ChangeWave Research: Consumer Spending and Shopping March 22, 2006

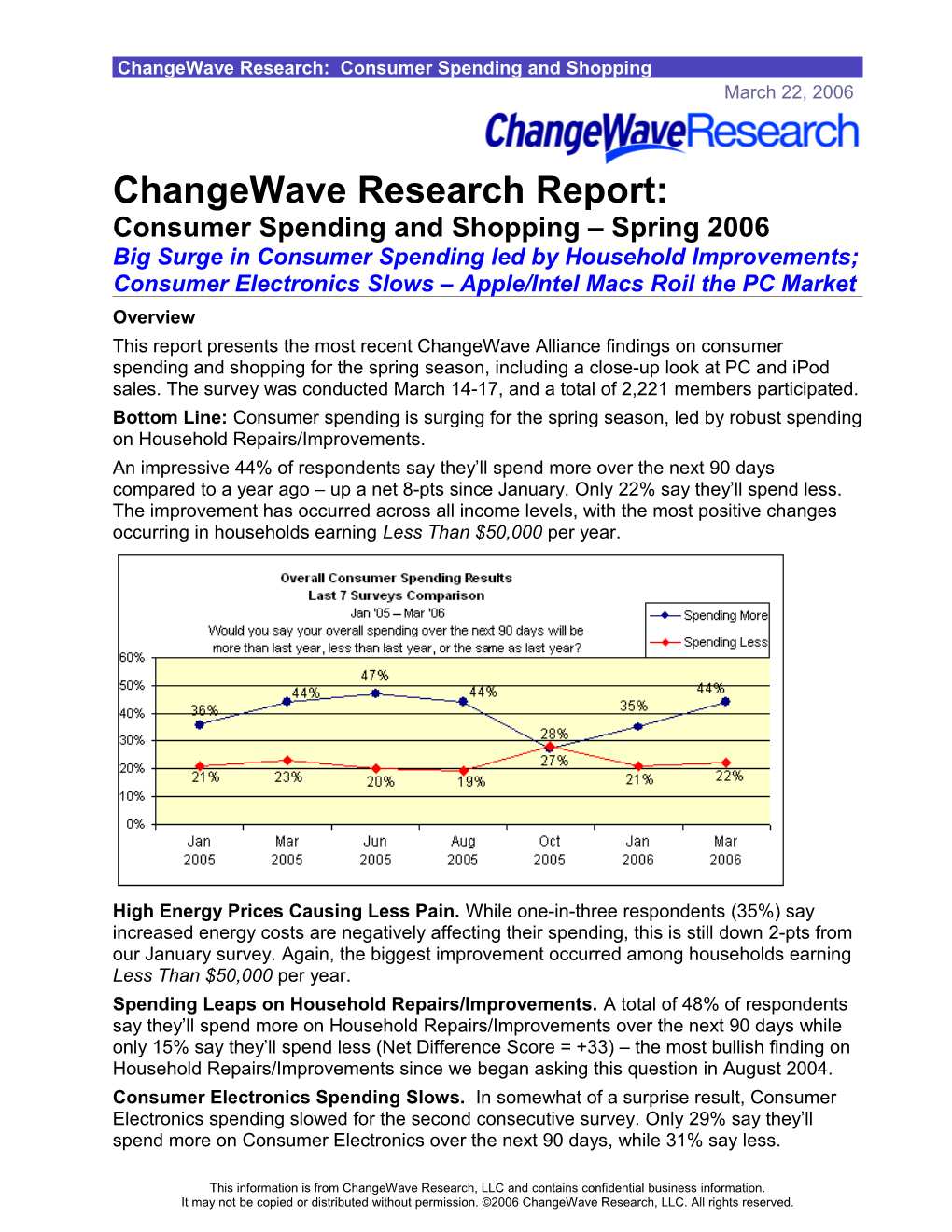

ChangeWave Research Report: Consumer Spending and Shopping – Spring 2006 Big Surge in Consumer Spending led by Household Improvements; Consumer Electronics Slows – Apple/Intel Macs Roil the PC Market Overview This report presents the most recent ChangeWave Alliance findings on consumer spending and shopping for the spring season, including a close-up look at PC and iPod sales. The survey was conducted March 14-17, and a total of 2,221 members participated. Bottom Line: Consumer spending is surging for the spring season, led by robust spending on Household Repairs/Improvements. An impressive 44% of respondents say they’ll spend more over the next 90 days compared to a year ago – up a net 8-pts since January. Only 22% say they’ll spend less. The improvement has occurred across all income levels, with the most positive changes occurring in households earning Less Than $50,000 per year.

High Energy Prices Causing Less Pain. While one-in-three respondents (35%) say increased energy costs are negatively affecting their spending, this is still down 2-pts from our January survey. Again, the biggest improvement occurred among households earning Less Than $50,000 per year. Spending Leaps on Household Repairs/Improvements. A total of 48% of respondents say they’ll spend more on Household Repairs/Improvements over the next 90 days while only 15% say they’ll spend less (Net Difference Score = +33) – the most bullish finding on Household Repairs/Improvements since we began asking this question in August 2004. Consumer Electronics Spending Slows. In somewhat of a surprise result, Consumer Electronics spending slowed for the second consecutive survey. Only 29% say they’ll spend more on Consumer Electronics over the next 90 days, while 31% say less.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Consumer Spending and Shopping Home Entertainment and Computer/Networking Increase in Online Shopping. While Big Box Specialty Stores (61%) remain the favorite place to shop for home entertainment & computer/networking, online shopping (46%) shows the most momentum – increasing 2-pts since January 2006. Momentum Shift towards Circuit City? Respondents still say Best Buy (53%) is the place they most prefer to shop at for home entertainment and computer/ networking products – but its market share is down 1-pt since January. Circuit City (23%), on the other hand, is up 2-pts to its highest level in more than a year. Moreover, this is the third survey in a row that Circuit City has shown an increase. Consumer PCs The new line of Apple/Intel Macs has been out just a few short months, but they have already begun roiling the Consumer Laptop market. (A) Consumer PCs – Past 90 Days Apple Surges in Both Desktops and Laptops. Apple’s share (8%) of Desktop purchases has doubled since January, while its share of Laptops (6%) is up 2-pts. HP Laptops Rise but Desktops Flat. HPs share of consumer laptop purchases (22%) jumped 3-pts in the last 90 days, though its share of desktops (23%) remains flat. Dell Market Share Falls. The industry leader’s Desktop share (36%) fell 7-pts since January and its Laptop share (41%) fell 3-pts – results that do not bode well for Dell’s next earnings announcement (May 2006). (B) Planned Purchases: Next 90 Days Apple on a Roll. Apple (17%) is up 4-pts in terms of planned Laptop purchases for the next 90 days – even as the other major manufacturers are each down 2- to 8-pts. The results suggest a major change may be starting to occur – with significant numbers of consumers holding off on other brands while they consider Apple/Intel Macs. Other Manufacturers. While HPs share of planned laptop purchases (12%; down 3- pts) has declined since the previous survey, it still shows momentum in desktops (16%; up 6-pts). Dell continues to lose ground in both planned purchases of laptops (37%; down 2-pts) and desktops (42%; down 1-pt). iPods As expected, the survey results point to a significant slowdown in iPod sales from the torrid pace we reported over the 2005 Holiday season. On the upside, the current iPod sales forecast looks significantly better than our previous one in January – with 6% of respondents saying they’ll purchase an iPod in the next 90 days, up 3-pts from previously. Overall, the bumpy iPod results suggest significant market volatility may be in store for Apple short term. However as a counterbalance, their coming quarterly earnings announcement should be quite favorable regarding Mac sales. Looking longer term, the survey results suggest the Intel chip deal could be one of the great moves in Apple history. The rollout has barely started, but the new Intel Mac already appears to be causing a revolution in the Consumer PC market. The ChangeWave Alliance is a group of 7,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

Helping You Profit From A Rapidly Changing World ™ www.ChangeWaveResearch.com This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 2 ChangeWave Research: Consumer Spending and Shopping

Summary of Key Findings Big Surge in Overall Home Entertainment Apple/Intel Macs Roil Consumer Spending and Computer/ the PC Market 44% say they'll spend Networking Past 90 Days – Purchases: more during next 90 days– Laptops 22% say they’ll spend less Increased Online Shopping for Home Entertainment HP (22%, up 3-pts) That’s a strong net 8-pt Apple (6%, up 2-pts) improvement over January 46% say they’re shopping online – net 2-pt Dell (41%, down 3-pts) Robust Spending on improvement over Jan Desktops Household Repairs/ Dell Online appears to Apple (8%, up 4-pts) benefit (17%, up 4-pts) HP (23%, unchanged) Improvements… Dell (36%, down 7-pts) 48% say they’ll spend Momentum Shift Towards Next 90 Days – Purchases: more during next 90 days-- Circuit City in Home 15% say they’ll spend less Entertainment Shopping Laptops A net 8-pt leap over Jan, 53% say they most prefer Apple (17%, up 4-pts) and above one year ago to shop at Best Buy – HP (12%, down 3-pts) …But Consumer down 1-pt since Jan Dell (37%, down 2-pts) 23% say they most prefer Desktops Electronics Slows to shop at Circuit City – HP (16%, up 6-pts) 29% say they’ll spend up 2-pts to a 1-year high Apple (12%, up 1-pt) more during next 90 days Third survey in a row that Dell (42%, down 1-pt) 31% say they’ll spend less Circuit City has shown an increase Table of Contents

Summary of Key Findings...... 2

The Findings...... 4

(A) Overall Consumer Spending...... 4

(B) PCs and iPods ...... 10

(C) Consumer Shopping Preferences ...... 15

ChangeWave Research Methodology...... 17

About ChangeWave Research...... 18

.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 3 ChangeWave Research: Consumer Spending and Shopping I. The Findings Introduction This report presents the most recent ChangeWave Alliance findings on consumer spending and shopping for the spring season, including a close look at PC and iPod sales. The survey was conducted March 14-17, and a total of 2,221 members participated.

Total Respondents (n=2,221) (A) Overall Consumer Spending

(1) Question Asked: What about compared to this time a year ago? Would you say your overall spending over the next 90 days will be more than last year, less than last year, or the same as last year? Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 More Spending Than 44% 35% 27% 44% 46% 44% Last Year Less Spending Than 22% 21% 28% 19% 20% 23% Last Year Spending Will Remain 33% 41% 44% 35% 33% 31% the Same as Last Year Don't Know 1% 2% 1% 2% 1% 1%

A Surge in Consumer Spending. An impressive 44% of respondents say they will be spending more over the next 90 days compared to a year ago, while 22% say they’ll be spending less – a significant 8-pt improvement from our previous survey (Jan ’06) and slightly better than the findings from one year ago (Mar ’05).

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 4 ChangeWave Research: Consumer Spending and Shopping

As the following Income Breakdowns show, improvement occurred across all income levels, but the biggest positive change occurred in respondent households earning Less Than $50,000 per year.

Current Survey (March 2006) – Breakdown by Income Levels Less $100,001 $125,001 Greater $50,001- $75,001- Total Than - - Than $75,000 $100,000 $50,000 $125,000 $150,000 $150,000 More Spending 44% 40% 39% 44% 43% 49% 48% Than Last Year Less Spending 22% 21% 26% 24% 23% 23% 18% Than Last Year Spending Will 33% 38% 35% 30% 33% 27% 34% Remain the Same as Last Year

Previous Survey (January 2006) – Breakdown by Income Levels Less $100,001 $125,001 Greater $50,001- $75,001- Total Than - - Than $75,000 $100,000 $50,000 $125,000 $150,000 $150,000 More Spending 35% 29% 36% 33% 34% 38% 38% Than Last Year Less Spending 21% 31% 27% 21% 21% 21% 20% Than Last Year Spending Will 41% 37% 35% 43% 42% 40% 40% Remain the Same as Last Year

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 5 ChangeWave Research: Consumer Spending and Shopping

(2A) Question Asked: Which of the following consumer items will you be spending more money on over the next 90 days than last year? (Check All That Apply)

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 Household 48% 40% 38% 45% 48% 46% Repairs/Improvements Travel/Vacation 39% 31% 33% 34% 48% 38% Consumer Electronics 29% 30% 43% 31% 34% 35% Durable Goods for the 23% 22% 25% 24% 22% 22% Home Restaurants/Everyday 18% 16% 22% 16% 21% 19% Entertainment Children's Services 14% 11% 10% 18% 15% 13% (e.g. camp, education, lessons, other activities) Automobile Purchase 10% 9% 7% 10% 11% 10% Other Services (e.g. 10% 10% 7% 11% 10% 11% adult ed, health, fitness activities)

(2B) Question Asked: And which of the following consumer items will you be spending less money on over the next 90 days than last year? (Check All That Apply)

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 Consumer Electronics 31% 26% 29% 30% 27% 30% Automobile Purchase 28% 25% 28% 28% 28% 29% Durable Goods for the 25% 25% 25% 26% 27% 26% Home Restaurants/Everyday 23% 25% 28% 28% 21% 25% Entertainment Travel/Vacation 22% 24% 30% 28% 21% 24% Household 15% 17% 18% 15% 16% 15% Repairs/Improvements Other Services (e.g. 11% 10% 12% 11% 12% 12% adult education, health and fitness activities) Children's Services 10% 9% 13% 9% 11% 11% (e.g. camp, education, lessons, other activities)

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 6 ChangeWave Research: Consumer Spending and Shopping Net Difference Score – Current Survey (March 2006) Spending Spending Net More Next Less Next Difference 90 Days 90 Days Score Household Repairs/Improvements 48% 15% +33 Travel/Vacation 39% 22% +17 Children's Services (e.g. camp, education, 14% 10% +4 lessons, other activities) Other Services (e.g. adult education, health 10% 11% -1 and fitness activities) Consumer Electronics 29% 31% -2 Durable Goods for the Home 23% 25% -2 Restaurants/Everyday Entertainment 18% 23% -5 Automobile Purchase 10% 28% -18

Change in Net Difference Score – Current Consumer Spending Survey (March 2006) vs. Previous Consumer Spending Survey (January 2006) 2006 2006 Net Net Difference Difference Change in Score Score Net Current Previous Difference Survey Survey Score (Mar ‘06) (Jan ‘06) Household Repairs/Improvements +33 +23 +10 Travel/Vacation +17 +7 +10 Restaurants/Everyday Entertainment -5 -9 +4 Children's Services (e.g. camp, education, +4 +2 +2 lessons, other activities) Durable Goods for the Home -2 -3 +1 Automobile Purchase -18 -16 -2 Other Services (e.g. adult education, health -1 0 -1 and fitness activities) Consumer Electronics -2 +4 -6

Spending Leaps on Household Repairs/Improvements. A total of 48% of respondents say they’ll spend more on Household Repairs/Improvements over the next 90 days while only 15% say they’ll spend less (Net Difference Score = +33) – the most bullish finding on Household Repairs/Improvements since we began asking this question in August 2004.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 7 ChangeWave Research: Consumer Spending and Shopping

Travel/Vacation Spending Up. Travel/Vacation spending (Net Difference Score = +17) also looks strong for the spring, with 39% saying they'll spend more over the next 90 days and 22% less – a net 3-pts higher than a year ago (Mar 2005).

Consumer Electronics Spending Slows. In somewhat of a surprise result, Consumer Electronics spending slowed for the second consecutive survey. Only 29% say they’ll spend more on Consumer Electronics over the next 90 days, while 31% say less.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 8 ChangeWave Research: Consumer Spending and Shopping (3) Question Asked: What effect – if any – are increased energy costs (i.e., gasoline, heating oil, natural gas, electricity) having on your spending plans for the next 90 days? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Oct ‘04 Significant Effect - My Spending 4% 4% 5% 5% 3% Will Be Much Lower Because of Increased Energy Costs Modest Effect - My Spending Will 31% 33% 30% 28% 27% Be Somewhat Lower Because of Increased Energy Costs No Effect on My Spending Plans 63% 61% 63% 63% 67% Don't Know 2% 2% 3% 4% 3%

*Note: In the previous October 2005 survey, the question was “What effect, if any, are increased energy costs (i.e., gasoline, heating oil, natural gas, electricity) having on your Holiday Spending plans?”

Current Survey (March 2006) – Breakdown by Income Levels Less $100,001 $125,001 Greater $50,001- $75,001- Total Than - - Than $75,000 $100,000 $50,000 $125,000 $150,000 $150,000 Significant Effect 4% 11% 6% 5% 3% 4% 2% Modest Effect 31% 38% 42% 38% 33% 29% 21% No Effect 63% 51% 49% 54% 62% 66% 75%

Previous Survey (January 2006) – Breakdown by Income Levels Less $100,001 $125,001 Greater $50,001- $75,001- Total Than - - Than $75,000 $100,000 $50,000 $125,000 $150,000 $150,000 Significant Effect 4% 18% 8% 3% 2% 7% 1% Modest Effect 33% 35% 42% 42% 41% 30% 23% No Effect 61% 47% 48% 53% 57% 61% 73%

High Energy Prices Causing Less Pain. While one-in-three respondents (35%) say increased energy costs are negatively affecting their spending, this is still down 2-pts from our January survey. Again, the biggest improvement occurred among households earning Less Than $50,000 per year.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 9 ChangeWave Research: Consumer Spending and Shopping (B) PC Purchasing and iPods

These next few questions focus on desktops and laptops.

(4) Question Asked: Did you buy a computer within the last 90 days?

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 Yes 16% 20% 21% 20% 20% 19% No 83% 79% 77% 79% 79% 80%

Slower PC Demand – Past 90 Days. A total of 16% of respondents say they bought a computer within the last 90 days, down 4-pts from our previous survey in January 2006.

(4A) Question Asked: Who is the manufacturer and what computer type did you buy? (Check All That Apply) Desktops

Current Previous Previous Previous Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Dell - Desktops 36% 43% 39% 48% Hewlett-Packard (including 23% 23% 24% 20% Compaq) - Desktops Apple - Desktops 8% 4% 5% 7% Gateway (including 7% NA NA NA eMachines) - Desktops Sony - Desktops 2% 2% 4% 1% Lenovo - Desktops 1% 4% 2% 1% Other - Desktops 20% 28% 26% 27% Don't Know 3% 1% 0% 1%

Laptops

Current Previous Previous Previous Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Dell - Laptops 41% 44% 42% 43% Hewlett-Packard (including 22% 19% 17% 16% Compaq) - Laptops Toshiba - Laptops 17% 13% 14% 12% Apple - Laptops 6% 4% 5% 9% Lenovo - Laptops 5% 3% 8% 6% Sony - Laptops 4% 7% 8% 8% Gateway (including 3% NA NA NA eMachines) - Laptops Other - Laptops 6% 13% 9% 10% Don't Know 0% 0% 0% 1%

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 10 ChangeWave Research: Consumer Spending and Shopping Apple Surges in Both Desktops and Laptops. Apple’s share (8%) of Desktop purchases has doubled since January, while its share of Laptops (6%) is up 2-pts. HP Laptops Rise but Desktops Flat. HPs share of consumer laptop purchases (22%) jumped 3-pts in the last 90 days, though its share of desktops (23%) remains flat. Toshiba (17%) also experienced a jump in Consumer Laptop share. Dell Market Share Falls. The industry leader’s Desktop share (36%) fell 7-pts since January and its Laptop share (41%) fell 3-pts – results that do not bode well for Dell’s next earnings announcement (May 2006).

(4B) Question Asked: (FOR THOSE WHO OWN AN APPLE COMPUTER) Which of the following statements best describes you? (Choose No More Than Two) Current Previous Survey Survey Mar ‘06 Jan ‘06 I use both Apple computers and traditional PCs for 23% 34% different purposes - but prefer traditional PCs I use both Apple computers and traditional PCs for 49% 32% different purposes - but prefer Apple computers I recently started using Apple computers, and prefer them 11% 13% to traditional PCs I am a long-time devoted Apple computer user 24% 26% Other 8% 13% Apple Computer Owners Prefer Macs Over Traditional PCs. While nearly three-in-four (72%) Apple computer owners use both Apples and traditional PCs, they are twice as likely to prefer an Apple computer over a traditional PC (49% prefer Apple compared to 23% preferring traditional PCs).

(5) Question Asked: Will you be buying a computer in the next 90 days?

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 Yes 14% 12% 20% 21% 19% 20% No 84% 85% 78% 77% 80% 79%

Future PC Demand. In the previous survey (Jan ’06), we saw a big drop in future PC purchasing among consumers. However, In the current survey 14% of respondents say they plan on buying a computer in the next 90 days – up 2-points from our previous survey (but still well below a year ago).

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 11 ChangeWave Research: Consumer Spending and Shopping (5A) Question Asked: (FOR THOSE BUYING A COMPUTER IN NEXT 90 DAYS) Who is the manufacturer and what computer type are you planning on buying? (Check All That Apply) Desktops Current Previous Previous Previous Survey Survey Survey Survey Jan ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Dell – Desktops 42% 43% 42% 55% Hewlett-Packard (including 16% 10% 10% 21% Compaq) - Desktops Apple - Desktops 12% 11% 11% 9% Sony – Desktops 2% 1% 5% 9% Lenovo – Desktops 1% 1% 2% 1% Gateway (including 5% NA NA NA eMachines) - Desktops Other – Desktops 22% 31% 23% 18% Don't Know 16% 18% 20% 17% Laptops Current Previous Previous Previous Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Dell – Laptops 37% 39% 43% 51% Hewlett-Packard (including 12% 15% 21% 19% Compaq) - Laptops Apple – Laptops 17% 13% 16% 12% Sony – Laptops 10% 13% 5% 10% Toshiba – Laptops 15% 23% 9% 14% Lenovo - Laptops 5% 7% 10% 9% Gateway (including 2% NA NA NA eMachines) – Laptops Other - Laptops 10% 5% 8% 9% Don't Know 16% 16% 16% 13% Apple on a Roll. Apple (17%) is up 4-pts in terms of planned Laptop purchases for the next 90 days – even as the other major manufacturers are each down 2- to 8-pts. The results suggest a major change may be starting to occur – with significant numbers of consumers holding off on other brands while they consider Apple/Intel Macs.

Other Manufacturers. While HPs share of planned laptop purchases (12%; down 3-pts) has declined since the previous survey, it still shows momentum in desktops (16%; up 6- pts). Dell continues to lose ground in both planned purchases of laptops (37%; down 2-pts) and desktops (42%; down 1-pt).

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 12 ChangeWave Research: Consumer Spending and Shopping These Next Few Questions are on Apple Computers and iPods

(5B) Question Asked: (FOR THOSE BUYING AN APPLE COMPUTER IN THE NEXT 90 DAYS) Have you purchased an Apple computer in the past, or are you purchasing an Apple computer for the first time?

Current Previous Previous Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 I have purchased an Apple computer within the past 50% 50% 63% 10 years I have purchased an Apple computer, but more than 5% 13% 7% 10 years ago I am purchasing an Apple computer for the first time 45% 38% 30%

Increase in New Apple Buyers. Among those who say they’ll buy an Apple computer in the next 90 days, 45% say they are buying for the first time – an increase of 7-points from the previous survey.

(6) Question Asked: Last year, Apple announced a deal with Intel to provide microprocessor chips for its Macintosh computers. The new Mac desktops and laptops were rolled out at the beginning of this year. Has this development made you more likely to buy an Apple computer in the future, less likely to buy an Apple computer, or has it had no effect?

Current Previous Previous Previous Survey Survey Survey Survey Mar ‘06 Jan ‘06 Aug ‘05 Jun ‘05 Significantly More Likely to Buy an Apple 7% 9% 4% 4% Computer in the Future Somewhat More Likely to Buy an Apple 22% 24% 14% 15% Computer in the Future Somewhat Less Likely to Buy an Apple 1% 2% 1% 1% Computer in the Future Significantly Less Likely to Buy an Apple 1% 1% 2% 2% Computer in the Future No Effect 65% 59% 75% 73% Don't Know 4% 6% 4% 4% Other 1% 0% 0% 1%

* Note: Previously the question asked was, “Last year, Apple announced a deal with Intel to provide the microprocessor chips for its Macintosh computers beginning this year. Has this development made you more likely to buy an Apple computer in the future, less likely to buy an Apple computer, or has it had no effect?”

Apple/Intel Chip Hits the Market. Apple started selling its Macs with Intel chips earlier this year, and nearly three-in-ten consumers (29%) say this development makes them More Likely to buy an Apple PC in the future.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 13 ChangeWave Research: Consumer Spending and Shopping (7A) Question Asked: Do you currently own an Apple iPod? (Check All That Apply)

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 Yes, Apple iPod (With 4% 4% 0% NA NA NA Video Capability) Yes, Apple iPod 9% 13% 10% 9% 10% 8% (Without Video)* Yes, Apple iPod Nano 7% 7% 2% NA NA NA Yes, Apple iPod Mini 5% 6% 6% 5% 5% 2% Yes, Apple iPod 3% 5% 3% 3% 1% 1% Shuffle Yes, Apple iPod Photo 1% 1% 1% 1% 1% 0% No 74% 72% 79% 82% 83% 88%

*Note: Previously this response choice was “Yes, Apple iPod (Traditional)”

(7B) Question Asked: Do you plan on purchasing an Apple iPod in the next 90 days? (Check All That Apply)

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Mar ‘05 Yes, Apple iPod (With 3% 1% 3% NA NA NA Video Capability) Yes, Apple iPod 1% 1% 3% 3% 2% 3% (Without Video) Yes, Apple iPod Nano 2% 1% 5% NA NA NA Yes, Apple iPod Mini 0% 0% 2% 2% 2% 2% Yes, Apple iPod 0% 0% 1% 1% 0% 1% Shuffle Yes, Apple iPod Photo 0% 0% 0% 1% 1% 1% No 86% 84% 75% 84% 84% 83% Don't Know 7% 8% 11% 6% 9% 9% *Note: Previously this survey choice was, “Yes, Apple iPod.”

iPod Sales. As expected, the survey results point to a significant slowdown in iPod sales from the torrid pace we reported over the 2005 Holiday season. On the upside, the current iPod sales forecast looks significantly better than our previous one in January – with 6% of respondents saying they’ll purchase an iPod in the next 90 days, up 3-pts from previously.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 14 ChangeWave Research: Consumer Spending and Shopping (C) Consumer Shopping Preferences

(8A) Question Asked: Currently, when my family and I shop for home entertainment and computer/networking products, we prefer to buy them at: (Check All That Apply) Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Jan ‘05 Oct ‘04 Big Box Specialty Stores (e.g., 61% 62% 65% 64% 64% Staples, Best Buy, Office Max) Online 46% 44% 40% 42% 36% Discount Store (e.g., Sam's Club, 34% 33% 35% 29% 38% Target, BJ's Wholesale Club) Local Specialty Store 12% 10% 10% 11% 11% Specialty Stores (e.g., Sharper 5% 6% 7% 7% 8% Image, Brookstone, Tweeters) None of the Above 1% 2% 1% 2% 2% Other 4% 3% 3% 3% 2%

Increase in Online Shopping. While Big Box Specialty Stores (61%) remain the favorite place to shop for home entertainment & computer/networking, online shopping (46%) shows the most momentum -- increasing 2-pts since January 2006.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 15 ChangeWave Research: Consumer Spending and Shopping (8B) Question Asked: Which of the following stores do you and your family most prefer to shop at for home entertainment and computer/networking products? (Choose No More Than Three)*

Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Mar ‘06 Jan ‘06 Oct ‘05 Aug ‘05 Jun ‘05 Jan ‘05 Best Buy 53% 54% 48% 46% 52% 50% Circuit City 23% 21% 16% 15% 21% 18% Costco 21% 19% 16% 14% 19% 14% Amazon 18% 20% 14% 14% 12% 12% Dell Online 17% 13% 9% 13% 7% 15% Fry's Electronics 13% 13% 11% 12% 11% 12% CompUSA 12% 10% 8% 9% 6% 8% Wal-Mart 11% 9% 9% 7% 7% 6% eBay 10% 11% 8% 8% 7% 5% Sam's Club 9% 8% 6% 5% 7% 5% Office Depot 7% 4% 4% 5% 2% 4% Staples 7% 8% 4% 6% 3% 4% Buy.com 6% 6% 5% 4% 4% 4% Newegg 5% 5% NA NA NA NA TigerDirect 5% 5% NA NA NA NA Apple 4% 4% NA NA NA NA Target 4% 3% 4% 3% 2% 2% BJ's Wholesale Club 3% 2% NA NA NA NA Radio Shack 3% 2% 2% 2% 3% 2% CDW 2% 1% 1% 1% 1% 1% Overstock.com 2% 2% 2% 2% 1% 2% Tweeter 1% 1% 1% 1% 1% 2% Ultimate Electronics 1% 1% 1% 1% 1% 1% Other 9% 7% 9% 10% 12% 10%

*Note: In the previous August 2005, June 2005, Jan 2005 and October 2004 surveys, the question asked, “Which one or two of the following stores do you and your family most prefer to shop at for home entertainment and networking products?”

Momentum Shift towards Circuit City? Respondents still say Best Buy (53%) is the place they most prefer to shop at for home entertainment and computer/ networking products – but its market share is down 1-point since January. Circuit City (23%), on the other hand, is up 2-pts to its highest level in more than a year. Moreover, this is the third survey in a row that Circuit City has shown an increase.

Other findings of note: Dell Online (17%; up 4-pts) and Office Depot (7%; up 3-pts) each show considerable momentum since our previous survey.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 16 ChangeWave Research: Consumer Spending and Shopping II. ChangeWave Research Methodology

This report presents the findings of a recent ChangeWave Consumer Spending survey. The survey was conducted between March 14-17, 2006. A total of 2,221 Alliance members participated in the survey.

The Alliance’s proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, interprets and reconciles the information in a cohesive manner and converts the information into valuable quantitative and qualitative reports.

The Alliance has assembled its membership team from senior technology and business executives in leading companies of select industries. Nearly 3 out of every 5 members (56%) have advanced degrees (e.g., Master’s or Ph.D.) and 93% have at least a four-year bachelor’s degree.

The business and investment intelligence provided by the Alliance provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 17 ChangeWave Research: Consumer Spending and Shopping III. About ChangeWave Research

ChangeWave Research, a subsidiary of Phillips Investment Resources, LLC, identifies and quantifies "change" in industries and companies through surveying a network of thousands of business executives and professionals working in more than 20 industries.

ChangeWave has a very unique asset in its 7,000-member Alliance. We have assembled our membership team from a broad cross section of more than 20 vertical markets such as telecom, semiconductors, data storage, and biotechnology, along with a wide range of professional disciplines including CIOs, IT managers and programmers, executive management, scientists, engineers and sales personnel.

The ChangeWave Alliance is composed of senior technology and business executives in leading companies - credentialed professionals who spend their everyday lives working on the frontline of technological change.

This proprietary research and business intelligence gathering system provides a real-time view of companies, technologies and business trends in key market sectors along with an in-depth perspective of the macro economy - well in advance of other available sources. ChangeWave surveys its 7,000 Alliance members on a wide range of investment research topics and converts the findings into valuable investment and business intelligence reports. ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

For More Information:

ChangeWave Research Telephone: 301-279-4200 9420 Key West Avenue Fax: 301-610-5206 Rockville, MD 20850 www.ChangeWaveResearch.com USA [email protected]

Helping You Profit From A Rapidly Changing World ™ www.ChangeWaveResearch.com

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2006 ChangeWave Research, LLC. All rights reserved. 18