Homework Assignment #2

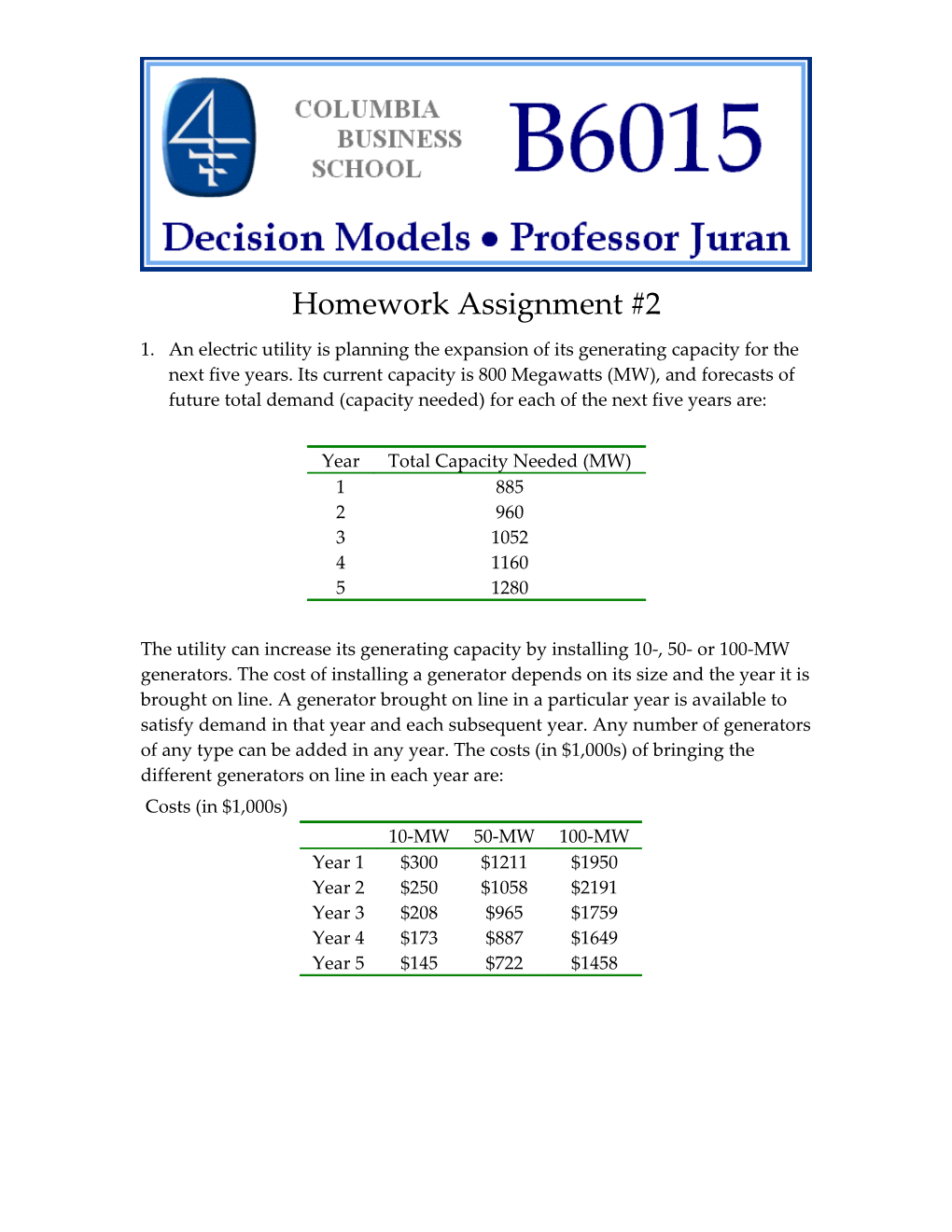

1. An electric utility is planning the expansion of its generating capacity for the next five years. Its current capacity is 800 Megawatts (MW), and forecasts of future total demand (capacity needed) for each of the next five years are:

Year Total Capacity Needed (MW) 1 885 2 960 3 1052 4 1160 5 1280

The utility can increase its generating capacity by installing 10-, 50- or 100-MW generators. The cost of installing a generator depends on its size and the year it is brought on line. A generator brought on line in a particular year is available to satisfy demand in that year and each subsequent year. Any number of generators of any type can be added in any year. The costs (in $1,000s) of bringing the different generators on line in each year are: Costs (in $1,000s) 10-MW 50-MW 100-MW Year 1 $300 $1211 $1950 Year 2 $250 $1058 $2191 Year 3 $208 $965 $1759 Year 4 $173 $887 $1649 Year 5 $145 $722 $1458 a. Formulate an integer (linear) decision model that minimizes the cost of bringing generators on line while satisfying the capacity requirements. What is the optimal plan to expand capacity? What is the total cost? b. Assume now that at most one generator of each type can be brought on line in any one year. What is the cost of satisfying the capacity requirements now? How has the optimal plan changed?

Decision Models 2 Prof. Juran 2. InvestCo, a U.S. fund management firm, wants to use scenario-based portfolio optimization on daily data to construct its short-term equity portfolio. Using the actual returns data on nine stocks over 63 days (in the data file

Decision Models 3 Prof. Juran