2012 Open Enrollment Information March 15 - March 26

Health Insurance Plan Overview Healthcare continues to be a significant challenge in today’s workplace. We firmly believe that comprehensive, affordable health insurance is one of the most important benefits we as an employer can offer you. Through the years we have taken great strides to maintain an excellent, comprehensive package that is valued by our associates and affordable to all while analyzing the financial impact on the company.

It is our pleasure to have the opportunity to afford you two benefit health plan options as well as dental, vision, 401K plan, tuition assistance, company paid Life, AD&D and Long-term Disability Insurance.

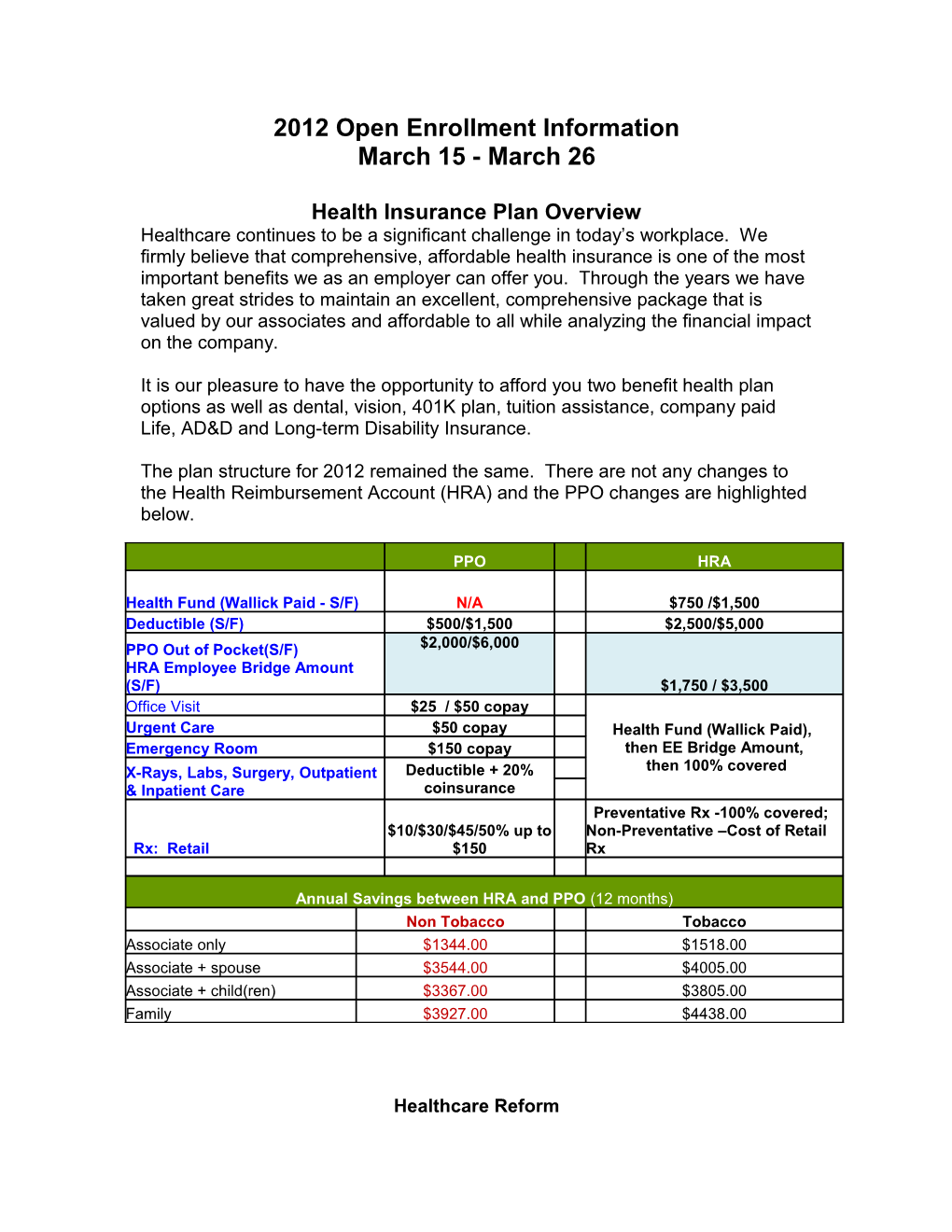

The plan structure for 2012 remained the same. There are not any changes to the Health Reimbursement Account (HRA) and the PPO changes are highlighted below.

PPO HRA

Health Fund (Wallick Paid - S/F) N/A $750 /$1,500 Deductible (S/F) $500/$1,500 $2,500/$5,000 PPO Out of Pocket(S/F) $2,000/$6,000 HRA Employee Bridge Amount (S/F) $1,750 / $3,500 Office Visit $25 / $50 copay Urgent Care $50 copay Health Fund (Wallick Paid), Emergency Room $150 copay then EE Bridge Amount, X-Rays, Labs, Surgery, Outpatient Deductible + 20% then 100% covered & Inpatient Care coinsurance Preventative Rx -100% covered; $10/$30/$45/50% up to Non-Preventative –Cost of Retail Rx: Retail $150 Rx

Annual Savings between HRA and PPO (12 months) Non Tobacco Tobacco Associate only $1344.00 $1518.00 Associate + spouse $3544.00 $4005.00 Associate + child(ren) $3367.00 $3805.00 Family $3927.00 $4438.00

Healthcare Reform dependant coverage to age 26 preventive care covered at 100% unlimited lifetime benefits elimination of pre-existing conditions under age 19

Earn Extra Dollars Health Reimbursement Account www.Anthem.com (Health & Wellness)

$50 for completing the MyHealth Assessment online health profile (one per family) $100 for enrolling in a health coaching program for an eligible condition (per qualified family member) $200 for graduating from a health coaching program for an eligible condition (per qualified family member) $50 for completing the Healthy Lifestyles: Tobacco-Free Program (per qualified employee and/or spouse) $50 for completing the Healthy Lifestyles: Healthy Weight Program (per qualified employee and/or spouse) Preventative Rx

Take Control of your Healthcare www.Anthem.com Anthem Care Comparison

Let Anthem take the worry and frustration away. Anthem has made it easy to find hospital facilities that match your location, your situation, and your preferences.

The Anthem tool displays both in and out of network providers. As a provider's network status may change, please verify provider participation prior to receiving care by checking your online provider directory, calling the Customer Service number on your ID card, or by contacting the provider.

This tool provides you with information such as facilities/hospitals, address, distance from your home, the typical minimum and maximum cost of the procedure and years in service. SpecialOffers@Anthem

SpecialOffers@Anthem provides Health and Wellness discounts for Anthem participants. The discount categories under SpecialOffers are: Family/Home Baby/maternity Senior Care Pets Books/Magazines Home & Living Fitness/Health Weight loss Club Memberships Equipment Coaching Vision, Hearing & Dental Medicine & Treatment Medicine Alternative Therapy

Enrollment Forms

Current Enrollees: Keeping same coverage elections: Submit a new Tobacco Affidavit (in order to receive non-tobacco discount) Spousal Waiver (if you currently cover a spouse on the medical plan) Switching plan options or adding/deleting dependents: Submit new enrollment form Submit a new Tobacco Affidavit (in order to receive non-tobacco discount) Spousal Waiver (if you currently cover a spouse on the medical plan)

New Enrollees: If you are not enrolled, and want health insurance – you must complete the following forms:

Enrollment form Spousal Mandate (if you currently cover a spouse on the medical plan) Tobacco Affidavit(in order to receive non-tobacco discount) Certified Marriage certificate (if covering a spouse on the plan) Birth Certificate for all covered dependents Beneficiary form for company paid Life and Accidental Death & Dismemberment

If you do not want coverage, you must complete a Waiver Form.

*Remember to include address, SSN and date of birth for everyone who will be covered by your plan.

These forms are also located on the Intranet.

Informational Webinars (30 minutes) will be held on 3/23 @ 10:30 am, 11:30 am & 2 pm, 3/26 @ 10:30 am and 11:30 am regarding the plan structure, questions and answers.

Webinar Information: Click on the link below to log onto the session you want to attend and for further instructions. 3/23 @ 10:30 am click here https://student.gototraining.com/r/2024436543302844416, 3/23 @ 11:30 am click here https://student.gototraining.com/r/5464484070683767552 3/23 @ 2:00 pm click here https://student.gototraining.com/r/8842880881583654656 3/26 @ 10:30 am click here https://student.gototraining.com/r/6425433044104193536 3/26 @ 11:30 am click here https://student.gototraining.com/r/3290040397570717184

All forms are due to Nicole Dixon no later than 3/26/2021 at 5:00 pm! You can email to [email protected] or fax to 614-322-8855 or mail to 6880 Tussing Road, Reynoldsburg, OH 43068 attn: Nicole Dixon.