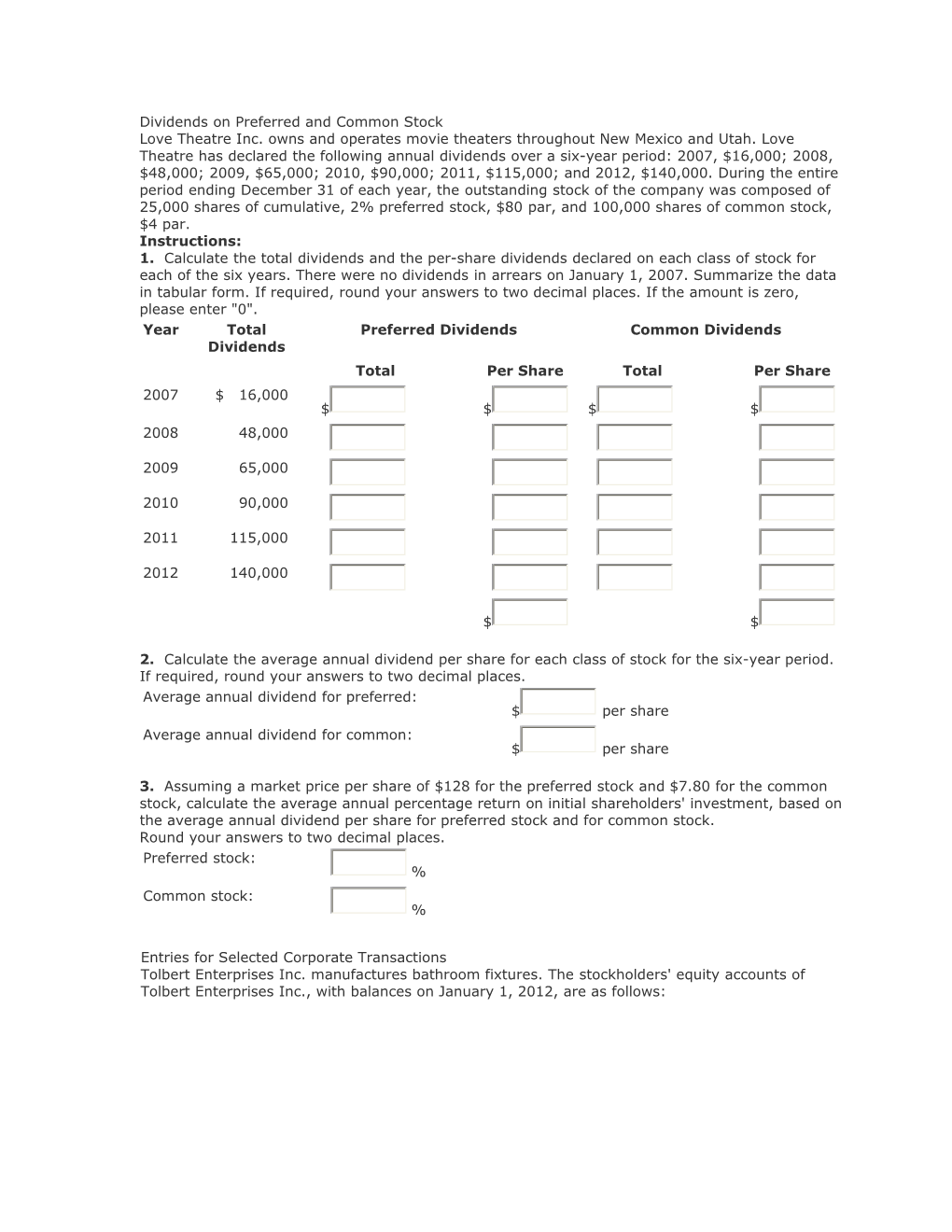

Dividends on Preferred and Common Stock Love Theatre Inc. owns and operates movie theaters throughout New Mexico and Utah. Love Theatre has declared the following annual dividends over a six-year period: 2007, $16,000; 2008, $48,000; 2009, $65,000; 2010, $90,000; 2011, $115,000; and 2012, $140,000. During the entire period ending December 31 of each year, the outstanding stock of the company was composed of 25,000 shares of cumulative, 2% preferred stock, $80 par, and 100,000 shares of common stock, $4 par. Instructions: 1. Calculate the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears on January 1, 2007. Summarize the data in tabular form. If required, round your answers to two decimal places. If the amount is zero, please enter "0". Year Total Preferred Dividends Common Dividends Dividends Total Per Share Total Per Share 2007 $ 16,000 $ $ $ $ 2008 48,000

2009 65,000

2010 90,000

2011 115,000

2012 140,000

$ $

2. Calculate the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to two decimal places. Average annual dividend for preferred: $ per share Average annual dividend for common: $ per share

3. Assuming a market price per share of $128 for the preferred stock and $7.80 for the common stock, calculate the average annual percentage return on initial shareholders' investment, based on the average annual dividend per share for preferred stock and for common stock. Round your answers to two decimal places. Preferred stock: % Common stock: %

Entries for Selected Corporate Transactions Tolbert Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Tolbert Enterprises Inc., with balances on January 1, 2012, are as follows: The following selected transactions occurred during the year:

1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T accounts and provide the December 31 balance where appropriate.

Common Stock Jan. 1 Bal. 4,000,000 Select

Select

Dec. 31 Bal.

Paid-In Capital in Excess of Stated Value Jan. 1 Bal. 750,000 Select

Select

Dec. 31 Bal.

Retained Earnings Select Jan. 1 Bal. 9,150,000

Select

Dec. 31 Bal. Treasury Stock Jan. 1 Bal. 600,000 Select

Select

Dec. 31 Bal.

Paid-In Capital from Sale of Treasury Stock Select

Stock Dividends Distributable Select Select

Stock Dividends Select Select

Cash Dividends Select Select

2. Journalize the entries to record the transactions. If an amount box does not require an entry, leave it blank or enter ("0"). Jan. 4. Paid cash dividends of $0.13 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $46,800.

Date Account Debit Credit

Jan. 4 Select

Select

Apr. 3. Issued 75,000 shares of common stock for $1,200,000.

Date Account Debit Credit

Apr. Select 3

Select

Select

June 6. Sold all of the treasury stock for $725,000.

Date Account Debit Credit

June Select 6 Select

Select

July 1. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share.

Date Account Debit Credit

July Select 1

Select

Select

Aug. 15. Issued the certificates for the dividend declared on July 1.

Date Account Debit Credit

Aug. 15 Select

Select

Nov. 10. Purchased 25,000 shares of treasury stock for $500,000.

Date Account Debit Credit

Nov. Select 10

Select

Dec. 27. Declared a $0.16-per-share dividend on common stock.

Date Account Debit Credit

Dec. 27 Select

Select

Dec. 31. Closed the credit balance of the income summary account, $950,000.

Date Account Debit Credit

Dec. Select 31

Select

Dec. 31. Closed the two dividends accounts to Retained Earnings.

Date Account Debit Credit

Dec. 31 Select Select

Select

3. Prepare a retained earnings statement for the year ended December 31, 2012.

Tolbert Enterprises Inc. Retained Earnings Statement For the Year Ended December 31, 2012 Select

Select

Select

Select

Select

Select

4. Prepare the Stockholders' Equity section of the December 31, 2012, balance sheet.

Stockholders' Equity Paid-in-capital: Select

Select

Select Total paid-in capital

Select Total

Select Total stockholders' equity

Problem 12-1A Effect of Financing on Earnings per Share Three different plans for financing a $200,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income.

1. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $30,000,000. Enter answers in dollars and cents, rounding to the nearest whole cent. Earnings per share on common stock Plan 1 $ Plan 2 $ Plan 3 $ 2. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $16,000,000. Enter answers in dollars and cents, rounding to the nearest whole cent. Earnings per share on common stock Plan 1 $ Plan 2 $ Plan 3 $ 3. Discuss the advantages and disadvantages of each plan. The input in the box below will not be graded, but may be reviewed and considered by your instructor.

Problem 12-2A Bond Discount, Entries for Bonds Payable Transactions On July 1, 2012, Bliss Industries Inc. issued $24,000,000 of 20-year, 11% bonds at a market (effective) interest rate of 14%, receiving cash of $19,200,577. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required:

Hide 1. Journalize the entry to record the amount of cash proceeds from the sale of the bonds. For a compound transaction, if an amount box does not require an entry, leave it blank.

Hide 2. Journalize the entries to record the following: (For a compound transaction, if an amount box does not require an entry, leave it blank.) a. The first semiannual interest payment on December 31, 2012, and the amortization of the bond discount, using the straight-line method. (Round to the nearest dollar.)

Hide b. The interest payment on June 30, 2013, and the amortization of the bond discount, using the straight-line method. (Round to the nearest dollar.)

3. Determine the total interest expense for 2012.

$ 4. Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? Select 5. Compute the price of $19,200,577 received for the bonds by using the tables of present value in Appendix A. (Round to the nearest dollar.) Your total may vary slightly from the price given due to rounding differences. Present value of the face amount $ Present value of the semi-annual interest payments $ Price received for the bonds $ Problem 12-3A Bond Premium, Entries for Bonds Payable Transactions Fabulator, Inc. produces and sells fashion clothing. On July 1, 2012, Fabulator, Inc. issued $120,000,000 of 20-year, 14% bonds at a market (effective) interest rate of 11%, receiving cash of $148,882,608. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: For all journal entries with a compound transaction, if an amount box does not require an entry, leave it blank.

Hide 1. Journalize the entry to record the amount of cash proceeds from the sale of the bonds.

Hide 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2012, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.)

Hide b. The interest payment on June 30, 2013, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.)

3. Determine the total interest expense for 2012.

$ 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? Select 5. Compute the price of $148,882,608 received for the bonds by using the tables of present value in Appendix A. (Round to the nearest dollar.) Your total may vary slightly from the price given due to rounding differences. Present value of the face amount $ Present value of the semi-annual interest payments $ Price received for the bonds $ Problem 14-2A Statement of Cash Flows—Indirect Method The comparative balance sheet of Hinson Enterprises, Inc. at December 31, 2013 and 2012, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 2013 are as follows: a. Net income, $220,500. b. Depreciation reported on the income statement, $72,975. c. Equipment was purchased at a cost of $142,450, and fully depreciated equipment costing $39,200 was discarded, with no salvage realized. d. The mortgage note payable was not due until 2014, but the terms permitted earlier payment without penalty. e. 7,000 shares of common stock were issued at $35 for cash. f. Cash dividends declared and paid, $134,400. Instructions: Hide Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. If needed, use the minus sign to indicate cash outflows, negative amounts or a decrease in cash.

Hinson Enterprises, Inc. Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities:

$

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activities $

Cash flows from investing activities:

$

Net cash flow used for investing activities

Cash flows from financing activities:

$

$

Net cash flow used in financing activities

$

Cash at beginning of the year

Cash at end of the year $

Problem 15-1A Horizontal Analysis for Income Statement For 2012, Eurie Company reported its most significant decline in net income in years. At the end of the year, H. Finn, the president, is presented with the following condensed comparative income statement:

Instructions:

Hide 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 2011 as the base year. If required, round to one decimal place.

Eurie Company Comparative Income Statement For the Years Ended December 31, 2012 and 2011 2012 2011 Difference - Amount Difference - Percent Sales $928,000 $800,000 $ %

Sales returns and allowances 70,000 50,000

Net sales $858,000 $750,000 $

Cost of goods sold 640,000 500,000

Gross profit $218,000 $250,000 $

Selling expenses $85,800 $65,000 $

Administrative expenses 43,400 35,000

Total operating expenses $129,200 $100,000 $

Income from operations $88,800 $150,000 $

Other income 16,000 10,000

Income before income tax $104,800 $160,000 $

Income tax expense 9,200 8,000

Net income $95,600 $152,000 $ %

2. To the extent the data permit, comment on the significant relationships revealed by the horizontal analysis prepared in (1). The input in the box below will not be graded, but may be reviewed and considered by your instructor.

Problem 15-3A Effect of Transactions on Current Position Analysis Data pertaining to the current position of Brin Company are as follows:

Instructions: 1. Compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. Round ratios to one decimal place. a. Working capital: $ b. Current ratio: c. Quick ratio:

2. Compute the working capital, the current ratio, and the quick ratio after each of the following transactions, and record the results in the appropriate columns. Consider each transaction separately and assume that only that transaction affects the data given above. Round ratios to one decimal place. Transaction Working Capital Current Ratio a. Sold temporary investments at no gain or loss, $90,000. $ b. Paid accounts payable, $175,000. $ c. Purchased goods on account, $125,000. $ d. Paid notes payable, $200,000. $ e. Declared a cash dividend, $160,000. $ f. Declared a common stock dividend on common stock, $45,000. $ g. Borrowed cash from bank on a long-term note, $300,000. $ h. Received cash on account, $140,000. $ i. Issued additional shares of stock for cash, $700,000. $ j. Paid cash for prepaid expenses, $80,000. $