April 12, 2005, 2005, Res. Asst: Vijeta Sureka,CFA,B.Com Editor: Ian Madsen, MBA, CFA Research Digest [email protected] , Tel: 1-800-767-3771, x 417

www.zackspro.com 155 North Wacker Drive Chicago, IL 60606

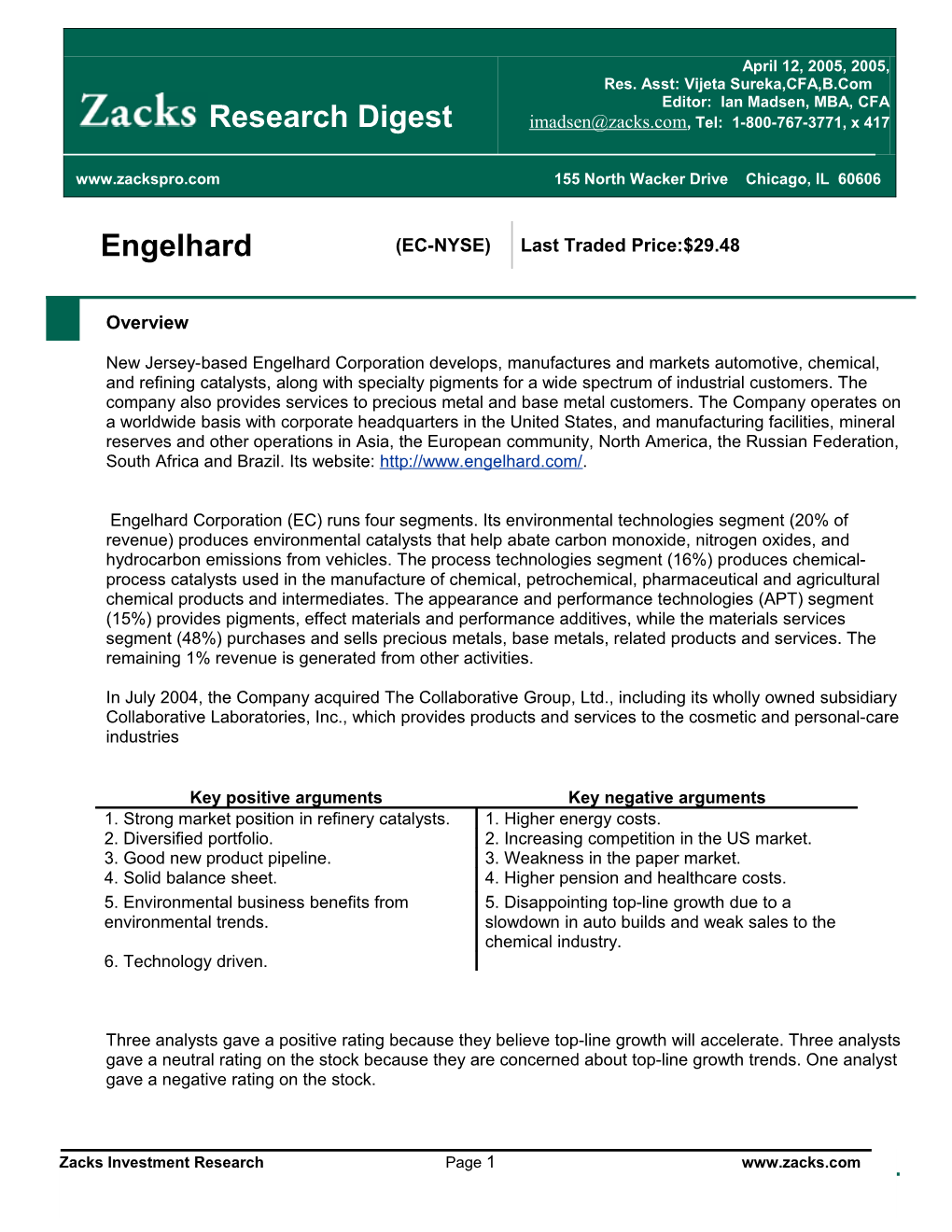

Engelhard (EC-NYSE) Last Traded Price:$29.48

Overview

New Jersey-based Engelhard Corporation develops, manufactures and markets automotive, chemical, and refining catalysts, along with specialty pigments for a wide spectrum of industrial customers. The company also provides services to precious metal and base metal customers. The Company operates on a worldwide basis with corporate headquarters in the United States, and manufacturing facilities, mineral reserves and other operations in Asia, the European community, North America, the Russian Federation, South Africa and Brazil. Its website: http://www.engelhard.com/.

Engelhard Corporation (EC) runs four segments. Its environmental technologies segment (20% of revenue) produces environmental catalysts that help abate carbon monoxide, nitrogen oxides, and hydrocarbon emissions from vehicles. The process technologies segment (16%) produces chemical- process catalysts used in the manufacture of chemical, petrochemical, pharmaceutical and agricultural chemical products and intermediates. The appearance and performance technologies (APT) segment (15%) provides pigments, effect materials and performance additives, while the materials services segment (48%) purchases and sells precious metals, base metals, related products and services. The remaining 1% revenue is generated from other activities.

In July 2004, the Company acquired The Collaborative Group, Ltd., including its wholly owned subsidiary Collaborative Laboratories, Inc., which provides products and services to the cosmetic and personal-care industries

Key positive arguments Key negative arguments 1. Strong market position in refinery catalysts. 1. Higher energy costs. 2. Diversified portfolio. 2. Increasing competition in the US market. 3. Good new product pipeline. 3. Weakness in the paper market. 4. Solid balance sheet. 4. Higher pension and healthcare costs. 5. Environmental business benefits from 5. Disappointing top-line growth due to a environmental trends. slowdown in auto builds and weak sales to the chemical industry. 6. Technology driven.

Three analysts gave a positive rating because they believe top-line growth will accelerate. Three analysts gave a neutral rating on the stock because they are concerned about top-line growth trends. One analyst gave a negative rating on the stock.

Zacks Investment Research Page 1 www.zacks.com

Sales

Detailed summaries of analyst sales, margin and earnings estimates on an annual basis by segment are provided in an accompanying excel spreadsheet.

The following are the digest average projections for total revenues:

(Figures in $Million) Year 2003A 2004A 2005E 2006E Total Revenue $3714 $4166 $4342 $4600

Environmental Technologies Environmental Technologies is growing despite weak auto production and has solid long term trends, which could accelerate with environmental regulations. Nearly all of the pieces of EC’s diesel business are profitable and management anticipates that growth will continue.

(Figures in $Million) Year 2003A 2004A 2005E 2006E Average revenue $831 $899 $856 $924

Material Services

The following are the average revenue estimates:

(Figures in $Million) Year 2003A 2004A 2005E 2006E Average revenue $1608 $1909 $1936 $2091

Process Technologies The following are the average revenue estimates:

Year 2003A 2004A 2005E 2006E Average revenue $569 $615 $641 $698

Appearance & Performance Technologies

Analysts believe that troubles in paper market will continue as EC walks away from low margin business. The following are the average revenue estimates:

Year 2003A 2004A 2005E 2006E Average revenue $654 $690 $717 $775

Margins

Zacks Investment Research Page 2 www.zacks.com Consensus Margins

2003A 2004A 2005E 2006E Gross Margin 17.1% 16.1% Operating Margin 7.6% 6.6% 7.0% 7.3% Net Margin 6.3% 5.7% 5.2% 5.6%

Earnings Per Share

EC reported FY04 EPS of $1.85 that increased by 3.4% compared to $1.79 in FY03.

Analysts’ projected EPS for FY05 ranges from a low of $1.95 (Smith Barney, UBS) to a high of $2.00 (Buckingham, Deutsche Bank and, J P Morgan). The digest average is $1.98. For FY06, analysts’ EPS forecast ranges from a low of $2.15 (J P Morgan, Smith Barney) to a high of $2.27 (CSFB) with the digest average being $2.22.

Annual Estimates Quarterly Estimates 12/2005 12/2006 03/2005 06/2005

Zacks Consensus $1.96 $2.19 $0.43 $0.50

Management guidance ranges from $1.90 to $2.00 for FY05.

Target Price/Valuation

Target prices for EC range from $30 to $35, with an average of $33.17. The analyst with the highest price target (Buckingham, Key Banc) has a positive rating on the stock. The analyst with the lowest price target (UBS) gave a neutral rating on the stock.

Rating Distribution Positive 43% Neutral 43% Negative 14% Avg. Target Price $33.17

Long-Term Growth

Top line growth in the chemical industry is likely to show only slow growth, although it is improving.

Demand is growing, but at a very slow pace. Demand for chemicals tracks industrial production and GDP very closely. Low interest rates engineered by the Federal Reserve should show broad-based improvement in the economy. Federal and State budget deficits are significant, implying the government is stimulating the economy.

Zacks Investment Research Page 3 www.zacks.com Analysts believe EC is well positioned to expand via acquisition with buying power of $1B. Engelhard continues to possess decent long-term earnings growth prospects because of its strong market positions in automobile catalysts, refinery catalysts and its core competence in precious metals management.

Currently 20% of new motorcycles use catalyst technology – a number that EC management expects to double through ’05 and ’06 with new regulations. Additionally, the small engine market (such as yard equipment) now faces emissions regulations in the U.S. that will continue to phase-in through ’07. Management anticipates that small engine emission standards will be finalized in Europe by ’07.

Individual Analyst Opinions

POSITIVE RATINGS

Buckingham – The stock is rated accumulate with a target price of $35. This is 17.5x 2005 EPS. The analyst believes above average valuation is possible as diesel engine regulation deadline nears. EC acquired Colectica, which is a relatively small deal for EC. The analyst expects the deal to be immaterially accretive to EPS and cash flow in one year. The analyst believes that operating margins have returned to nearly 20%, so that the deal is near a mid-teens multiple to trailing EBIT, which appears reasonable in this market.

Deutsche Bank – The stock is rated buy with target price of $34.This is 10x 2005 EV/EBITDA. The analyst expects to see improvement in 2005 and 2006 and so he reiterated his buy rating. EC expects its own business to grow 12%-15%. Key risks include higher natural gas prices, a faltering economic recovery and deterioration in auto catalyst pricing discipline. The analyst expects EC’s earnings to return to double-digit growth rates.

Key Banc – The stock is rated buy (2) with a target price of $35. This is 10x 2005 EV/EBITDA. The analyst opines that EC offers minimal exposure to the petrochemical cycle, attractive returns on capital, strong financial discipline, heightened focus on technology and an accelerating earnings profile. So the analyst maintained his buy rating on the stock. While the overall macro-environment appears mixed, the analyst expects pockets of strength in environmental technologies to overcome a flattish outlook for North American and European automotive builds.

NEUTRAL RATINGS

Smith Barney – The stock is rated hold (2) with a target price of $31. This is an average of P/E multiple and EV/EBITDA. The analyst continues to believe that diversified and specialty chemical companies are gaining pricing power. EC reported a relatively weak fourth quarter in both sales and EPS at a time when diversified and specialty chemical companies are gaining pricing power and reporting improved results. EC’s environmental segment is hindered by the lack of new regulations until 2006 and its process technology segment continues to disappoint despite strong operating rates in the chemical industry.

J.P. Morgan – The stock is rated neutral. The analyst expects improved comparisons in Appearance/Performance in non-paper businesses versus weak comparisons offset by continued weakness in EC’s North American auto-catalyst business. EC could face some headwinds in 2005 stemming from market share losses in paper chemicals, pressures to the environmental catalyst operation, weakness in the material services business, higher healthcare and pension expenses. EC continues to possess decent long-term earnings growth prospects because of its strong market positions in automobile catalysts.

Zacks Investment Research Page 4 www.zacks.com UBS – The stock is rated neutral (1) with a target price of $30. This is 15x 2005 EPS. EC's franchise environmental technologies business should be slower in 2005 on low auto production and reduced demand for bricks. The analyst expects growth to reaccelerate with help from new emission control regulations and late cycle chemical catalyst sales. EC’s risks include delayed cyclical recovery, softness in automotive builds, extended chemical customer downtime, lower metal pricing volatility, and delayed customer compliance with regulatory requirements.

NEGATIVE RATINGS

CSFB – The stock is rated underperform with a target price of $34. This is based on historical average P/E, EV/EBITDA applied to 2005 estimates. EC announced it has an agreement with the majority holders of Coletica to purchase roughly 78% of the company and will tender for the remaining shares shortly. Coletica is a French personal care chemistry/technology company that 1) develops active compounds/ingredients to add to cosmetics to generate certain effects (like anti-wrinkle effects) and 2) uses “encapsulation technology” to create barriers for active compounds in order to prolong the effects. The analyst views the acquisition as a positive step toward reducing the impact of the paper industry on EC’s APT division. The analyst expects that the estimate will see high single digit to low double-digit growth for the foreseeable future.

Zacks Investment Research Page 5 www.zacks.com