Rochester Institute of Technology Finance for Global Business 0104760-75 Winter 2003 / 2004 Saturday 8:30 am – 11:50 am Building 12 Room 3225 Quarter: 20032

Instructor: Dr. Merouane Lakehal-Ayat Office hours: One hour after class or by appointment Office address: A309 Lowenthal Office phone: 385-8429; 475-7402 / 6063 Fax number: 475-6920 E-mail address: [email protected]

Course description: This course provides a framework for the study of concepts, theories, principles and techniques that form the foundation of decisions in the field of international finance. Credit 4.

Prerequisites: 0104-721 Financial Analysis for Managers

Course Objectives: This course has four objectives

Study and analyze the international financial environment under which the multinational corporation operates, including current major international issues. Examine the concepts, issues and challenges associated with changing rates. Gain exposure to the various approaches used in the management of risks associated with differing exchange rate systems and behavior. Discuss concepts and issues associated with short and long term asset and liability management.

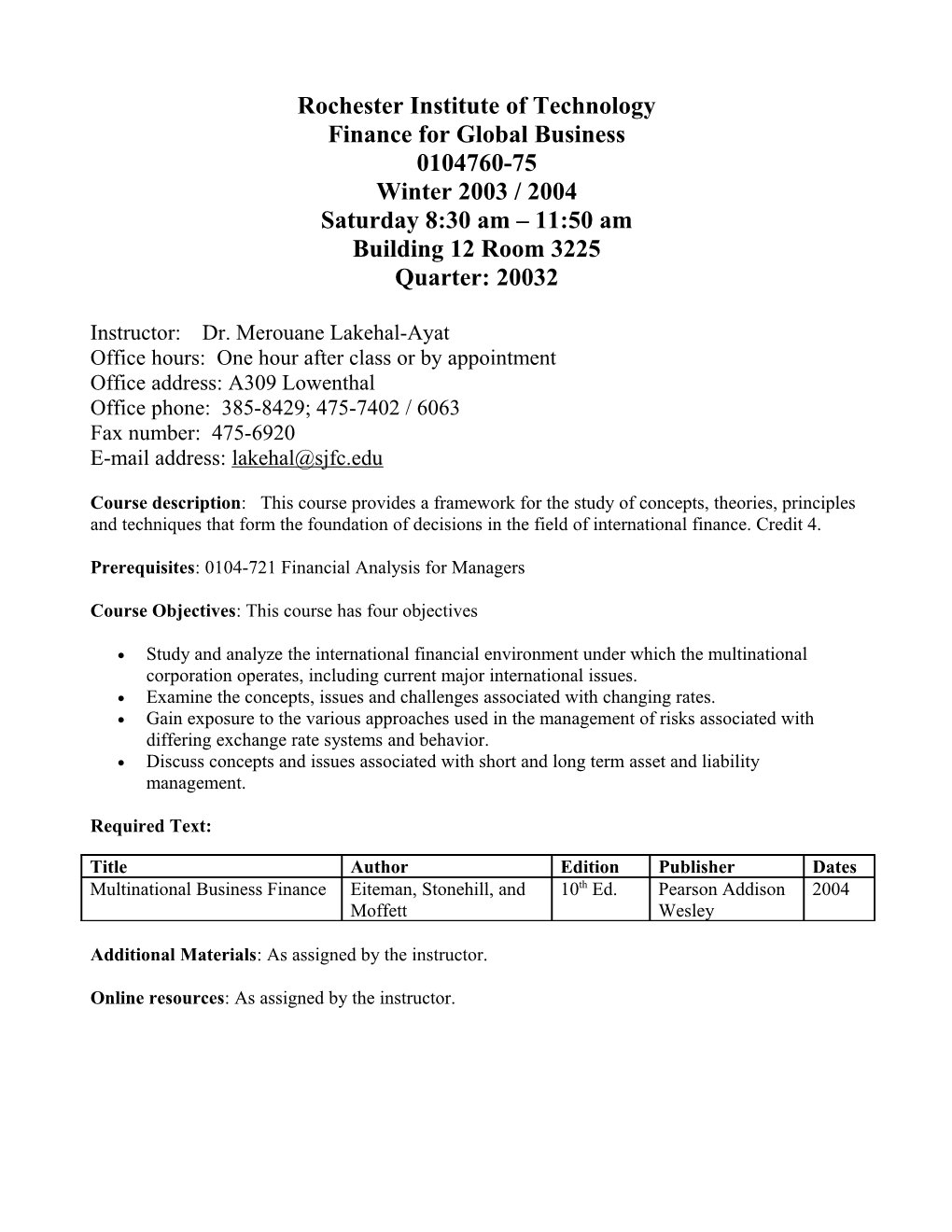

Required Text:

Title Author Edition Publisher Dates Multinational Business Finance Eiteman, Stonehill, and 10th Ed. Pearson Addison 2004 Moffett Wesley

Additional Materials: As assigned by the instructor.

Online resources: As assigned by the instructor. Grading:

. Participation 15% . Cases 10% . Research Paper 20% . Currency Project 5% . Midterm 20% . Final Examination 30 % . Total 100%

Participation: Students’ participation is actively sought and rewarded. Each student is expected to read the assigned chapters before class and work out the problems. Students will be asked to answer questions and solve problems in class.

Research Paper: This is an individual assignment. You are expected to develop an indebt analysis on the future of the Chinese Renminbi currency (To float or not to float). Additional details and guidelines will be given in class. The paper is due on February 7, 2004.

Cases: The class will be divided into groups. Groups are required to prepare and present a main case for class discussion with a formal submission to the instructor.

Currency Project: Students are expected to select a currency of their choice (exclude Chinese Renminbi) at the beginning of the semester. Each student is expected to follow the daily movement of the currency spot, forward, options, and future prices, then analyze and report on these changes to the class every week. Moreover, a final paper has to be submitted by February 14th. Additional detail about the paper will be provided in class. Course Outline: May be subject to adjustments

Class Date Topics Covered Remarks

1 December 6th Chapter 1: Financial Goals and Corporate Problems: 3, 5, 6 (pg: 16, 17) Governance Problems: 2, 4, 7, 9 (pg: 42, 43) Chapter 2: The International Monetary System 2 December 13th Chapter 3: The Balance of Payments Presentation mini-case ch.1 Chapter 4: The Foreign Exchange Market (pg 19 – 22) Presentation mini-case ch.3 (pg: 66 - 68) Problems: 5 through 9, 14 through 20 (pg: 64, 65) Problems: 1, 2, 7, 8, 9, 13, 15 (pg: 90 through 92) 3 December 20th Chapter 5: Foreign Currency Derivatives Presentation mini-case ch.5 (pg: 127 - 132) Problems: 2, 4, 6, 7, 8, 15 (pg: 122, 123, 124, 126) 4 December 27th No Class, Winter Break

5 January 3rd No Class, Winter Break

6 January 10th Mid-Term Exam

7 January 17th Chapter 6: International Parity Conditions Problems: 1, 2, 7, 9, 17 (pg: 156, 157, 158, Chapter 7: Foreign Exchange Rate 159) Determination Problems: 1 through 10 (pg: 191, 192, 193) 8 January 24th Chapter 8: Transaction Exposure Presentation mini-case ch.8 Chapter 9: Operating Exposure (pg: 231 – 232) Presentation mini-case ch.9 (pg: 265 – 268) Problems: 9, 15 (pg: 223, 225) Problems: 2, 6, 8 (pg: 262, 263) 9 January 31st Chapter 10: Accounting Exposure Presentation mini-case ch.11 Chapter 11: Global Cost and Availability of (pg: 325) Capital Problems: 8, 9, 10 (pg: 293) Problems: 6 through 10 (pg: 322, 323) 10 February 7th Chapter 18: Multinational Capital Budgeting Presentation mini-case ch.18 (pg: 560 - 563) Problems: 1, 3, 5 (pg: 555, 556, 557) 11 February 14th Chapter 22: Working Capital Management Presentation mini-case ch.22 in the MNE (pg: 709 - 711) Problems: 1 through 5 (pg: 704, 705) 12 February 21st Final Exam