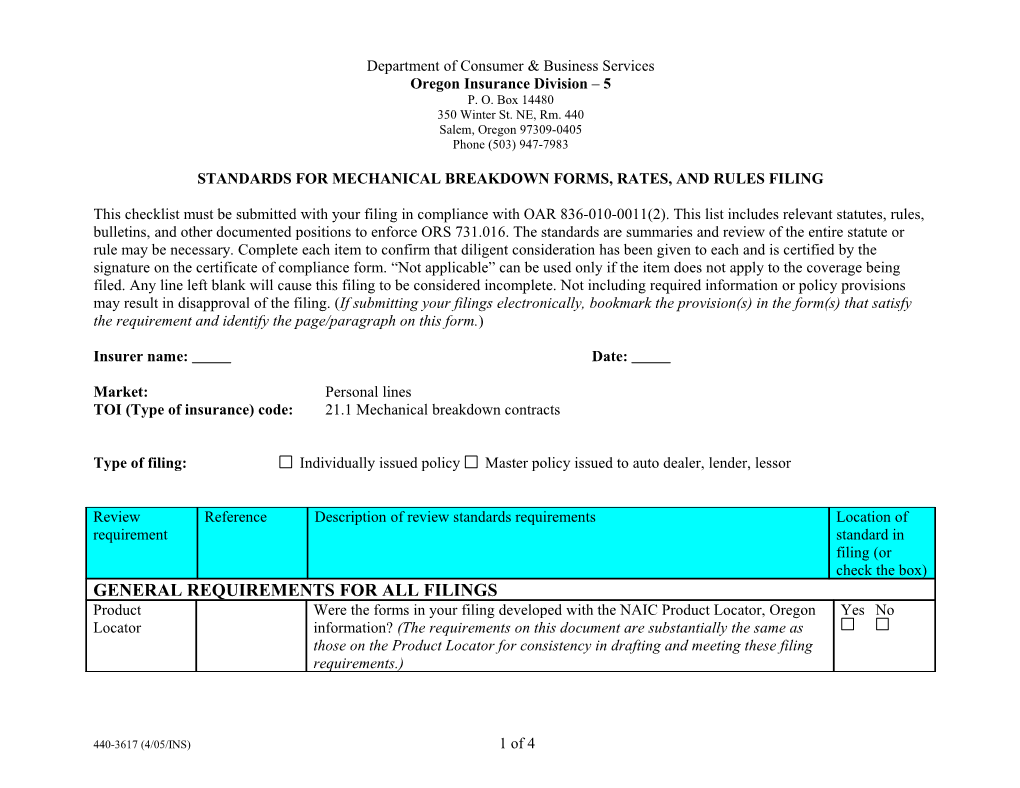

Department of Consumer & Business Services Oregon Insurance Division – 5 P. O. Box 14480 350 Winter St. NE, Rm. 440 Salem, Oregon 97309-0405 Phone (503) 947-7983

STANDARDS FOR MECHANICAL BREAKDOWN FORMS, RATES, AND RULES FILING

This checklist must be submitted with your filing in compliance with OAR 836-010-0011(2). This list includes relevant statutes, rules, bulletins, and other documented positions to enforce ORS 731.016. The standards are summaries and review of the entire statute or rule may be necessary. Complete each item to confirm that diligent consideration has been given to each and is certified by the signature on the certificate of compliance form. “Not applicable” can be used only if the item does not apply to the coverage being filed. Any line left blank will cause this filing to be considered incomplete. Not including required information or policy provisions may result in disapproval of the filing. (If submitting your filings electronically, bookmark the provision(s) in the form(s) that satisfy the requirement and identify the page/paragraph on this form.)

Insurer name: Date:

Market: Personal lines TOI (Type of insurance) code: 21.1 Mechanical breakdown contracts

Type of filing: Individually issued policy Master policy issued to auto dealer, lender, lessor

Review Reference Description of review standards requirements Location of requirement standard in filing (or check the box) GENERAL REQUIREMENTS FOR ALL FILINGS Product Were the forms in your filing developed with the NAIC Product Locator, Oregon Yes No Locator information? (The requirements on this document are substantially the same as those on the Product Locator for consistency in drafting and meeting these filing requirements.)

440-3617 (4/05/INS) 1 of 4 Filing OAR 836-010- Required forms are located on SERFF or on our Web site: Yes No Submission 0011 www.oregoninsurance.org/docs/serff/filing_requirements.htm. These must be As required on submitted for your filing to be accepted as complete: SERFF or our 1 Transmittal form. Web site 2. Cover letter & explanatory memorandum (See transmittal form for instructions.) 3. Third party filers’ letter of authorization. 4. Certificate of compliance form. 5. Product standards (this document). 6. Forms filed for approval. 7. For mail filings, submit two complete sets of the filing and a large self- addressed, stamped envelopes in which the division can return approved forms. Review ORS Check all that are submitted in this filing for review: Yes No 742.003(1) 1. New policy or program. 2. Endorsements amending an existing program that include additional coverages in these standards. 3. Debtor’s certificate, if a group. 4. Certificate of insurance, if a group. Applicability ORS No policy has been issued or will be issued upon the forms in this filing until Yes No 742.048(2) approved. OAR 836-030- Agents are not allowed to charge a service fee. Yes No 0060 FORM REQUIREMENTS Legibility of ORS 742.005(2) The forms are clear and understandable in the presentation of premiums, labels, Yes No forms descriptions of contents, title, headings, backing, and other indication (including restrictions) in the provisions. The information is clear and understandable to the consumer and is not unintelligible, uncertain, ambiguous, abstruse, or likely to mislead. Policy OAR 736-062- For individually owned motor vehicle physical damage only policies, a notice of Yes No documentation 0005 the limited nature of the coverage is filed under one of the following standards: 1. Exact wording and font stated in OAR 836-062-0005 displayed on the face of the policy or evidence of coverage. 2. Attached with a sticker or stamp that contains the required warning. 3. Submitting an alternative notice provision that substantially complies for approval.

440-3617 (4/05/INS) 2 of 4 Policy period ORS 742.048 & Effective date and time – Policy states that coverage commences at 12:01 a.m. and the 742.504(3) date. It includes a statement that coverage applies only to accidents that occur on and after the effective date of the policy; during the policy period; and within the United States of America, its territories or possessions, or Canada. Access to courts ORS 742.061 Attorney fees – If a claim settlement is not made within six months and action is brought to court, should the plaintiff’s recovery exceed the amount of payment made by the defendant, the court will set attorney fees to be paid as part of the costs of legal action and any appeal, unless the parties agree to binding arbitration. Appraisal ORS 742.466(1) The policy contains a provision, in the event of a dispute, authorizing the insured to obtain an independent appraisal by a disinterested party of the physical damage. Arbitration ORS 36.600- Voluntary arbitration is permitted by the Oregon Constitution and statutes after all 36.740 internal appeals have been exhausted and can be binding upon consent of the covered insured. (If the policy provides for arbitration when claim settlement cannot be reached, the enrollee may elect arbitration by mutual agreement at the time of the dispute. Arbitration takes place under the laws of Oregon or another agreed-upon procedure. Arbitration must be held in the insured’s county and state.) Bankruptcy ORS 742.031 The policy includes a bankruptcy provision similar to that in ORS 742.031. Cancellation & ORS 742.023 Cancellation refund method is clearly defined. nonrenewal Fees, service OAR 836-030- All charges to the policyholder are listed on the declarations page. Field add-ons are not charges, taxes 0050 and ORS permitted. 731.808 Limits ORS 742.023 Describes limits on coverage. Loss settlement ORS 742.023 The policyholder is the borrower or lessee who receives benefits. ORS 742.053 Policy states that proof of loss forms are available from an insurer upon request by an insured. Loss valuation Oregon case law Diminution of value – If the policy does not provide coverage for loss of market value or “diminution of value,” the term describing the limitation is specifically defined in the policy. (Rossier vs. Union Automobile Ins. Co. 134 Or. 211, 291 P.2d 498 (1930); and Dunmire Motor Company vs. Oregon Mutual Fire Ins. Co. 166 Or. 690, 114 P.2d 1005 (1941)) Primary ORS 742.023 The policy states the value of the benefit, defines the terms of coverage, and describes the coverage conditions and provisions pertaining to the coverage. Rebates ORS 746.035 & Inducements or rebates specified in the policy. If answer is other than “N/A,” details 746.045 must be included in the rates and rules filing. Titles & ORS 742.005(2) Each form filed identifies the insurer and is clearly titled. Headings for benefits include headings references to any limitations and restrictions in the provision.. RATE, RULE, RATING PLAN, CLASSIFICATION, AND TERRITORY FILING REQUIREMENTS 440-3617 (4/05/INS) 3 of 4 Filing ORS 737.205 Copies of rates, rating plans, and rating systems are included in the filing. Yes No submission Fictitious group ORS 737.600, Fictitious groups for rate purposes meet the requirements of ORS 737.600 (3)(b) for mass- Yes No OAR 836-042- marketing plans. 0030 to 0322 Discrimination ORS 746.015, Rates, rating plans, and rating systems do not discriminate unfairly in the availability of Yes No OAR 836-081- insurance and the application of rates. 0010 Fees, service ORS 737.310 Cost-accounting justification on initial filings and subsequent changes. charges, taxes and OAR 836- 010-0021 Investment ORS 737.310 1. Cash flow method. income and OAR 836- Or 010-0021 2. Alternative method showing amount of investment income earned on loss, LAE and unearned premium reserve to earned premium. Loss ratio Position (ORS Expected loss ratio is at least 50 percent. Yes No standards 737.310(1)) Loss valuation ORS 737.310 Premium data. and OAR 836- Loss and LAE data. 010-0021 Expected loss ratio. Ratemaking Position (ORS If filing commission levels higher than 20 percent, details are provided of which Yes No generally 737.310) company-administration functions have been transferred to the agent to cause an increase in commissions. The commission should not exceed 35 percent. Position - OAR Rates are filed as they are actually charged to the consumer, to include all expenses and Yes No 836-030-0050, fees. Field add-ons to the rates are not permitted. ORS 731.808 Position Only the lender pays premium costs for repossession, skip/confiscation/conversion, liens, Yes No and title misfiling. Rebates ORS 746.035 Are inducements or rebates specified in policy? If “yes,” explain in the cover letter and Yes No and 746.045 identify the location in the rule. Schedule rating Bulletin 82-4 Schedule rating plan identifies the credit or debit modification criteria and the maximum plan modification. Modifications in excess of 25 percent include supporting statistical evidence. Underwriting ORS 737.310 1. Oregon data for commission and brokerage. profit & and OAR 836- 2. Countrywide data for general and other acquisition expenses as reported in the contingencies 010-0021 Insurance Expense Exhibit. 3. Oregon data for taxes, licenses, and fees.

440-3617 (4/05/INS) 4 of 4