Instructions for FASRI Discussion

Overview: We are trying something different this week. We want each participant to read selected parts of a FASB/IASB discussion paper on leases and then attempt to answer several questions in advance of office hours. During office hours, we will see how well participants applied the guidance in the discussion paper. But much more importantly, we will discuss how participants might generate some researchable ideas regarding practice issues raised by the discussion paper.

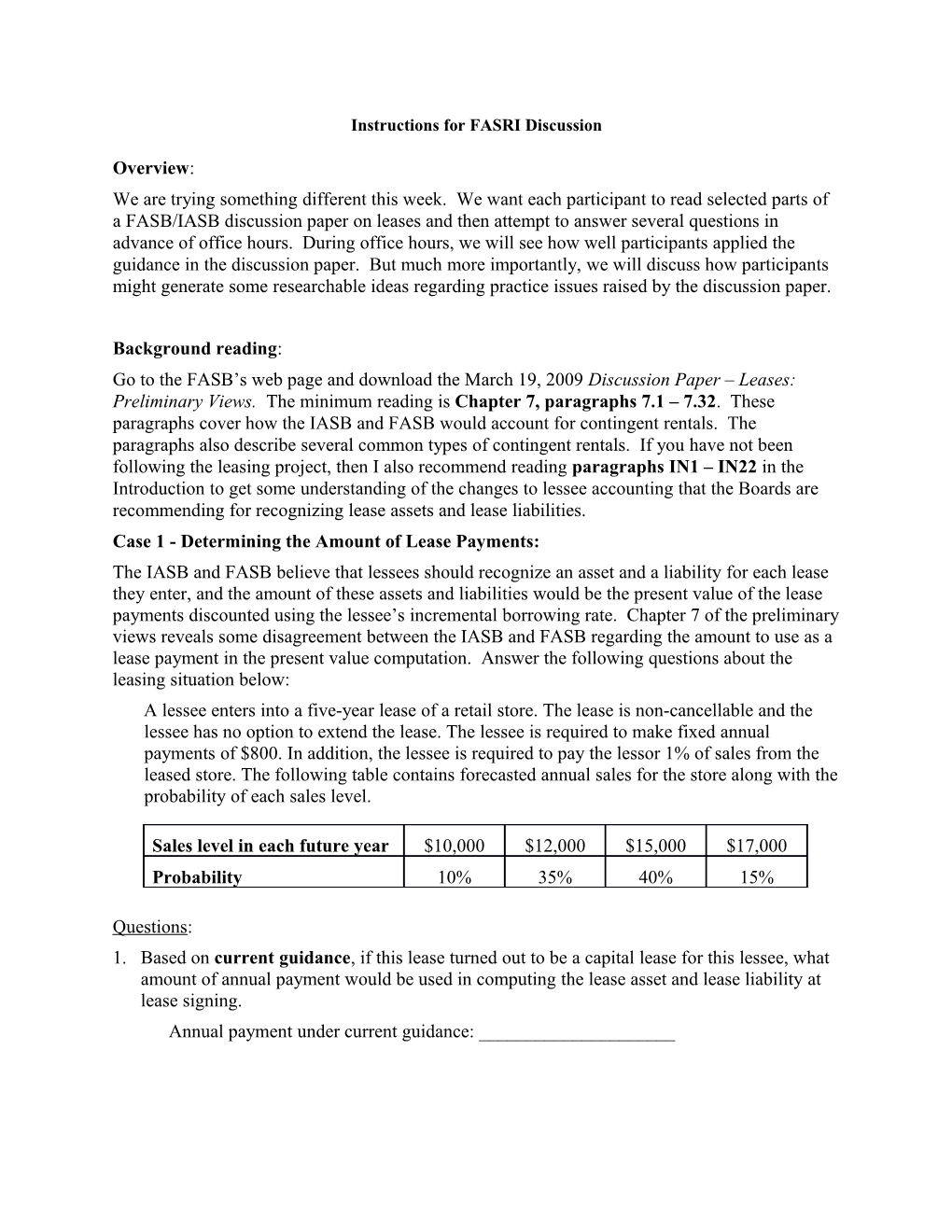

Background reading: Go to the FASB’s web page and download the March 19, 2009 Discussion Paper – Leases: Preliminary Views. The minimum reading is Chapter 7, paragraphs 7.1 – 7.32. These paragraphs cover how the IASB and FASB would account for contingent rentals. The paragraphs also describe several common types of contingent rentals. If you have not been following the leasing project, then I also recommend reading paragraphs IN1 – IN22 in the Introduction to get some understanding of the changes to lessee accounting that the Boards are recommending for recognizing lease assets and lease liabilities. Case 1 - Determining the Amount of Lease Payments: The IASB and FASB believe that lessees should recognize an asset and a liability for each lease they enter, and the amount of these assets and liabilities would be the present value of the lease payments discounted using the lessee’s incremental borrowing rate. Chapter 7 of the preliminary views reveals some disagreement between the IASB and FASB regarding the amount to use as a lease payment in the present value computation. Answer the following questions about the leasing situation below: A lessee enters into a five-year lease of a retail store. The lease is non-cancellable and the lessee has no option to extend the lease. The lessee is required to make fixed annual payments of $800. In addition, the lessee is required to pay the lessor 1% of sales from the leased store. The following table contains forecasted annual sales for the store along with the probability of each sales level.

Sales level in each future year $10,000 $12,000 $15,000 $17,000 Probability 10% 35% 40% 15%

Questions: 1. Based on current guidance, if this lease turned out to be a capital lease for this lessee, what amount of annual payment would be used in computing the lease asset and lease liability at lease signing. Annual payment under current guidance: ______2. Under the guidance in the preliminary views, what annual lease payment would the IASB use in measuring the lease asset and liability? Annual payment under IASB preliminary views: ______

3. What annual lease payment would the FASB use in measuring the lease asset and liability? Annual payment under FASB preliminary views: ______

What research questions arise from these three different approaches to accounting for contingent rental payments at lease inception? Questions can relate to equity valuation, contracting, ability of practitioners to implement the various approaches, ability of auditors to audit the various approaches, etc.

Case 2 - Remeasuring the Amount of Lease Payments In addition to holding different views about how to assess lease payments at the inception of the lease in the presence of contingent rentals, the two Boards also disagree regarding how new information about contingent rentals after inception should be handled. Answer the following questions about the leasing situation below: A lessee booked a $10,000 lease asset and lease liability on January 1, 2005. This amount includes fixed payments and estimated contingent payments. By the end of 2006, the lessee reevaluates the estimated contingent payments and concludes that the ending balance in the lease liability would be different if it was remeasured based on the current information. Questions: 1. Based on current guidance, would net income in 2006 contain a lease remeasurement? Current guidance has remeasurement in net income: yes no 2. Under the guidance in the preliminary views, does the IASB believe net income in 2006 should contain a lease remeasurement? IASB preliminary views has remeasurement in net income: yes no 3. Under the guidance in the preliminary views, does the FASB believe net income in 2006 should contain a lease remeasurement? FASB preliminary views has remeasurement in net income: yes no

What research questions arise from the different approaches to accounting for reassessments of contingent rental payments after lease inception?