SEATTLE UNIVERSITY PROF. KEN SHAH FINC 580

EVIDENCE ON MERGERS AND ACQUISITIONS

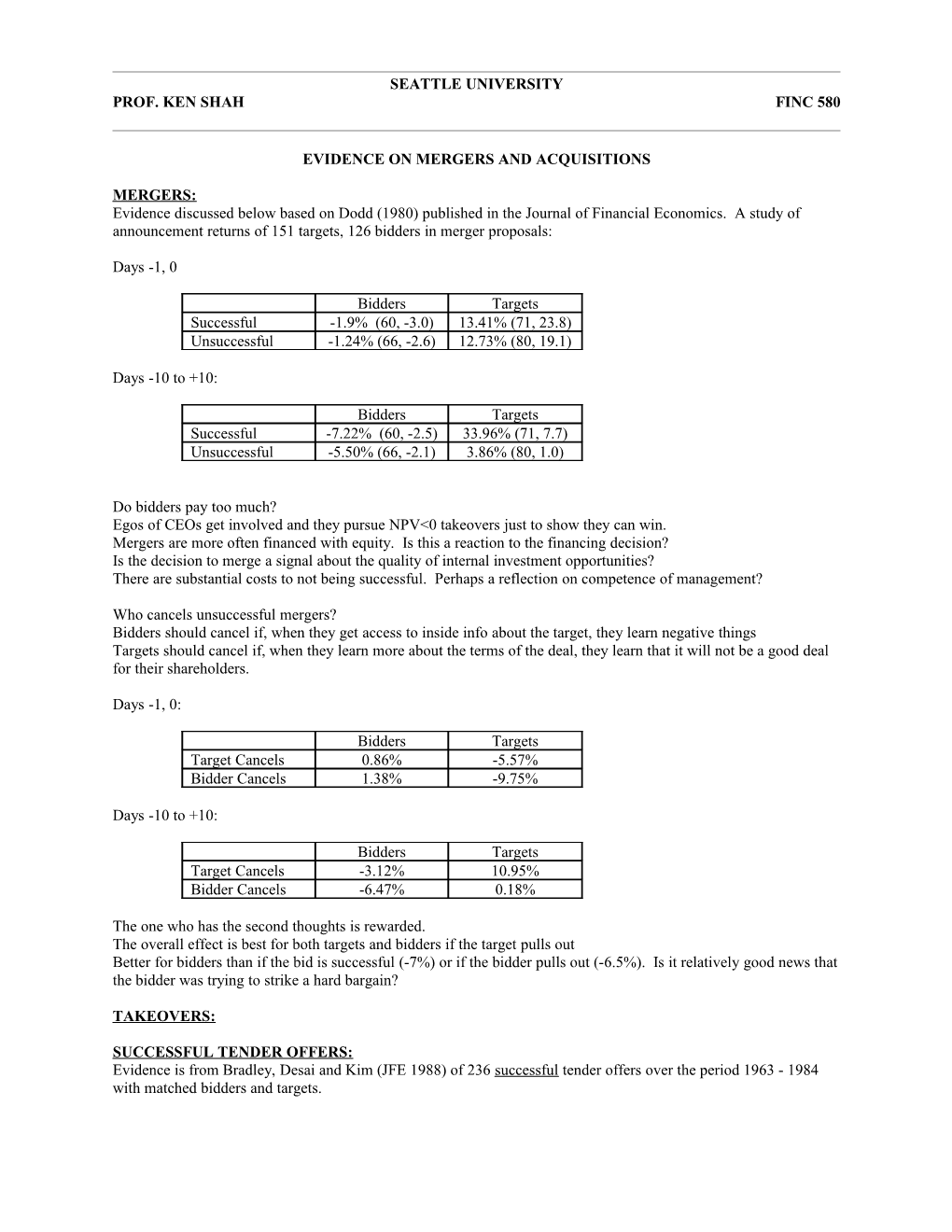

MERGERS: Evidence discussed below based on Dodd (1980) published in the Journal of Financial Economics. A study of announcement returns of 151 targets, 126 bidders in merger proposals:

Days -1, 0

Bidders Targets Successful -1.9% (60, -3.0) 13.41% (71, 23.8) Unsuccessful -1.24% (66, -2.6) 12.73% (80, 19.1)

Days -10 to +10:

Bidders Targets Successful -7.22% (60, -2.5) 33.96% (71, 7.7) Unsuccessful -5.50% (66, -2.1) 3.86% (80, 1.0)

Do bidders pay too much? Egos of CEOs get involved and they pursue NPV<0 takeovers just to show they can win. Mergers are more often financed with equity. Is this a reaction to the financing decision? Is the decision to merge a signal about the quality of internal investment opportunities? There are substantial costs to not being successful. Perhaps a reflection on competence of management?

Who cancels unsuccessful mergers? Bidders should cancel if, when they get access to inside info about the target, they learn negative things Targets should cancel if, when they learn more about the terms of the deal, they learn that it will not be a good deal for their shareholders.

Days -1, 0:

Bidders Targets Target Cancels 0.86% -5.57% Bidder Cancels 1.38% -9.75%

Days -10 to +10:

Bidders Targets Target Cancels -3.12% 10.95% Bidder Cancels -6.47% 0.18%

The one who has the second thoughts is rewarded. The overall effect is best for both targets and bidders if the target pulls out Better for bidders than if the bid is successful (-7%) or if the bidder pulls out (-6.5%). Is it relatively good news that the bidder was trying to strike a hard bargain?

TAKEOVERS:

SUCCESSFUL TENDER OFFERS: Evidence is from Bradley, Desai and Kim (JFE 1988) of 236 successful tender offers over the period 1963 - 1984 with matched bidders and targets. Announcement effects: (3-day)

Bidders Targets Total Sample 0.00% 21.6% Single Bidder 0.65% 22.0% Multiple Bidders -1.45% 20.8%

Total weath effects (5-days before first offer to 5-days after last offer by winning bidder)

Bidders Targets Total* 7/1963 - 12/1984 1.0% 31.8% 7.4% *percent change in combined value of target and bidder

Total wealth effects to winning bidder (5-day before first offer to 5-days after last offer by winning bidder)

Single Bidder Multiple Bidders Total 7/1963 - 12/1984 2.0% -1.3% 1.0%

Unsuccessful Tender offers: Management has no veto power. Must convince shareholders not to tender. Bidder management has stronger commitment. It is hard, but not impossible to cancel a tender offer before it expires. Don't usually get access to inside info duing hostile tender offer Would lose credibility with financing sources, investment bankers, arbitrageurs if frequently cancels bids.

UNSUCCESSFUL TENDER OFFERS:

Evidence is from Bradley, Desai & Kim (JFE, 1983): 353 targets: 241 bids successful, 112 unsuccessful; 94 bidders who were unsuccessful. Period is 1980-83.

Abnormal returns to target stock from one month before announcement to month K:

Period Total Subsequently Subsequently NOT Taken Over Taken Over -1, +1 40.2% 46.3% 20.2% -1, +12 42.2 56.9 7.0 -1, +24 40.9 60.2 1.9

Cumulative abnormal returns to bidder stock from month before announcement (-20 days) to day K:

Period Total Subsequently Subsequently NOT Taken Over Taken Over -20, +1 2.3% 1.9% 3.4% -20, +140 -5.9 -7.9 0.7

SUMMARY: Market reacts negatively to bidder in mergers, not in tender offers. Bidder is defined as the company that is offering a premium for other company's stock. At the initial announcement of merger, it is hard to tell which deals will be successful. Unsuccessful tender offers have lower announcement returns. Tender offers that are followed by other bids have higher announcement returns. Market can tell which are likely to succeed. Targets that are not taken over within 5 years lose all of the tender offer premium. Bidders for those firms also lose value. Reflects on competence of management? Multiple bidder auctions lead to higher target returns and negative bidder returns. You don't want to be a 'white knight'. For example, DuPont in Conoco takeover. SEATTLE UNIVERSITY PROF. KEN SHAH FINC 541 SPRING 1998

NOTES ON MERGERS AND ACQUISITIONS

Basic Facts: Mergers are generally friendly. They require the approval of both managements/boards before shareholder vote. Mergers are often done in an exchange of securities using common stock of bidding firm. They are not taxable events for the target shareholders, unless they sell the bidder's stock.

Tender offers are generally unfriendly. Target management is by-passed by asking shareholders to sell their stock directly. Tender offers are often done with cash (or new debt securities). They are taxable events for target shareholders. Strong incentives to complete them quickly to reduce the chance of a competing offer.

Why are premiums smaller in mergers? Taxes. Larger premium in tender offers account for larger tax liability. Could be that some of the 'cost' of the bid is used to buy off target management (to get them to cooperate).

Why are premiums smaller for bidders in mergers? Could be that bidders know that tender offers are more expensive: a higher premium is required; increasing chance of competition; more lawyer/banker fees; hence only persue deals that have large potential gains.

Where do the gains come from? Horizontal mergers: Firms producing similar products in similar markets (same industry). Monopoly pricing, reducing competition: demand curve for product less elastic; more monopoly profits. Antitrust Division of Justice Dept. worry about horizontal mergers.

Vertical Mergers: Upstream firm buys a downstream firm (or vice versa). If one firm has a monopoly, the merged firm cannot charge monopoly prices at both levels. There could be efficiency gains from internal rather than external contracting. However, there could be transfer pricing problem within the merged firm.

Conglomerate Mergers: Firms in totally different industries. Perhaps there are efficiencies in management or some centralized service. This argument is doubtful today - may have been more important when centralized information systems first were introduced in 1960's.

Diversification Gains from mergers: Stockholders do not benefit because they can do it on their own account, and avoid paying a premium. Also, they have greater leeway in investment proportions. Management apparently benefit from reduced volatility of earnings, and prestige related to size.

Gains must come from internal as against external contracting. DuPont wanted Conoco for access to petroleum as inputs to production process. Couldn't it simply sign a long-term supply arrangement? Tax credits and offsetting losses: only possible with merger. Patents, distribution networks, brand name acquisition. Assumes that patents and distribution networks cannot be bought or brand name will extend to other products. E.g. Kodak with Verbatim floppies or batteries.

SUMMARY: Gains come from efficiency (good) or monopoly (bad). However, management shouldn't care where the gains come from unless antitrust problems increase. Diversificatin should not increase firm value