NIFTY Midcap Liquid 15 Index Is Designed to Provide Investors Exposure to the Liquid Midcap Stocks While Making the Index Easily Replicable and Tradable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Page Industries Sector: Apparels /Mid-Cap

Page Industries Sector: Apparels /Mid-Cap Earnings Update – 4QFY13 May 31, 2013 Sensex Nifty Price: INR 4256 Target Price: INR 3878 MARKETPERFORMER 19,760 5,986 Background : Page Industries is the exclusive licensee of Jockey International Inc (USA) to manufacture and distribute Jockey brand in India, Sri Lanka, Nepal, Bangladesh and UAE till 2030. They broadly operate in premium men’s innerwear; women’s innerwear and leisure wear segments. Jockey enjoys high brand recall and they spend ~5% of their annual sales for brand building and promotional activity, which enables them to dominate most of the segments in which they operate. In the men’s and women’s segment, they have a market share of ~21% and ~12% respectively. They are also exclusive licensee of Speedo swimwear brand in India. Page has network of 450 distributors and ~23,000 retail outlets in India. They compete with major brands like Crusoe, Hanes, Lovable and Enamor. 52 Week High/Low INR 4,440/2,776 Strong numbers Bloomberg / Reuters PAG IN/PAGE.BO Revenue up by 35. 5% YoY and -3.3% QoQ at INR 2,090.6 mn Equity (shares in mn) 11.15 Volumes grew by 16% YoY and blended realization grew by 18.2% YoY Mkt. Cap in mn INR 47,820/ $ 846.2 EBITDA at INR 367.3mn up 51.9% YoY; PAT grew by 38.4% YoY to INR 236mn Avg. Daily Vol. (‘000) 6. 01 EBITDA Margin stood at 17.6% in 4QFY13 Avg. Daily Vol. (mn) INR 25 .8 /$ 0.46 Company announced final dividend of INR 14 per share (FY13) and an interim dividend of INR 14 Shareholding Mar 12 Dec 12 Mar 13 Dec 11 perSep share 12 (FY14). -

Factsheet March 2021

FACTSHEET MARCH 2021 Remember this TASK, Always wear a MASK Stay Safe. Stay Healthy *The Bank of Baroda logo belongs to Bank of Baroda and is used under license. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The Bank of Baroda logo belongs to Bank of Baroda CIO LETTER - March 2021 and is used under license Mr. Sanjay Chawla Chief Investment Officer Dear Investors, Warm Greetings! The BSE Sensex and Nifty 50 index ended with minor gains of 0.8% and 1.1% in the month of March. Globally, stock markets rallied sharply with DOW JONES up 5.6% and S&P500 up 3.8%. European markets too rallied by 5-6% for the month of March. In India, the breadth was positive with the BSE Mid-cap and BSE Small-cap indices gaining by 1% and 2.5% respectively. Amongst sector indices, IT, FMCG, Metals outperformed while Oil & Gas, Bank and Auto underperformed during last month. While the month started on a positive note as 3QFY21 GDP grew at 0.4% after two quarters of contraction and expansion of the vaccination drive, a rapid spurt in Covid-19 cases, imposition of lockdowns, night curfews and other restrictions, weak macroeconomic data, elevated crude prices and jump in bond yield weighed on market sentiments. In its policy meeting the US Federal Reserve kept interest rates unchanged; it also mentioned that it does not currently expect to hike interest rates through 2023 and will maintain the current quantum of bond purchases. The policy rates remained at 0%-0.25% band and median estimate for unemployment rates are pegged at 4.5% end 2021 and 3.9% end 2022. -

Presentation Has Been Prepared and Issued on the Basis of Internal Data, Publicly Available Information and Other Sources Believed to Be Reliable

Next Trillion Dollar Opportunities Portfolio Linear GDP growth = Exponential opportunities August 2021 1 Next Trillion dollar opportunity is on, QGLP works 훼 Documented India growth story on Alpha across products Investment Philosophy THINK EQUITY THINK MOTILAL OSWAL India growth story is on … The next trillion dollar opportunity India’s GDP trend in USD bn • 60 years for first 6,000 th 5 USD tn trillion dollar of GDP 3 years 5,022 5,000 4th USD tn 3 years 3,950 4,000 3rd USD tn • Every NTD (next 8 years 3,107 trillion dollar) in 3,000 2nd USD tn 7 years 2,039 successively few years 2,000 1st USD tn 58 years 948 1,000 0 FY51 FY60 FY70 FY80 FY90 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY24E FY25E FY26E FY27E FY28E FY29E Source: MOAMC Internal Research Disclaimer: The above graph/data is used to explain the concept and is for illustration purpose only. The data mentioned herein are for general and comparison purpose only and not a complete disclosure of every material fact. and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future. THINK EQUITY 3 THINK MOTILAL OSWAL NTD Framework : Linear growth, Exponential opportunities Doubling of per capita GDP leads to 10x opportunity in Basic Spend discretionary categories Discretionary Spend Housing Saving Consumer 1200 Autos Durables 4 x Entertainment Premium 1050 Travel 10 x Wear 300 Higher savings also mean 100 opportunities in: 600 750 Capital Infrastructure USD 1,000 USD 3,000 Goods Source: MOAMC Internal Research Disclaimer: The above graph/data is used to explain the concept and is for illustration purpose only. -

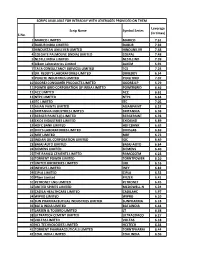

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

July 21, 2020 the Secretary Corporate Relationship Dept

July 21, 2020 The Secretary The Secretary Corporate Relationship Dept. National Stock Exchange of India The Bombay Stock Exchange Limited Rotunda Building Exchange Plaza, Phiroze Jeejeebhoy Towers Bandra Kurla Complex Dalal Street, Mumbai – 400 001 Mumbai – 400 051 Dear Sir, Sub: 25th AGM Notice & Annual Report 2019-20 We herewith enclose copy of the Notice for 25th Annual General Meeting, scheduled on 13th August 2020 at 11.30 a.m & Annual Report 2019-20, pursuant to the Regulation 34(1) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015. The said Notice and Annual Report are available on the Company’s website. Thanking you, Yours faithfully, For Page Industries Limited Murugesh C Company Secretary Encl: as above Corporate & Registered Office: Cessna Business Park, Tower-1, 7th Floor,Umiya Business Bay, Varthur Hobli, Outer Ring Road, Bengaluru - 560103. Ph: 080 - 4945 4545, Fax: 080 - 4946 5700 www.jockey.in | e-mail : [email protected] | CIN#: L18101KA1994PLC016554 NOTICE TO SHAREHOLDERS NOTICE is hereby given that the 25th Annual General million only), (excluding sitting fees) subject to the Meeting “AGM” of Members of Page Industries Limited limit prescribed in the Companies Act, 2013, to be will be held on Thursday, 13th August, 2020 at 11:30 AM paid to and distributed amongst the Directors of IST through Video Conferencing (“VC”) / Other Audio the Company or some or any of them (other than Visual Means (“OAVM”) to transact the following Managing Directors / Whole-time Directors) in business. The venue of the meeting shall be deemed such amounts, subject to such ceiling and in such to be the registered office of the Company. -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

FTSE India 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE India 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3M India 0.1 INDIA Glenmark Pharmaceuticals 0.14 INDIA Oil India Ltd 0.07 INDIA ABB India 0.13 INDIA GMR Infrastructure 0.1 INDIA Oracle Financial Services Software 0.12 INDIA ACC 0.24 INDIA Godrej Consumer Products 0.45 INDIA Page Industries 0.24 INDIA Adani Enterprises 0.57 INDIA Godrej Industries 0.07 INDIA Petronet LNG 0.24 INDIA Adani Gas 0.4 INDIA Godrej Properties 0.18 INDIA PI Industries 0.3 INDIA Adani Green Energy 0.63 INDIA Grasim Industries 0.82 INDIA Pidilite Industries 0.47 INDIA Adani Ports and Special Economic Zone 0.77 INDIA Gujarat Gas 0.19 INDIA Piramal Enterprises 0.41 INDIA Adani Power 0.15 INDIA Havells India 0.34 INDIA Power Finance 0.21 INDIA Aditya Birla Capital 0.08 INDIA HCL Technologies 1.52 INDIA Power Grid Corp of India 0.78 INDIA Alkem Laboratories 0.11 INDIA HDFC Asset Management 0.27 INDIA Punjab National Bank 0.06 INDIA Ambuja Cements 0.33 INDIA HDFC Life Insurance Company 0.63 INDIA Rajesh Exports 0.11 INDIA Apollo Hospitals Enterprise 0.51 INDIA Hero MotoCorp 0.54 INDIA RBL Bank 0.13 INDIA Ashok Leyland 0.25 INDIA Hindalco 0.75 INDIA REC 0.2 INDIA Asian Paints 1.92 INDIA Hindustan Aeronautics 0.05 INDIA Reliance Industries 9.35 INDIA Astral 0.25 INDIA Hindustan Petroleum 0.3 INDIA Reliance Industries - Partly Paid 0.36 INDIA AU Small Finance Bank 0.23 INDIA Hindustan -

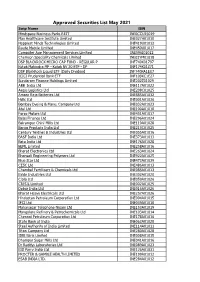

Group1 MAY-2021 APPROVED LIST

Approved Securities List May 2021 Scrip Name ISIN Mindspace Business Parks REIT INE0CCU25019 Max Healthcare Institute Limited INE027H01010 Happiest Minds Technologies Limited INE419U01012 Route Mobile Limited INE450U01017 Computer Age Management Services Limited INE596I01012 Chemcon Speciality Chemicals Limited INE03YM01018 DSP BLACKROCK MICRO CAP FUND - REGULAR P INF740K01797 Kotak Mahindra MF - Kotak NV 20 ETF - DP INF174K01Z71 DSP BlackRock Liquid ETF (Daily Dividend INF740KA1EU7 ICICI Prudential Bank ETF INF109KC1E27 Sundaram Finance Holdings Limited INE202Z01029 ABB India Ltd INE117A01022 Aegis Logistics Ltd INE208C01025 Amara Raja Batteries Ltd INE885A01032 Hdfc Ltd INE001A01036 Bombay Dyeing & Manu. Company Ltd INE032A01023 Atul Ltd INE100A01010 Force Motors Ltd INE451A01017 Bajaj Finance Ltd INE296A01024 Balrampur Chini Mills Ltd INE119A01028 Banco Products India Ltd INE213C01025 Century Textiles & Industries Ltd INE055A01016 BASF India Ltd INE373A01013 Bata India Ltd INE176A01028 BEML Limited INE258A01016 Bharat Electronics Ltd INE263A01024 Bhansali Engineering Polymers Ltd INE922A01025 Blue Star Ltd INE472A01039 CESC Ltd INE486A01013 Chambal Fertilisers & Chemicals Ltd INE085A01013 Exide Industries Ltd INE302A01020 Cipla Ltd INE059A01026 CRISIL Limited INE007A01025 Dabur India Ltd INE016A01026 Bharat Heavy Electricals Ltd INE257A01026 Hindustan Petroleum Corporation Ltd INE094A01015 IFCI Ltd INE039A01010 Mahanagar Telephone Nigam Ltd INE153A01019 Mangalore Refinery & Petrochemicals Ltd INE103A01014 Chennai Petroleum Corporation -

Solutions Oriented Scheme-Retirement Fund

SOLUTIONS ORIENTED SCHEME-RETIREMENT FUND NET ASSET VALUE NET ASSET VALUE Option NAV (`) Option NAV (`) Reg-Plan-IDCW 11.6071 Direct Plan-IDCW 11.6939 Reg-Plan-Growth 11.6075 Dir-Plan-Growth 11.6977 Investment Objective The investment objective of the scheme is to provide a comprehensive retirement saving solution that serves the variable needs of the investors through long term diversified investments in major asset classes. However, there can be no assurance that the PORTFOLIO investment objective of the Scheme will be realized. Issuer Name Rating (%) Of Total Issuer Name Rating (%) Of Total AUM AUM AIA Engineering Ltd. 2.36 Fund Details Equity Shares ICICI Bank Ltd. 4.66 Hawkins Cookers Ltd. 2.32 • Type of Scheme An open-ended retirement solution-oriented Page Industries Ltd. 4.53 Wabco India Ltd. 2.25 scheme having a lock-in of 5 years or till HDFC Bank Ltd. 3.92 The Indian Hotels Company Ltd. 2.23 retirement age (whichever is earlier) State Bank Of India 3.58 Bharti Airtel Ltd. 2.10 • Date of Allotment: 10/02/2021 HCL Technologies Ltd. 3.54 GAIL (India) Ltd. 2.00 • Report As On: 31/07/2021 Relaxo Footwears Ltd. 3.46 Chalet Hotels Ltd. 1.99 • AAUM for the Month of July 2021 ` 517.74 Crores Hindalco Industries Ltd. 3.04 Cholamandalam Investment & Finance Co. Ltd. 1.95 • AUM as on July 31, 2021 Sona Blw Precision Forgings Ltd. 3.02 Asian Paints Ltd. 1.70 ` 534.47 Crores V-Mart Retail Ltd. 3.01 ESAB India Ltd. 1.56 • Fund Manager: ICICI Lombard General Insurance Company Ltd. -

India Disclosure Index 2016

23 JUNE 2016 INDIA DISCLOSURE INDEX HOW INDIA’S LEADING LISTED COMPANIES FARE ON MANDATORY & VOLUNTARY DISCLOSURE CRITICAL THINKING AT THE CRITICAL TIME™ INDIA DISCLOSURE INDEX HOW INDIA’S LEADING LISTED COMPANIES FARE ON MANDATORY & VOLUNTARY DISCLOSURE 23 JUNE 2016 Table of Contents Executive Summary ..................................................................................................................................................................................... 3 Introduction .......................................................................................................................................................................................... 3 Report Findings .................................................................................................................................................................................... 3 Composite Disclosure Scores...................................................................................................................................................... 3 Mandatory Disclosure Scores ..................................................................................................................................................... 3 Voluntary Disclosure Scores ........................................................................................................................................................ 4 Conclusion ........................................................................................................................................................................................... -

Page Industries ACCUMULATE CMP Rs1,280 Jockeying for Growth Target Price Rs1,392 Page Industries Is the Exclusive Licensee of Jockey International, Inc

Initiating Coverage | Apparel October 7, 2010 Page Industries ACCUMULATE CMP Rs1,280 Jockeying for growth Target Price Rs1,392 Page Industries is the exclusive licensee of Jockey International, Inc. (USA). The Investment Period 12 Months company manufactures and distributes the JOCKEY® brand of innerwear and leisurewear for men and women in India, Sri Lanka, Bangladesh and Nepal. Stock Info Considering the company’s dominant presence in a fast-growing market, strong Sector Apparel brand recall, consistent financial performance and high dividend payout, we Market Cap (Rs cr) 1,426 believe Page Industries is an ideal contender to get re-rated. Expecting the company’s PAT to witness a 28% CAGR over FY2010–12E and considering its Beta 0.16 robust RoE profile, we have assigned a P/E multiple of 24x for its FY2012E 52 Week High / Low 1,353/616 earnings. Hence, we Initiate Coverage on the stock assigning an Accumulate Avg. Daily Volume 3068 rating with a Target Price of Rs1,392. Face Value (Rs) 10 BSE Sensex 20,315 Exclusive licensee for JOCKEY® through 2030: Page Industries has entered into a new licensing agreement with Jockey International, which makes Page Industries Nifty 6,120 the exclusive licensee to manufacture and distribute the JOCKEY® brand of Reuters Code PAGE.BO products up to the end of CY2030. Under this agreement, United Arab Emirates Bloomberg Code PAG@IN (UAE) will be added to the list of existing markets served by Page Industries. In essence, this agreement of exclusivity for 20 years, of a well-renowned global Shareholding Pattern (%) brand, lends good growth visibility to the company.