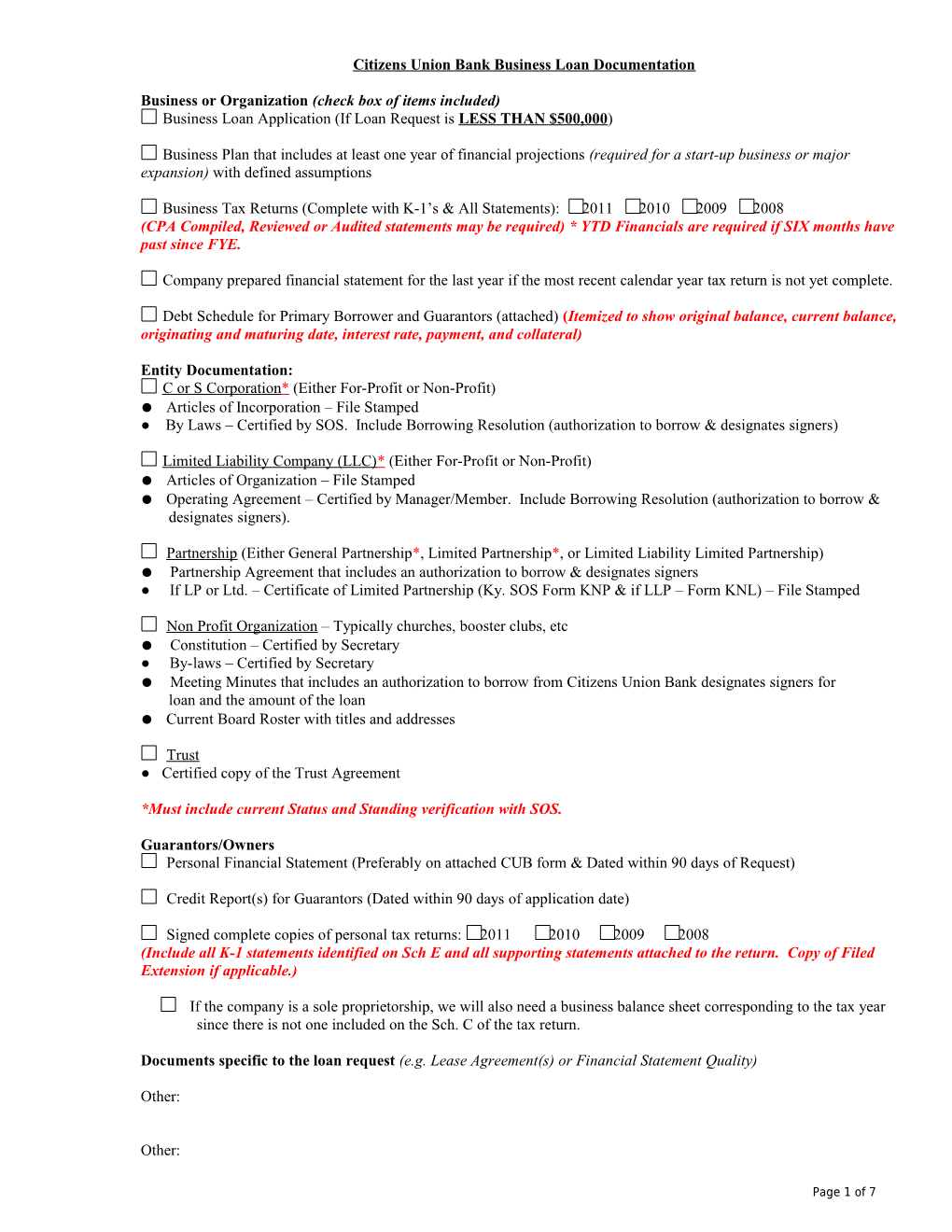

Citizens Union Bank Business Loan Documentation

Business or Organization (check box of items included) Business Loan Application (If Loan Request is LESS THAN $500,000)

Business Plan that includes at least one year of financial projections (required for a start-up business or major expansion) with defined assumptions

Business Tax Returns (Complete with K-1’s & All Statements): 2011 2010 2009 2008 (CPA Compiled, Reviewed or Audited statements may be required) * YTD Financials are required if SIX months have past since FYE.

Company prepared financial statement for the last year if the most recent calendar year tax return is not yet complete.

Debt Schedule for Primary Borrower and Guarantors (attached) (Itemized to show original balance, current balance, originating and maturing date, interest rate, payment, and collateral)

Entity Documentation: C or S Corporation * (Either For-Profit or Non-Profit) ● Articles of Incorporation – File Stamped ● By Laws – Certified by SOS. Include Borrowing Resolution (authorization to borrow & designates signers)

Limited Liability Company (LLC) * (Either For-Profit or Non-Profit) ● Articles of Organization – File Stamped ● Operating Agreement – Certified by Manager/Member. Include Borrowing Resolution (authorization to borrow & designates signers).

Partnership (Either General Partnership*, Limited Partnership*, or Limited Liability Limited Partnership) ● Partnership Agreement that includes an authorization to borrow & designates signers ● If LP or Ltd. – Certificate of Limited Partnership (Ky. SOS Form KNP & if LLP – Form KNL) – File Stamped

Non Profit Organization – Typically churches, booster clubs, etc ● Constitution – Certified by Secretary ● By-laws – Certified by Secretary ● Meeting Minutes that includes an authorization to borrow from Citizens Union Bank designates signers for loan and the amount of the loan ● Current Board Roster with titles and addresses

Trust ● Certified copy of the Trust Agreement

*Must include current Status and Standing verification with SOS.

Guarantors/Owners Personal Financial Statement (Preferably on attached CUB form & Dated within 90 days of Request)

Credit Report(s) for Guarantors (Dated within 90 days of application date)

Signed complete copies of personal tax returns: 2011 2010 2009 2008 (Include all K-1 statements identified on Sch E and all supporting statements attached to the return. Copy of Filed Extension if applicable.)

If the company is a sole proprietorship, we will also need a business balance sheet corresponding to the tax year since there is not one included on the Sch. C of the tax return.

Documents specific to the loan request (e.g. Lease Agreement(s) or Financial Statement Quality)

Other:

Other:

Page 1 of 7 CITIZENS UNION BANK BUSINESS LOAN APPLICATION for CREDIT REQUEST LESS THAN $500,000 LOAN REQUEST Amount Requested: Loan Purpose/Use of Funds: Credit Request: Applicant Only Term Requested: Joint w/ Co-Applicant Primary Source of Repayment: Secondary Source of Repayment:

BUSINESS/BORROWER INFORMATION Borrower/Organization: Individual(s) Sole Proprietorship Limited Liability Company (LLC) Sub S Corporation

General Partnership Limited Liability Partnership (LLP) Corporation Other Legal Name(s): Tax ID#/SSN (for all applicants):

Current Address: City: State: Zip Code:

Borrower/Business Telephone: Business Website: Business/Borrower Email Address:

Business Description:

MANAGEMENT/OWNERSHIP (All Owners MAY be required to guaranty) Name Title Salary Ownership % Guaranteeing? (Yes or No)

SIGNATURES of BORROWER(S)/AUTHORIZED AGENT The Undersigned certifies that all statements in this Application and on each document required to be submitted in connection herewith, including federal income tax returns, are true, correct and complete. The undersigned authorizes Citizens Union Bank (Lender) to make such inquiries and gather such information as they deem necessary and reasonable concerning any information provided to them on this application or on any such required document, including inquiries to the Internal Revenue Service, and any local Credit Bureau Reporting Agencies. The undersigned further agrees to notify the Lender promptly of any material change in any such information.

Signature: Title: Date:

Signature: Title: Date:

CREDIT DENIAL NOTICE: If your gross revenues were $1,000,000 or less in your previous fiscal year, or you are requesting trade credit, a factoring agreement and if your application for business credit is denied, you have the right to a written statement of the specific reasons for the denial. To obtain the statement please contact Citizens Union Bank, P.O. Box 189, Shelbyville, KY 40066 within 60 days from the date you are notified of our decision. We will send you a written statement of reasons for the denial within 30 days of receiving your request for the statement.

Page 2 of 7 BUSINESS DEBT SCHEDULE

Include the following information on all installment debts, notes, contracts, and mortgages. Current balance SHOULD match the current Balance Sheet. Include all capital leases shown on the Balance Sheet (if any). Do not include accounts receivable and accounts payable.

Business Name: As of

Original Original Current Interest Maturity Monthly Name of Creditor Collateral Covenants Amount Date Balance Rate Date Payment

Total Total Current 0 Monthly 0 Balance Payment

Signature: Title: Date:

Page 3 of 7 PERSONAL FINANCIAL STATEMENT AS OF

PERSONAL INFORMATION APPLICANT (NAME) CO-APPLICANT (NAME)

Employer Employer

Address of Employer Address of Employer

No. of Years No. of Years Business Phone Business Phone No. with Title/Position Salary with Title/Position Salary No. Employer Employer

Home Address Home Address

Email Address Email Address

Home Phone No. Social Security No. Date of Birth Home Phone No. Social Security No. Date of Birth

Accountant and Phone # Accountant and Phone #

Attorney and Phone # Attorney and Phone #

Investment Advisor/Broker and Phone # Investment Advisor/Broker and Phone #

Insurance Advisor and Phone # Insurance Advisor and Phone #

Marital Status: Single: Married: Divorced: Widowed: Marital Status: Single: Married: Divorced: Widowed:

ASSETS AMOUNT ($) LIABILITIES AMOUNT ($) Cash in CUB Notes Payable to this Bank

(including money market accounts, CDs) Secured Cash in Other Financial Institutions (List) Unsecured

Notes Payable to others (Schedule E)

Readily Marketable Securities (Schedule A) Secured Non-Readily Marketable Securities (Schedule A) Unsecured Accounts and Notes Receivable Accounts Payable (Including credit cards) Cash Surrender Value of Life Insurance (Schedule B) Margin Accounts Residential Real Estate (Schedule C) Notes Due: Partnership (Schedule D) Real Estate Investments (Schedule C) Taxes Payable Partnerships/PC Interests/S Corporations (Schedule D) Mortgage Debt (Schedule C) IRA, Keogh, Profit-Sharing & Other Vested Retirement Life Insurance Loans (Schedule B) Accts. Deferred Income number of years deferred: Other Liabilities (List): Personal Property (including automobiles) Sole Proprietorship Assets: Accounts Receivable Inventory Fixed Assets Other Assets (List):

TOTAL ASSETS $0.00 TOTAL LIABILITIES $0.00 NET WORTH $0.00

CONTINGENT LIABILITIES YES NO AMOUNT Are you a guarantor, co-maker, or endorser for any debt of an individual, corporation or partnership? Do you have any outstanding letters of credit or surety bonds? Are there or any suits or legal actions pending against you? Are you contingently liable on any lease or contract? Page 4 of 7 Are any of your tax obligations past due? Are you obligated to pay alimony and/or child support? What would be your total estimated tax liability if you were to sell your major assets? If yes for any of the above, give details:

Schedule A – All Securities (including Non-Money Market Mutual Funds) No. of Shares PLEDGED (Stock) or CURRENT MARKET YE Face Value DESCRIPTION OWNER(S) WHERE HELD COST VALUE NO S (Bonds) READILY MARKETABLE SECURITIES (INCLUDING U.S. GOVERNMENTS AND MUNICIPALS)*

NON-READILY MARKETABLE SECURITIES (CLOSELY HELD, THINLY TRADED, OR RESTRICTED STOCK)

* If not enough space, attach a separate schedule or brokerage statement and enter totals only. Schedule B—Insurance Life Insurance (use additional sheets if necessary) Face Amount Cash Surrender Amount Insurance Company Type of Policy Beneficiary Ownership of Policy Value Borrowed

Disability Insurance Applicant Co-Applicant Monthly Distribution if Disabled Number of Years Covered

Schedule C—Personal Residence & Real Estate Investments, Mortgage Debt (majority ownership only) Personal Residence Purchase Present Loan Market Loan Interest Maturity Monthly Property Address Legal Owner Year Price Balance Rate Date Payment Lender

Investment Present Loan Purchase Market Loan Interest Maturity Monthly Property Address Legal Owner Year Price Value Balance Rate Date Payment Lender

Schedule D—Partnerships and S Corporations (less than majority ownership for real estate partnerships)* Date of Balance Due on Current Year Type of Investment Initial Cost % Owned Current Market Value Partnerships: Notes, Investments Investment Cash Call Business/Professional (indicate name)

Investments (including tax shelters)

Page 5 of 7

*Note: For investments, which represent a material portion of your total assets, please include the relevant financial statements or tax returns, or in the case of partnership investments or S-Corporations, schedule K-1’s. Schedule E—Notes Payable Secured Interest Unpaid Due To Type of Facility Amount of Line Collateral Maturity Yes No Rate Balance

Please Answer the Following Questions: YES NO 1. Income Tax returns filed through (date): Are any returns currently being audited or contested? If so, what year? 2. Have (either of) you or any firm in which you were a major owner ever declared bankruptcy? If Yes, please provide details: 3. Have you ever drawn a will If Yes, please furnish the name of the executor(s) and year will was drawn: 4. Number of dependents (excluding self) and relationship to applicant: 5. Do you live in a community property state? 6. Have you ever had a financial plan prepared for you? 7. Did you include two years federal and state tax returns? 8. Do (either of) you have a line of credit or unused credit facility at any other institution?

If so, please indicate where, how much and name of banker:

9. Do you have ownership of an LLC, trust or other assets protection device? 10. Do you anticipate any substantial inheritances? If yes, please explain: Representations and Warranties - The information contained in this statement is provided to induce you to extend or to continue the extension of credit to the undersigned or to others upon the guarantee of the undersigned. The undersigned acknowledge and understand that you are relying on the information provided herein in deciding to grant or continue credit or to accept a guarantee thereof. Each of the undersigned represents, warrants and certifies that the information provided herein is true, correct and complete. Each of the undersigned agrees to notify you immediately and in writing of any change in name, address, or employment and of any material adverse change (1) in any of the information contained in this statement or (2) in the financial condition of any of the undersigned or (3) in the ability of any of the undersigned to perform its (or their) obligations to you. In the absence of such notice or a new and full written statement, this should- be considered as a continuing statement and substantially correct. If the undersigned fail to notify you as required above, or if any of the information herein should prove to be inaccurate or incomplete in any material respect, you may declare the indebtedness of the undersigned or the indebtedness guaranteed by the undersigned, as the case may be, immediately due and payable. You are authorized to make all inquiries you deem necessary to verify the accuracy of the information contained herein and to determine the creditworthiness of the undersigned. The undersigned authorize any person or consumer reporting agency to give you any information it may have on the undersigned. Each of the undersigned authorizes you to answer questions about your credit experience with the undersigned. As long as any obligation or guarantee of the undersigned to you is outstanding, the undersigned shall supply annually an updated financial statement. This personal financial statement and any other financial or other information that the undersigned give you shall be your property.

______Your Signature Date

______Co-Applicant’s Signature (if you are requesting the financial Date accommodation jointly)

Financial Statement Addendum

A. Are any of the Assets listed on the Financial Statement dated , 20 titled in the name of another person, in a trust, 401(k), IRA or other retirement account, corporation, partnership or limited liability company (LLC)? Page 6 of 7 YES NO, if YES please list these assets and the name of the person or entity that holds title:

1) Name of Person of Entity: Assets held:

2) Name of Person or Entity: Assets held:

3) Name of Person or Entity: Assets held:

B. Are any of the assets listed on the Financial Statement dated , 20 , held joint with survivorship?

YES NO, if YES please list the assets and the name of the joint owner:

1) Name of Joint Owner: Assets held:

2) Name of Joint Owner: Assets held:

3) Name of Joint Owner: Assets held:

I hereby certify under penalty of perjury that the answers and information provided above are true and accurate.

______Signature Date

______Print Name Date

Page 7 of 7