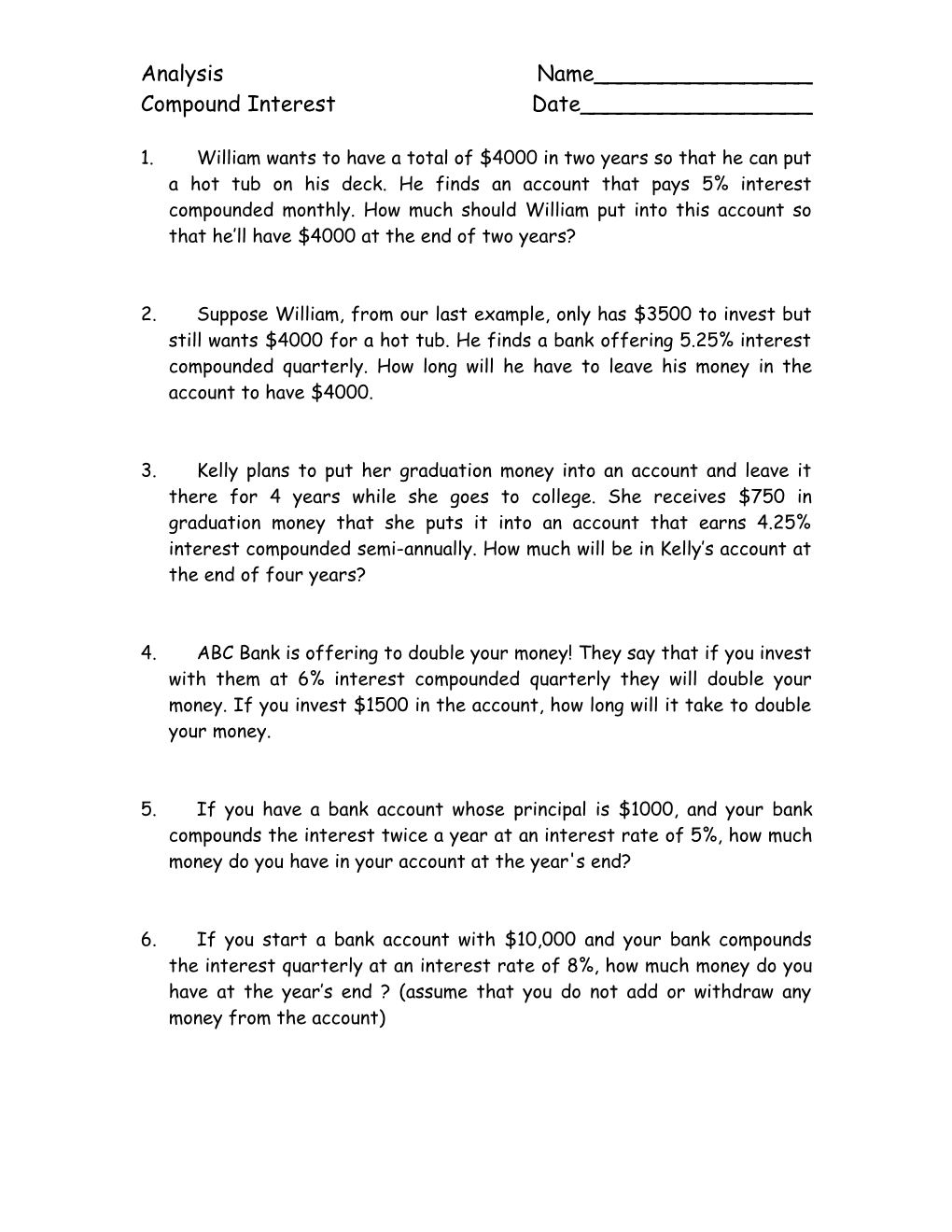

Analysis Name______Compound Interest Date______

1. William wants to have a total of $4000 in two years so that he can put a hot tub on his deck. He finds an account that pays 5% interest compounded monthly. How much should William put into this account so that he’ll have $4000 at the end of two years?

2. Suppose William, from our last example, only has $3500 to invest but still wants $4000 for a hot tub. He finds a bank offering 5.25% interest compounded quarterly. How long will he have to leave his money in the account to have $4000.

3. Kelly plans to put her graduation money into an account and leave it there for 4 years while she goes to college. She receives $750 in graduation money that she puts it into an account that earns 4.25% interest compounded semi-annually. How much will be in Kelly’s account at the end of four years?

4. ABC Bank is offering to double your money! They say that if you invest with them at 6% interest compounded quarterly they will double your money. If you invest $1500 in the account, how long will it take to double your money.

5. If you have a bank account whose principal is $1000, and your bank compounds the interest twice a year at an interest rate of 5%, how much money do you have in your account at the year's end?

6. If you start a bank account with $10,000 and your bank compounds the interest quarterly at an interest rate of 8%, how much money do you have at the year’s end ? (assume that you do not add or withdraw any money from the account) Analysis Page 2 Compound Interest

7. The first credit card that you got charges 12.49 % interest to its customers and compounds that interest monthly. Within one day of getting your first credit card, you max out the credit limit by spending $1,200.00 . If you do not buy anything else on the card and you do not make any payments, how much money would you owe the company after 6 months?

8. How long will it take $1200 to double if it is invested at 10.5% compounded continuously?

9. Victor wants to buy a new car that costs $90,000. He has saved $20,000. Determine how many years it will take his $20,000 to grow to $90,000 at 6.25% interest compounded continuously.

10. Suppose Karen has $1000 that she invests in an account that pays 3.5% interest compounded quarterly. How much money does Karen have at the end of 5 years?

11. At age 27, Jill deposited $4,000 into an IRA, where it earns 9 7/8% interest compounded monthly. What will it be worth when she retires at sixty-five?

12. Jamie wants to earn $500 in interest so she’ll have enough to buy a used car. She puts $2000 into an account that earns 2.5% interest compounded semiannually. How long will she need to leave her money in the account to earn $500 in interest?

13. Find the interest rate needed for an investment of $7000 to triple on 10 years if interest is compounded continuously. Analysis Page 3 Compound Interest

14. If Jack invests $5,000 in an account at 6% interest, what is the answer if we continuously compound the interest for five years?

15. Aunt Hildegarde likes free gifts so when her bank gave away toasters, she invested $2,500 in an account that is compounded continuously at 3.2%. Unfortunately, Aunt Hildegarde was somewhat senile and she forgot about the account and when she died, you inherited it. If the money was untouched for 38 years, how much did you inherit?

16. Suppose that you plan to need $10,000 in thirty-six months' time when your child starts attending university. You want to invest in an instrument yielding 3.5% interest, compounded continuously. How much should you invest?

17. You invest $1,100 in an account that has an annual interest rate of 2.1%, compounded continuously. How much money will be in the account after 7 years?

18. If you invest $1,000 at an annual interest rate of 5% compounded continuously, calculate the final amount you will have in the account after five years.

19. Mom and Dad want to give you $20,000 when you graduate high school to help pay for your first year of college. After searching around, they found a bank willing to offer 3.6% interest compounded continuously. How much should they invest when you graduate 8th grade to have the desired amount when you graduate high school? Analysis Page 4 Compound Interest

20. Mom and Dad want to give you $20,000 when you graduate high school to help pay for your first year of college. After searching around, they found a bank willing to offer 3.6% interest compounded continuously. How much should they invest when you graduate fourth grade to have the desired amount when you graduate high school?

21. Mom and Dad want to give you $20,000 when you graduate high school to help pay for your first year of college. After searching around, they found a bank willing to offer 3.6% interest compounded continuously. How much should they invest when you graduate kindergarten to have the desired amount when you graduate high school?

22. Mom and Dad want to give you $20,000 on your 18th birthday to help pay for your first year of college. After searching around, they found a bank willing to offer 3.6% interest compounded continuously. How much should they invest when you are born to have the desired amount on your 18th birthday?

23. Instead of taking the money for college from problem #22, you decide to leave it in the bank for another five years to help purchase your first house. How much money will you have if you decide to wait? Assume continuous interest at 3.6%.