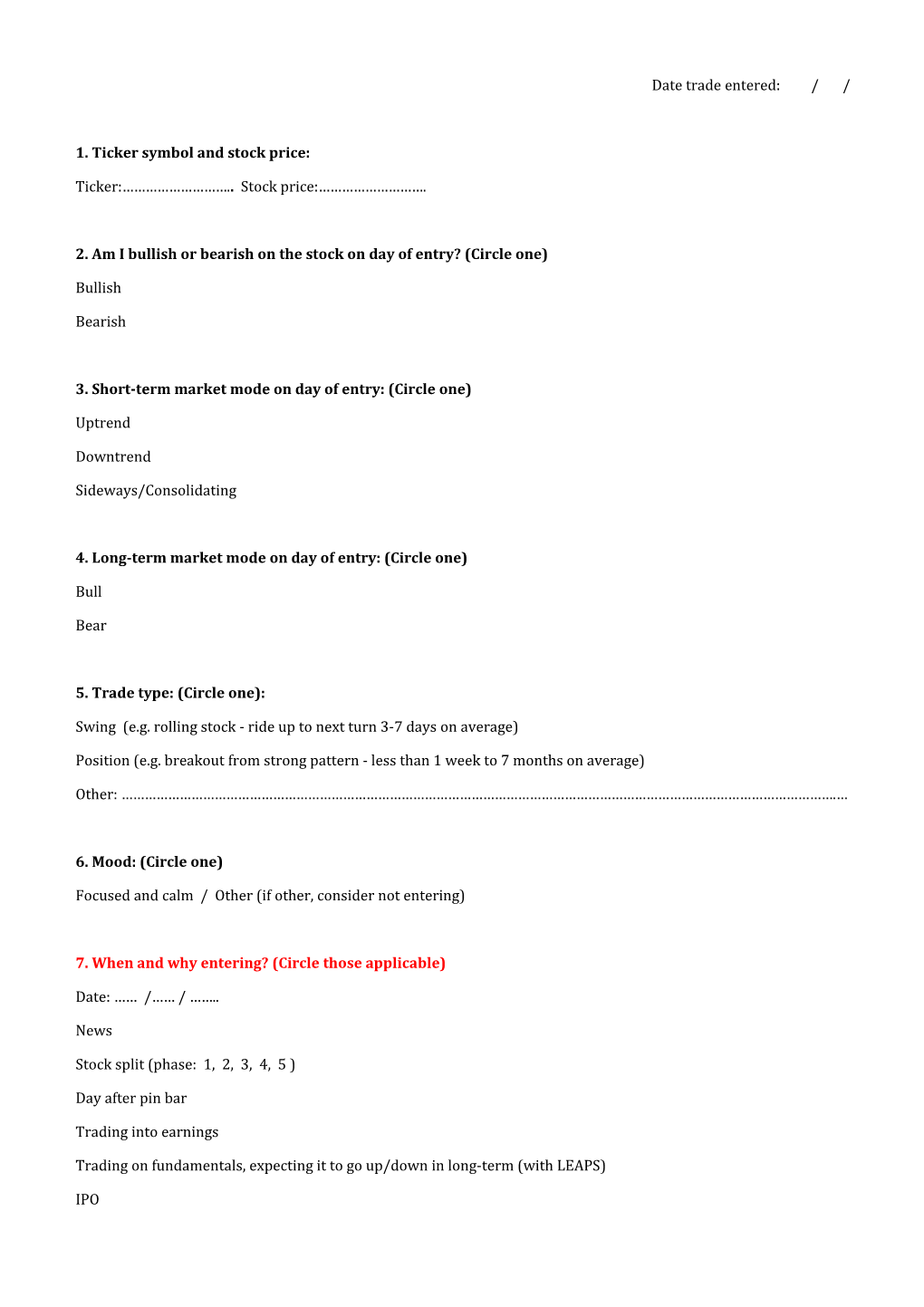

Date trade entered: / /

1. Ticker symbol and stock price:

Ticker:……………………….. Stock price:……………………….

2. Am I bullish or bearish on the stock on day of entry? (Circle one)

Bullish

Bearish

3. Short-term market mode on day of entry: (Circle one)

Uptrend

Downtrend

Sideways/Consolidating

4. Long-term market mode on day of entry: (Circle one)

Bull

Bear

5. Trade type: (Circle one):

Swing (e.g. rolling stock - ride up to next turn 3-7 days on average)

Position (e.g. breakout from strong pattern - less than 1 week to 7 months on average)

Other: ………………………………………………………………………………………………………………………………………………………………….…

6. Mood: (Circle one)

Focused and calm / Other (if other, consider not entering)

7. When and why entering? (Circle those applicable)

Date: …… /…… / ……..

News

Stock split (phase: 1, 2, 3, 4, 5 )

Day after pin bar

Trading into earnings

Trading on fundamentals, expecting it to go up/down in long-term (with LEAPS)

IPO Rolling stock

Breakout from channelling between support and resistance (daily chart)

Breakout from 7+ week cup+handle (daily chart)

Other reason

Detail: ………………………………………………………………………………………………….…………………………………………………………………

………………………………………………………………………………………………………………………. ………………………………………………………

……………………………………………………………………………………………………. …………………………………………………………………………

8. Implied volatility zone: (Circle one)

Green

Amber

9. Implied volatility % BELOW historical volatility (Circle one):

Same as HV

5%

10%

15%

Over 20%

10. 14 day ATR

………………………………..

11. (Plain) Call or Put?: (Circle one)

Call

Put

12. Month of expiration and strike price:

………………………………..

13. Premium price (USD):

……………………………… / ………………………………

14. Number of contracts purchased and total paid (USD): Contracts purchased:……………………………… Total price:……………………………

15. Break-even point (USD):

…………………………….

16. Spread (difference between bid & ask) (USD):

………………………………

17. Opint (min 300) / vol (on day):

Opint……………… Vol ………………

18. Buying or selling volume day before / buying or selling on day of entry:

Vol day before:..……….……..…..… Vol so far on current day:….……..…..……… Institutions buying/selling: …………………….…

19. Average trading volume: (Tick below for over 300k)

…………

20. State the following:

Delta (min 0.70) ……..……. Gamma …..………. Theta …..………. Vega ……….…. Implied volatility % ………... Rho………….

21. What is MACD showing? (Circle one)

Convergence / facing upwards

Divergence / facing downwards

22. Where is the stock in relation to the 50 day MA and 200 day MA?

Above 50

Below 50

Above 200

Below 200

Notes: …………………………………………………………….………………………………………………………………………………………………………

23. Contingent order: (Circle one)

Based on ATR …………......

Based on % ………………… Based on support / resistance ………..……

24. Planned profit amount – pref. 2:1 risk to reward (USD):

………………………….

25. Max. loss (USD):

………………………….

26. When and why exit?

Date: …… /…… /…….

Why? ……………………………………………………………………….……………………………………………………………………………………………..

……………………………………………………………………………………………………. …………………………………………………………………………

……………………………………………………………………………………………………. …………………………………………………………………………

27. Prepared to keep track of news on stock and change contingent order to lock in profit? (Circle one)

Yes / No

28. Attach print-out of chart identifying entry point, break even and planned exit point.

29. Profit / Loss (USD) and what could improve on next time:

Profit/loss: …………………..

Improvements: ………………………………………………………………………………………………………………………………………………………

………………………………………………………………………………………………………………………………… …….……………………….……..………

………………………………………………………………………………………………………………………………… …….……………………….……..………

………………………………………………………………………………………………………………………………… …….……………………….……..…