ST_Darvas Box for TradeStation®

Table of Contents

1 What Is the ST_Darvas Box 2 Using the ST_Darvas Box 3 Inputs 1.What Is the ST_Darvas Box?

The Darvas Box was developed by Nicholas Darvas in the 1950’s. His strategy was to buy stocks that made new 52-week highs on high volume then pulled back slightly. The low of this pullback would form the bottom of the box and the high formed the top. He became famous for turning $10,000 into $2 million over an 18-month period using this simple strategy.

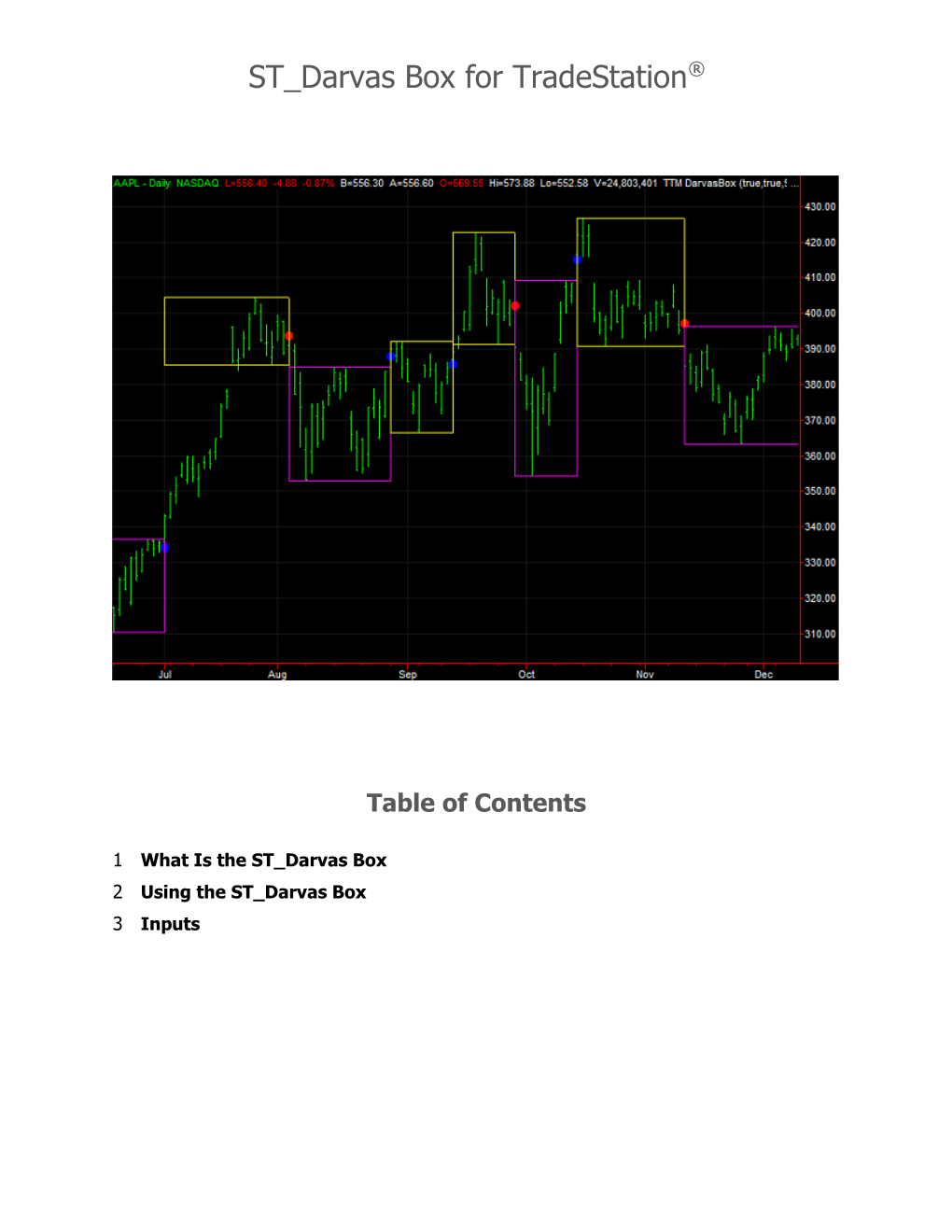

We have adapted the use of this indicator for intraday and swing trading. When conditions are met, a box is formed around the corresponding price action. Buy and sell signals are plotted with blue and red dots respectively as can be seen in the image above.

The philosophy behind the indicator is that prices will often test new highs or lows, retrace slightly, and then continue their path of price discovery. The Darvas Box allows traders to use an auto-populated structure for taking advantage of this repetitive pattern.

Higher boxes are outlined in yellow and lower boxes in purple by default. 2.Using the ST_Darvas Box

To use the ST_Darvas Box indicator, right click on your chart and select ‘Insert Analysis Technique’. Scroll through the list and select ST_Darvas Box’. Click ‘OK’ and the indicator will be applied to your chart.

By default your indicator should look like the image above. This is a 5-minute chart of AAPL with the ST Darvas Box. Note that there were 4 signals given during this trading session – 3 shorts and 1 long. These are indicated by the dots along the right side of the boxes: Red=SHORT and Blue=LONG.

A commonly used strategy to use for the Darvas Box is to take the signals given by the red and blue dots. The opposing side of the box is the stop and the target is the vertical height of the box. In the chart above, the final signal given was a short signal at the red dot on the right side of the far right yellow box. The stop for this trade would be 566.74 (the top of the box) and the target would be 557.26. The target was derived by taking the vertical distance of the box, 4.74, and subtracting it from the low of the box, 562.00.

An easy way to remember this strategy is to keep roughly a 1:1 risk/reward ratio. Others use a similar approach but use only half the box height for the stop and target. 3.Inputs

General tab – Displays the name and version of the indicator; use default settings. Inputs tab – Primary indicator settings: o ShowAll – If set to false will only plot the current Darvas Box. o ShowBoxSides – If set to false, boxes will only plot horizontal lines without vertical box sides. o DisplayOffset – Leave set to 5. Alerts tab – Used to set up custom indicator alerts. Style tab – Sets the style, type and weight of the buy and sell signals. Color tab – Sets the color of the buy and sell signals. Scaling tab – N/A; use default settings. Advanced tab – Allows for tick optimization; use default auto-detect setting.