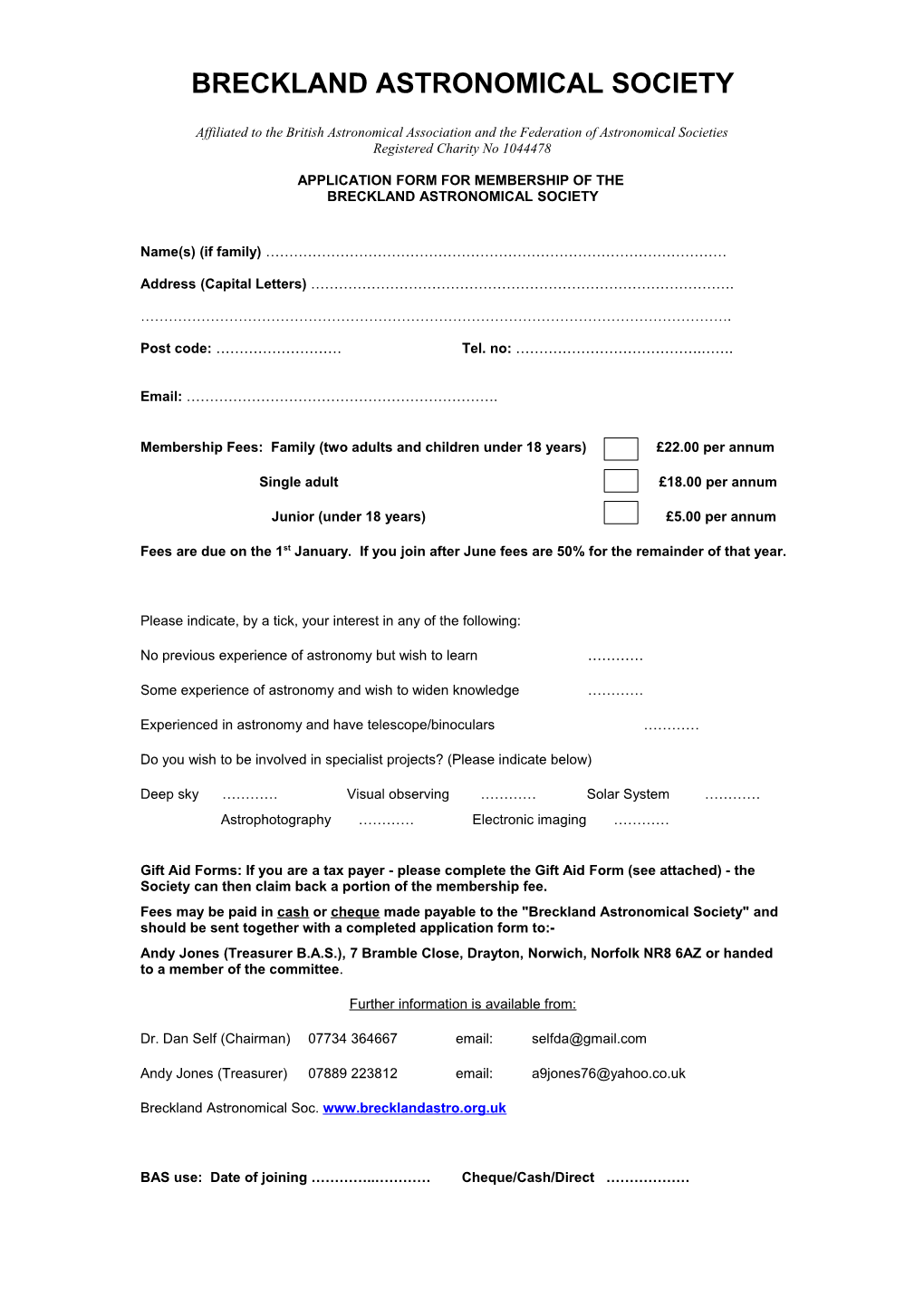

BRECKLAND ASTRONOMICAL SOCIETY

Affiliated to the British Astronomical Association and the Federation of Astronomical Societies Registered Charity No 1044478

APPLICATION FORM FOR MEMBERSHIP OF THE BRECKLAND ASTRONOMICAL SOCIETY

Name(s) (if family) ………………………………………………………………………………………

Address (Capital Letters) ……………………………………………………………………………….

……………………………………………………………………………………………………………….

Post code: ……………………… Tel. no: ………………………………….…….

Email: ………………………………………………………….

Membership Fees: Family (two adults and children under 18 years) £22.00 per annum

Single adult £18.00 per annum

Junior (under 18 years) £5.00 per annum

Fees are due on the 1st January. If you join after June fees are 50% for the remainder of that year.

Please indicate, by a tick, your interest in any of the following:

No previous experience of astronomy but wish to learn …………

Some experience of astronomy and wish to widen knowledge …………

Experienced in astronomy and have telescope/binoculars …………

Do you wish to be involved in specialist projects? (Please indicate below)

Deep sky ………… Visual observing ………… Solar System ………… Astrophotography ………… Electronic imaging …………

Gift Aid Forms: If you are a tax payer - please complete the Gift Aid Form (see attached) - the Society can then claim back a portion of the membership fee. Fees may be paid in cash or cheque made payable to the "Breckland Astronomical Society" and should be sent together with a completed application form to:- Andy Jones (Treasurer B.A.S.), 7 Bramble Close, Drayton, Norwich, Norfolk NR8 6AZ or handed to a member of the committee.

Further information is available from:

Dr. Dan Self (Chairman) 07734 364667 email: [email protected]

Andy Jones (Treasurer) 07889 223812 email: [email protected]

Breckland Astronomical Soc. www.brecklandastro.org.uk

BAS use: Date of joining …………..………… Cheque/Cash/Direct ……………… Gift Aid Declaration

Breckland Astronomical Society Registered Charity 1044478

Title…………..Forename(s) …………………………..Surname……………………

Address……………………………………………………………………………… …

………………………………………………………………………………………… ..

………………………………………………………………………………………… ..

Post Code…………………………..

I want the Charity to treat all donations that I make from the date of this declaration until I notify you otherwise as Gift Aid donations.

You must pay an amount of Income Tax and/or Capital Gains Tax at least equal to the tax that the charity reclaims on your donations in the appropriate tax year. (currently 25p for each £1 you give).

Date ..….../………./………… Signature …………………………………………

Notes

1. You can cancel this Declaration at any time by notifying the charity. 2. If in future your circumstances change and you no longer pay tax on your income and capital gains equal to the tax that the charity claims; you can cancel your declaration. 3. If you pay tax at the higher rate you can claim further tax relief in your Self Assessment tax return. 4. If you are unsure whether your donations qualify for Gift Aid tax relief, ask the charity. Or, refer to help sheet IR65 on the HRMC web site (www.hrmc.gov.uk). Please notify the charity if you change your name or address.