P C Finance Research Clarifying Complexities Registration Number: 1985/000022/23 Members: P E Hattingh and C P Hattingh Tele: 011 476-3626; Fax: 011 476-3627; Email: [email protected]; Web: www.mafiabuzz.co.za; Add: P O Box 731625 Fairland 2030

IFRS Buzz 024

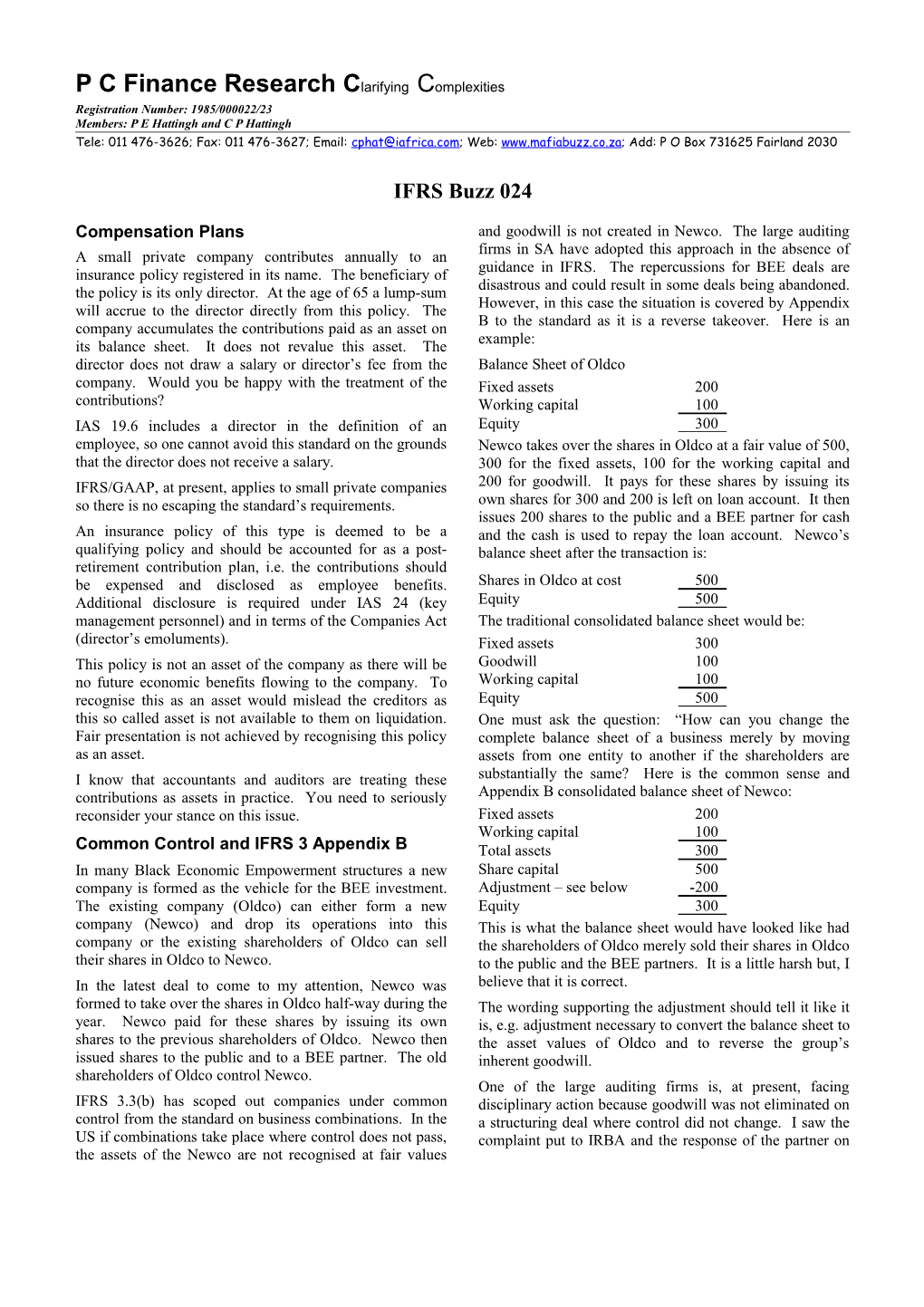

Compensation Plans and goodwill is not created in Newco. The large auditing firms in SA have adopted this approach in the absence of A small private company contributes annually to an guidance in IFRS. The repercussions for BEE deals are insurance policy registered in its name. The beneficiary of disastrous and could result in some deals being abandoned. the policy is its only director. At the age of 65 a lump-sum However, in this case the situation is covered by Appendix will accrue to the director directly from this policy. The B to the standard as it is a reverse takeover. Here is an company accumulates the contributions paid as an asset on example: its balance sheet. It does not revalue this asset. The director does not draw a salary or director’s fee from the Balance Sheet of Oldco company. Would you be happy with the treatment of the Fixed assets 200 contributions? Working capital 100 IAS 19.6 includes a director in the definition of an Equity 300 employee, so one cannot avoid this standard on the grounds Newco takes over the shares in Oldco at a fair value of 500, that the director does not receive a salary. 300 for the fixed assets, 100 for the working capital and IFRS/GAAP, at present, applies to small private companies 200 for goodwill. It pays for these shares by issuing its so there is no escaping the standard’s requirements. own shares for 300 and 200 is left on loan account. It then issues 200 shares to the public and a BEE partner for cash An insurance policy of this type is deemed to be a and the cash is used to repay the loan account. Newco’s qualifying policy and should be accounted for as a post- balance sheet after the transaction is: retirement contribution plan, i.e. the contributions should be expensed and disclosed as employee benefits. Shares in Oldco at cost 500 Additional disclosure is required under IAS 24 (key Equity 500 management personnel) and in terms of the Companies Act The traditional consolidated balance sheet would be: (director’s emoluments). Fixed assets 300 This policy is not an asset of the company as there will be Goodwill 100 no future economic benefits flowing to the company. To Working capital 100 recognise this as an asset would mislead the creditors as Equity 500 this so called asset is not available to them on liquidation. One must ask the question: “How can you change the Fair presentation is not achieved by recognising this policy complete balance sheet of a business merely by moving as an asset. assets from one entity to another if the shareholders are I know that accountants and auditors are treating these substantially the same? Here is the common sense and contributions as assets in practice. You need to seriously Appendix B consolidated balance sheet of Newco: reconsider your stance on this issue. Fixed assets 200 Working capital 100 Common Control and IFRS 3 Appendix B Total assets 300 In many Black Economic Empowerment structures a new Share capital 500 company is formed as the vehicle for the BEE investment. Adjustment – see below -200 The existing company (Oldco) can either form a new Equity 300 company (Newco) and drop its operations into this This is what the balance sheet would have looked like had company or the existing shareholders of Oldco can sell the shareholders of Oldco merely sold their shares in Oldco their shares in Oldco to Newco. to the public and the BEE partners. It is a little harsh but, I In the latest deal to come to my attention, Newco was believe that it is correct. formed to take over the shares in Oldco half-way during the The wording supporting the adjustment should tell it like it year. Newco paid for these shares by issuing its own is, e.g. adjustment necessary to convert the balance sheet to shares to the previous shareholders of Oldco. Newco then the asset values of Oldco and to reverse the group’s issued shares to the public and to a BEE partner. The old inherent goodwill. shareholders of Oldco control Newco. One of the large auditing firms is, at present, facing IFRS 3.3(b) has scoped out companies under common disciplinary action because goodwill was not eliminated on control from the standard on business combinations. In the a structuring deal where control did not change. I saw the US if combinations take place where control does not pass, complaint put to IRBA and the response of the partner on the assets of the Newco are not recognised at fair values IFRS Buzz 013 the job. The partner has, effectively, admitted that he was wrong. Don’t mess with GAAP/IFRS! Kind regards,

Charles Hattingh February 2007 CPD 10 Minutes

2