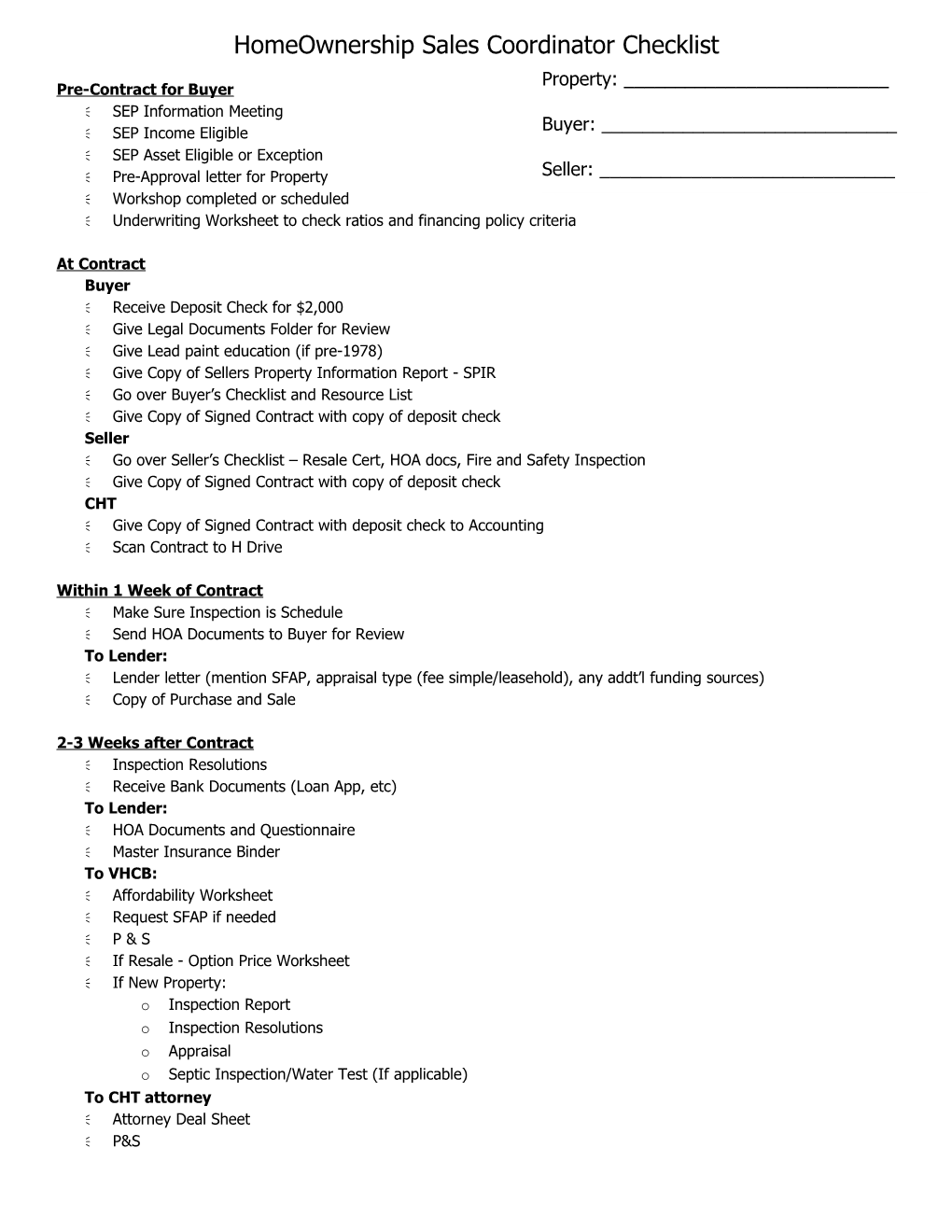

HomeOwnership Sales Coordinator Checklist Property: ______Pre-Contract for Buyer SEP Information Meeting SEP Income Eligible Buyer: ______ SEP Asset Eligible or Exception Pre-Approval letter for Property Seller: ______ Workshop completed or scheduled Underwriting Worksheet to check ratios and financing policy criteria

At Contract Buyer Receive Deposit Check for $2,000 Give Legal Documents Folder for Review Give Lead paint education (if pre-1978) Give Copy of Sellers Property Information Report - SPIR Go over Buyer’s Checklist and Resource List Give Copy of Signed Contract with copy of deposit check Seller Go over Seller’s Checklist – Resale Cert, HOA docs, Fire and Safety Inspection Give Copy of Signed Contract with copy of deposit check CHT Give Copy of Signed Contract with deposit check to Accounting Scan Contract to H Drive

Within 1 Week of Contract Make Sure Inspection is Schedule Send HOA Documents to Buyer for Review To Lender: Lender letter (mention SFAP, appraisal type (fee simple/leasehold), any addt’l funding sources) Copy of Purchase and Sale

2-3 Weeks after Contract Inspection Resolutions Receive Bank Documents (Loan App, etc) To Lender: HOA Documents and Questionnaire Master Insurance Binder To VHCB: Affordability Worksheet Request SFAP if needed P & S If Resale - Option Price Worksheet If New Property: o Inspection Report o Inspection Resolutions o Appraisal o Septic Inspection/Water Test (If applicable) To CHT attorney Attorney Deal Sheet P&S To Buyer’s and Seller’s Attorney Attorney Deal Sheet P&S Any Other Funding Sources If VHFA Funds (second mortgage) in deal, Homeownership Specialist, Diane Edson at VHFA contacted Burlington HOME Funds

4-5 Weeks after Contract Check on Inspection Resolutions Fire and Safety Inspection Finalized – Send to CHT’s Attorney Appraisal received – Send to VHCB if new property Start Coordinating Closing Date (Lender, All Attorneys)

1 Week before Closing Send Lender Appraisal Info to CHT Attorney Insurance Binder Received from Buyer Legal Docs Meeting with Buyer Resale certificate in hand – Update if needed Check requisition Checks needed:______ Does seller owe any delinquent membership fees:______Any Delinquent Taxes:______ Does CHT attorney have payoff, appraisal reimbursement info, overdue membership, prorations, escrow info, any unusual details? Schedule Walk through Date:______ Legal docs from Other Funders (VHFA, HOME Funds, Etc) Closing Date:______Time:______Place:______Settlement Agent:______ Informed of closing date: CHT Atty buyer lender buyer’s atty seller seller’s atty Escrow for repairs? Escrow Holder:______

Day Before Closing Final Walk Through - Remove Lock Box Check HUDs Check in with Buyer – bring bank check Check in with Seller – especially if have to bring money Get Bank Check from Merchants – if CHT is bringing money to closing

During Closing Buyer Bag Given Exit Interview from Sellers

Post Closing Notes in CMax To Accounting: Checks Closing Recap Both HUDs Housing Subsidy Covenant/Declaration of Covenant Copy of Checks Property File: Closing Recap Both HUDs Copy of Checks Give file to AmeriCorps for Post Closing