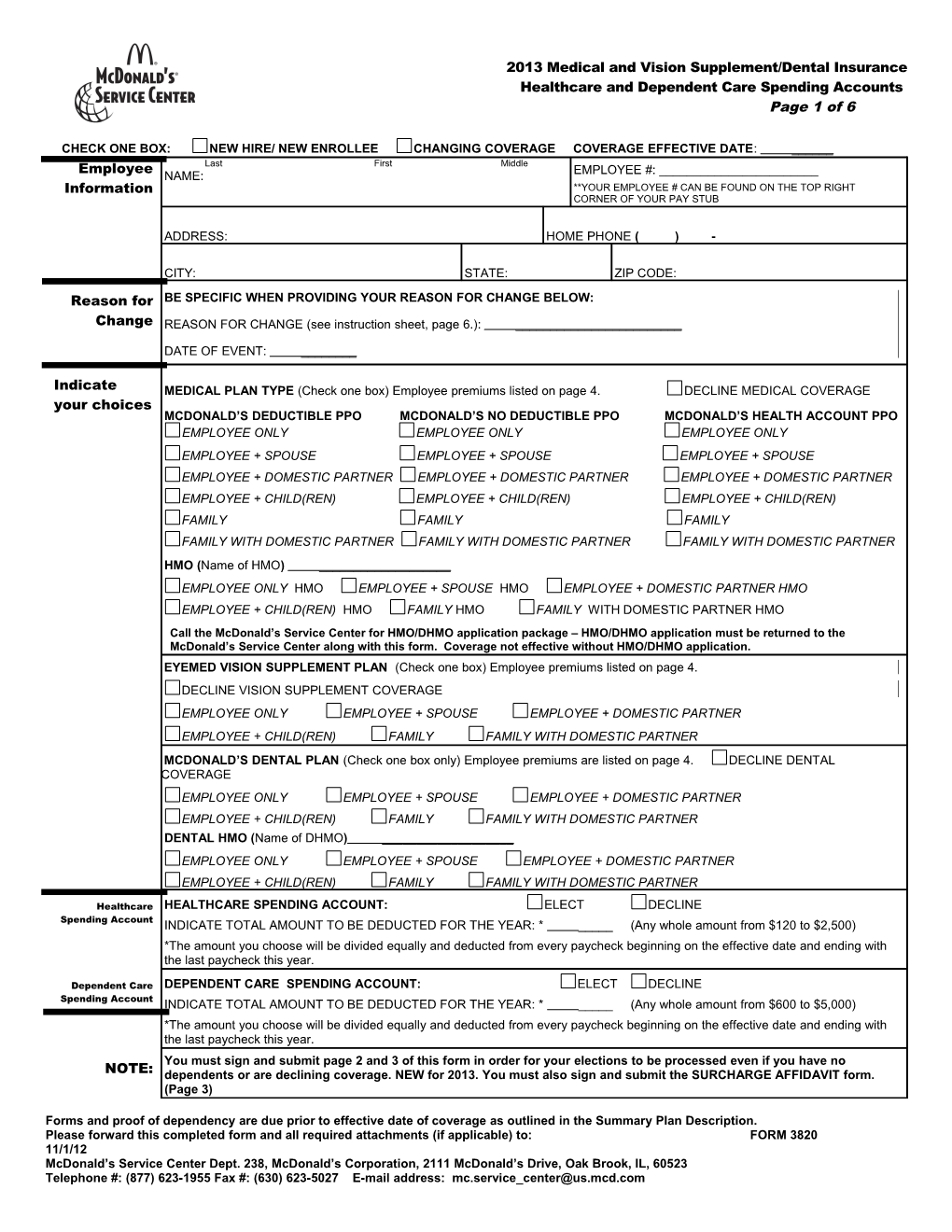

2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 1 of 6

CHECK ONE BOX: NEW HIRE/ NEW ENROLLEE CHANGING COVERAGE COVERAGE EFFECTIVE DATE: ______Last First Middle Employee NAME: EMPLOYEE #: ______ Information **YOUR EMPLOYEE # CAN BE FOUND ON THE TOP RIGHT CORNER OF YOUR PAY STUB

ADDRESS: HOME PHONE ( ) -

CITY: STATE: ZIP CODE:

Reason for BE SPECIFIC WHEN PROVIDING YOUR REASON FOR CHANGE BELOW: Change REASON FOR CHANGE (see instruction sheet, page 6.): ______

DATE OF EVENT: ______

Indicate MEDICAL PLAN TYPE (Check one box) Employee premiums listed on page 4. DECLINE MEDICAL COVERAGE your choices MCDONALD’S DEDUCTIBLE PPO MCDONALD’S NO DEDUCTIBLE PPO MCDONALD’S HEALTH ACCOUNT PPO EMPLOYEE ONLY EMPLOYEE ONLY EMPLOYEE ONLY EMPLOYEE + SPOUSE EMPLOYEE + SPOUSE EMPLOYEE + SPOUSE EMPLOYEE + DOMESTIC PARTNER EMPLOYEE + DOMESTIC PARTNER EMPLOYEE + DOMESTIC PARTNER EMPLOYEE + CHILD(REN) EMPLOYEE + CHILD(REN) EMPLOYEE + CHILD(REN) FAMILY FAMILY FAMILY FAMILY WITH DOMESTIC PARTNER FAMILY WITH DOMESTIC PARTNER FAMILY WITH DOMESTIC PARTNER HMO (Name of HMO) ______EMPLOYEE ONLY HMO EMPLOYEE + SPOUSE HMO EMPLOYEE + DOMESTIC PARTNER HMO EMPLOYEE + CHILD(REN) HMO FAMILY HMO FAMILY WITH DOMESTIC PARTNER HMO Call the McDonald’s Service Center for HMO/DHMO application package – HMO/DHMO application must be returned to the McDonald’s Service Center along with this form. Coverage not effective without HMO/DHMO application. EYEMED VISION SUPPLEMENT PLAN (Check one box) Employee premiums listed on page 4. DECLINE VISION SUPPLEMENT COVERAGE EMPLOYEE ONLY EMPLOYEE + SPOUSE EMPLOYEE + DOMESTIC PARTNER EMPLOYEE + CHILD(REN) FAMILY FAMILY WITH DOMESTIC PARTNER MCDONALD’S DENTAL PLAN (Check one box only) Employee premiums are listed on page 4. DECLINE DENTAL COVERAGE EMPLOYEE ONLY EMPLOYEE + SPOUSE EMPLOYEE + DOMESTIC PARTNER EMPLOYEE + CHILD(REN) FAMILY FAMILY WITH DOMESTIC PARTNER DENTAL HMO (Name of DHMO) ______EMPLOYEE ONLY EMPLOYEE + SPOUSE EMPLOYEE + DOMESTIC PARTNER EMPLOYEE + CHILD(REN) FAMILY FAMILY WITH DOMESTIC PARTNER

Healthcare HEALTHCARE SPENDING ACCOUNT: ELECT DECLINE Spending Account INDICATE TOTAL AMOUNT TO BE DEDUCTED FOR THE YEAR: * _____ (Any whole amount from $120 to $2,500) *The amount you choose will be divided equally and deducted from every paycheck beginning on the effective date and ending with the last paycheck this year.

Dependent Care DEPENDENT CARE SPENDING ACCOUNT: ELECT DECLINE Spending Account INDICATE TOTAL AMOUNT TO BE DEDUCTED FOR THE YEAR: * _____ (Any whole amount from $600 to $5,000) *The amount you choose will be divided equally and deducted from every paycheck beginning on the effective date and ending with the last paycheck this year. You must sign and submit page 2 and 3 of this form in order for your elections to be processed even if you have no NOTE: dependents or are declining coverage. NEW for 2013. You must also sign and submit the SURCHARGE AFFIDAVIT form. (Page 3)

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected] 2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 2 of 6

Documents Documentation is required when adding or removing all dependents. A complete list of Required acceptable documents is included on page 5.

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected] 2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 3 of 6

Last First Middle EMPLOYEE #: ______ Employee NAME: Information YOUR EMPLOYEE # CAN BE FOUND ON THE TOP RIGHT CORNER OF YOUR PAY STUB Please indicate: If child age 26 or Dependent Yes or No older: Information SPOUSE, DOMESTIC Handicapped? DEPENDENT NAME SOCIAL SECURITY DATE OF BIRTH for Medical PARTNER* MALE OR Please indicate: Y and Vision Last name, first name middle initial NUMBER mm/dd/yyyy OR CHILD FEMALE Dental Vision Medical or No Supplement/ Dental Plan

Dependents Your eligible Dependents under the McDonald’s Plans (HMO/DHMO eligibility may differ) are: Your Spouse or Domestic Partner* (with completed Affidavit of Domestic Partnership/Dependent Tax Certification (form 3838), after meeting domestic partner eligibility criteria). Do not list Domestic Partners as Spouses. Fiancées are not eligible. Children: Your child under age 26 (older if handicapped and dependent on you for support) who is your natural child, adopted child, step child, foster child, or a child for whom you are the legal guardian. Children or dependents, such as grandchildren or parents, should not be listed even if they are your IRS dependents, except in the case of children for whom you are the legal guardian. These same rules apply for the child(ren) of your spouse or domestic partner.* * If you are adding a domestic partner, complete the Affidavit for Domestic Partnership / Dependent Tax Certification to (a) ensure coverage for your partner, and (b) certify any of your family members (domestic partner and /or domestic partner’s eligible children) who are your dependents for federal income tax purposes. The Affidavit is available online through the annual enrollment web site or from the Service Center by calling (877) 623-1955.

Please read . If electing an HMO/Dental HMO (DHMO), in addition to this form, you must fill out an HMO/DHMO enrollment form, which can the be obtained from the McDonald’s Service Center and must be returned to the McDonald’s Service Center. You will not be following covered without submitting both the HMO/DHMO form and this form to the McDonald’s Service Center. before you . A qualifying life event change allows you to request a change in your Medical and Vision Supplement/Dental coverage category (i.e., employee + spouse, family) and McDonald’s Medical Plan option or your Healthcare Spending Account or Dependent Care sign the Spending Account within 60 days (31 days for HMO/DHMO plans) of the event. If you do not submit a change by that date you form will have to wait until the next annual enrollment period to do it. I have reviewed the above insurance, Healthcare Spending Account and Dependent Care Spending Account elections. Where I have Signature not made an election or selected “Decline Coverage”, I have rejected coverage. I have until prior to the first day of the month that coverage could begin to make this election. After that date I understand that I will not be able to change the coverage elected or to enroll for any coverage until McDonald’s next annual enrollment period or within 60 days (31 days for HMO/DHMO plans) of a qualifying life event. At that time acceptance of the requested insurance change may depend on approval based on acceptance by an HMO/DHMO. If applicable, I certify that this request is consistent with my life event change. I understand that I am responsible for paying each premium for the group insurance or HMO/DHMO coverage I elect. I elect to pay my premiums and Healthcare/Dependent Care salary reductions by payroll deductions under the McDonald’s Premium Payment Plan, the McDonald’s Healthcare Spending Account and the McDonald’s Day Care Spending Account, for coverage that I elect. Failure to do so may result in termination of my coverage. I understand that, unless I change my election for a future year or because of a life event change, my group insurance election on this form will remain in effect from year to year at the employee premium amounts announced by McDonald’s in the future; and that my Healthcare Spending Account salary reduction election under the McDonald’s Healthcare and Dependent Care salary reduction election under the McDonald’s Dependent Care Spending Account will remain in effect from year to year at the amount I have requested. I understand that Healthcare and Dependent Care Spending Account balances remaining after all eligible expenses for the calendar year, including the grace period, have been reimbursed will be forfeited to the Plans. I certify that I will only submit eligible medical/dental/vision expenses to the Healthcare Spending Account and eligible Dependent Care expenses to the Dependent Care Spending Account and that I will not have those expenses reimbursed from any other source.

EMPLOYEE SIGNATURE: DATE:

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected] 2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 4 of 6

SURCHARGE AFFIDAVITS for Annual enrollment IF YOU WORK IN HAWAII, UNDER HAWAII LAW THE SURCHARGES DO NOT APPLY TO YOU AND YOU DO NOT NEED TO COMPLETE THIS AFFADAVIT. Last First Middle Employe EMPLOYEE #: ______ e NAME: **YOUR EMPLOYEE # CAN BE FOUND ON THE TOP RIGHT CORNER OF YOUR PAY STUB Information

Tobacco use Complete only if ee elects medical coverage

TOBACCO USE AFFIDAVIT

Beginning in 2013, a tobacco use surcharge is being added to the medical premium for tobacco users. Complete the affidavit below to certify whether or not the surcharge should apply to you. IF YOU DO NOT COMPLETE THE AFFIDAVIT AND FINISH YOUR ANNUAL ENROLLMENT, YOU WILL AUTOMATICALLY PAY THE SURCHARGE if you’re enrolled in a McDonald’s medical plan for 2013. You will not be able to change this surcharge until annual enrollment for 2014.

Remember, use of a tobacco product means any use (even one time) of a tobacco product, including cigarettes, chewing tobacco, cigars, pipes or any other product that contains tobacco.

---- CERTIFICATION ------By checking a box below, I agree that the statement I check is true and accurate to the best of my knowledge. I understand that if I am being purposefully dishonest, I could be subject to one or more of the following actions: I may be required to pay the surcharge for any months of the year that I didn’t pay it; my coverage may be terminated back to January 1, and I may be required to pay back all amounts that were paid from the medical plan on my behalf; and I may be subject to disciplinary action up to and including termination of my employment.

I certify … r I and all of my covered dependents have not used any tobacco products during the past 90 days or more, or have completed the medical plan’s smoking cessation program since August 1, 2012. (Surcharge does not apply.)

OR r I or at least one of my covered dependents have used a tobacco product within the past 90 days and have not completed the medical plan’s smoking cessation program since August 1, 2012. (Surcharge applies.)

Spouse coverage Complete only if medical coverage category is ee+ spouse or DP, or family with spouse or DP r Click here if you are not covering a SP or DP

AFFIDAVIT REGARDING SPOUSE ACCESS TO OTHER COVERAGE

Beginning in 2013, a spousal surcharge is being added to the medical plan premium for employees whose covered spouse or domestic partner also has access to comprehensive medical coverage through his or her employer (other than McDonald’s). IF YOU DO NOT COMPLETE THE AFFIDAVIT AND FINISH YOUR ANNUAL ENROLLMENT, YOU WILL AUTOMATICALLY PAY THE SURCHARGE if you cover a spouse or domestic partner on your McDonald’s medical plan for 2013.Remember, comprehensive coverage means the insurance covers a wide variety of health care services (including doctor visits, hospital stays, surgery and rehabilitation) and has no lifetime dollar benefit limit, and has an annual dollar benefit limit of $2 million or more. Limited benefit plans and Medicare are not considered comprehensive coverage.

---- CERTIFICATION ------By checking a box below, I agree that the statement I check is true and accurate to the best of my knowledge. I understand that if I am being purposefully dishonest, I could be subject to one or more of the following actions: I may be required to pay the surcharge for any months of the year that I didn’t pay it; my coverage may be terminated back to January 1, and I may be required to pay back all amounts that were paid from the medical plan on my behalf; and I may be subject to disciplinary action up to and including termination of my employment.

I certify … r My covered spouse or domestic partner does not have access to comprehensive medical coverage through his or her employer (or he/she is a McDonald’s staff or McOpCo restaurant employee). (No surcharge.) OR r My covered spouse or domestic partner has access to comprehensive medical coverage through his or her employer (other than McDonald’s). (Surcharge applies.)

Surcharge Add from Mailer What’s the extra cost? The add-on premium cost is the same for tobacco use and spouse/domestic partner coverage. If both add-ons apply to you (you and/or a covered family member use tobacco and you cover a spouse/domestic partner who has access to another employer’s coverage), then the extra cost you pay each month is two times the number below.

For 2013, the surcharge for McDonalds PPOs and HMOs is: $33 per month for Restaurant employees and Staff in the Associate and Coordination bands $45 per month for Staff above the Coordination band $58 per month for Officers

Take note: The add-on cost is only applied once for tobacco use, regardless of how many family members use tobacco. Annual Premium Rates

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected] 2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 5 of 6

The premium rates shown in this chart are annual pre-tax* amounts. To determine the amount deducted from each pay check, divide the annual amount by 24 if you are paid semi-monthly, by 26 if you are paid bi-weekly or by 52 if you are paid weekly. If you are covering a domestic partner refer to the note below.

Restaurant – Certified Swing, Primary Maintenance, Massachusetts Core Hourly and Salaried Restaurant Management Full time Staff – Home Office and Regional Associate and Coordination Bands Part time Staff – Home Office and Regional Associate and Coordination Bands (working at least 20 hours per week) MCDONALD’S MCDONALD’S MCDONALD’S EYEMED DEDUCTIBLE NO DEDUCTIBLE HEALTH ACCOUNT VISION MCDONALD’S PPO PPO PPO SUPPLEMENT DENTAL EMPLOYEE ONLY $ 743.04 $1,077.36 $ 807.96 $ 63.96 $117.84 EMPLOYEE + SPOUSE OR DOMESTIC PARTNER* $1,560.60 $2,262.36 $ 1,696.92 $128.16 $247.56 EMPLOYEE + CHILD(REN) $1,411.92 $2,046.84 $ 1,535.16 $115.32 $223.92 FAMILY OR FAMILY WITH DOMESTIC PARTNER* $2,229.32 $3,231.96 $ 2,424.00 $176.16 $353.64 Call McDonald’s Service Center for HMO/DHMO rates. Full time Staff – Home Office and Regional Specialist, Supervisor, Manager, and Director Bands Part time Staff – Home Office and Regional Specialist, Supervisor, Manager, and Director Bands (working at least 20 hours per week) MCDONALD’S MCDONALD’S MCDONALD’S EYEMED DEDUCTIBLE NO DEDUCTIBLE HEALTH ACCOUNT VISION MCDONALD’S PPO PPO PPO SUPPLEMENT DENTAL EMPLOYEE ONLY $1,003.32 $1,454.28 $1,090.68 $ 63.96 $117.84 EMPLOYEE + SPOUSE OR DOMESTIC PARTNER* $2,106.84 $3,054.00 $2,290.68 $128.16 $247.56 EMPLOYEE + CHILD(REN) $1,906.08 $2,763.24 $2,072.28 $115.32 $223.92 FAMILY OR FAMILY WITH DOMESTIC PARTNER* $3,009.72 $4,362.96 $3,272.52 $176.16 $353.64 Call McDonald’s Service Center for HMO/DHMO rates. Full time Officers – Home Office and Regional Part time Officers – Home Office and Regional (working at least 20 hours per week) MCDONALD’S MCDONALD’S MCDONALD’S EYEMED DEDUCTIBLE NO DEDUCTIBLE HEALTH ACCOUNT VISION MCDONALD’S PPO PPO PPO SUPPLEMENT DENTAL EMPLOYEE ONLY $1,300.56 $1,885.20 $1,410.96 $ 63.96 $117.84 EMPLOYEE + SPOUSE OR DOMESTIC PARTNER* $2,730.96 $3,959.04 $2,963.16 $128.16 $247.56 EMPLOYEE + CHILD(REN) $2,470.92 $3,582.00 $2,680.92 $115.32 $223.92 FAMILY OR FAMILY WITH DOMESTIC PARTNER* $3,901.56 $5,655.72 $4,233.12 $176.16 $353.64 Call McDonald’s Service Center for HMO/DHMO rates.

* Note: If you cover a domestic partner, the portion of your premium for your partner and any children is deducted from your pay after taxes, and you pay taxes on the value of the company’s contribution for their coverage. However, if you complete an Affidavit of Domestic Partnership/Dependent Tax Certification form to certify the family members that qualify as your dependents for federal income tax purposes, your premiums for the coverage of those family members will be taken pre-tax, and the company-paid portion of their coverage will not be treated as taxable income to you.

NOTE: Refer to page 3 for additional Surcharge costs that may apply.

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected] 2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 6 of 6

NOTE: DOCUMENTATION MUST INCLUDE EMPLOYEE’S NAME AND RELATIONSHIP TO DEPENDENT NOTE: If required documentation is not provided, coverage will terminate, but premium amount will remain the same until you make changes at the next annual enrollment or next life event, whichever is earlier. If your dependents are dropped due to non-certification, they will not be eligible for COBRA benefits.

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected] 2013 Medical and Vision Supplement/Dental Insurance Healthcare and Dependent Care Spending Accounts Page 7 of 6

Reason for Change Instruction Sheet

To make an insurance change based on a qualifying life event, you must notify the McDonald’s Service Center by completing the attached election form within 60 days (31 days for HMO/DHMOs plans) of your qualifying life event date. If it is past that date, changes cannot be processed.

Note: Because pre-tax dollars are used for Plan contributions, the IRS requires that changes in elections for these Life Event contributions be made only on an annual basis (effective January 1st) unless you have one of the following qualifying life Changes event changes: Marriage, divorce, or annulment.* (Submit first and last page of divorce decree along with this application.) Applies to all Plans. Death of Spouse or Dependent.* Applies to all Plans. Birth, adoption, or placement for adoption of a Dependent.* Applies to all Plans. Beginning or termination of employment for you, your spouse or your Dependent.* Applies to all Plans. Change in employment-related eligibility for the Plan or another health or Healthcare/Dependent Care Spending Account Plan by you, your spouse or Dependent.* Applies to all Plans. Change in eligibility status of your spouse or your Dependent under the Plan or another health or Healthcare/Dependent Care Spending Account Plan.* Applies to all Plans. Beginning or returning from an unpaid leave of absence by you, your spouse or Dependent (subject to the “Unpaid Leave" rules).* Applies to all Plans. Strike or lockout involving you, your spouse or your Dependent.* Applies to all Plans. You, your spouse or your Dependent becomes entitled to Medicare, Medicaid or the Child Health Insurance Program (CHIP). Applies to Health Plans and Healthcare Spending Account Plan. Your Dependent’s coverage under a Qualified Medical Child Support Order. Applies to Health Plans and Healthcare Spending Account. Loss of coverage under another health plan that qualifies you or your Dependents for special enrollment under the Plan or another health plan. Applies to Health Plans only. Certain significant increases or decreases in cost of a health, vision supplement or dental option under the Plan, as determined by the Plan Administrator. Applies to Health Plans only. Significant decrease in coverage provided under a health, vision supplement or dental option under the Plan, as determined by the Plan Administrator. Applies to Health Plans only. Your change in residence due to a job transfer that is at least 30 miles from your previous job location, if the change in location causes you to lose coverage under an HMO under the Plan. Applies to Health Plans only. Change in election under your spouse’s or Dependent’s medical, dental or vision supplement or Dependent Care Spending Account Plan if that change is allowed under the IRS rules or that plan has a different enrollment period and the change in election under this Plan is consistent with and corresponds to the change in election under the other plan. Applies to Health Plans and Dependent Care Spending Account Plan. Change in Dependent Care provider or rate changed by Dependent Care provider. Applies to Dependent Care Spending Account Plan only. *Your change of election must be consistent with the life event change. Changes marked by an * are allowed only if the life event change causes you, your spouse, or Dependent to lose or gain eligibility for coverage under the Plan or another health, healthcare spending account or dependent care spending account plan, as applicable. The life event changes also apply to your domestic partner, but only for the medical, vision supplement and dental plans.

When New Hires/Newly Benefit Eligible Employee’s: Your Employee coverage starts on the first day of the month following the end of your waiting period (refer to Summary Plan Coverage Description), assuming you have enrolled for that coverage prior to that date. Begins Enrolled Dependents: The date you become covered, or The first day of the following month, unless you enroll the Dependent on the first day of the month in which you acquire the Dependent. Special Enrollment Period: (Must elect coverage within 60 days (31 days for HMO/DHMOs plans) of a special event; refer to Summary Plan Description. As a general rule: coverage begins the first of the month following the event except: For marriage, not later than the first day of the month following the event or For a dependent’s birth, as of the date of birth; or For adoption or placement for adoption, the date of the adoption or placement for adoption. When Premiums Due: “premium payments” are due the first day of the month in which you elect to begin coverage even though “coverage” will only begin on the exact date of the event (i.e. marriage date, date of birth, or adoption placement.)

Forms and proof of dependency are due prior to effective date of coverage as outlined in the Summary Plan Description. Please forward this completed form and all required attachments (if applicable) to: FORM 3820 11/1/12 McDonald’s Service Center Dept. 238, McDonald’s Corporation, 2111 McDonald’s Drive, Oak Brook, IL, 60523 Telephone #: (877) 623-1955 Fax #: (630) 623-5027 E-mail address: [email protected]