using interactive media will demonstrate how to compute simple and compound interest. Students will use a calculator to compute interest. BE.O.BKFN.3.6 appraise banks’ innovative use of technology Students will take a field trip to a bank in the involving day-to-day transactions and community and write a brief summary of their security issues such as magnetic ink findings to present to the class. character recognition BE.O.BKFN.3.7. write checks, maintain a checkbook balance, Students will complete a banking simulation. and compute a bank reconciliation statement Banking simulations can be obtained through the State Treasurer’s Office.

Teacher will prepare a list of bank deposit slips, bank reconciliation and check registers to demonstrate to students using interactive media.

Teacher will prepare a bank statement for students to reconcile. Teacher will prepare a bank statement that has been reconciled, with errors, and have the students to review and correct the statement 4 Standard Federal Reserve System Number: Students will analyze the Federal Reserve System and monetary policy. BE.S.BKFN.4 Essential What is the role of the Federal Reserve Bank? Question: Objective: Students will Learning Plan & Notes to Instructor: BE.O.BKFN.4.1 identify the organization of the Federal The teacher and the students will utilize the Federal Reserve System Reserve website.

Students will create a pyramid showing the four levels using appropriate software. Students can use media software to create the pyramid. BE.O.BKFN.4.2 recognize the functions of the Federal The instructor will divide the class into teams and Reserve System assign a level to each team. Each team will conduct an Internet research and discuss the functions of their level and present it to the class in the form of charts and graphs using multimedia presentation software. BE.O.BKFN.4.3 assess the role of the Federal Reserve Students will research this topic on the Internet and System’s monetary policy and it’s influence create a one-three page report. on the banking system Invite a local banker to discuss the Federal Reserve System. BE.O.BKFN.4.4 recognize factors that influence the economy The teacher will lead a class discussion and create a list of factors using interactive media. Using responders the students will rank the factors in order of importance. Standard Participating in the Organization Number: Students will participate in a student organization. BE.S.BMH.5 Essential What are the benefits of a career, technical student organization? Question: Objectives: Students will Learning Plan & Notes to Instructor: BE.O.BMH.5.1 identify the purposes and goals of the Invite students to participate in an FBLA chapter student/professional organization. event. Invite State FBLA Officer to present at a 5 chapter meeting or to a class on the activities, purpose and benefits of membership. Show the FBLA promotional video located on www.FBLA- PBL.org web site. Have students to locate and discuss the FBLA-PBL goals, mission statement, and pledge. BE.O.BMH.5.2 explain the benefits and responsibilities of Invite FBLA-PBL alumni members to be guest participation in student/professional/civic speakers in the classroom and during chapter organization as an adult events. Coordinate a chapter event with another service organization in the community (such as Lion’s Club, Women’s Club, Jaycees, Rotary, etc.). BE.O.BMH.5.3 demonstrate leadership skills through Have the local FBLA officer team to develop a participation in student/professional/civic program of work for the school year and form various organization activities such as meetings, committees to complete the task using chapter programs, and projects. members. Encourage students to actively participate in State, regional, and national conferences and vie for leadership positions.

21st Century Learning Skills & Technology Tools T Evidence of Success Skills e a c h i n g

S t r a t e g i 6 e s

C u l m i n a t i n g

A c t i v i t y 21C.O.9- Student recognizes information Research the Rubric Information and 12.1.LS1. needed for problem solving, can regulations on the Communication efficiently browse, search and Internet. Format and Skills: navigate online to access relevant type a 1-3 page report information, evaluates information discussing your findings based on credibility, social, economic, political and/or ethical issues, and presents findings clearly and persuasively using a range of technology tools and media.

7 21C.O.9- Student creates information using Complete an Internet Rubric 12.1.LS3. advanced skills of analysis, search and summarize synthesis and evaluation and information in a media shares this information through a presentation. variety of oral, written and multimedia communications that target academic, professional and technical audiences and purposes.

21C.O.9- Student routinely applies Students will search this Rubric 12.1.TT2 keyboarding skills, keyboard topic on the Internet and 21C.0.9- shortcut techniques, and mouse create a one-three page 12.1.TT5. skills with facility, speed and report. accuracy. Student uses advanced features of word processing software e.g., outline, table of contents, index feature draw tool, headers and footers, track changes, macros, hyperlinks to other file formats, etc.).

8 21C.O.9- Student engages in a critical Create a small venture: Checklist Thinking and 12.2.LS1 thinking process that supports divide students into Rubric Reasoning Skills: synthesis and conducts teams of three or four; evaluation using complex criteria. each student has $1,000 to invest and use for a student loan program for students who are temporarily cash poor; team members must decide how much of their cash they are willing to loan and at what interest rate; create loan application. 21C.0.9- Student draws conclusions from a Create an investor Checklist 12.2.LS2 variety of data sources to analyze blueprint and interpret systems.

21C.0.9- Student collaborates with peers, Divide the class into Presentation 12.2.TT2 experts and others to contribute teams and assign a Checklist to a content-related knowledge level to each team. base by using technology to Each team will conduct compile, synthesize, produce, an Internet research and disseminate information, and discuss the models, and other creative works. functions of their level and present it to the class in the form of posters, charts, and graphs.

9 21C.0.9- Student uses technology tools Participate in The Stock Track student 12.2.TT4 and multiple media sources to Market Game online progress weekly. analyze a real-world problem, Completion of game design and implement a process to assess the information, and chart and evaluate progress toward the solution.

21C.O.9- Student demonstrates ethical Create posters, role- Checklist Personal, and 12.3.LS4 behavior and works responsibly play the ethical Observation Workplace, and collaboratively with others in character traits Skills: the context of the school and the larger community, and he/she demonstrates civic responsibility through engagement in public discourse and participation in service learning.

21C.O.9- Student maintains a strong focus Students will complete a Completion of 12.3.LS6 on the larger project goal and banking simulation. Package frames appropriate questions and Quiz for accuracy planning processes around goal. Prior to beginning work, student reflects upon possible courses of action and their likely consequences; sets objectives related to the larger goal; and establishes benchmarks for monitoring progress. While working on the project, student adjusts time and resources to allow for completion of a quality product.

10 21C,O.9- Student works collaboratively to Complete an Internet Presentation 12.3.TT2 acquire information from search and summarize Rubric electronic resources, conducts information in a media online research, and evaluates presentation. information as to validity, appropriateness, usefulness, comprehensiveness and bias. Learning Skills & Technology Tools T Evidence of Success e a c h i n g

S t r a t e g i e s

C u l m i n a t 11 i n g

A c t i v i t y A.07 Generate venture ideas Create a small venture: Student will display Entrepreneurship A.10 Explain tools used by divide students into appropriate Skills: entrepreneurs for venture teams of three or four; leadership, planning each student has communication, and A.17 Distinguish between debit and $1,000 to invest and interpersonal equity financing for venture use for a student loan traits/behaviors in creation program for students personal A.19 Select sources to finance venture who are temporarily applications and creation/start-up cash poor; team collaboration with members must decide others. A.26 Evaluate risk-taking opportunities how much of their cash Student will use they are willing to loan basic computer skill and at what interest to complete tasks. rate; create loan application. Culminating Assessment: Students will learn the responsibility of maintaining their own personal checking account through a Culminating banking simulation packet. Simulations can be obtained free through the State Treasurer’s Office, Assessment: National Endowment for Financial Education (Nefe), Federal Reserve System Educator’s resources, or purchased through a textbook vendor. Students will gain a better understanding of the important aspects of maintaining a checking account. This practice set provides students practical experience in writing checks, keeping checkbook records and reconciling monthly statements.

12 Students will be graded on monthly transactions recorded in the check register as well as reconciling monthly bank statements.

FBLA Competitive Events Links and Other Resources Related Websites: Links and Other Resources www.finlitproject.com

http://www.burbank.com/math/checking.shtml

The Stock Market Game http://www.stockmarketgame.org

Virtual Stock Market Game http://www.howthemarketworks.com

Game Market Stock Student http://the-stock-site.net/s/game_market_stock_student

Money Instructor http://www.moneyinstructor.com/investing.asp

The Federal Reserve System http://www.federalreserve.gov/pubs/frseries/frseri.htm

Federal Reserve Education http://www.federalreserveeducation.org

IRS www.irs.gov

FDIC (Federal Deposit Insurance Corporation) www.fdic.gov

13 Contacts: Business Teachers: Utilize K12 Business Marketing Listserv at [email protected] Contacts: Business Coordinator: Abby Reynolds, [email protected] OCTI Assistant Executive Director: Donna Burge-Tetrick OCTI Executive Director: Gene Coulson

14